444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines plastic market represents a dynamic and rapidly expanding sector within Southeast Asia’s manufacturing landscape. Market dynamics indicate substantial growth driven by increasing industrialization, urbanization, and rising consumer demand across multiple sectors. The market encompasses diverse plastic products including packaging materials, automotive components, construction materials, electronics housings, and consumer goods.

Growth projections show the market expanding at a robust CAGR of 6.8% through the forecast period, supported by strong domestic consumption and export opportunities. Key drivers include the booming e-commerce sector, infrastructure development initiatives, and the country’s strategic position as a manufacturing hub for multinational corporations. The market benefits from abundant raw material availability, competitive labor costs, and government support for industrial development.

Regional positioning places the Philippines as a significant player in the ASEAN plastic manufacturing ecosystem. The country’s market share in Southeast Asian plastic production has grown to approximately 12%, reflecting increased investment in manufacturing capabilities and technological advancement. Industry transformation is evident through adoption of advanced processing technologies, sustainable manufacturing practices, and integration of circular economy principles.

The Philippines plastic market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and consumption of plastic materials and products within the Philippine archipelago. This market includes raw material suppliers, manufacturers, converters, distributors, and end-users across various industrial and consumer segments.

Market scope covers thermoplastics, thermosets, engineering plastics, and specialty polymers used in packaging, automotive, construction, electronics, healthcare, and consumer applications. The market encompasses both domestic production facilities and import operations, serving local consumption needs and export markets throughout Asia-Pacific and beyond.

Value chain integration extends from petrochemical feedstock suppliers to finished product manufacturers, including recycling and waste management operations. The market represents a critical component of the Philippines’ manufacturing sector, contributing significantly to industrial output, employment generation, and economic development across multiple provinces and regions.

Market performance demonstrates strong momentum across key segments, with packaging applications leading demand growth at 8.2% annually. The Philippines plastic market benefits from favorable demographic trends, increasing disposable income, and expanding industrial base. Strategic positioning as a preferred manufacturing destination for global brands continues to drive investment and capacity expansion.

Technology adoption accelerates across the value chain, with manufacturers implementing advanced injection molding, extrusion, and blow molding technologies. Sustainability initiatives gain prominence as companies respond to environmental regulations and consumer preferences for eco-friendly solutions. The market shows 65% adoption rate of improved manufacturing processes among major players.

Competitive dynamics feature both international corporations and domestic manufacturers competing across price, quality, and innovation dimensions. Market consolidation trends emerge as larger players acquire smaller operations to achieve economies of scale and expand geographic coverage. Export growth reaches 15% annually, driven by competitive manufacturing costs and improving product quality standards.

Market intelligence reveals several critical insights shaping the Philippines plastic industry landscape:

Economic growth serves as the primary catalyst for plastic market expansion in the Philippines. GDP growth consistently above regional averages creates favorable conditions for industrial development and consumer spending. The expanding middle class drives demand for packaged goods, consumer electronics, and automotive products, all requiring significant plastic content.

Infrastructure development under government initiatives like “Build, Build, Build” generates substantial demand for construction plastics. Urbanization trends accelerate with 68% of population expected to live in urban areas, creating needs for modern packaging, construction materials, and consumer products. Industrial diversification efforts attract foreign investment in manufacturing sectors requiring plastic components.

E-commerce expansion drives packaging demand as online retail grows rapidly across the archipelago. Food processing industry development requires advanced packaging solutions to meet safety and shelf-life requirements. Automotive sector growth creates opportunities for lightweight plastic components as vehicle production increases. Electronics manufacturing expansion positions the Philippines as a key supplier of plastic housings and components for global technology companies.

Environmental regulations present significant challenges as the government implements stricter policies on single-use plastics and waste management. Raw material costs fluctuate with global oil prices, affecting manufacturing margins and pricing strategies. Infrastructure limitations in some regions constrain distribution efficiency and market penetration.

Skilled labor shortage affects advanced manufacturing operations requiring technical expertise in modern plastic processing technologies. Import dependence for specialized raw materials and additives creates supply chain vulnerabilities and cost pressures. Competition from regional manufacturers in Vietnam, Thailand, and Malaysia intensifies pricing pressure across export markets.

Waste management challenges create negative public perception and regulatory pressure on plastic usage. Energy costs remain relatively high compared to some regional competitors, affecting manufacturing competitiveness. Currency fluctuations impact import costs and export competitiveness, creating planning uncertainties for manufacturers. Quality standards requirements from international buyers necessitate continuous investment in equipment and training.

Sustainable plastics represent the most significant growth opportunity as biodegradable and recyclable materials gain market acceptance. Circular economy initiatives create new business models around plastic recycling and waste-to-energy conversion. Advanced manufacturing technologies enable production of high-value specialty plastics for aerospace, medical, and electronics applications.

Regional trade agreements like RCEP and CPTPP open new export markets with reduced tariff barriers. Smart packaging solutions incorporating IoT and sensor technologies create premium market segments. Automotive lightweighting trends drive demand for advanced composite materials and engineering plastics. Medical device manufacturing expansion creates opportunities for specialized biocompatible plastics.

Digital transformation enables manufacturers to optimize operations, reduce waste, and improve customer service. Government incentives for green technology adoption support investment in sustainable manufacturing processes. Export processing zones offer tax advantages and streamlined operations for export-oriented manufacturers. Research partnerships with universities and international organizations accelerate innovation in plastic materials and applications.

Supply chain evolution reflects increasing integration between raw material suppliers, processors, and end-users. MarkWide Research analysis indicates that vertical integration strategies help companies achieve cost reductions of 12-15% while improving quality control. Technology adoption accelerates across the value chain, with automation and digitalization improving efficiency and reducing labor dependency.

Competitive intensity increases as both domestic and international players expand capacity and capabilities. Price competition remains significant in commodity plastic segments, while specialty applications offer higher margins and growth potential. Innovation cycles shorten as companies invest in R&D to develop new materials and applications.

Regulatory landscape evolves rapidly with new environmental standards and safety requirements affecting product development and manufacturing processes. Consumer preferences shift toward sustainable and eco-friendly products, influencing material selection and packaging design. Global supply chains face disruption risks, encouraging localization and regional sourcing strategies. Investment flows favor companies demonstrating strong ESG credentials and sustainable business practices.

Comprehensive analysis employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, manufacturers, suppliers, and end-users across key market segments. Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements.

Data collection utilizes both quantitative and qualitative approaches, including structured surveys, focus groups, and expert consultations. Market sizing methodology incorporates bottom-up and top-down approaches to validate findings and ensure consistency. Trend analysis examines historical data patterns and forward-looking indicators to project future market developments.

Quality assurance processes include data triangulation, expert validation, and peer review to maintain research integrity. Regional analysis covers all major provinces and economic zones to provide comprehensive geographic insights. Competitive intelligence gathering includes company visits, trade show participation, and industry conference attendance. Continuous monitoring ensures research findings remain current and relevant to market participants.

Metro Manila dominates the Philippines plastic market with approximately 35% market share, driven by concentration of manufacturing facilities, headquarters operations, and consumer markets. Calabarzon region (Cavite, Laguna, Batangas, Rizal, Quezon) represents the fastest-growing market segment with annual growth of 8.5%, benefiting from industrial park development and proximity to ports.

Central Luzon emerges as a key manufacturing hub with significant automotive and electronics plastic production. Cebu province leads Visayas region development with strong export-oriented manufacturing and growing domestic consumption. Davao region shows promising growth potential in Mindanao, supported by infrastructure development and agricultural processing industries.

Clark Freeport Zone and Subic Bay serve as important manufacturing centers with favorable investment incentives and logistics infrastructure. Bataan province benefits from petrochemical industry presence and established industrial base. Regional distribution networks expand to serve growing provincial markets, with logistics efficiency improvements of 18% over recent years. Economic zones across regions attract foreign investment and drive local plastic demand growth.

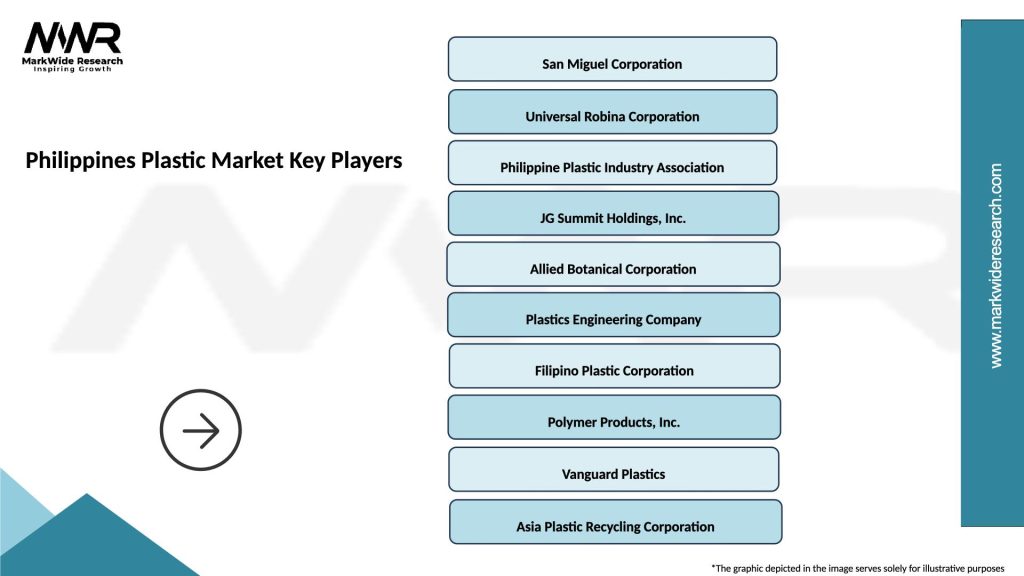

Market leadership features a mix of multinational corporations and strong domestic players competing across various segments:

Competitive strategies focus on capacity expansion, technology upgrading, and market diversification. Strategic partnerships with international technology providers enhance manufacturing capabilities and product quality. Merger and acquisition activities increase as companies seek scale advantages and market consolidation opportunities.

By Product Type:

By Application:

By End-User Industry:

Packaging plastics maintain market leadership with consistent demand growth across food, beverage, and consumer goods sectors. Flexible packaging shows particularly strong growth with annual expansion of 9.2%, driven by e-commerce and convenience food trends. Rigid packaging benefits from beverage industry growth and industrial applications requiring durable containers.

Automotive plastics experience rapid growth as vehicle production increases and lightweighting initiatives gain momentum. Interior components lead automotive plastic consumption, followed by exterior parts and under-hood applications. Electric vehicle adoption creates new opportunities for specialized plastic components and battery housings.

Construction plastics benefit from infrastructure development and urbanization trends. Pipe and fittings represent the largest construction plastic segment, supported by water infrastructure projects and building construction. Insulation materials gain importance with energy efficiency regulations and green building standards.

Electronics plastics grow with expanding consumer electronics manufacturing and industrial automation. Specialty grades for high-temperature and flame-retardant applications command premium pricing. Miniaturization trends require advanced processing capabilities and precision manufacturing.

Manufacturers benefit from growing domestic demand, export opportunities, and government support for industrial development. Cost advantages include competitive labor rates, improving infrastructure, and strategic location for Asian markets. Technology transfer opportunities through foreign partnerships enhance manufacturing capabilities and product quality.

Suppliers gain from expanding customer base, increasing order volumes, and opportunities for value-added services. Raw material suppliers benefit from growing domestic petrochemical capacity and reduced import dependence. Equipment suppliers find opportunities in capacity expansion and technology upgrade projects.

End-users access improved product quality, competitive pricing, and reliable supply chains. Local sourcing reduces lead times, transportation costs, and supply chain risks. Customization capabilities enable tailored solutions for specific application requirements.

Investors find attractive opportunities in a growing market with strong fundamentals and government support. Economic zones offer tax incentives and streamlined operations for manufacturing investments. ESG-focused investments in sustainable plastic technologies align with global trends and regulatory requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation emerges as the dominant trend reshaping the Philippines plastic market. Circular economy principles drive investment in recycling infrastructure and closed-loop manufacturing systems. Bio-based plastics gain traction with adoption rates increasing 25% annually among progressive manufacturers seeking environmental differentiation.

Digital manufacturing revolutionizes production processes through IoT integration, predictive maintenance, and real-time quality monitoring. Industry 4.0 adoption reaches 45% penetration among major manufacturers, improving efficiency and reducing waste. Smart packaging incorporating sensors and connectivity features creates new market segments and premium pricing opportunities.

Lightweighting initiatives across automotive and aerospace applications drive demand for advanced engineering plastics and composite materials. Additive manufacturing gains momentum for prototyping and small-batch production, enabling rapid product development and customization. Supply chain localization accelerates as companies seek resilience and reduced dependence on distant suppliers.

Regulatory compliance becomes increasingly complex with evolving environmental standards and safety requirements. Extended producer responsibility programs create new business models around product lifecycle management and waste collection. Consumer awareness of environmental issues influences purchasing decisions and brand preferences.

Capacity expansion projects across major manufacturers indicate strong confidence in market growth prospects. JG Summit Petrochemicals announced significant investment in new production lines for specialty plastics and engineering grades. Foreign investment continues with several multinational companies establishing or expanding Philippine operations.

Technology partnerships between local manufacturers and international technology providers accelerate capability development. Research collaborations with universities and research institutions focus on sustainable materials and advanced processing technologies. MWR analysis shows that companies investing in R&D achieve revenue growth rates 40% higher than industry average.

Regulatory developments include new environmental standards and waste management requirements affecting industry operations. Government initiatives support circular economy development through tax incentives and regulatory frameworks. Trade agreements create new opportunities for export growth and technology transfer.

Sustainability initiatives gain momentum with industry commitments to reduce environmental impact and improve recycling rates. Certification programs for sustainable plastics help manufacturers differentiate products and access premium markets. Waste-to-energy projects provide alternative disposal methods and energy generation opportunities.

Strategic positioning should focus on high-value applications and sustainable solutions to differentiate from low-cost competitors. Investment priorities should emphasize technology upgrading, capacity expansion in growth segments, and sustainability initiatives. Market development efforts should target emerging applications in healthcare, electronics, and renewable energy sectors.

Partnership strategies with international technology providers can accelerate capability development and market access. Supply chain optimization through vertical integration or strategic alliances can improve cost competitiveness and quality control. Export diversification reduces dependence on traditional markets and captures growth in emerging economies.

Sustainability leadership creates competitive advantages and aligns with global trends toward environmental responsibility. Digital transformation investments improve operational efficiency and enable new business models. Talent development programs address skills shortages and support technology adoption initiatives.

Regulatory compliance preparation helps companies adapt to evolving environmental standards and maintain market access. Innovation focus on specialty materials and advanced applications commands premium pricing and higher margins. Customer relationship strengthening through value-added services and technical support enhances market position.

Long-term prospects for the Philippines plastic market remain highly positive, supported by demographic trends, economic development, and industrial diversification. Growth momentum is expected to accelerate with infrastructure completion, technology advancement, and expanding export opportunities. MarkWide Research projects continued market expansion with compound annual growth rates exceeding 7% across key segments.

Technology evolution will drive market transformation through advanced materials, smart manufacturing, and sustainable solutions. Circular economy implementation creates new business models and revenue streams while addressing environmental concerns. Regional integration through trade agreements and economic partnerships expands market opportunities and competitive dynamics.

Investment flows are expected to increase as companies capitalize on growth opportunities and government incentives. Capacity additions will focus on high-value segments and sustainable technologies rather than commodity plastics. Export growth potential remains strong with projected annual increases of 12-15% driven by competitive advantages and market development efforts.

Sustainability transformation will accelerate with regulatory pressure, consumer demand, and corporate responsibility initiatives. Innovation ecosystems will strengthen through research partnerships, technology transfer, and startup development. Market maturation will favor companies with strong capabilities, sustainable practices, and customer-focused strategies.

The Philippines plastic market stands at a pivotal moment of transformation and growth, driven by robust domestic demand, expanding export opportunities, and increasing focus on sustainability. Market fundamentals remain strong with supportive demographics, government policies, and strategic geographic positioning creating favorable conditions for continued expansion.

Industry evolution toward sustainable practices, advanced technologies, and high-value applications presents significant opportunities for forward-thinking companies. Competitive advantages in cost, location, and capabilities position the Philippines as an attractive destination for plastic manufacturing investments. Future success will depend on companies’ ability to adapt to changing market dynamics, embrace sustainability, and deliver innovative solutions to evolving customer needs.

The Philippines plastic market trajectory indicates sustained growth and development, making it an essential component of the country’s industrial future and a key player in the regional manufacturing ecosystem.

What is Plastic?

Plastic refers to a wide range of synthetic or semi-synthetic materials that are used in various applications, including packaging, construction, and consumer goods. It is known for its versatility, durability, and lightweight properties.

What are the key players in the Philippines Plastic Market?

Key players in the Philippines Plastic Market include companies like Universal Robina Corporation, D&L Industries, and First Philippine Industrial Corporation, among others. These companies are involved in the production and distribution of various plastic products across different sectors.

What are the main drivers of growth in the Philippines Plastic Market?

The growth of the Philippines Plastic Market is driven by increasing demand in packaging, automotive, and construction industries. Additionally, the rise in consumer goods production and urbanization contributes to the market’s expansion.

What challenges does the Philippines Plastic Market face?

The Philippines Plastic Market faces challenges such as environmental concerns regarding plastic waste and regulatory pressures for sustainable practices. Additionally, competition from alternative materials can impact market growth.

What opportunities exist in the Philippines Plastic Market?

Opportunities in the Philippines Plastic Market include the development of biodegradable plastics and innovations in recycling technologies. The growing emphasis on sustainability presents avenues for companies to create eco-friendly products.

What trends are shaping the Philippines Plastic Market?

Trends in the Philippines Plastic Market include a shift towards sustainable packaging solutions and increased investment in recycling infrastructure. Additionally, advancements in plastic manufacturing technologies are enhancing product quality and efficiency.

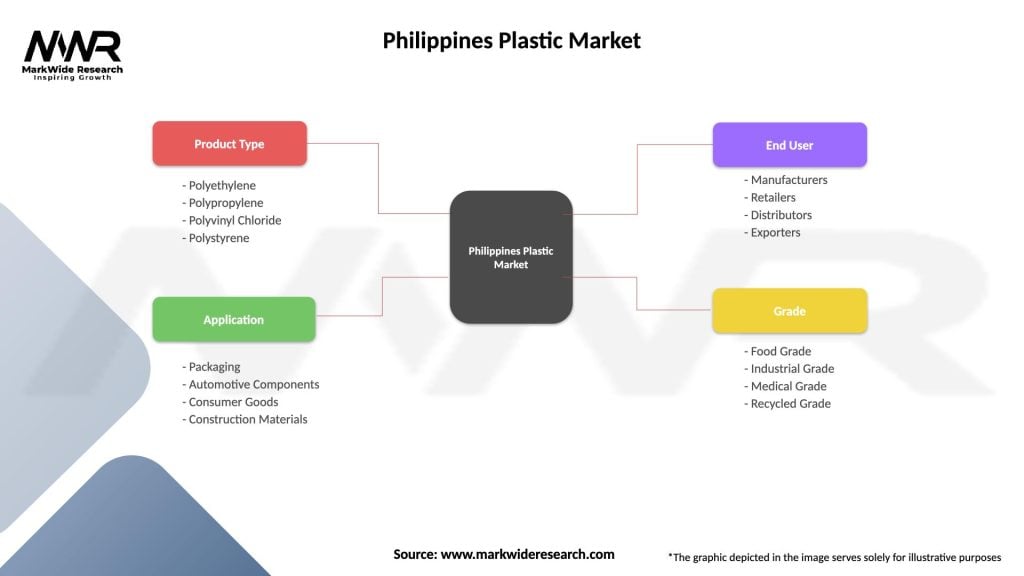

Philippines Plastic Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene |

| Application | Packaging, Automotive Components, Consumer Goods, Construction Materials |

| End User | Manufacturers, Retailers, Distributors, Exporters |

| Grade | Food Grade, Industrial Grade, Medical Grade, Recycled Grade |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Plastic Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at