444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines commercial vehicles market represents a dynamic and rapidly evolving sector within Southeast Asia’s automotive landscape. Commercial vehicles in the Philippines encompass a diverse range of transportation solutions including trucks, buses, vans, and specialized utility vehicles that serve the nation’s growing logistics, construction, and public transportation needs. The market has demonstrated remarkable resilience and adaptability, particularly in response to infrastructure development initiatives and the expanding e-commerce sector.

Market dynamics indicate sustained growth driven by government infrastructure projects, urbanization trends, and increasing demand for efficient freight transportation. The sector benefits from the Philippines’ strategic position as a logistics hub in Southeast Asia, with commercial vehicles playing a crucial role in supporting both domestic commerce and international trade operations. Growth projections suggest the market will expand at a robust CAGR of 8.2% over the forecast period, reflecting strong underlying demand fundamentals.

Key market segments include light commercial vehicles, medium-duty trucks, heavy-duty trucks, and passenger commercial vehicles, each serving distinct operational requirements across various industries. The market landscape is characterized by both established international manufacturers and emerging local players, creating a competitive environment that drives innovation and cost optimization.

The Philippines commercial vehicles market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of commercial transportation vehicles designed for business and industrial applications within the Philippine archipelago. This market includes vehicles specifically engineered for cargo transportation, passenger transit, construction activities, and specialized commercial operations.

Commercial vehicles are distinguished from passenger cars by their design focus on utility, durability, and operational efficiency rather than personal transportation comfort. These vehicles typically feature enhanced payload capacities, robust construction, and specialized configurations to meet specific industry requirements. The market encompasses various vehicle categories from compact delivery vans to heavy-duty trucks capable of handling substantial cargo loads across the Philippines’ diverse terrain.

Market participants include vehicle manufacturers, importers, dealers, fleet operators, logistics companies, and supporting service providers who collectively contribute to the commercial transportation infrastructure that enables economic activity throughout the Philippine islands.

Strategic analysis reveals the Philippines commercial vehicles market as a high-growth sector positioned to benefit from sustained economic expansion and infrastructure development. The market demonstrates strong fundamentals supported by increasing urbanization, expanding logistics networks, and government initiatives promoting efficient transportation systems. Key growth drivers include the Build Build Build infrastructure program, rising e-commerce penetration, and modernization of public transportation systems.

Market segmentation shows light commercial vehicles commanding the largest share at approximately 45% of total sales, driven by small and medium enterprises’ transportation needs. Heavy-duty trucks represent a significant growth segment, supported by construction and mining activities. The passenger commercial vehicle segment benefits from urban transportation modernization initiatives and tourism industry recovery.

Competitive landscape features a mix of established international brands and emerging local manufacturers, with market leaders focusing on product localization, after-sales service excellence, and financing solutions. Technology integration, fuel efficiency improvements, and environmental compliance represent key differentiating factors in the evolving market dynamics.

Market intelligence reveals several critical insights shaping the Philippines commercial vehicles landscape:

Economic expansion serves as the primary catalyst for Philippines commercial vehicles market growth, with GDP growth supporting increased business activity and transportation demand. The country’s sustained economic development creates favorable conditions for commercial vehicle adoption across multiple sectors including logistics, construction, manufacturing, and services.

Infrastructure development initiatives represent a significant growth driver, particularly the government’s Build Build Build program which encompasses major transportation, utilities, and urban development projects. These initiatives generate substantial demand for construction vehicles, material transport trucks, and specialized equipment carriers. Project implementation requires diverse commercial vehicle types, from concrete mixers to heavy-duty haulers.

E-commerce proliferation fundamentally transforms logistics requirements, driving demand for delivery vehicles, warehouse equipment, and last-mile transportation solutions. The shift toward online retail creates new market segments for specialized commercial vehicles designed for urban delivery operations. Digital commerce growth of approximately 25% annually directly translates to increased commercial vehicle requirements.

Urbanization trends contribute to market expansion as growing cities require enhanced public transportation, waste management, and utility services. Urban development creates demand for buses, garbage trucks, utility vehicles, and construction equipment. Population concentration in urban areas necessitates efficient commercial transportation solutions.

High acquisition costs present significant barriers for many potential commercial vehicle buyers, particularly small and medium enterprises with limited capital resources. The substantial upfront investment required for commercial vehicles can delay purchase decisions and limit market expansion, especially in price-sensitive segments where operators seek maximum value for their investment.

Financing accessibility remains challenging for certain market segments, despite improvements in vehicle financing options. Small business operators and individual entrepreneurs often face difficulties securing affordable financing for commercial vehicle purchases, constraining market growth potential. Credit requirements and collateral demands can exclude potential buyers from the market.

Infrastructure limitations in certain regions affect commercial vehicle utilization and efficiency. Poor road conditions, inadequate maintenance facilities, and limited fuel distribution networks can impact vehicle performance and operating costs. Geographic challenges across the Philippine archipelago create logistical complexities for vehicle distribution and service support.

Regulatory compliance costs associated with environmental standards, safety requirements, and operational permits add to the total cost of commercial vehicle ownership. Evolving regulations require ongoing investments in compliance measures, potentially deterring some market participants from vehicle acquisition or fleet expansion.

Electric vehicle transition presents substantial opportunities for market participants willing to invest in sustainable transportation technologies. Government incentives for electric commercial vehicles, combined with improving charging infrastructure, create favorable conditions for electric truck and bus adoption. Environmental consciousness drives demand for cleaner commercial vehicle alternatives.

Rural market development offers significant expansion potential as agricultural modernization and rural economic development increase demand for commercial vehicles in provincial areas. Improved rural infrastructure and rising agricultural productivity create opportunities for specialized agricultural vehicles, rural transport solutions, and logistics services.

Tourism industry recovery generates renewed demand for passenger commercial vehicles including buses, vans, and specialized tourism transport. The Philippines’ tourism sector rebound creates opportunities for vehicle manufacturers and operators serving the hospitality and travel industries. Tourism growth directly correlates with commercial passenger vehicle demand.

Technology integration opportunities enable the development of smart commercial vehicles with advanced telematics, autonomous features, and connectivity solutions. Fleet management technology adoption creates new value propositions for commercial vehicle buyers seeking operational efficiency improvements and cost optimization.

Supply chain evolution significantly influences Philippines commercial vehicles market dynamics, with manufacturers increasingly focusing on local assembly and component sourcing to improve cost competitiveness and reduce import dependencies. This localization strategy enhances supply chain resilience while creating employment opportunities and supporting local industrial development.

Competitive intensity drives continuous innovation and value enhancement across the market, with manufacturers competing on product quality, after-sales service, financing options, and total cost of ownership. Market leaders invest in dealer network expansion, service capability enhancement, and customer relationship management to maintain competitive advantages.

Technology disruption reshapes market dynamics through the introduction of advanced vehicle technologies, digital platforms, and data-driven solutions. Manufacturers integrate connectivity features, predictive maintenance capabilities, and fleet optimization tools to differentiate their offerings and provide enhanced value to commercial vehicle operators.

Regulatory evolution influences market dynamics through changing emission standards, safety requirements, and operational regulations. Compliance with evolving regulations drives product development priorities and affects vehicle pricing, while creating opportunities for manufacturers offering compliant solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Philippines commercial vehicles market. Primary research involves direct engagement with industry stakeholders including manufacturers, dealers, fleet operators, and end-users to gather firsthand market intelligence and validate market trends.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and regulatory documents to establish market context and historical trends. Data triangulation techniques ensure information accuracy and reliability across multiple sources and research approaches.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market trends, segment performance, and growth trajectories. Market sizing methodologies incorporate vehicle registration data, sales statistics, and economic indicators to establish baseline market measurements and future projections.

Qualitative research includes expert interviews, focus groups, and industry surveys to capture market sentiment, emerging trends, and strategic insights that quantitative data alone cannot provide. This approach ensures comprehensive understanding of market dynamics and future development patterns.

Metro Manila dominates the Philippines commercial vehicles market, accounting for approximately 35% of total demand due to its concentration of economic activity, logistics operations, and urban transportation requirements. The capital region’s dense population, extensive business districts, and major port facilities create substantial demand for various commercial vehicle types from delivery vans to heavy-duty trucks.

Luzon region beyond Metro Manila represents a significant market segment driven by agricultural activities, manufacturing operations, and regional commerce. Central Luzon’s industrial zones and agricultural areas generate demand for specialized commercial vehicles, while Northern and Southern Luzon contribute through mining, agriculture, and tourism-related transportation needs.

Visayas region demonstrates growing market potential supported by economic development in Cebu, Iloilo, and other major cities. The region’s strategic location for inter-island commerce and growing manufacturing sector create opportunities for commercial vehicle market expansion. Regional growth rates exceed national averages in several Visayas provinces.

Mindanao region offers substantial long-term growth potential driven by agricultural modernization, mining activities, and infrastructure development. The region’s vast agricultural areas and natural resource extraction operations require specialized commercial vehicles, while urban centers like Davao and Cagayan de Oro drive demand for conventional commercial transportation solutions.

Market leadership in the Philippines commercial vehicles sector is characterized by intense competition among established international manufacturers and emerging local players. The competitive landscape reflects diverse strategies ranging from product localization to service excellence and financing innovation.

Competitive strategies emphasize local market adaptation, comprehensive after-sales support, flexible financing options, and technology integration to meet diverse customer requirements across different market segments and geographic regions.

By Vehicle Type: The Philippines commercial vehicles market segmentation reveals distinct patterns across different vehicle categories, each serving specific operational requirements and market segments.

By Application: Market segmentation by application demonstrates the diverse use cases driving commercial vehicle demand across the Philippine economy.

Light Commercial Vehicles represent the market’s largest and most dynamic segment, driven by small and medium enterprises’ transportation needs and the expanding e-commerce sector. This category benefits from relatively lower acquisition costs, operational flexibility, and diverse application possibilities. Pickup trucks dominate this segment, serving both commercial and personal use requirements.

Medium Commercial Vehicles serve as the backbone of regional transportation and distribution networks, offering optimal balance between payload capacity and operational efficiency. This segment experiences steady growth supported by inter-city commerce, regional logistics operations, and specialized transportation requirements. Versatility and reliability represent key purchasing criteria in this category.

Heavy Commercial Vehicles cater to specialized applications requiring maximum payload capacity and durability. Construction projects, mining operations, and long-haul transportation drive demand in this segment. Despite higher acquisition costs, these vehicles offer superior total cost of ownership for appropriate applications. Technology integration increasingly influences purchasing decisions in this premium segment.

Passenger Commercial Vehicles including buses and coaches serve essential public transportation and tourism functions. This segment benefits from government modernization initiatives and tourism industry recovery. Safety features and passenger comfort increasingly influence vehicle selection criteria as operators compete for ridership and regulatory compliance.

Manufacturers benefit from the Philippines commercial vehicles market through access to a growing economy with substantial transportation infrastructure needs. The market offers opportunities for local assembly operations, reducing costs while supporting economic development. Product localization enables manufacturers to better serve specific market requirements while building stronger customer relationships.

Dealers and distributors gain from expanding market opportunities across diverse geographic regions and customer segments. The growing market supports dealer network expansion and service capability development. After-sales services provide recurring revenue streams and customer loyalty building opportunities.

Fleet operators benefit from improved vehicle technologies, financing options, and support services that enhance operational efficiency and profitability. Modern commercial vehicles offer better fuel efficiency, reliability, and total cost of ownership compared to older alternatives. Technology integration enables data-driven fleet optimization and predictive maintenance.

End-users and businesses gain access to transportation solutions that support business growth, operational efficiency, and competitive advantage. Commercial vehicles enable businesses to expand their geographic reach, improve service delivery, and optimize logistics operations. Financing accessibility makes vehicle acquisition more feasible for small and medium enterprises.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification momentum represents a transformative trend in the Philippines commercial vehicles market, with government incentives and environmental regulations driving adoption of electric trucks, buses, and delivery vehicles. Early adopters focus on urban delivery applications where electric vehicles offer operational advantages including lower operating costs and zero local emissions.

Digitalization integration encompasses the adoption of telematics, fleet management systems, and connectivity features that enhance operational efficiency and provide data-driven insights. Commercial vehicle operators increasingly value technology solutions that optimize routes, monitor vehicle performance, and predict maintenance requirements. Data analytics enable improved decision-making and cost optimization.

Financing innovation includes the development of flexible payment schemes, lease options, and alternative financing structures that make commercial vehicle acquisition more accessible to diverse market segments. Financial institutions and manufacturers collaborate to create tailored solutions for different customer profiles and business models.

Service excellence focus drives manufacturers and dealers to enhance after-sales support, parts availability, and maintenance services. Customer satisfaction becomes a key differentiator as operators seek reliable partners for their commercial vehicle needs. Service network expansion and technician training investments reflect this trend.

Local assembly expansion represents a significant industry development as manufacturers establish or expand Philippine production facilities to serve domestic and regional markets. These investments reduce import dependencies, create employment opportunities, and enable better market responsiveness. Manufacturing localization supports cost competitiveness and supply chain resilience.

Technology partnerships between vehicle manufacturers and technology companies accelerate the integration of advanced features including autonomous driving capabilities, artificial intelligence, and Internet of Things connectivity. These collaborations enable rapid innovation and market introduction of next-generation commercial vehicle solutions.

Regulatory framework evolution includes the implementation of updated emission standards, safety requirements, and operational regulations that shape market development. According to MarkWide Research analysis, regulatory changes drive product development priorities and create opportunities for compliant vehicle technologies.

Sustainable transportation initiatives encompass government programs promoting electric vehicles, alternative fuels, and efficient transportation systems. These initiatives include tax incentives, infrastructure development, and procurement preferences that support market transformation toward more sustainable commercial transportation solutions.

Market entry strategies should prioritize local partnership development, comprehensive service network establishment, and product adaptation to Philippine market requirements. Successful market participants invest in understanding local customer needs, regulatory environment, and competitive dynamics. Long-term commitment to the Philippine market proves essential for sustainable success.

Product development focus should emphasize fuel efficiency, durability, and total cost of ownership optimization to meet price-sensitive market requirements. Manufacturers should consider local assembly options to improve cost competitiveness while maintaining quality standards. Customer feedback integration ensures product relevance and market acceptance.

Technology adoption strategies should balance advanced features with cost considerations, focusing on technologies that provide clear operational benefits and return on investment. Fleet management systems, telematics, and predictive maintenance capabilities offer immediate value to commercial vehicle operators. Gradual technology integration allows market education and adoption.

Financing partnerships with local financial institutions enable broader market access and customer acquisition. Flexible financing options, competitive interest rates, and simplified application processes remove barriers to commercial vehicle ownership. Financial accessibility directly correlates with market expansion potential.

Long-term growth prospects for the Philippines commercial vehicles market remain highly positive, supported by sustained economic expansion, infrastructure development, and evolving transportation requirements. MWR projections indicate continued market expansion at approximately 8.2% CAGR through the forecast period, driven by fundamental demand drivers and emerging opportunities.

Technology transformation will accelerate over the coming years, with electric vehicles, autonomous features, and connectivity solutions becoming mainstream market offerings. The transition toward sustainable transportation will create new market segments while transforming existing categories. Innovation adoption rates are expected to increase as technology costs decline and infrastructure develops.

Market consolidation may occur as competitive pressures intensify and economies of scale become increasingly important. Strategic partnerships, mergers, and acquisitions could reshape the competitive landscape while driving operational efficiency improvements. Market leaders will likely strengthen their positions through strategic investments and capability development.

Regional expansion opportunities will emerge as economic development spreads beyond major urban centers to provincial areas. Rural market development, agricultural modernization, and regional infrastructure projects will create new demand centers for commercial vehicles. Geographic diversification will become increasingly important for sustained growth.

The Philippines commercial vehicles market represents a compelling growth opportunity characterized by strong fundamental drivers, evolving customer requirements, and supportive economic conditions. Market expansion reflects the country’s economic development trajectory, infrastructure modernization initiatives, and increasing integration with regional and global commerce networks.

Strategic success factors include local market understanding, comprehensive service capabilities, competitive financing options, and technology integration that delivers measurable operational benefits. Market participants who invest in long-term relationships, product localization, and customer-centric solutions are positioned to capture the substantial opportunities presented by this dynamic market.

The market’s future development will be shaped by sustainability trends, technology adoption, regulatory evolution, and changing customer expectations. MarkWide Research analysis indicates that companies embracing innovation while maintaining focus on fundamental customer needs will achieve sustainable competitive advantages in this expanding market. The Philippines commercial vehicles market offers significant potential for stakeholders committed to supporting the country’s continued economic growth and transportation infrastructure development.

What is Commercial Vehicles?

Commercial vehicles refer to motor vehicles used for transporting goods or passengers for commercial purposes. This includes trucks, vans, buses, and other vehicles designed for business use.

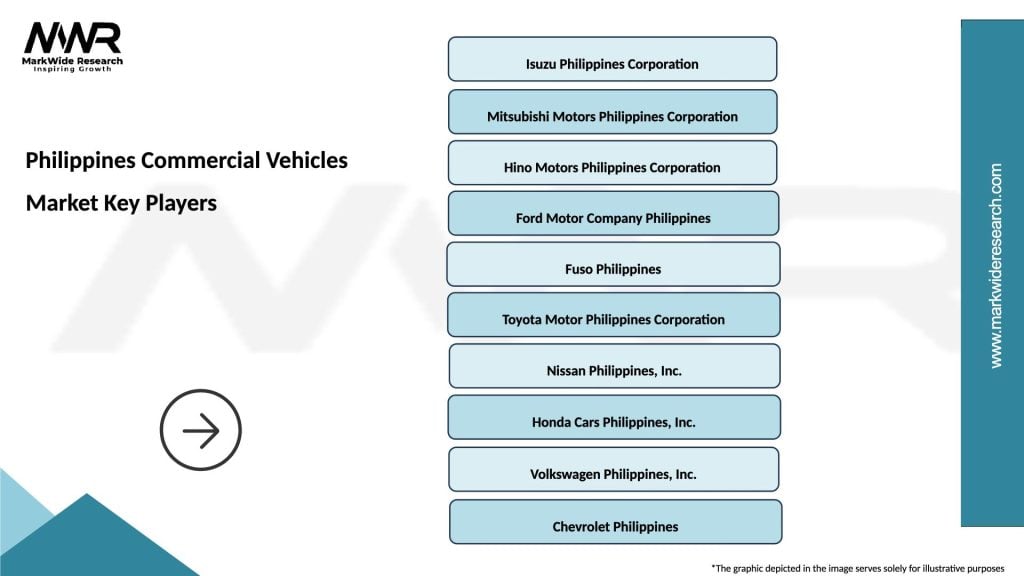

What are the key players in the Philippines Commercial Vehicles Market?

Key players in the Philippines Commercial Vehicles Market include Toyota Motor Philippines, Mitsubishi Motors Philippines, and Isuzu Philippines Corporation, among others.

What are the main drivers of growth in the Philippines Commercial Vehicles Market?

The growth of the Philippines Commercial Vehicles Market is driven by increasing urbanization, rising demand for logistics and transportation services, and government infrastructure projects that enhance road networks.

What challenges does the Philippines Commercial Vehicles Market face?

Challenges in the Philippines Commercial Vehicles Market include regulatory hurdles, high import tariffs on vehicles, and competition from used vehicle imports, which can affect new vehicle sales.

What opportunities exist in the Philippines Commercial Vehicles Market?

Opportunities in the Philippines Commercial Vehicles Market include the growing e-commerce sector, which requires efficient delivery vehicles, and advancements in electric vehicle technology that can cater to environmentally conscious consumers.

What trends are shaping the Philippines Commercial Vehicles Market?

Trends in the Philippines Commercial Vehicles Market include the shift towards electric and hybrid vehicles, the integration of telematics for fleet management, and the increasing focus on sustainability and fuel efficiency.

Philippines Commercial Vehicles Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Light Duty Trucks, Heavy Duty Trucks, Buses, Vans |

| Fuel Type | Diesel, Gasoline, Electric, Hybrid |

| End User | Logistics, Public Transport, Construction, Agriculture |

| Technology | Telematics, Autonomous Driving, Fleet Management, Safety Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Commercial Vehicles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at