444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines diabetes drugs and devices market represents a rapidly expanding healthcare sector driven by increasing diabetes prevalence and growing awareness of advanced treatment options. Market dynamics indicate significant growth potential as the country faces rising diabetes incidence rates, with approximately 7.1% of the adult population affected by this chronic condition. The market encompasses a comprehensive range of therapeutic solutions including insulin products, oral antidiabetic medications, glucose monitoring devices, and insulin delivery systems.

Healthcare infrastructure improvements across the Philippines have facilitated better access to diabetes management solutions, particularly in urban centers like Manila, Cebu, and Davao. The market benefits from government initiatives promoting diabetes awareness and prevention programs, coupled with increasing healthcare expenditure and insurance coverage expansion. Private healthcare facilities and public hospitals are increasingly adopting advanced diabetes management technologies, creating substantial opportunities for market participants.

Regional distribution shows concentrated demand in Metro Manila and other major urban areas, accounting for approximately 65% of total market consumption. However, rural market penetration is gradually improving through telemedicine initiatives and mobile health programs. The market demonstrates strong growth momentum with projected expansion at a compound annual growth rate of 8.2% over the forecast period, driven by demographic trends and evolving treatment paradigms.

The Philippines diabetes drugs and devices market refers to the comprehensive healthcare sector encompassing all pharmaceutical products, medical devices, and technological solutions designed for the prevention, diagnosis, monitoring, and treatment of diabetes mellitus within the Philippine healthcare system. This market includes insulin formulations, oral hypoglycemic agents, glucose monitoring systems, insulin delivery devices, and emerging digital health solutions specifically tailored for diabetes management.

Market scope extends beyond traditional pharmaceutical products to include continuous glucose monitoring systems, insulin pumps, smart glucose meters, and mobile health applications that support diabetes self-management. The definition encompasses both prescription medications available through healthcare providers and over-the-counter monitoring devices accessible to patients for daily diabetes management. Healthcare stakeholders within this market include pharmaceutical manufacturers, medical device companies, healthcare providers, patients, and government health agencies working collaboratively to address the growing diabetes burden in the Philippines.

Strategic analysis reveals the Philippines diabetes drugs and devices market as a high-growth healthcare segment characterized by increasing patient population, evolving treatment protocols, and expanding access to advanced therapeutic options. The market benefits from favorable demographic trends, including urbanization, lifestyle changes, and an aging population contributing to higher diabetes incidence rates. Government support through the Universal Health Care Act and PhilHealth coverage expansion has improved patient access to diabetes medications and monitoring devices.

Key market drivers include rising diabetes prevalence, increasing healthcare awareness, growing disposable income, and technological advancements in diabetes management solutions. The market faces challenges related to affordability concerns, particularly in rural areas, and the need for enhanced healthcare infrastructure to support advanced diabetes technologies. Competitive landscape features both international pharmaceutical giants and emerging local players focusing on cost-effective solutions tailored to Filipino patients’ needs.

Market segmentation reveals insulin products commanding the largest share, followed by oral antidiabetic drugs and glucose monitoring devices. The devices segment shows particularly strong growth potential, driven by increasing adoption of continuous glucose monitoring and smart insulin delivery systems. Future prospects indicate sustained market expansion supported by ongoing healthcare reforms, digital health initiatives, and increasing focus on preventive diabetes care.

Market intelligence reveals several critical insights shaping the Philippines diabetes drugs and devices landscape. The following key insights provide strategic direction for market participants:

Primary market drivers propelling growth in the Philippines diabetes drugs and devices market stem from multiple interconnected factors creating sustained demand for diabetes management solutions. The increasing prevalence of diabetes represents the fundamental driver, with lifestyle changes associated with urbanization, sedentary behavior, and dietary modifications contributing to rising incidence rates across all age groups.

Government healthcare initiatives serve as significant market catalysts, particularly the implementation of the Universal Health Care Act and expanded PhilHealth coverage for diabetes medications and supplies. These policy changes have improved patient access to essential diabetes treatments, reducing financial barriers that previously limited market penetration. Healthcare infrastructure development across the Philippines has enhanced distribution networks and improved availability of diabetes products in previously underserved regions.

Technological advancement in diabetes management solutions drives market expansion through innovative products offering improved patient outcomes and enhanced convenience. The growing adoption of continuous glucose monitoring systems, smart insulin pens, and mobile health applications reflects increasing patient demand for advanced diabetes management tools. Healthcare provider education and awareness campaigns have improved diabetes diagnosis rates and treatment compliance, expanding the addressable patient population.

Economic factors including rising disposable income, expanding middle class, and increased health insurance coverage contribute to market growth by improving patient affordability for diabetes treatments and devices. The growing recognition of diabetes as a serious health condition requiring comprehensive management has increased patient willingness to invest in quality diabetes care solutions.

Significant market restraints challenge the Philippines diabetes drugs and devices market growth, primarily centered around affordability and accessibility issues affecting patient adoption of diabetes management solutions. High treatment costs remain a substantial barrier, particularly for advanced diabetes devices and newer insulin formulations that may not be fully covered by insurance programs, limiting access for lower-income patient populations.

Healthcare infrastructure limitations in rural and remote areas restrict market penetration, with inadequate cold chain storage for insulin products and limited availability of specialized diabetes care services. The shortage of endocrinologists and diabetes specialists across the Philippines creates treatment gaps and reduces optimal diabetes management, particularly in provincial areas where specialist care is scarce.

Regulatory challenges including lengthy product registration processes and complex import requirements can delay market entry for innovative diabetes products, limiting patient access to the latest treatment options. Cultural factors and health literacy issues may impact patient compliance with diabetes management protocols, affecting treatment outcomes and market growth potential.

Supply chain vulnerabilities exposed during the COVID-19 pandemic highlighted dependencies on imported diabetes products and potential disruptions to medication availability. The lack of local manufacturing capabilities for advanced diabetes devices creates supply security concerns and limits price competitiveness compared to markets with domestic production facilities.

Substantial market opportunities exist within the Philippines diabetes drugs and devices market, driven by unmet medical needs and evolving healthcare landscape dynamics. The expanding digital health ecosystem presents significant opportunities for innovative diabetes management solutions, including telemedicine platforms, mobile health applications, and remote patient monitoring systems that can address healthcare access challenges in rural areas.

Generic drug market opportunities are particularly promising, with patent expirations for several branded diabetes medications creating space for affordable generic alternatives. Local pharmaceutical companies can capitalize on these opportunities by developing cost-effective formulations tailored to Filipino patients’ needs and economic circumstances. Biosimilar insulin products represent another significant opportunity as healthcare systems seek to reduce treatment costs while maintaining therapeutic efficacy.

Preventive care market expansion offers substantial growth potential through diabetes screening programs, lifestyle intervention products, and early detection devices. The growing focus on workplace wellness programs and corporate health initiatives creates opportunities for diabetes prevention and management solutions targeting employed populations.

Public-private partnerships present opportunities for market participants to collaborate with government agencies in implementing nationwide diabetes management programs, potentially expanding market reach while contributing to public health objectives. The development of locally manufactured devices and pharmaceutical products could address affordability concerns while building domestic healthcare manufacturing capabilities.

Complex market dynamics shape the Philippines diabetes drugs and devices market through interconnected forces influencing supply, demand, and competitive positioning. Demographic transitions including population aging and urbanization create sustained demand growth, while evolving lifestyle patterns contribute to changing diabetes epidemiology and treatment requirements.

Healthcare policy evolution significantly impacts market dynamics through coverage decisions, pricing regulations, and quality standards that influence product accessibility and market competitiveness. The ongoing implementation of Universal Health Care reforms continues to reshape market access patterns and reimbursement landscapes, creating both opportunities and challenges for market participants.

Competitive dynamics reflect the interplay between established multinational pharmaceutical companies and emerging local players, with competition intensifying around pricing, product innovation, and market access strategies. Technology convergence between traditional pharmaceuticals and digital health solutions is creating new competitive paradigms and partnership opportunities.

Supply chain dynamics influence market stability and pricing, with most diabetes products imported from international manufacturers. The development of regional distribution networks and cold chain infrastructure continues to evolve, impacting product availability and market penetration across different geographic regions. Regulatory dynamics including evolving approval processes and safety requirements shape product development timelines and market entry strategies for diabetes innovations.

Comprehensive research methodology employed in analyzing the Philippines diabetes drugs and devices market incorporates multiple data collection and analysis approaches to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with healthcare providers, diabetes specialists, hospital administrators, and pharmaceutical industry executives to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of government health statistics, pharmaceutical industry reports, academic publications, and regulatory filings to establish market baseline data and identify trends. Data triangulation methods are employed to cross-verify information from multiple sources and ensure research validity.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing patient population data, treatment patterns, and product consumption rates to develop accurate market assessments. Qualitative analysis techniques including expert interviews and focus group discussions provide insights into market dynamics, competitive positioning, and future growth drivers.

Quantitative analysis incorporates statistical modeling and trend analysis to project market growth trajectories and identify key performance indicators. The research methodology ensures comprehensive coverage of all market segments, geographic regions, and stakeholder perspectives to deliver actionable market intelligence for strategic decision-making.

Regional market analysis reveals significant geographic variations in diabetes drugs and devices consumption patterns across the Philippines, with Metro Manila representing the largest and most sophisticated market segment. The National Capital Region demonstrates the highest penetration rates for advanced diabetes technologies and premium pharmaceutical products, driven by concentrated healthcare infrastructure, higher income levels, and greater healthcare awareness among the population.

Luzon region outside Metro Manila shows growing market potential, particularly in urban centers like Baguio, Dagupan, and Batangas, where expanding healthcare facilities and rising economic development support increased diabetes product adoption. The region benefits from proximity to Manila-based distribution networks and healthcare services, facilitating better product availability and clinical support.

Visayas region demonstrates moderate market development with Cebu City serving as the primary healthcare hub and distribution center. The region shows approximately 20% market share in diabetes product consumption, with growing demand for both pharmaceutical products and monitoring devices. Healthcare infrastructure improvements and increasing specialist availability support market expansion in key urban areas.

Mindanao region represents an emerging market with significant growth potential, led by Davao City and other major urban centers. While currently representing a smaller market share, the region shows strong growth momentum driven by economic development, healthcare infrastructure expansion, and increasing diabetes awareness programs. Rural areas across all regions present both challenges and opportunities, with telemedicine and mobile health initiatives beginning to address healthcare access barriers.

Competitive landscape in the Philippines diabetes drugs and devices market features a diverse mix of international pharmaceutical giants, medical device manufacturers, and emerging local players competing across different market segments and price points. The market demonstrates clear segmentation between premium branded products and cost-effective generic alternatives, with companies positioning themselves accordingly.

Leading market participants include:

Competitive strategies focus on product differentiation, pricing optimization, healthcare provider education, and patient support programs. Companies increasingly emphasize digital health integration and comprehensive diabetes management solutions rather than standalone products.

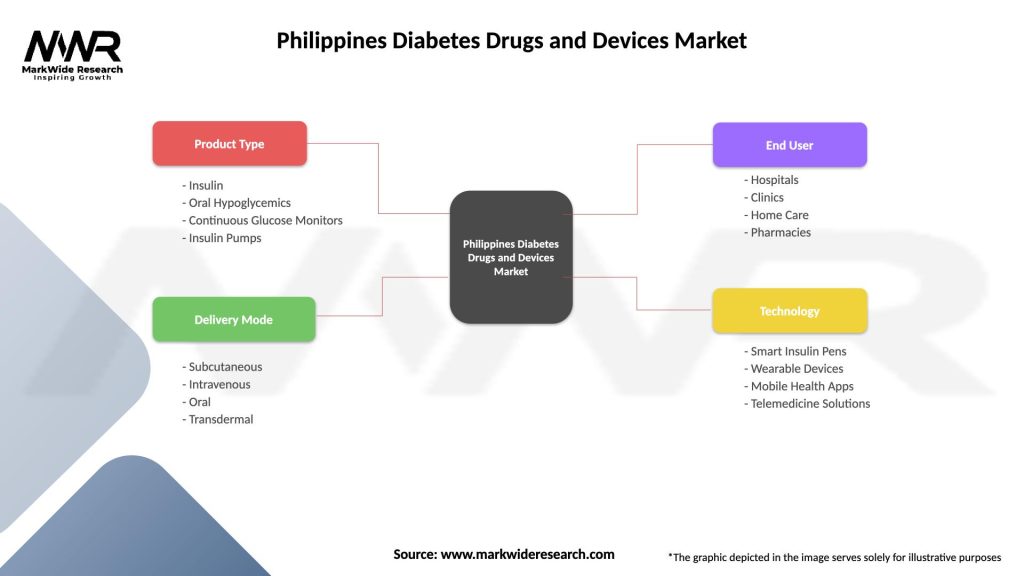

Market segmentation analysis reveals distinct categories within the Philippines diabetes drugs and devices market, each characterized by unique growth dynamics, competitive landscapes, and patient adoption patterns. Product-based segmentation provides the primary framework for understanding market structure and opportunities.

By Product Type:

By Diabetes Type:

By End User:

Insulin products category dominates the Philippines diabetes market, driven by the essential nature of insulin therapy for Type 1 diabetes patients and increasing insulin requirements among Type 2 diabetes patients with disease progression. Long-acting insulin analogs show particularly strong growth as healthcare providers and patients recognize the benefits of improved glycemic control and reduced hypoglycemia risk. The category benefits from continuous product innovation and expanding insurance coverage for insulin products.

Oral antidiabetic drugs category represents the foundation of Type 2 diabetes treatment, with metformin maintaining its position as the first-line therapy. Generic competition has significantly reduced prices in this category, improving patient access while creating challenges for branded product manufacturers. Combination therapies show growing adoption as healthcare providers seek to optimize glycemic control through multi-mechanism approaches.

Glucose monitoring devices category demonstrates rapid evolution from traditional glucometers toward continuous glucose monitoring systems and smart connected devices. The category benefits from increasing patient awareness of the importance of regular glucose monitoring and technological advances that improve user experience and clinical outcomes. Smartphone integration and data sharing capabilities are becoming standard features driving category growth.

GLP-1 receptor agonists category represents the fastest-growing segment, with approximately 25% annual growth rate, driven by clinical evidence supporting cardiovascular and weight management benefits beyond glucose control. Despite higher costs, increasing insurance coverage and patient awareness of additional benefits support category expansion. Weekly formulations improve patient convenience and compliance compared to daily injection alternatives.

Pharmaceutical manufacturers benefit from the expanding Philippines diabetes market through sustained revenue growth opportunities driven by increasing patient population and evolving treatment paradigms. The market offers product lifecycle extension opportunities through local partnerships, generic competition strategies, and value-based pricing approaches tailored to Filipino healthcare economics.

Healthcare providers gain access to comprehensive diabetes management solutions that improve patient outcomes while enhancing clinical efficiency. Advanced diabetes technologies enable remote patient monitoring and data-driven treatment optimization, supporting better resource utilization and patient care quality. Educational programs and clinical support services from industry partners enhance healthcare provider capabilities in diabetes management.

Patients benefit from expanded treatment options, improved product accessibility through insurance coverage, and enhanced quality of life through better diabetes management tools. Digital health integration empowers patients with real-time health data and personalized treatment insights, supporting better self-management and clinical outcomes. Cost-effective generic alternatives improve treatment affordability for price-sensitive patient segments.

Government health agencies benefit from industry collaboration in addressing the growing diabetes burden through public-private partnerships, educational initiatives, and innovative healthcare delivery models. Economic benefits include reduced long-term healthcare costs through better diabetes management and prevention of complications, supporting sustainable healthcare system development.

Healthcare investors find attractive opportunities in the growing diabetes market through direct investments in pharmaceutical companies, medical device manufacturers, and digital health startups focused on diabetes solutions. The market’s defensive characteristics and essential nature provide stable investment returns with growth potential driven by demographic trends and healthcare infrastructure development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the Philippines diabetes drugs and devices market, with increasing integration of smartphone applications, cloud-based data management, and artificial intelligence-powered treatment optimization. Patients increasingly expect connected devices that provide real-time insights and seamless integration with healthcare provider systems, driving innovation in traditional diabetes management products.

Personalized medicine trends are gaining momentum as healthcare providers recognize the importance of individualized treatment approaches based on patient genetics, lifestyle factors, and treatment response patterns. Precision dosing and customized treatment protocols are becoming more common, supported by advanced glucose monitoring data and predictive analytics capabilities.

Value-based healthcare trends are influencing market dynamics as healthcare systems focus on patient outcomes rather than product volume. This shift encourages development of comprehensive diabetes management solutions that demonstrate measurable improvements in glycemic control, quality of life, and healthcare cost reduction. Outcome-based pricing models are emerging as innovative approaches to address affordability concerns while ensuring access to effective treatments.

Preventive care integration shows growing importance as healthcare stakeholders recognize the cost-effectiveness of diabetes prevention compared to treatment of established disease. Lifestyle intervention programs, early screening initiatives, and workplace wellness programs are expanding market opportunities beyond traditional treatment-focused products. Continuous glucose monitoring adoption is extending to prediabetic populations for prevention and early intervention purposes.

Sustainability focus is becoming increasingly important, with companies developing environmentally friendly packaging, reducing waste in diabetes supplies, and implementing sustainable manufacturing practices. Patients and healthcare providers show growing preference for companies demonstrating environmental responsibility and social impact commitment.

Regulatory advancements have significantly impacted the Philippines diabetes market, with the Food and Drug Administration implementing streamlined approval processes for diabetes products and establishing clearer guidelines for digital health applications. Recent regulatory updates have facilitated faster market entry for innovative diabetes technologies while maintaining safety and efficacy standards.

Healthcare infrastructure investments continue expanding across the Philippines, with new hospital construction, pharmacy network expansion, and cold chain storage improvements supporting better diabetes product distribution. The Department of Health has prioritized diabetes care infrastructure development as part of broader healthcare system strengthening initiatives.

Insurance coverage expansions represent major industry developments, with PhilHealth continuously updating its coverage policies to include newer diabetes medications and monitoring devices. Private health insurance companies have also expanded diabetes coverage options, improving patient access to premium treatment alternatives and advanced diabetes technologies.

Technology partnerships between pharmaceutical companies and digital health startups are creating innovative diabetes management solutions tailored to Filipino patients’ needs. These collaborations focus on developing culturally appropriate mobile applications, telemedicine platforms, and patient education resources that address local healthcare challenges and preferences.

Manufacturing investments by both international and local companies are beginning to address supply chain vulnerabilities and cost concerns. Several pharmaceutical companies have announced plans for local production facilities focused on diabetes medications, potentially improving product availability and affordability in the Philippine market.

Market entry strategies for new participants should prioritize understanding local healthcare dynamics, regulatory requirements, and patient affordability constraints. MarkWide Research analysis suggests that successful market entry requires partnerships with established local distributors, healthcare providers, and patient advocacy organizations to build market credibility and access.

Product development focus should emphasize cost-effective solutions that maintain clinical efficacy while addressing price sensitivity in the Philippine market. Companies should consider developing tiered product portfolios that serve different economic segments, from premium solutions for affluent urban patients to affordable alternatives for broader market access.

Digital health integration represents a critical success factor for future market competitiveness. Companies should invest in developing or partnering for mobile health capabilities, telemedicine integration, and data analytics platforms that enhance patient engagement and clinical outcomes while addressing healthcare access challenges in remote areas.

Healthcare provider engagement strategies should include comprehensive education programs, clinical support services, and partnership opportunities that build long-term relationships with diabetes specialists, primary care physicians, and hospital systems. Continuous medical education initiatives can differentiate companies while improving overall diabetes care quality.

Government collaboration opportunities should be actively pursued through public-private partnerships, policy advocacy, and support for national diabetes prevention and management programs. Companies that demonstrate commitment to addressing public health challenges while maintaining commercial viability will benefit from favorable regulatory treatment and market access opportunities.

Long-term market prospects for the Philippines diabetes drugs and devices market remain highly positive, driven by sustained demographic trends, healthcare infrastructure development, and evolving treatment paradigms. Market expansion is expected to continue at a robust pace, with projected growth rates of 8-10% annually over the next five years, supported by increasing diabetes prevalence and improved healthcare access.

Technology evolution will fundamentally transform diabetes management approaches, with artificial intelligence, machine learning, and predictive analytics becoming standard features in diabetes care solutions. The integration of continuous glucose monitoring with insulin delivery systems will create closed-loop diabetes management systems, significantly improving patient outcomes and quality of life.

Market accessibility improvements through generic competition, local manufacturing development, and innovative financing models will expand the addressable patient population. MWR projections indicate that market penetration rates will increase significantly as affordability barriers are addressed through policy interventions and industry innovations.

Healthcare delivery transformation through telemedicine, mobile health platforms, and remote patient monitoring will address geographic access challenges and improve diabetes care quality across the Philippines. Digital health adoption is expected to reach 60% of diabetes patients within the next decade, fundamentally changing patient-provider interactions and treatment optimization approaches.

Preventive care integration will expand market opportunities beyond traditional treatment-focused segments, with diabetes prevention programs, early intervention initiatives, and lifestyle management solutions becoming significant market contributors. The shift toward value-based healthcare will reward companies that demonstrate measurable improvements in patient outcomes and healthcare cost reduction.

The Philippines diabetes drugs and devices market represents a dynamic and rapidly expanding healthcare sector characterized by significant growth opportunities, evolving patient needs, and transformative technological innovations. Market fundamentals remain strong, supported by increasing diabetes prevalence, government healthcare initiatives, and improving economic conditions that enhance patient access to diabetes management solutions.

Strategic positioning in this market requires understanding of local healthcare dynamics, patient affordability constraints, and regulatory requirements while maintaining focus on clinical efficacy and patient outcomes. Companies that successfully balance innovation with cost-effectiveness while building strong relationships with healthcare providers and patients will capture the greatest market opportunities.

Future success will depend on embracing digital transformation, developing comprehensive diabetes management solutions, and contributing to public health objectives through innovative approaches to diabetes prevention and treatment. The market’s evolution toward personalized medicine, value-based healthcare, and integrated care delivery models creates opportunities for companies that can adapt to changing healthcare paradigms while maintaining commercial viability.

The Philippines diabetes drugs and devices market stands poised for continued expansion, offering substantial opportunities for market participants who can navigate the complex healthcare landscape while delivering meaningful value to patients, healthcare providers, and the broader healthcare system. Success in this market will require sustained commitment to innovation, patient-centricity, and collaborative approaches to addressing the growing diabetes burden in the Philippines.

What is Diabetes Drugs and Devices?

Diabetes Drugs and Devices refer to the medications and tools used to manage diabetes, including insulin, oral hypoglycemics, glucose meters, and continuous glucose monitoring systems. These products are essential for maintaining blood sugar levels and preventing complications associated with diabetes.

What are the key players in the Philippines Diabetes Drugs and Devices Market?

Key players in the Philippines Diabetes Drugs and Devices Market include Sanofi, Novo Nordisk, and Abbott, which are known for their innovative diabetes management solutions. These companies focus on developing effective medications and advanced monitoring devices to improve patient outcomes, among others.

What are the growth factors driving the Philippines Diabetes Drugs and Devices Market?

The growth of the Philippines Diabetes Drugs and Devices Market is driven by the increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in technology. Additionally, the growing demand for personalized medicine and improved healthcare infrastructure contribute to market expansion.

What challenges does the Philippines Diabetes Drugs and Devices Market face?

The Philippines Diabetes Drugs and Devices Market faces challenges such as high costs of advanced devices, limited access to healthcare in rural areas, and regulatory hurdles. These factors can hinder the availability and adoption of essential diabetes management tools.

What opportunities exist in the Philippines Diabetes Drugs and Devices Market?

Opportunities in the Philippines Diabetes Drugs and Devices Market include the potential for telemedicine solutions, the introduction of innovative drug delivery systems, and partnerships between healthcare providers and technology companies. These developments can enhance patient care and improve diabetes management.

What trends are shaping the Philippines Diabetes Drugs and Devices Market?

Trends shaping the Philippines Diabetes Drugs and Devices Market include the rise of digital health solutions, increased focus on preventive care, and the integration of artificial intelligence in diabetes management. These trends aim to provide more personalized and efficient care for diabetes patients.

Philippines Diabetes Drugs and Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Oral Hypoglycemics, Continuous Glucose Monitors, Insulin Pumps |

| Delivery Mode | Subcutaneous, Intravenous, Oral, Transdermal |

| End User | Hospitals, Clinics, Home Care, Pharmacies |

| Technology | Smart Insulin Pens, Wearable Devices, Mobile Health Apps, Telemedicine Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Diabetes Drugs and Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at