444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines retail industry market represents one of Southeast Asia’s most dynamic and rapidly evolving commercial landscapes. Consumer spending patterns have undergone significant transformation, driven by digital adoption, urbanization, and changing demographic preferences. The market encompasses traditional retail formats alongside modern shopping centers, e-commerce platforms, and hybrid retail models that cater to diverse consumer segments across the archipelago.

Digital transformation has emerged as a critical catalyst, with online retail penetration reaching 15.2% of total retail sales in recent years. Modern trade formats continue to expand their footprint, particularly in urban centers like Metro Manila, Cebu, and Davao, while traditional sari-sari stores maintain their essential role in neighborhood commerce. The industry demonstrates remarkable resilience and adaptability, incorporating international retail concepts while preserving local market characteristics.

Consumer behavior shifts reflect increasing preference for convenience, value-oriented shopping, and omnichannel experiences. The market benefits from a young, tech-savvy population with growing disposable income, creating opportunities for both domestic and international retail players. Infrastructure development and improved logistics networks support retail expansion into secondary cities and emerging markets throughout the Philippines.

The Philippines retail industry market refers to the comprehensive ecosystem of businesses engaged in selling goods and services directly to consumers through various channels and formats. This market encompasses traditional retail establishments, modern shopping centers, department stores, specialty retailers, supermarkets, convenience stores, and digital commerce platforms operating across the Philippine archipelago.

Market participants include local retailers, international brands, franchise operations, and independent merchants serving diverse consumer segments. The industry spans multiple categories including fashion and apparel, food and beverages, electronics, home goods, personal care products, and specialty merchandise. Retail formats range from small neighborhood stores to large-scale shopping malls, reflecting the country’s diverse economic landscape and consumer preferences.

Digital integration has become increasingly important, with many retailers adopting omnichannel strategies that combine physical and online presence. The market serves as a crucial economic driver, providing employment opportunities and supporting local supply chains while facilitating consumer access to both domestic and imported products.

Market dynamics in the Philippines retail industry reflect strong fundamentals supported by demographic advantages, urbanization trends, and digital adoption. The sector demonstrates consistent growth trajectory despite periodic challenges, with modern retail formats gaining market share while traditional channels adapt to changing consumer expectations.

Key growth drivers include expanding middle class, increasing urbanization rates of 47.3%, and rising smartphone penetration that enables digital commerce adoption. Shopping mall development continues in major cities, while e-commerce platforms experience accelerated growth, particularly following increased digital adoption during recent years.

Competitive landscape features established local players alongside international retailers, creating a diverse market environment. Consumer preferences increasingly favor convenience, competitive pricing, and integrated shopping experiences that combine online and offline touchpoints. The market outlook remains positive, supported by favorable demographics and continued economic development across the Philippines.

Strategic insights reveal several critical trends shaping the Philippines retail landscape:

Market segmentation reveals distinct consumer groups with varying preferences, spending patterns, and channel preferences. Urban consumers demonstrate higher adoption of modern retail formats and digital channels, while rural markets maintain stronger preference for traditional retail establishments and personal service approaches.

Demographic advantages serve as fundamental growth drivers for the Philippines retail industry. The country’s young population, with median age below 25 years, creates a consumer base that readily adopts new retail concepts and digital shopping platforms. Rising disposable income among middle-class families enables increased consumer spending across various retail categories.

Urbanization trends continue driving retail market expansion, with more Filipinos migrating to cities and adopting urban consumption patterns. Infrastructure development including improved transportation networks, telecommunications, and logistics capabilities supports retail expansion into previously underserved markets. The growth of business process outsourcing and other service industries creates employment opportunities that boost consumer purchasing power.

Digital transformation accelerates retail evolution, with smartphone penetration reaching 71.8% of the population. E-commerce platforms benefit from improved internet connectivity and digital payment systems that facilitate online transactions. Social media influence on purchasing decisions creates new marketing channels and customer engagement opportunities for retailers across all segments.

Government initiatives supporting economic development and foreign investment create favorable conditions for retail market growth. Tourism recovery and international visitor arrivals contribute to retail sales, particularly in major cities and tourist destinations throughout the Philippines.

Economic volatility presents ongoing challenges for the Philippines retail industry, with currency fluctuations affecting import costs and consumer purchasing power. Income inequality limits market expansion potential, as significant portions of the population maintain limited discretionary spending capacity for non-essential retail purchases.

Infrastructure limitations in certain regions constrain retail expansion and logistics efficiency. Traffic congestion in major urban centers affects customer accessibility to retail locations and increases operational costs for retailers. Natural disaster risks including typhoons and earthquakes create periodic disruptions to retail operations and supply chains.

Regulatory complexity surrounding foreign ownership restrictions and local business requirements can limit international retailer entry and expansion strategies. Competition from informal retail sectors, including street vendors and unregistered businesses, creates pricing pressures for formal retail establishments.

Digital divide between urban and rural areas affects e-commerce adoption rates and limits online retail penetration in certain markets. Logistics challenges across the archipelago’s numerous islands increase distribution costs and complexity for retailers serving nationwide markets.

E-commerce expansion presents substantial growth opportunities, with online retail penetration remaining below regional averages, indicating significant room for development. Mobile commerce adoption offers particular potential given high smartphone usage rates and improving mobile payment infrastructure.

Regional market development beyond Metro Manila creates opportunities for retail expansion into secondary cities experiencing economic growth. Franchise models enable rapid market penetration while leveraging local knowledge and reducing operational risks for expanding retailers.

Sustainable retail concepts appeal to environmentally conscious consumers, creating differentiation opportunities for retailers implementing green practices and ethical sourcing. Private label development allows retailers to improve margins while offering unique products tailored to Filipino consumer preferences.

Technology integration including artificial intelligence, data analytics, and automation creates opportunities for operational efficiency improvements and enhanced customer experiences. Cross-border e-commerce enables access to international products while allowing local retailers to reach overseas Filipino communities.

Experiential retail concepts combining shopping with entertainment, dining, and services create new revenue streams and customer engagement opportunities. Health and wellness retail segments show strong growth potential as consumer awareness and spending in these categories increases.

Competitive intensity continues increasing as both local and international retailers expand their presence across the Philippines. Market consolidation occurs in certain segments as larger players acquire smaller retailers or form strategic partnerships to enhance market coverage and operational efficiency.

Consumer expectations evolve rapidly, demanding seamless omnichannel experiences, competitive pricing, and personalized service delivery. Technology adoption accelerates across all retail segments, with retailers investing in digital platforms, inventory management systems, and customer relationship management tools.

Supply chain optimization becomes increasingly critical as retailers seek to improve efficiency and reduce costs while maintaining service quality. Labor market dynamics affect retail operations, with retailers adapting to changing workforce expectations and implementing training programs to develop retail skills.

Seasonal variations significantly impact retail performance, with holiday seasons, back-to-school periods, and summer months creating distinct sales patterns. Economic cycles influence consumer spending behavior, requiring retailers to maintain flexibility in their operational and marketing strategies.

Comprehensive analysis of the Philippines retail industry market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes structured interviews with retail executives, industry experts, and consumer surveys across different demographic segments and geographic regions.

Secondary research incorporates analysis of government statistics, industry reports, company financial statements, and market data from various sources. MarkWide Research utilizes proprietary databases and analytical frameworks to evaluate market trends, competitive positioning, and growth opportunities across retail segments.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Quantitative analysis includes statistical modeling and trend analysis to project market developments and identify key performance indicators.

Qualitative insights complement quantitative data through in-depth analysis of market dynamics, consumer behavior patterns, and competitive strategies. Regional analysis covers major metropolitan areas as well as secondary cities and rural markets to provide comprehensive market understanding.

Metro Manila dominates the Philippines retail landscape, accounting for approximately 38.5% of total retail activity. The region hosts major shopping centers, department stores, and serves as the primary market for international retail brands entering the Philippines. Consumer sophistication in Metro Manila drives adoption of new retail concepts and digital shopping platforms.

Cebu emerges as the second-largest retail market, benefiting from strong economic growth and increasing urbanization. Regional shopping centers and modern retail formats expand rapidly, serving both local consumers and tourists visiting the region.

Davao and other major cities in Mindanao present growing retail opportunities, with improving infrastructure and rising income levels supporting market development. Provincial markets maintain distinct characteristics, with traditional retail formats remaining important while modern concepts gradually gain acceptance.

Tourist destinations including Boracay, Palawan, and Bohol create specialized retail segments focused on visitor needs and souvenir markets. Regional preferences vary significantly across the archipelago, requiring retailers to adapt product assortments and marketing approaches to local tastes and cultural preferences.

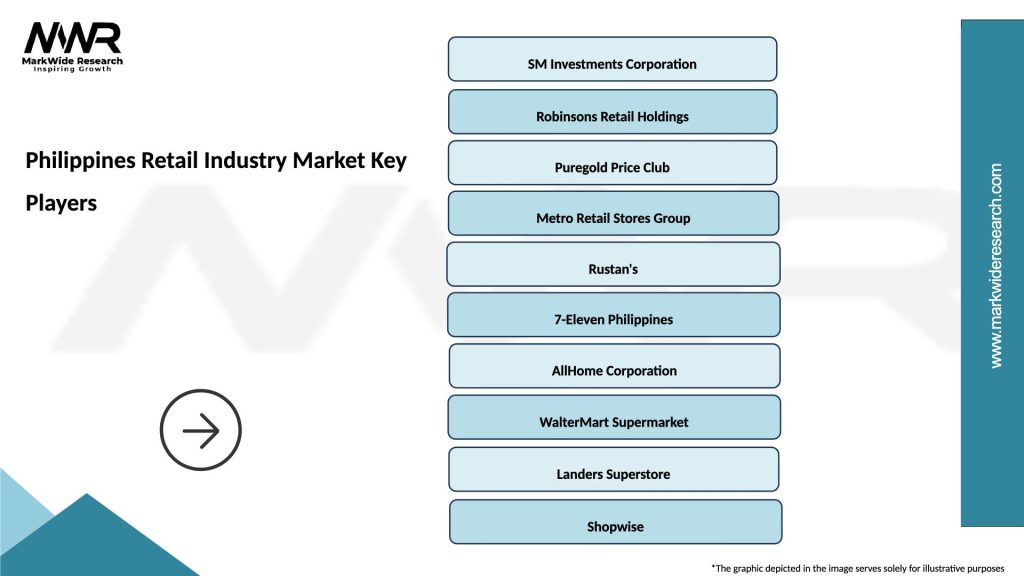

Market leadership in the Philippines retail industry features a mix of established local companies and international retailers:

International retailers including H&M, Uniqlo, Zara, and McDonald’s maintain significant market presence through franchise partnerships and direct operations. E-commerce platforms such as Shopee, Lazada, and local players create additional competitive dynamics in the digital retail space.

By Retail Format:

By Product Category:

By Consumer Segment:

Food and Grocery Retail represents the largest segment, with supermarkets and hypermarkets experiencing steady growth. Fresh food categories remain important, with consumers preferring traditional wet markets for certain products while adopting modern formats for packaged goods. Organic and health-focused products show increasing demand among urban consumers.

Fashion and Apparel retail benefits from young demographics and increasing fashion consciousness. Fast fashion brands perform well in urban markets, while traditional and cultural clothing maintains importance for special occasions. Online fashion retail grows rapidly, particularly among younger consumers comfortable with digital shopping.

Electronics Retail experiences strong growth driven by smartphone adoption and consumer electronics demand. Mobile phone retailers maintain prominent positions in shopping centers, while home appliance sales benefit from rising household formation and urbanization trends.

Health and Beauty retail shows consistent expansion, with pharmacy chains leading market development. Personal care products demonstrate strong demand across all consumer segments, while cosmetics and skincare categories benefit from social media influence and beauty consciousness.

Retailers benefit from access to a large, young consumer base with increasing purchasing power and digital adoption rates. Market expansion opportunities exist across multiple regions and consumer segments, supported by improving infrastructure and economic development.

Suppliers and Manufacturers gain access to diverse distribution channels and growing consumer markets. Local producers benefit from retailer support for domestic products and increasing consumer preference for Filipino-made goods.

Real Estate Developers capitalize on retail expansion demand, particularly for shopping centers and mixed-use developments in growing urban areas. Logistics providers benefit from increased demand for distribution and delivery services supporting both traditional and e-commerce retail.

Technology Companies find opportunities in providing retail technology solutions, payment systems, and e-commerce platforms. Financial Services benefit from increased consumer lending and payment processing opportunities generated by retail growth.

Employment Creation across retail operations, from store associates to management positions, supports economic development and skills development throughout the Philippines.

Strengths:

Weaknesses:

Opportunities:

Threats:

Omnichannel Retail Integration emerges as a dominant trend, with retailers developing seamless customer experiences across physical stores, websites, and mobile applications. Click-and-collect services gain popularity, allowing customers to order online and pick up at convenient locations.

Social Commerce expansion transforms how retailers engage customers, with social media platforms becoming important sales channels. Influencer partnerships and user-generated content drive product discovery and purchase decisions, particularly among younger consumers.

Sustainable Retail Practices gain importance as consumers become more environmentally conscious. Eco-friendly packaging, sustainable sourcing, and waste reduction initiatives become competitive differentiators for forward-thinking retailers.

Personalization Technology enables retailers to offer customized shopping experiences based on customer data and preferences. AI-powered recommendations and targeted marketing improve customer engagement and sales conversion rates.

Contactless Shopping solutions including mobile payments, self-checkout systems, and curbside pickup services respond to changing consumer preferences for convenience and safety.

Digital Payment Adoption accelerates across the retail sector, with GCash, PayMaya, and other digital wallets becoming widely accepted payment methods. QR code payments and mobile banking integration simplify transaction processes for both retailers and consumers.

Warehouse Automation and logistics optimization improve supply chain efficiency for major retailers. Last-mile delivery solutions expand, supporting e-commerce growth and customer convenience expectations.

Retail Technology Integration includes implementation of inventory management systems, customer relationship management platforms, and data analytics tools. MarkWide Research indicates that retailers investing in technology solutions achieve 23.7% higher operational efficiency compared to traditional operations.

Franchise Expansion continues as international brands partner with local operators to enter and expand within the Philippine market. Local brand development also accelerates as Filipino entrepreneurs create retail concepts tailored to domestic consumer preferences.

Sustainability Initiatives include plastic reduction programs, renewable energy adoption, and community development projects that enhance retailer reputation and customer loyalty.

Digital Transformation Priority should focus on developing comprehensive omnichannel capabilities that integrate online and offline customer touchpoints. Mobile-first strategies are essential given high smartphone penetration and mobile commerce growth trends.

Regional Market Development beyond Metro Manila presents significant opportunities for retailers willing to adapt to local preferences and market conditions. Franchise models and local partnerships can facilitate expansion while reducing operational risks.

Customer Data Utilization through advanced analytics and personalization technologies can improve customer engagement and loyalty. Inventory optimization and demand forecasting capabilities become increasingly important for operational efficiency.

Sustainability Integration should be viewed as a long-term competitive advantage rather than just a compliance requirement. Environmental initiatives and social responsibility programs can differentiate retailers in an increasingly competitive market.

Talent Development in retail technology, customer service, and digital marketing skills will be crucial for maintaining competitive advantage as the industry continues evolving rapidly.

Growth trajectory for the Philippines retail industry remains positive, supported by favorable demographics, continued urbanization, and digital adoption trends. E-commerce penetration is projected to reach 25.8% of total retail sales within the next five years, driven by improved logistics infrastructure and payment systems.

Market consolidation may accelerate as smaller retailers struggle to compete with larger players offering superior technology and customer experiences. International expansion by successful Philippine retailers into other Southeast Asian markets presents growth opportunities beyond domestic boundaries.

Technology integration will continue transforming retail operations, with artificial intelligence, augmented reality, and Internet of Things applications becoming more prevalent. MWR analysis suggests that retailers adopting advanced technologies will capture 31.4% higher market share compared to traditional competitors.

Sustainable retail practices will transition from optional initiatives to essential business requirements as consumer awareness and regulatory requirements increase. Circular economy principles and waste reduction programs will become standard operating procedures for leading retailers.

Consumer expectations will continue evolving toward greater convenience, personalization, and value, requiring retailers to maintain flexibility and innovation in their service delivery approaches.

The Philippines retail industry market demonstrates remarkable resilience and growth potential, driven by favorable demographics, increasing urbanization, and rapid digital adoption. Market dynamics reflect a transformation from traditional retail formats toward integrated omnichannel experiences that serve evolving consumer expectations.

Competitive landscape continues evolving as both local and international retailers adapt to changing market conditions and consumer preferences. Technology integration and digital transformation emerge as critical success factors, enabling retailers to improve operational efficiency while enhancing customer experiences.

Regional opportunities beyond Metro Manila present significant growth potential for retailers willing to invest in market development and local adaptation strategies. Sustainability initiatives and social responsibility programs become increasingly important for long-term competitive advantage and brand differentiation.

Future success in the Philippines retail market will depend on retailers’ ability to balance traditional market understanding with innovative approaches to customer engagement, operational efficiency, and market expansion. The industry outlook remains optimistic, supported by continued economic development and the dynamic nature of Filipino consumer markets.

What is Philippines Retail Industry?

The Philippines Retail Industry encompasses the sale of goods and services to consumers through various channels, including physical stores, e-commerce platforms, and mobile applications. It includes a wide range of sectors such as food and beverage, clothing, electronics, and household goods.

What are the key players in the Philippines Retail Industry Market?

Key players in the Philippines Retail Industry Market include SM Retail, Robinsons Retail Holdings, and Puregold Price Club, which dominate the grocery and department store segments. Other notable companies include Lazada and Shopee, which are significant in the e-commerce space, among others.

What are the growth factors driving the Philippines Retail Industry Market?

The growth of the Philippines Retail Industry Market is driven by increasing consumer spending, the rise of e-commerce, and the expansion of retail formats such as convenience stores and specialty shops. Additionally, urbanization and a growing middle class contribute to the industry’s expansion.

What challenges does the Philippines Retail Industry Market face?

The Philippines Retail Industry Market faces challenges such as intense competition, supply chain disruptions, and changing consumer preferences. Additionally, economic fluctuations and regulatory hurdles can impact retail operations and profitability.

What opportunities exist in the Philippines Retail Industry Market?

Opportunities in the Philippines Retail Industry Market include the growth of online shopping, the increasing demand for sustainable products, and the potential for expansion into underserved regions. Retailers can also leverage technology to enhance customer experiences and streamline operations.

What trends are shaping the Philippines Retail Industry Market?

Trends shaping the Philippines Retail Industry Market include the rise of omnichannel retailing, the integration of digital payment solutions, and a focus on sustainability. Additionally, personalized marketing and the use of data analytics are becoming increasingly important for retailers.

Philippines Retail Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Apparel, Electronics, Home Goods, Groceries |

| Price Tier | Luxury, Mid-range, Discount, Value |

| Distribution Channel | Online, Supermarkets, Convenience Stores, Specialty Shops |

| Customer Type | Families, Young Adults, Seniors, Professionals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Retail Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at