444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines building system component market represents a dynamic and rapidly evolving sector within the country’s construction industry. This comprehensive market encompasses a wide range of structural elements, prefabricated components, and integrated building systems that form the backbone of modern construction projects across the archipelago. Market dynamics indicate substantial growth potential driven by urbanization, infrastructure development, and increasing adoption of sustainable building practices.

Construction activity in the Philippines has experienced remarkable momentum, with the building system component sector benefiting from government infrastructure initiatives and private sector investments. The market demonstrates robust expansion at a projected compound annual growth rate (CAGR) of 8.2% through the forecast period, reflecting strong demand across residential, commercial, and industrial segments.

Regional development patterns show concentrated activity in Metro Manila, Cebu, and Davao, with emerging opportunities in secondary cities as urbanization spreads throughout the country. The integration of advanced building technologies, sustainable materials, and modular construction approaches continues to reshape market dynamics, creating new opportunities for industry participants and stakeholders.

The Philippines building system component market refers to the comprehensive ecosystem of structural elements, prefabricated modules, and integrated building systems used in construction projects throughout the Philippine archipelago. This market encompasses everything from basic structural components like beams and columns to sophisticated modular systems that enable rapid construction deployment.

Building system components include structural steel frameworks, precast concrete elements, modular wall systems, roofing components, and integrated building modules that can be manufactured off-site and assembled on location. These components represent a shift toward more efficient, standardized, and quality-controlled construction methodologies that reduce project timelines while maintaining structural integrity.

Market scope extends beyond traditional construction materials to include smart building technologies, sustainable material solutions, and innovative assembly systems that address the unique challenges of tropical construction environments. The sector serves diverse applications from residential housing developments to large-scale commercial and infrastructure projects across the country’s varied geographic and climatic conditions.

Strategic analysis of the Philippines building system component market reveals a sector positioned for significant expansion driven by multiple convergent factors. The market benefits from sustained economic growth, urbanization trends, and government infrastructure investments that create consistent demand for efficient construction solutions.

Key market drivers include the country’s growing population, increasing urbanization rates of approximately 47%, and substantial infrastructure development programs. The sector demonstrates particular strength in modular construction systems, sustainable building components, and technology-integrated solutions that address local construction challenges while meeting international quality standards.

Competitive landscape features a mix of international manufacturers, local producers, and specialized component suppliers who serve diverse market segments. The market shows increasing adoption of prefabricated solutions, with modular construction approaches gaining 15% market penetration in urban development projects.

Future prospects indicate continued growth supported by infrastructure modernization, sustainable building initiatives, and technological advancement in construction methodologies. The market is expected to benefit from increased foreign investment, tourism development, and expanding manufacturing capabilities that drive demand for efficient building system solutions.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Philippines building system component market:

Economic expansion serves as the primary catalyst for Philippines building system component market growth, with sustained GDP growth creating favorable conditions for construction investment and development activity. The country’s emerging market status attracts international investment that translates directly into construction demand and component requirements.

Population growth and urbanization trends create fundamental demand drivers for building system components. With urban population growth rates exceeding 2.3% annually, cities require rapid construction solutions that modular and prefabricated building systems can provide efficiently. This demographic shift necessitates innovative construction approaches that building system components enable.

Government infrastructure initiatives represent significant market drivers through programs like “Build, Build, Build” and various public-private partnership projects. These initiatives create substantial demand for standardized, quality-controlled building components that can support large-scale construction projects while meeting stringent performance requirements.

Tourism industry expansion drives demand for hospitality construction projects that require sophisticated building system solutions. Resort developments, hotel construction, and tourism infrastructure projects create specialized demand for components that can withstand tropical conditions while providing aesthetic appeal and functional performance.

Manufacturing sector growth creates demand for industrial building components as companies establish production facilities throughout the country. These projects require specialized structural systems, modular construction approaches, and integrated building solutions that support modern manufacturing operations.

Economic volatility poses challenges for the building system component market, as construction projects are sensitive to economic fluctuations and financing availability. Currency fluctuations, inflation pressures, and interest rate changes can impact project feasibility and component demand patterns.

Regulatory complexity creates barriers for market participants, particularly regarding building codes, safety standards, and approval processes that vary across different regions and municipalities. These regulatory challenges can delay project implementation and increase compliance costs for component suppliers.

Skills shortage in specialized construction trades limits market growth potential, as building system components often require specific installation expertise and technical knowledge. The lack of trained personnel can slow adoption rates and increase project costs, particularly for advanced modular construction systems.

Import dependence for certain specialized components creates vulnerability to supply chain disruptions and cost fluctuations. Many advanced building system components require importation, making the market susceptible to international trade conditions and logistics challenges.

Natural disaster risks including typhoons, earthquakes, and flooding create additional requirements for building system components that must meet enhanced structural standards. These requirements can increase costs and complexity while limiting component options for certain applications.

Sustainable construction trends create substantial opportunities for building system component suppliers who can provide eco-friendly, energy-efficient solutions. The growing emphasis on green building certifications and environmental compliance opens new market segments for innovative component technologies.

Smart city development initiatives across major Philippine cities create opportunities for integrated building system solutions that incorporate technology, sustainability, and efficiency features. These projects require sophisticated component systems that can support modern urban infrastructure requirements.

Affordable housing programs represent significant market opportunities as government and private sector initiatives seek cost-effective construction solutions. Modular and prefabricated building systems offer potential for mass housing development that can address the country’s housing shortage while maintaining quality standards.

Industrial development zones create specialized demand for building system components as manufacturing companies establish operations throughout the country. These projects require rapid construction capabilities and standardized building solutions that component suppliers can provide effectively.

Disaster-resilient construction requirements create opportunities for specialized building system components designed to withstand natural disasters. The increasing focus on climate resilience drives demand for advanced structural systems and protective building components.

Supply chain evolution significantly impacts market dynamics as local manufacturing capabilities expand and international suppliers establish regional operations. This development improves component availability while reducing costs and delivery times for construction projects throughout the Philippines.

Technology advancement drives market transformation through digital design tools, automated manufacturing processes, and integrated building management systems. These technological improvements enhance component quality, reduce production costs, and enable more sophisticated building system solutions.

Competitive intensity increases as both domestic and international players compete for market share in the growing Philippines construction sector. This competition drives innovation, improves quality standards, and creates more competitive pricing for building system components.

Regulatory development influences market dynamics through evolving building codes, safety standards, and environmental requirements. According to MarkWide Research analysis, regulatory changes drive approximately 30% of component specification updates in major construction projects.

Customer preferences shift toward integrated solutions that combine multiple building functions into single component systems. This trend drives demand for sophisticated modular systems that can reduce construction complexity while improving building performance and efficiency.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Philippines building system component market. Primary research includes extensive interviews with industry participants, construction companies, component manufacturers, and government officials involved in infrastructure development.

Secondary research incorporates analysis of government statistics, industry reports, construction permits data, and economic indicators that influence market conditions. This approach provides quantitative foundation for market size estimation and growth projections while identifying key trends and development patterns.

Field research involves direct observation of construction projects, component manufacturing facilities, and supply chain operations throughout major Philippine cities. This hands-on approach validates market data while providing insights into operational challenges and opportunities.

Expert consultation includes discussions with construction industry professionals, architects, engineers, and building system specialists who provide technical insights and market perspective. These consultations ensure research findings reflect practical market conditions and industry expertise.

Data validation processes cross-reference multiple information sources to ensure accuracy and reliability of market insights. This rigorous approach maintains research quality while providing stakeholders with dependable information for strategic decision-making.

Metro Manila dominates the Philippines building system component market, accounting for approximately 42% of total demand due to concentrated construction activity, infrastructure development, and commercial projects. The region benefits from established supply chains, skilled workforce availability, and proximity to major ports and transportation networks.

Cebu region represents the second-largest market segment with growing demand for building system components driven by tourism development, business process outsourcing expansion, and residential construction projects. The region shows particular strength in hospitality construction and commercial development that requires sophisticated building solutions.

Davao and Mindanao emerge as significant growth markets with increasing construction activity supported by agricultural development, mining operations, and infrastructure improvements. These regions demonstrate growing adoption of modular construction approaches that utilize prefabricated building system components.

Central Luzon benefits from industrial development, logistics facilities, and residential expansion that create diverse demand for building system components. The region’s strategic location and transportation infrastructure support efficient component distribution and project implementation.

Secondary cities throughout the archipelago show increasing market potential as urbanization spreads and regional development programs create new construction opportunities. These markets represent future growth areas for building system component suppliers seeking expansion opportunities.

Market leadership in the Philippines building system component sector features a diverse mix of international corporations, regional manufacturers, and specialized local suppliers who serve different market segments and applications.

Competitive strategies focus on product innovation, quality improvement, supply chain optimization, and customer service enhancement. Companies invest in manufacturing capabilities, technology advancement, and market expansion to maintain competitive positioning in the growing market.

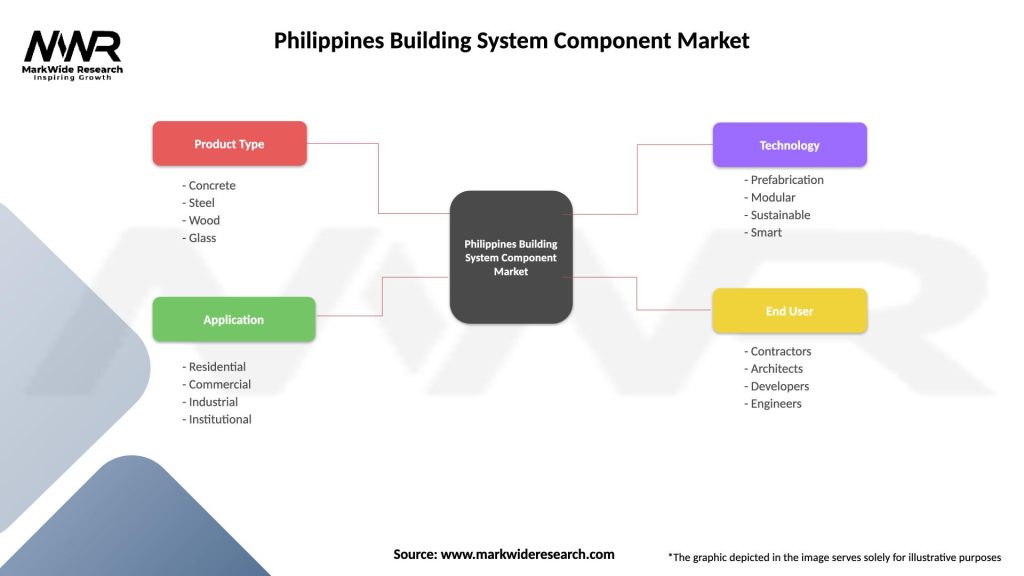

By Product Type:

By Application:

By Technology:

Structural components represent the largest market segment, driven by fundamental construction requirements and infrastructure development projects. This category benefits from consistent demand across all construction types while showing increasing adoption of advanced materials and engineering solutions.

Modular building systems demonstrate the highest growth rates with 18% annual expansion as construction companies seek efficiency improvements and cost reduction opportunities. These systems offer particular advantages for large-scale projects and standardized construction applications.

Smart building components emerge as a high-value segment with growing demand from commercial and residential projects that require integrated technology solutions. This category shows strong potential for premium pricing and specialized applications.

Sustainable building components gain market traction as environmental regulations and green building certifications drive demand for eco-friendly construction solutions. This segment attracts premium pricing while addressing growing sustainability requirements.

Specialized applications including disaster-resistant components and tropical climate solutions create niche market opportunities for suppliers who can address specific Philippine construction challenges and requirements.

Construction companies benefit from building system components through reduced project timelines, improved quality control, and enhanced cost predictability. These advantages enable more competitive bidding and improved project profitability while meeting client requirements for faster delivery.

Property developers gain advantages through standardized construction approaches that reduce development risks and enable faster market entry. Building system components provide consistency, quality assurance, and cost control that improve development project economics.

Architects and engineers benefit from expanded design possibilities and integrated solutions that building system components provide. These tools enable more creative and efficient building designs while ensuring structural integrity and performance standards.

Government agencies achieve infrastructure development goals more efficiently through standardized building system approaches that reduce project costs and implementation timelines. These benefits support public infrastructure programs and housing initiatives.

End users benefit from improved building quality, enhanced functionality, and better long-term performance that building system components provide. These advantages translate into lower maintenance costs and improved occupant satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization adoption transforms the building system component market through Building Information Modeling (BIM), digital design tools, and automated manufacturing processes. These technologies improve component precision, reduce waste, and enable more sophisticated building system integration.

Sustainability integration becomes a dominant trend as environmental regulations and green building certifications drive demand for eco-friendly components. MWR data indicates that sustainable building components show 22% higher adoption rates in new construction projects compared to traditional alternatives.

Modular construction expansion continues as construction companies seek efficiency improvements and cost reduction opportunities. This trend particularly benefits large-scale residential and commercial projects that can utilize standardized component systems effectively.

Smart building integration drives demand for components that incorporate technology features including sensors, automation systems, and connectivity capabilities. These advanced components enable intelligent building management and enhanced occupant experiences.

Disaster resilience focus influences component design and specification as climate change increases the frequency and severity of natural disasters. This trend creates demand for enhanced structural systems and protective building components.

Manufacturing capacity expansion by major component suppliers addresses growing market demand while reducing import dependence. Several international companies establish local production facilities to serve the Philippine market more effectively and competitively.

Technology partnerships between component manufacturers and construction companies create integrated solutions that improve project efficiency and quality. These collaborations drive innovation in building system design and implementation approaches.

Government policy support through infrastructure investment programs and building code modernization creates favorable market conditions for building system component adoption. These policies encourage standardization and quality improvement throughout the construction industry.

Sustainability certifications become standard requirements for major construction projects, driving demand for certified green building components and systems. This development creates market differentiation opportunities for suppliers who can meet environmental standards.

Skills development programs address workforce challenges through training initiatives that improve technical capabilities for building system component installation and maintenance. These programs support market growth by ensuring adequate skilled labor availability.

Market entry strategies should focus on understanding local construction practices, regulatory requirements, and customer preferences that influence building system component selection. Successful market participants invest in local partnerships and technical support capabilities.

Product development priorities should emphasize tropical climate adaptation, disaster resilience, and sustainability features that address specific Philippine construction challenges. Components designed for local conditions achieve better market acceptance and competitive positioning.

Supply chain optimization becomes critical for market success as companies balance cost efficiency with reliability and quality requirements. Local manufacturing capabilities and strategic partnerships improve supply chain resilience and cost competitiveness.

Technology investment in digital design tools, automated manufacturing, and smart building integration creates competitive advantages and market differentiation opportunities. Companies that embrace technological advancement achieve better market positioning and customer satisfaction.

Sustainability focus provides market differentiation and premium pricing opportunities as environmental requirements become standard in construction projects. Early adoption of green building technologies creates competitive advantages and market leadership positions.

Market expansion prospects remain strong through the forecast period, supported by sustained economic growth, urbanization trends, and infrastructure development programs. The building system component market is positioned for continued growth with increasing sophistication and technology integration.

Technology advancement will drive market evolution through digital design tools, automated manufacturing, and smart building integration. These developments will improve component quality, reduce costs, and enable more sophisticated building system solutions that meet evolving market requirements.

Sustainability requirements will become standard features rather than premium options, driving widespread adoption of green building components and systems. This trend will create new market segments while transforming existing product categories to meet environmental standards.

Regional development will expand market opportunities beyond traditional centers as secondary cities experience growth and infrastructure investment. According to MarkWide Research projections, regional markets will account for 35% of total market growth over the next five years.

Innovation opportunities in disaster-resilient construction, smart building integration, and sustainable materials will create new market segments and competitive advantages for forward-thinking suppliers. These developments will reshape market dynamics while creating value for all stakeholders.

The Philippines building system component market represents a dynamic and rapidly evolving sector with substantial growth potential driven by economic expansion, urbanization, and infrastructure development. The market demonstrates strong fundamentals with increasing adoption of advanced building technologies, sustainable construction practices, and modular construction approaches that improve efficiency and quality.

Strategic opportunities exist across multiple market segments, from traditional structural components to advanced smart building systems that incorporate technology and sustainability features. The market benefits from government infrastructure investment, private sector development, and growing demand for quality construction solutions that building system components provide.

Future success in this market will depend on understanding local requirements, investing in appropriate technologies, and developing supply chain capabilities that can serve the diverse needs of Philippine construction projects. Companies that can combine international expertise with local market knowledge will achieve the strongest competitive positions and growth opportunities in this expanding market.

What is Building System Component?

Building System Components refer to the various elements used in the construction and assembly of buildings, including structural components, mechanical systems, and finishing materials. These components play a crucial role in ensuring the safety, functionality, and aesthetic appeal of buildings.

What are the key players in the Philippines Building System Component Market?

Key players in the Philippines Building System Component Market include companies like Holcim Philippines, Inc., and A. Brown Company, Inc. These companies are involved in the production and supply of essential building materials and components, among others.

What are the growth factors driving the Philippines Building System Component Market?

The growth of the Philippines Building System Component Market is driven by increasing urbanization, rising infrastructure development projects, and a growing demand for sustainable building practices. Additionally, government initiatives to improve housing and commercial spaces contribute to market expansion.

What challenges does the Philippines Building System Component Market face?

The Philippines Building System Component Market faces challenges such as fluctuating raw material prices, supply chain disruptions, and regulatory hurdles. These factors can impact the availability and cost of building components, affecting overall market growth.

What opportunities exist in the Philippines Building System Component Market?

Opportunities in the Philippines Building System Component Market include the adoption of innovative construction technologies, the increasing focus on green building materials, and the potential for expansion in rural housing projects. These trends can lead to new product developments and market segments.

What trends are shaping the Philippines Building System Component Market?

Trends shaping the Philippines Building System Component Market include the rise of prefabricated building systems, advancements in smart building technologies, and a growing emphasis on energy-efficient materials. These trends are influencing how buildings are designed and constructed.

Philippines Building System Component Market

| Segmentation Details | Description |

|---|---|

| Product Type | Concrete, Steel, Wood, Glass |

| Application | Residential, Commercial, Industrial, Institutional |

| Technology | Prefabrication, Modular, Sustainable, Smart |

| End User | Contractors, Architects, Developers, Engineers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Building System Component Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at