444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines food service market represents one of the most dynamic and rapidly evolving sectors in Southeast Asia’s hospitality industry. Market dynamics indicate robust growth driven by urbanization, changing consumer preferences, and increasing disposable income among Filipino families. The sector encompasses restaurants, fast food chains, cafes, catering services, and institutional food providers serving millions of consumers daily across the archipelago.

Growth trajectories show the market expanding at a compound annual growth rate (CAGR) of 8.2%, reflecting strong consumer demand and business investment in food service infrastructure. Urban centers like Metro Manila, Cebu, and Davao drive significant market activity, while emerging provincial markets present substantial expansion opportunities for established and new market players.

Consumer behavior patterns reveal increasing preference for convenience dining, international cuisine, and premium food experiences. The market benefits from a young demographic profile, with approximately 65% of the population under 35 years, creating sustained demand for diverse food service offerings. Digital transformation accelerates market evolution through online ordering platforms, delivery services, and mobile payment integration.

The Philippines food service market refers to the comprehensive ecosystem of businesses and establishments that prepare, serve, and deliver food and beverages to consumers outside their homes. This market encompasses various segments including quick service restaurants, casual dining establishments, fine dining venues, coffee shops, food trucks, catering companies, and institutional food service providers serving schools, hospitals, and corporate facilities.

Market scope includes both traditional Filipino cuisine establishments and international food concepts that have adapted to local tastes and preferences. The sector plays a crucial role in the country’s economy, providing employment opportunities, supporting agricultural supply chains, and contributing significantly to tourism and hospitality industries.

Strategic analysis reveals the Philippines food service market experiencing unprecedented growth momentum driven by demographic advantages, economic development, and evolving consumer lifestyles. Market penetration of international food chains continues expanding while local brands strengthen their competitive positions through innovation and regional expansion strategies.

Key performance indicators demonstrate healthy market fundamentals with restaurant density increasing by 12% annually in major urban areas. Investment flows from both domestic and foreign investors support market expansion, particularly in franchise operations and technology-enabled food service concepts. The sector’s resilience during economic challenges showcases its essential role in Filipino consumer spending patterns.

Competitive landscape features a mix of established multinational chains, growing local brands, and innovative startup concepts. Market leaders leverage economies of scale, brand recognition, and operational efficiency to maintain market share while emerging players focus on niche segments and unique value propositions to capture consumer attention.

Consumer preferences in the Philippines food service market reflect a unique blend of traditional Filipino tastes and international culinary influences. Market research indicates several critical insights shaping industry development:

Economic growth serves as the primary catalyst propelling the Philippines food service market forward. GDP expansion and rising per capita income enable increased consumer spending on dining experiences and convenience food options. The growing middle class demonstrates stronger purchasing power and willingness to explore diverse culinary offerings.

Urbanization trends create concentrated consumer bases in metropolitan areas, supporting higher restaurant density and specialized food service concepts. Infrastructure development improves accessibility to dining establishments and enables efficient supply chain operations. Modern shopping malls and commercial districts provide prime locations for food service businesses to establish operations.

Demographic advantages position the Philippines favorably for sustained food service market growth. The young population profile drives demand for trendy dining concepts, international cuisines, and social dining experiences. Lifestyle changes among urban professionals increase reliance on food service establishments for daily meals due to busy work schedules and longer commuting times.

Tourism industry growth generates additional demand for food service establishments, particularly in popular destinations like Boracay, Palawan, and Bohol. Business process outsourcing sector expansion creates large employee populations requiring convenient dining options near office complexes and business districts.

Regulatory challenges present significant obstacles for food service operators in the Philippines. Complex permitting processes involving multiple government agencies create delays and increased compliance costs for new establishments. Health and safety regulations require substantial investments in equipment, training, and ongoing monitoring systems.

Supply chain limitations affect food service operations, particularly for establishments requiring consistent quality ingredients. Infrastructure constraints in transportation and cold storage facilities impact food distribution efficiency and increase operational costs. Seasonal availability of certain ingredients creates menu planning challenges and price volatility.

Labor market dynamics pose ongoing challenges with high turnover rates in food service positions. Skills shortages in culinary arts and hospitality management limit expansion capabilities for growing restaurant chains. Training costs and employee retention strategies require significant resource allocation from food service operators.

Economic volatility influences consumer spending patterns, with food service being among the first categories affected during economic downturns. Competition intensity creates pressure on profit margins, particularly for smaller independent establishments competing against well-funded chain operations.

Digital transformation presents substantial opportunities for Philippines food service market participants. Online ordering platforms enable restaurants to reach broader customer bases and increase order frequency through convenient mobile applications. Integration of artificial intelligence and data analytics helps optimize menu offerings, pricing strategies, and inventory management.

Provincial market expansion offers significant growth potential as economic development spreads beyond major metropolitan areas. Secondary cities demonstrate increasing consumer sophistication and disposable income, creating demand for diverse food service concepts. Franchise models provide scalable approaches to capture these emerging market opportunities.

Health and wellness trends create opportunities for innovative menu development focusing on nutritious, organic, and locally-sourced ingredients. Specialized dietary requirements including vegetarian, vegan, and gluten-free options represent underserved market segments with growing consumer interest.

Corporate catering services present lucrative opportunities as businesses seek convenient meal solutions for employees. Event catering for weddings, conferences, and social gatherings benefits from Filipino cultural emphasis on food in celebrations and gatherings.

Competitive forces shape the Philippines food service market through continuous innovation, pricing strategies, and customer experience enhancement. Market leaders leverage brand recognition, operational efficiency, and marketing capabilities to maintain competitive advantages while emerging players focus on differentiation through unique concepts and localized offerings.

Consumer behavior evolution drives market dynamics as Filipino diners become more adventurous in trying international cuisines while maintaining strong preferences for familiar flavors. Social media influence significantly impacts restaurant popularity and consumer decision-making processes, with Instagram-worthy presentations becoming crucial marketing elements.

Technology integration transforms operational efficiency through point-of-sale systems, inventory management software, and customer relationship management platforms. Delivery aggregator platforms capture 42% of online food orders, reshaping how restaurants interact with customers and manage order fulfillment processes.

Supply chain optimization becomes increasingly important as restaurants seek to control costs while maintaining food quality and consistency. Local sourcing initiatives support community development while reducing transportation costs and ensuring ingredient freshness.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Philippines food service market. Primary research includes structured interviews with industry executives, restaurant owners, franchise operators, and food service suppliers to gather firsthand market intelligence and operational insights.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and academic studies related to food service trends and consumer behavior patterns. Data triangulation methods validate findings across multiple sources to ensure research accuracy and reliability.

Market surveys capture consumer preferences, dining frequency patterns, spending behaviors, and satisfaction levels across different demographic segments and geographic regions. Focus group discussions provide qualitative insights into consumer motivations, decision-making processes, and emerging trend preferences.

Quantitative analysis utilizes statistical modeling to project market trends, growth rates, and segment performance. Competitive intelligence gathering includes monitoring of pricing strategies, menu innovations, expansion plans, and marketing campaigns across major market participants.

Metro Manila dominates the Philippines food service market, accounting for approximately 45% of total market activity. The capital region benefits from high population density, concentrated business districts, and strong consumer purchasing power. Makati, Bonifacio Global City, and Ortigas serve as primary commercial hubs driving demand for diverse food service concepts.

Cebu Province represents the second-largest regional market, capturing 18% market share through its role as the economic center of the Visayas region. Tourism activities and growing business process outsourcing sector support sustained demand for restaurants, cafes, and catering services. Local culinary traditions blend with international influences to create unique dining experiences.

Davao Region demonstrates strong market potential with 12% regional market share, driven by agricultural prosperity and emerging urban development. The region’s strategic location and growing infrastructure investments position it for continued food service market expansion.

Provincial markets collectively represent 25% of market activity with significant growth potential as economic development spreads beyond traditional urban centers. Baguio, Iloilo, Bacolod, and Cagayan de Oro emerge as key secondary markets attracting food service investment and franchise expansion.

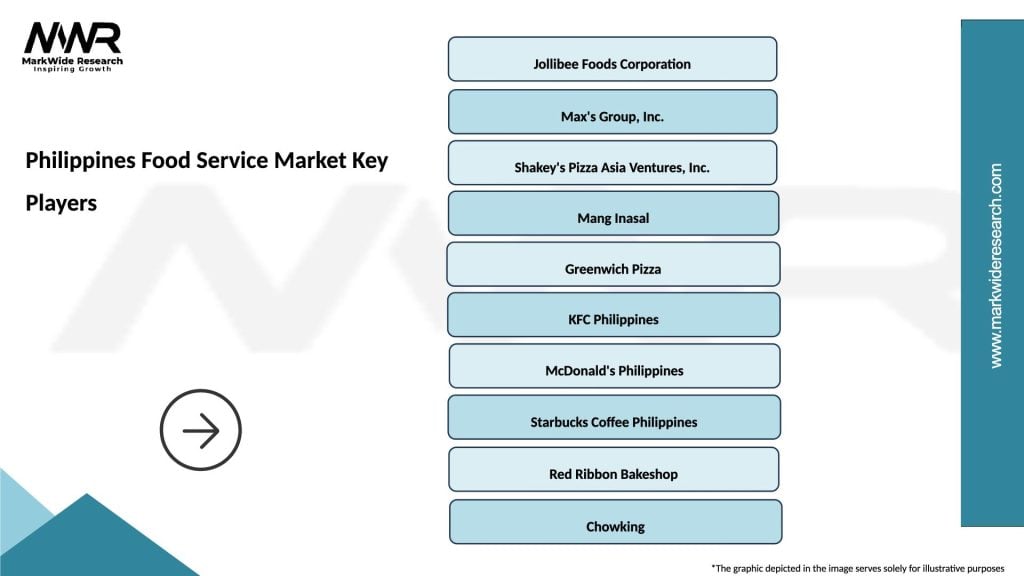

Market leadership in the Philippines food service sector features a diverse mix of international chains, local brands, and regional players competing across multiple segments. Competitive positioning strategies focus on brand differentiation, operational efficiency, and customer loyalty development.

Emerging competitors include innovative local concepts and new international entrants seeking to capture market share through unique positioning and targeted consumer segments.

Market segmentation analysis reveals distinct categories within the Philippines food service market, each serving specific consumer needs and preferences. Segmentation strategies help businesses identify target markets and develop appropriate positioning approaches.

By Service Type:

By Cuisine Type:

By Location:

Quick Service Restaurant segment demonstrates the strongest growth momentum, capturing 52% of total market transactions. Consumer preferences for convenience, affordability, and consistent quality drive segment expansion. Major players invest heavily in technology integration, delivery capabilities, and menu innovation to maintain competitive advantages.

Casual dining establishments serve the growing middle-class market seeking quality dining experiences at moderate price points. Family-oriented concepts perform particularly well, leveraging Filipino cultural values emphasizing shared meals and celebrations. This segment benefits from increasing disposable income and changing lifestyle patterns among urban consumers.

Coffee shop and cafe segment experiences rapid growth driven by young professionals and students seeking social spaces and productivity environments. Local coffee chains compete effectively against international brands by incorporating Filipino flavors and creating community-focused atmospheres.

Food delivery and takeaway services transform traditional restaurant operations, with online orders growing 45% annually. Ghost kitchens and delivery-only concepts emerge as cost-effective approaches to serve growing demand for convenient meal solutions.

Institutional food service presents significant opportunities in schools, hospitals, and corporate facilities. Contract catering companies develop specialized capabilities to serve large-scale food service requirements while maintaining quality and cost efficiency.

Restaurant operators benefit from the Philippines food service market through access to a large and growing consumer base with increasing purchasing power. Franchise opportunities enable rapid expansion with reduced capital requirements and operational risks. Strong brand loyalty among Filipino consumers provides sustainable competitive advantages for established market participants.

Food suppliers and distributors gain from increased demand for quality ingredients, packaging materials, and specialized food products. Supply chain partnerships with restaurant chains provide stable revenue streams and opportunities for business growth. Local agricultural producers benefit from direct relationships with food service establishments seeking fresh, locally-sourced ingredients.

Technology providers find substantial opportunities in point-of-sale systems, inventory management software, delivery platforms, and customer engagement tools. Digital transformation initiatives across the food service sector create demand for innovative technology solutions that improve operational efficiency and customer experiences.

Real estate developers benefit from strong demand for prime restaurant locations in shopping centers, business districts, and residential areas. Food service tenants often provide stable rental income and attract foot traffic that benefits other retail establishments.

Employment generation across the food service value chain supports economic development and provides career opportunities for millions of Filipinos in culinary arts, hospitality management, and related service industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness consciousness drives significant changes in menu development and ingredient sourcing across the Philippines food service market. Restaurants increasingly offer organic options, reduced sodium alternatives, and transparent nutritional information to meet evolving consumer demands. Plant-based protein alternatives gain traction among health-conscious diners seeking sustainable dining options.

Technology integration transforms customer experiences through mobile ordering applications, contactless payment systems, and personalized marketing campaigns. Artificial intelligence applications help restaurants optimize inventory management, predict demand patterns, and enhance customer service delivery. Social media integration becomes essential for brand building and customer engagement strategies.

Sustainability initiatives gain importance as consumers and businesses focus on environmental responsibility. Restaurants adopt eco-friendly packaging materials, waste reduction programs, and energy-efficient equipment to minimize environmental impact. Local sourcing initiatives support community development while reducing transportation costs and carbon footprints.

Experiential dining concepts emerge as restaurants seek differentiation through unique atmospheres, interactive experiences, and Instagram-worthy presentations. Themed restaurants, cooking classes, and chef’s table experiences cater to consumers seeking memorable dining adventures beyond traditional meal service.

Delivery optimization becomes crucial as online food ordering continues expanding. Ghost kitchen concepts and delivery-only brands optimize operations for takeaway and delivery services while reducing overhead costs associated with traditional dine-in establishments.

Major franchise expansions characterize recent industry developments as established brands accelerate growth strategies across provincial markets. International food chains continue entering the Philippines market through partnerships with local operators who understand consumer preferences and regulatory requirements.

Technology partnerships between restaurants and fintech companies enable advanced payment solutions, loyalty programs, and customer data analytics. Delivery platform consolidation creates more efficient logistics networks and improved service quality for consumers and restaurant partners.

Investment activities include private equity funding for promising local restaurant concepts and acquisition strategies among major food service companies seeking market share expansion. Real estate development projects increasingly incorporate food service spaces as anchor tenants in mixed-use developments.

Regulatory updates focus on food safety standards, nutritional labeling requirements, and digital payment regulations affecting food service operations. Government initiatives supporting small business development provide financing options and training programs for aspiring restaurant entrepreneurs.

According to MarkWide Research, strategic partnerships between food service operators and agricultural producers strengthen supply chain relationships and ensure consistent ingredient quality while supporting local farming communities.

Market entry strategies should prioritize understanding local consumer preferences and cultural dining habits before launching new concepts. Successful operators invest time in market research, consumer testing, and menu adaptation to ensure alignment with Filipino tastes and price sensitivity expectations.

Technology adoption represents a critical success factor for modern food service operations. Restaurants should prioritize mobile ordering capabilities, efficient point-of-sale systems, and customer relationship management tools to compete effectively in the digital marketplace.

Location selection requires careful analysis of foot traffic patterns, demographic profiles, and competition density. Prime locations in shopping centers, business districts, and residential areas command premium rents but provide access to target customer segments and sustained revenue potential.

Operational efficiency improvements through staff training, inventory management, and quality control systems help maintain profitability in competitive market conditions. Cost management strategies should balance quality maintenance with pricing competitiveness to attract and retain customers.

Brand building through social media marketing, community engagement, and customer loyalty programs creates sustainable competitive advantages. Local market adaptation while maintaining core brand values helps international concepts succeed in the Philippines market environment.

Growth projections indicate the Philippines food service market will continue expanding at a robust pace, driven by favorable demographic trends, economic development, and evolving consumer lifestyles. MarkWide Research analysis suggests sustained growth momentum with increasing market sophistication and segment diversification.

Digital transformation will accelerate across all market segments, with technology becoming integral to operations, customer engagement, and business growth strategies. Artificial intelligence applications will enhance menu optimization, demand forecasting, and personalized customer experiences.

Market consolidation may occur as successful operators acquire smaller competitors and expand their geographic presence through strategic acquisitions and franchise development. International brands will continue entering the market while local concepts strengthen their competitive positions through innovation and regional expansion.

Sustainability focus will intensify as environmental consciousness grows among consumers and businesses. Restaurants will increasingly adopt eco-friendly practices, local sourcing initiatives, and waste reduction programs to meet stakeholder expectations and regulatory requirements.

Provincial market development presents the greatest growth opportunity as economic development spreads beyond major metropolitan areas. Secondary cities will attract increased food service investment as consumer purchasing power and dining sophistication continue improving.

The Philippines food service market demonstrates exceptional growth potential driven by favorable demographic trends, economic development, and evolving consumer preferences. Market participants who understand local culture, invest in technology, and maintain operational excellence will capture the greatest opportunities in this dynamic and expanding sector.

Strategic success requires balancing global best practices with local market adaptation, ensuring that food service concepts resonate with Filipino consumers while maintaining operational efficiency and profitability. Technology integration and sustainability initiatives will become increasingly important differentiators in the competitive marketplace.

Future growth will be supported by continued urbanization, rising disposable income, and the young population’s openness to diverse dining experiences. MWR research indicates that operators who invest in understanding consumer needs, embrace digital transformation, and maintain high service standards will achieve sustainable success in the Philippines food service market.

What is Philippines Food Service?

Philippines Food Service refers to the sector that provides food and beverage services to consumers outside their homes, including restaurants, cafes, catering services, and institutional food services.

What are the key players in the Philippines Food Service Market?

Key players in the Philippines Food Service Market include Jollibee Foods Corporation, Max’s Group, and Mang Inasal, among others.

What are the main drivers of growth in the Philippines Food Service Market?

The main drivers of growth in the Philippines Food Service Market include the increasing urbanization, rising disposable incomes, and changing consumer preferences towards dining out and convenience foods.

What challenges does the Philippines Food Service Market face?

The Philippines Food Service Market faces challenges such as intense competition, fluctuating food prices, and the need for compliance with health and safety regulations.

What opportunities exist in the Philippines Food Service Market?

Opportunities in the Philippines Food Service Market include the growth of online food delivery services, the expansion of international cuisine offerings, and the increasing demand for healthy and sustainable food options.

What trends are shaping the Philippines Food Service Market?

Trends shaping the Philippines Food Service Market include the rise of food trucks, the integration of technology in ordering and payment systems, and a growing focus on local and organic ingredients.

Philippines Food Service Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fast Food, Casual Dining, Fine Dining, Cafés |

| Customer Type | Families, Young Adults, Business Professionals, Tourists |

| Service Type | Dine-in, Takeout, Delivery, Catering |

| Price Tier | Budget, Mid-range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Food Service Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at