444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines Software-Defined Wide Area Network (SD-WAN) market represents a rapidly evolving segment within the country’s telecommunications and networking infrastructure landscape. As Filipino enterprises increasingly embrace digital transformation initiatives, the demand for flexible, cost-effective, and scalable networking solutions has surged dramatically. SD-WAN technology offers organizations the ability to optimize network performance while reducing operational costs through intelligent traffic routing and centralized management capabilities.

Market dynamics in the Philippines are particularly influenced by the archipelagic nature of the country, where traditional WAN connectivity has historically faced challenges related to reliability and cost-effectiveness across multiple islands. The adoption of SD-WAN solutions is experiencing robust growth, with implementation rates increasing by approximately 12.5% annually as organizations seek to modernize their network infrastructure and support remote workforce requirements.

Enterprise adoption spans across various sectors including banking, retail, manufacturing, and government agencies, each recognizing the strategic value of software-defined networking approaches. The market’s expansion is further accelerated by the increasing availability of high-speed internet connectivity and the government’s commitment to improving the country’s digital infrastructure through various national broadband initiatives.

The Philippines SD-WAN market refers to the comprehensive ecosystem of software-defined wide area networking solutions, services, and technologies specifically deployed within the Philippine business environment. This market encompasses the deployment, management, and optimization of virtualized network functions that enable organizations to connect branch offices, data centers, and cloud resources through intelligent, policy-driven connectivity.

SD-WAN technology fundamentally transforms traditional networking approaches by decoupling network hardware from its control mechanism, allowing for centralized management and dynamic traffic routing based on real-time network conditions. In the Philippine context, this technology addresses unique geographical challenges while providing enterprises with enhanced network agility, improved application performance, and significant cost optimization opportunities.

Key characteristics of the Philippine SD-WAN market include hybrid connectivity options that leverage multiple transport methods, including MPLS, broadband internet, and LTE connections, ensuring optimal performance across the country’s diverse geographical landscape.

Strategic market positioning of SD-WAN solutions in the Philippines demonstrates exceptional growth potential driven by accelerating digital transformation initiatives across multiple industry verticals. The market’s expansion is characterized by increasing enterprise recognition of SD-WAN’s ability to deliver superior network performance while reducing total cost of ownership compared to traditional WAN architectures.

Technology adoption patterns reveal that approximately 68% of large enterprises are actively evaluating or implementing SD-WAN solutions, with small and medium-sized businesses representing the fastest-growing adoption segment. The market benefits from strong government support for digital infrastructure development and increasing availability of reliable internet connectivity across urban and rural areas.

Competitive landscape dynamics feature both international technology vendors and local system integrators collaborating to deliver comprehensive SD-WAN solutions tailored to Philippine market requirements. The integration of cloud-native security features and support for hybrid work environments continues to drive market demand, with organizations prioritizing solutions that offer seamless scalability and enhanced user experience.

Primary market drivers encompass several critical factors that are reshaping the Philippine networking landscape:

Technological advancement serves as a fundamental driver propelling the Philippine SD-WAN market forward. The increasing sophistication of software-defined networking technologies enables organizations to achieve unprecedented levels of network flexibility and performance optimization. Cloud computing adoption continues to accelerate across Filipino enterprises, creating substantial demand for networking solutions that can seamlessly integrate on-premises infrastructure with cloud-based resources.

Economic factors play a crucial role in driving market growth, as organizations seek to optimize their networking expenditures while maintaining high-performance connectivity. Traditional MPLS-based networks often represent significant ongoing operational expenses, particularly for organizations with multiple branch locations across the Philippine archipelago. SD-WAN solutions offer compelling cost reduction opportunities through the intelligent utilization of broadband internet connections alongside existing MPLS infrastructure.

Regulatory support from the Philippine government, including initiatives to improve national broadband infrastructure and promote digital transformation across various sectors, creates a favorable environment for SD-WAN adoption. The government’s commitment to enhancing the country’s digital competitiveness through improved connectivity infrastructure directly benefits the SD-WAN market by expanding the availability of reliable internet services necessary for successful implementations.

Implementation complexity represents a significant challenge for many Philippine organizations considering SD-WAN adoption. The transition from traditional networking architectures to software-defined approaches requires substantial technical expertise and careful planning to ensure seamless migration without disrupting critical business operations. Many enterprises lack the internal technical capabilities necessary for successful SD-WAN deployment and ongoing management.

Infrastructure limitations in certain regions of the Philippines continue to pose challenges for comprehensive SD-WAN implementation. While urban areas generally enjoy reliable high-speed internet connectivity, rural and remote locations may still experience connectivity issues that can impact the effectiveness of SD-WAN solutions. The quality and consistency of internet service providers across different geographical areas can vary significantly.

Security concerns related to the increased reliance on internet-based connectivity create hesitation among some organizations, particularly those in highly regulated industries such as banking and healthcare. While modern SD-WAN solutions incorporate advanced security features, some enterprises remain cautious about transitioning from the perceived security of private MPLS networks to internet-based connectivity models.

Small and medium enterprise (SME) segment presents exceptional growth opportunities for SD-WAN vendors in the Philippines. As SMEs increasingly recognize the competitive advantages of advanced networking technologies, the demand for affordable, scalable SD-WAN solutions continues to expand. These organizations often lack the resources for complex traditional WAN implementations, making SD-WAN’s simplified management and cost-effective deployment particularly attractive.

Industry-specific solutions offer substantial market expansion potential, with sectors such as retail, manufacturing, and healthcare requiring specialized networking capabilities. The development of vertical-specific SD-WAN offerings that address unique industry requirements, compliance needs, and operational challenges represents a significant opportunity for market participants to differentiate their solutions and capture market share.

Managed services growth creates opportunities for service providers to offer comprehensive SD-WAN solutions that include deployment, management, and ongoing optimization services. Many Philippine organizations prefer to outsource complex networking functions to specialized providers, enabling them to focus on core business activities while benefiting from expert SD-WAN management and support.

Competitive intensity within the Philippine SD-WAN market continues to increase as both international technology vendors and local service providers recognize the substantial growth potential. This competition drives innovation and leads to more comprehensive solution offerings that address specific Philippine market requirements. Partnership strategies between global SD-WAN vendors and local system integrators are becoming increasingly common, combining international technology expertise with local market knowledge.

Technology evolution remains a constant factor influencing market dynamics, with vendors continuously enhancing their SD-WAN platforms to incorporate advanced features such as artificial intelligence-driven network optimization, enhanced security capabilities, and improved cloud integration. The integration of 5G connectivity options is beginning to influence SD-WAN solution architectures, offering new possibilities for mobile and remote connectivity scenarios.

Customer expectations are evolving rapidly, with organizations demanding more sophisticated analytics, reporting capabilities, and integration with existing IT management systems. The shift toward zero-touch provisioning and automated network optimization reflects the growing emphasis on operational efficiency and reduced administrative overhead in SD-WAN implementations.

Comprehensive market analysis for the Philippine SD-WAN market employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include extensive interviews with key stakeholders across the SD-WAN ecosystem, including technology vendors, service providers, system integrators, and end-user organizations representing various industry sectors and company sizes.

Secondary research components encompass detailed analysis of industry reports, government publications, regulatory documents, and technology vendor announcements specific to the Philippine market. This research approach ensures comprehensive coverage of market dynamics, competitive landscape developments, and emerging trends that influence SD-WAN adoption patterns within the Philippines.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews with industry experts, and analyzing market data consistency across different research methodologies. The research framework incorporates both quantitative analysis of market metrics and qualitative assessment of strategic factors influencing market development and future growth prospects.

Metro Manila region dominates the Philippine SD-WAN market, accounting for approximately 45% of total market activity due to the concentration of large enterprises, multinational corporations, and government agencies in the National Capital Region. The availability of advanced telecommunications infrastructure and high-speed internet connectivity in Metro Manila creates an ideal environment for SD-WAN implementations across various industry sectors.

Cebu and Davao represent the second and third largest regional markets respectively, with growing adoption rates driven by the expansion of business process outsourcing operations and regional corporate headquarters. These cities benefit from improving telecommunications infrastructure and increasing availability of reliable internet services that support effective SD-WAN deployments.

Provincial markets are experiencing accelerating growth as internet infrastructure improvements reach more remote areas of the Philippines. The government’s national broadband initiatives and private sector investments in telecommunications infrastructure are expanding the addressable market for SD-WAN solutions beyond traditional urban centers. Regional growth rates in provincial areas are exceeding 15% annually as organizations in these locations recognize the benefits of modern networking technologies.

Market leadership in the Philippine SD-WAN sector is characterized by a diverse ecosystem of international technology vendors, local service providers, and specialized system integrators. The competitive environment features both established networking companies and emerging SD-WAN specialists competing for market share across different customer segments and use cases.

Key market participants include:

By deployment model, the Philippine SD-WAN market demonstrates distinct preferences across different organizational types and requirements:

By organization size, market segmentation reveals varying adoption patterns and requirements:

By industry vertical, SD-WAN adoption patterns in the Philippines demonstrate sector-specific requirements and growth trajectories:

Banking and Financial Services: This sector leads in SD-WAN adoption with approximately 72% implementation rate among major financial institutions. Banks prioritize solutions offering enhanced security features, regulatory compliance capabilities, and reliable connectivity for branch office networks. The sector’s focus on digital banking initiatives drives demand for high-performance networking solutions that support customer-facing applications and internal operations.

Business Process Outsourcing (BPO): The BPO industry represents a significant growth segment, with companies requiring reliable, high-performance connectivity to support global client operations. SD-WAN solutions enable BPO providers to optimize network performance for voice and data applications while maintaining cost-effective operations across multiple facility locations.

Retail and E-commerce: Retail organizations increasingly adopt SD-WAN solutions to support point-of-sale systems, inventory management applications, and customer experience platforms. The sector’s growth is driven by the expansion of omnichannel retail strategies and the need for consistent network performance across store locations.

Manufacturing: Industrial companies implement SD-WAN solutions to support Industry 4.0 initiatives, connecting manufacturing facilities, supply chain partners, and cloud-based analytics platforms. The sector emphasizes solutions offering low latency, high reliability, and support for industrial IoT applications.

Enterprise organizations realize substantial operational and strategic benefits through SD-WAN implementation. Cost optimization represents a primary advantage, with organizations typically achieving network cost reductions of 30-50% through intelligent utilization of broadband internet connections and reduced reliance on expensive MPLS circuits. The centralized management capabilities of SD-WAN solutions significantly reduce administrative overhead and enable more efficient network operations.

Service providers benefit from new revenue opportunities through managed SD-WAN services, professional services, and ongoing support contracts. The recurring revenue model associated with SD-WAN services provides predictable income streams while enabling providers to develop deeper customer relationships through comprehensive networking solutions.

Technology vendors gain access to expanding market opportunities as Philippine organizations modernize their networking infrastructure. The shift toward software-defined networking creates demand for innovative solutions that address specific local market requirements while providing global scalability and feature richness.

System integrators find new business opportunities in SD-WAN deployment, migration, and optimization services. The complexity of transitioning from traditional networking architectures creates demand for specialized expertise and project management capabilities that experienced integrators can provide.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-first networking strategies are reshaping how Philippine organizations approach their networking infrastructure requirements. The increasing adoption of cloud applications and services drives demand for SD-WAN solutions that can optimize connectivity to multiple cloud providers while maintaining consistent performance and security standards. Multi-cloud connectivity has become a critical requirement for many enterprises seeking to avoid vendor lock-in and optimize their cloud strategies.

Security integration trends demonstrate the growing importance of built-in security features within SD-WAN platforms. Organizations increasingly prefer solutions that combine networking and security functions, eliminating the need for separate security appliances and reducing complexity. Zero-trust networking principles are becoming standard requirements for SD-WAN implementations, particularly in security-conscious industries.

Artificial intelligence and machine learning integration is emerging as a key differentiator among SD-WAN solutions. Vendors are incorporating AI-driven capabilities for network optimization, predictive analytics, and automated troubleshooting. These advanced features enable organizations to achieve better network performance while reducing the need for manual intervention and specialized technical expertise.

Strategic partnerships between international SD-WAN vendors and Philippine telecommunications providers are accelerating market development. Recent collaborations have focused on combining global technology expertise with local market knowledge and infrastructure capabilities. MarkWide Research analysis indicates that these partnerships are crucial for successful market penetration and customer adoption in the Philippine context.

Product innovation continues to drive market evolution, with vendors introducing enhanced features specifically designed for the Philippine market. Recent developments include improved support for satellite connectivity in remote areas, enhanced security features for regulated industries, and simplified deployment tools for organizations with limited technical resources.

Government initiatives supporting digital transformation across various sectors are creating new opportunities for SD-WAN adoption. The implementation of digital government services and smart city projects requires advanced networking capabilities that SD-WAN solutions can provide effectively.

Market participants should focus on developing comprehensive go-to-market strategies that address the unique characteristics of the Philippine business environment. Local partnership development remains crucial for success, as organizations often prefer working with providers who understand local business practices, regulatory requirements, and cultural considerations.

Technology vendors should prioritize the development of solutions that can operate effectively across the diverse connectivity landscape in the Philippines. This includes support for various transport methods, resilience features for areas with less reliable internet connectivity, and simplified management tools that reduce the need for specialized technical expertise.

Service providers should consider developing industry-specific SD-WAN offerings that address the unique requirements of key vertical markets in the Philippines. The customization of solutions for sectors such as banking, retail, and manufacturing can create competitive advantages and improve customer satisfaction levels.

Long-term market prospects for SD-WAN in the Philippines remain exceptionally positive, driven by continued digital transformation initiatives and improving telecommunications infrastructure. MWR projections indicate that market growth will accelerate as more organizations recognize the strategic value of software-defined networking approaches and as implementation barriers continue to decrease.

Technology evolution will continue to enhance the value proposition of SD-WAN solutions, with emerging capabilities such as edge computing integration, enhanced AI-driven optimization, and improved security features. The integration of 5G connectivity is expected to create new use cases and deployment scenarios that will further expand the addressable market.

Market maturation is expected to result in more standardized offerings, improved interoperability between different vendors’ solutions, and enhanced integration with existing IT infrastructure. The development of industry-specific solutions will continue to drive adoption across various vertical markets, with growth rates potentially exceeding 18% annually in specialized sectors.

The Philippines SD-WAN market represents a dynamic and rapidly evolving segment within the country’s broader telecommunications and networking landscape. The convergence of digital transformation initiatives, improving infrastructure capabilities, and growing recognition of SD-WAN benefits creates a compelling environment for continued market expansion and innovation.

Strategic opportunities abound for market participants who can effectively address the unique requirements of Philippine organizations while delivering solutions that provide tangible business value. The combination of cost optimization, performance improvement, and operational simplification offered by SD-WAN solutions aligns well with the priorities of Filipino enterprises across various industry sectors.

Future success in the Philippine SD-WAN market will depend on the ability to navigate local market dynamics, develop effective partnerships, and deliver solutions that address specific customer requirements while maintaining global standards for performance and reliability. As the market continues to mature, organizations that invest in SD-WAN technology today will be well-positioned to capitalize on the ongoing digital transformation of the Philippine economy.

What is Software-Defined Wide Area Network (SD-WAN)?

Software-Defined Wide Area Network (SD-WAN) is a technology that enables organizations to manage their wide area networks more efficiently by using software to control the connectivity, management, and services between data centers and remote branches. It enhances network performance, reduces costs, and improves security through centralized control and automation.

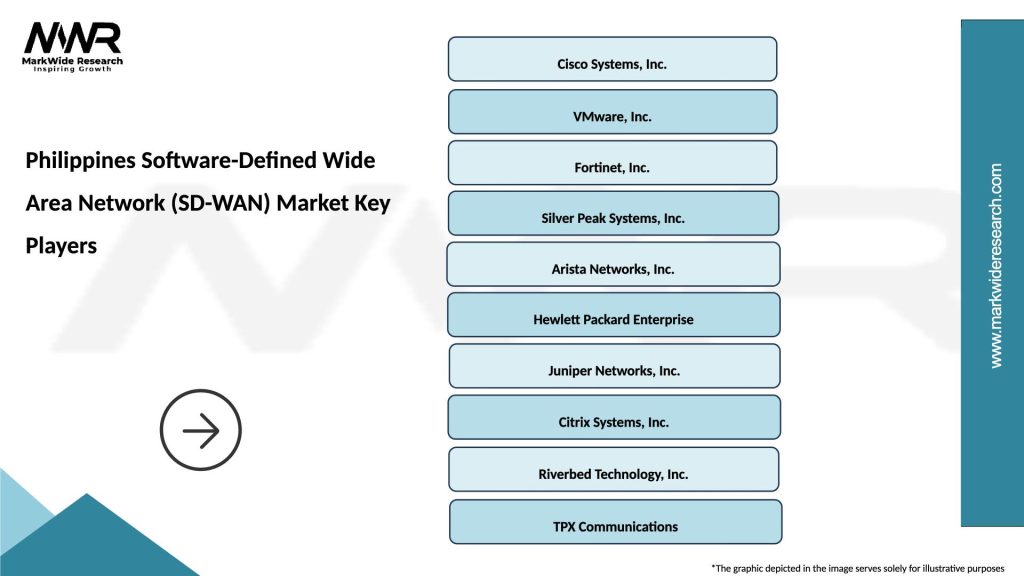

What are the key companies in the Philippines Software-Defined Wide Area Network (SD-WAN) Market?

Key companies in the Philippines Software-Defined Wide Area Network (SD-WAN) Market include Cisco Systems, VMware, and Aryaka Networks, among others.

What are the drivers of growth in the Philippines Software-Defined Wide Area Network (SD-WAN) Market?

The growth of the Philippines Software-Defined Wide Area Network (SD-WAN) Market is driven by the increasing demand for reliable and secure connectivity, the rise of cloud-based applications, and the need for cost-effective network management solutions. Additionally, the shift towards remote work has accelerated the adoption of SD-WAN technologies.

What challenges does the Philippines Software-Defined Wide Area Network (SD-WAN) Market face?

Challenges in the Philippines Software-Defined Wide Area Network (SD-WAN) Market include concerns over data security, the complexity of integration with existing infrastructure, and the need for skilled personnel to manage SD-WAN solutions. These factors can hinder the adoption of SD-WAN technologies among businesses.

What opportunities exist in the Philippines Software-Defined Wide Area Network (SD-WAN) Market?

Opportunities in the Philippines Software-Defined Wide Area Network (SD-WAN) Market include the growing trend of digital transformation across various industries, the increasing adoption of Internet of Things (IoT) devices, and the expansion of 5G networks. These factors are expected to create new use cases and drive demand for SD-WAN solutions.

What trends are shaping the Philippines Software-Defined Wide Area Network (SD-WAN) Market?

Trends shaping the Philippines Software-Defined Wide Area Network (SD-WAN) Market include the integration of artificial intelligence for network optimization, the rise of multi-cloud environments, and the focus on enhancing user experience through improved application performance. These trends are influencing how businesses implement and utilize SD-WAN technologies.

Philippines Software-Defined Wide Area Network (SD-WAN) Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Healthcare, Education, Retail, Manufacturing |

| Solution | Network Security, Traffic Management, Performance Monitoring, Data Optimization |

| Service Type | Consulting, Integration, Support, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Software-Defined Wide Area Network (SD-WAN) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at