444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Philippines remittance market plays a crucial role in the country’s economy, facilitating the transfer of funds from overseas Filipino workers (OFWs) to their families and loved ones back home. Remittances are a significant source of income for many Filipino households, contributing to poverty reduction, consumption, and overall economic stability. The market has witnessed substantial growth over the years, driven by the increasing number of Filipinos working abroad and the need to support their families financially.

Meaning

Remittance refers to the act of sending money or transferring funds from one place to another, typically from a migrant worker to their home country. In the case of the Philippines, remittances primarily involve the transfer of money from Filipinos working overseas to their families and dependents in the Philippines. These funds are often sent through various channels, including banks, money transfer operators, and online platforms, to ensure a secure and efficient transfer process.

Executive Summary

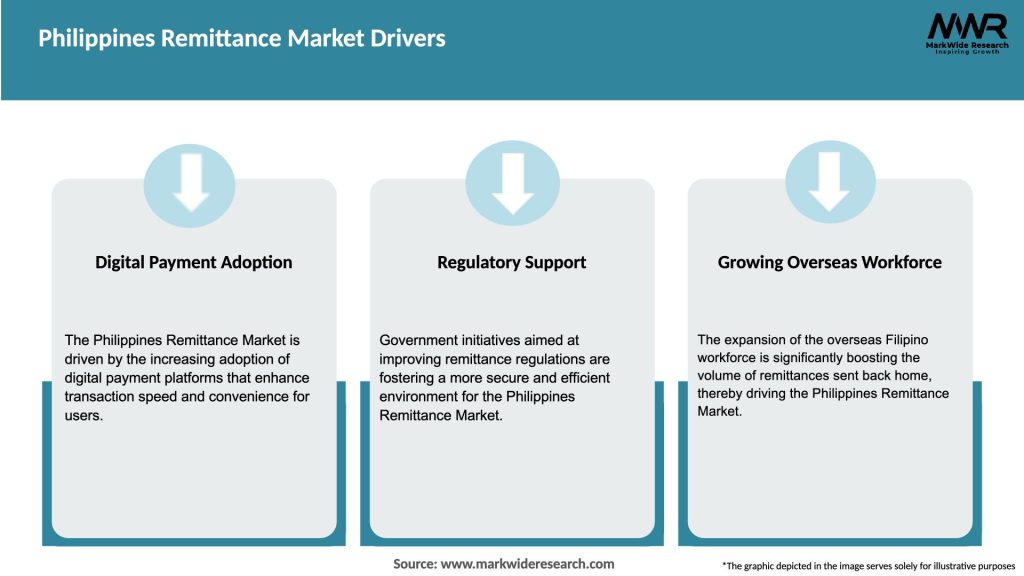

The Philippines remittance market has experienced robust growth in recent years, driven by factors such as the increasing number of OFWs, the rise of digital remittance platforms, and the continuous support of the Philippine government in promoting and facilitating remittance flows. This market provides vital support to Filipino families by enabling them to meet their financial needs and improve their living standards. However, the market also faces challenges, including regulatory complexities, high transaction costs, and potential risks associated with remittance flows.

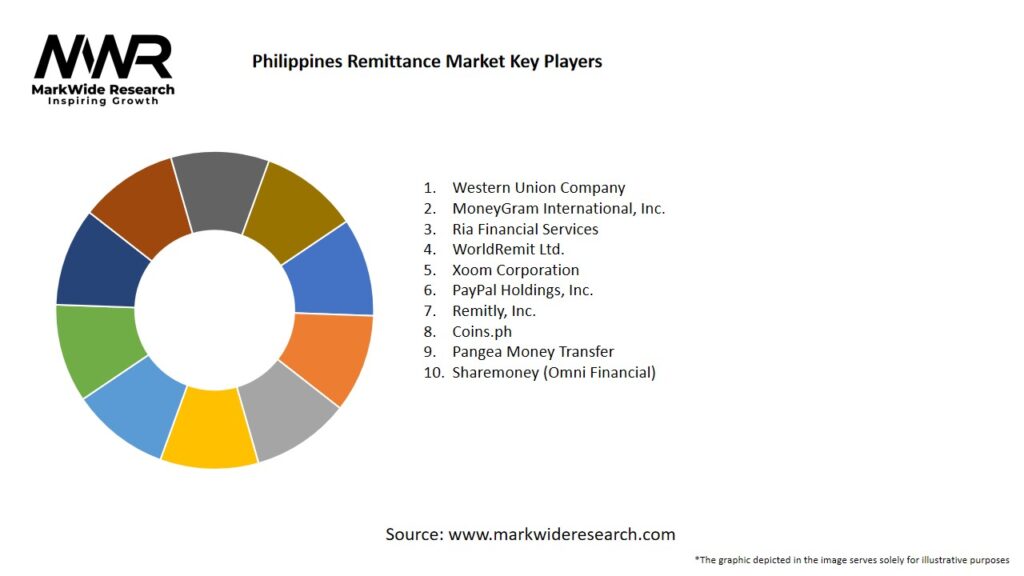

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Philippines remittance market is characterized by intense competition, evolving customer preferences, and regulatory influences. The market dynamics are shaped by factors such as economic conditions, government policies, technological advancements, and customer expectations. Service providers must continuously adapt to these dynamics to remain competitive and meet the changing needs of customers.

Regional Analysis

The remittance market in the Philippines is not limited to specific regions within the country but is spread across various provinces and cities. However, certain regions, such as Metro Manila, Central Luzon, and CALABARZON, have a higher concentration of OFWs and receive a significant share of remittances. These regions benefit from the economic impact of remittances, which drives consumption, real estate development, and other related industries.

Competitive Landscape

Leading Companies in the Philippines Remittance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

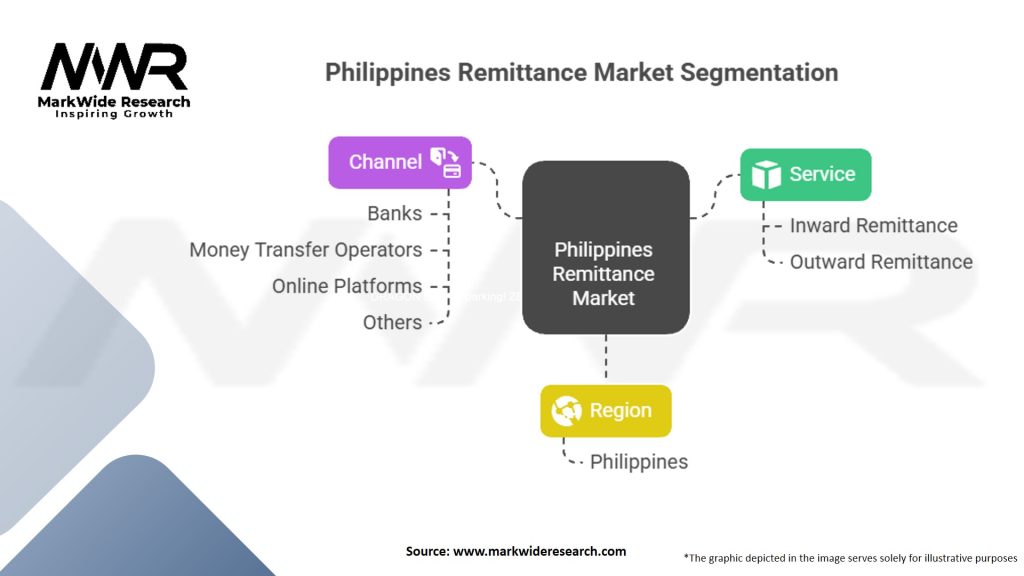

Segmentation

The Philippines remittance market can be segmented based on various factors, including the mode of transfer, recipient location, and purpose of remittance. Common modes of transfer include bank transfers, cash pickup, and mobile wallet transfers. Recipient locations can range from urban areas to rural communities. The purpose of remittance can vary, including household expenses, education, healthcare, and investments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Philippines remittance market. The restrictions on international travel and global lockdowns led to disruptions in global migration patterns, affecting the number of OFWs and the inflow of remittances. Many OFWs faced job losses, salary cuts, or reduced working hours, impacting their ability to send money back home. However, the pandemic also accelerated the adoption of digital remittance channels as people sought safer and contactless transfer options. The market witnessed a shift towards digital platforms, with an increased emphasis on online transactions and mobile wallets.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Philippines remittance market remains positive, albeit with some uncertainties. The market is expected to continue its growth trajectory, driven by factors such as the increasing number of OFWs, digital transformation, and government support. The adoption of digital platforms and the integration of emerging technologies like blockchain are likely to reshape the market and enhance the overall remittance experience. However, challenges such as regulatory complexities, high transaction costs, and geopolitical factors may pose risks to the market’s growth potential. Ongoing efforts to address these challenges and embrace opportunities will be crucial for industry participants to thrive in the evolving remittance landscape.

Conclusion

The Philippines remittance market is a vital component of the country’s economy, enabling overseas Filipino workers to support their families and contribute to poverty reduction. The market has experienced significant growth, driven by factors such as the increasing number of OFWs, government support, and technological advancements. However, challenges such as regulatory complexities, high transaction costs, and informal channels persist. Industry participants must adapt to market dynamics, embrace digital transformation, and prioritize customer-centricity to remain competitive. The future outlook for the market is optimistic, with opportunities in digital platforms, financial inclusion, and collaborations with fintech companies.

What is the Philippines remittance?

The Philippines remittance refers to the money sent back home by overseas Filipino workers to their families and communities in the Philippines. This financial flow plays a crucial role in the country’s economy, supporting household consumption and local businesses.

Who are the major players in the Philippines remittance market?

Major players in the Philippines remittance market include Western Union, MoneyGram, and PayPal, which provide various services for transferring money internationally. Additionally, local banks and fintech companies are increasingly participating in this space, enhancing competition and service offerings among others.

What are the key drivers of growth in the Philippines remittance market?

Key drivers of growth in the Philippines remittance market include the increasing number of overseas Filipino workers, the rise in digital payment solutions, and the growing demand for financial services among families relying on remittances for their livelihood. These factors contribute to a robust remittance ecosystem.

What challenges does the Philippines remittance market face?

The Philippines remittance market faces challenges such as high transaction fees, regulatory hurdles, and competition from informal money transfer channels. These issues can affect the efficiency and reliability of remittance services for users.

What opportunities exist in the Philippines remittance market?

Opportunities in the Philippines remittance market include the expansion of digital remittance services, partnerships with local businesses for cash-out options, and the potential for blockchain technology to enhance transaction security and reduce costs. These developments can significantly improve user experience.

What trends are shaping the Philippines remittance market?

Trends shaping the Philippines remittance market include the increasing adoption of mobile wallets, the shift towards online remittance platforms, and the growing emphasis on customer experience and service personalization. These trends reflect changing consumer behaviors and technological advancements.

Philippines Remittance Market

| Segmentation Details | Information |

|---|---|

| Service | Inward Remittance, Outward Remittance |

| Channel | Banks, Money Transfer Operators, Online Platforms, Others |

| Region | Philippines |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Philippines Remittance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at