444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines automotive engine oil market represents a dynamic and rapidly evolving sector within the country’s automotive industry. Market dynamics indicate substantial growth potential driven by increasing vehicle ownership, expanding commercial transportation networks, and rising consumer awareness about engine maintenance. The market encompasses various product categories including conventional, semi-synthetic, and fully synthetic engine oils, serving both passenger vehicles and commercial applications across the archipelago.

Regional distribution shows concentrated demand in major urban centers such as Metro Manila, Cebu, and Davao, where vehicle density remains highest. The market experiences consistent growth at approximately 6.2% CAGR, reflecting the country’s expanding automotive sector and improving economic conditions. Consumer preferences are shifting toward higher-quality synthetic formulations, driven by increased awareness of engine protection benefits and longer service intervals.

Industry participants include both international oil companies and local distributors, creating a competitive landscape that benefits consumers through diverse product offerings and competitive pricing. The market’s growth trajectory aligns with the Philippines’ infrastructure development initiatives and the government’s push toward modernizing public transportation systems.

The Philippines automotive engine oil market refers to the comprehensive ecosystem of lubricant products specifically designed for internal combustion engines operating within the Philippine automotive sector. This market encompasses the manufacturing, distribution, retail, and consumption of various engine oil formulations tailored to meet the specific requirements of vehicles operating in tropical climate conditions.

Market scope includes conventional mineral oils, semi-synthetic blends, and fully synthetic formulations across multiple viscosity grades. The sector serves diverse vehicle categories from motorcycles and passenger cars to heavy-duty commercial vehicles and industrial equipment. Geographic coverage spans the entire Philippine archipelago, with distribution networks adapted to reach both urban centers and remote provincial areas.

Product categories within this market address specific performance requirements including high-temperature stability, corrosion protection, and extended drain intervals. The market also encompasses specialized formulations for diesel engines, gasoline engines, and hybrid powertrains, reflecting the evolving automotive landscape in the Philippines.

Market performance in the Philippines automotive engine oil sector demonstrates robust expansion driven by several key factors including urbanization, economic growth, and increasing vehicle penetration rates. Consumer behavior shows a notable shift toward premium synthetic products, with adoption rates increasing by 12% annually as vehicle owners prioritize engine longevity and performance.

Competitive dynamics feature established international brands competing alongside emerging local players, creating a diverse marketplace that caters to various price points and performance requirements. The market benefits from strategic partnerships between global oil companies and local distributors, ensuring comprehensive market coverage across the Philippine islands.

Growth drivers include expanding e-commerce platforms, increasing automotive aftermarket awareness, and government initiatives supporting transportation infrastructure development. Market challenges involve managing distribution logistics across the archipelago and addressing price sensitivity among cost-conscious consumers while maintaining product quality standards.

Market intelligence reveals several critical insights shaping the Philippines automotive engine oil landscape:

According to MarkWide Research, these insights reflect the market’s maturation and increasing sophistication among Filipino consumers regarding automotive maintenance products.

Economic expansion serves as the primary catalyst for automotive engine oil market growth in the Philippines. Rising disposable incomes enable consumers to invest in higher-quality lubricants, while expanding middle-class demographics drive increased vehicle ownership rates. Infrastructure development projects create additional demand through commercial vehicle fleets and construction equipment requirements.

Urbanization trends contribute significantly to market expansion as city populations grow and transportation needs increase. The development of ride-sharing services and delivery platforms creates substantial demand for commercial-grade engine oils designed for high-mileage applications. Government initiatives supporting public transportation modernization further stimulate market growth through fleet renewal programs.

Consumer awareness regarding engine maintenance benefits drives premium product adoption. Educational campaigns by manufacturers and automotive service providers highlight the cost-effectiveness of quality lubricants in preventing expensive engine repairs. Climate considerations specific to tropical conditions create demand for specialized formulations offering superior high-temperature performance and humidity resistance.

Price sensitivity among Filipino consumers presents a significant challenge for market expansion, particularly in rural areas where cost considerations often outweigh performance benefits. Economic volatility can impact consumer spending on automotive maintenance products, leading to delayed service intervals and preference for lower-cost alternatives.

Distribution challenges across the Philippine archipelago create logistical complexities that increase costs and limit product availability in remote areas. Infrastructure limitations in some regions affect supply chain efficiency and contribute to price disparities between urban and rural markets.

Counterfeit products pose ongoing challenges to legitimate market participants, undermining consumer confidence and creating unfair competition. Regulatory compliance requirements, while necessary for quality assurance, can increase operational costs for smaller market players and create barriers to entry for new participants.

Digital transformation presents substantial opportunities for market expansion through e-commerce platforms and direct-to-consumer sales channels. Mobile commerce adoption in the Philippines creates new avenues for reaching consumers in previously underserved markets, particularly younger demographics comfortable with online purchasing.

Fleet management services represent a growing opportunity as businesses increasingly outsource vehicle maintenance to specialized providers. Subscription-based oil change services and preventive maintenance programs offer recurring revenue streams while ensuring customer retention.

Environmental consciousness among consumers creates opportunities for eco-friendly formulations and recycling programs. Hybrid and electric vehicle adoption, while still emerging, presents opportunities for specialized lubricants designed for new powertrain technologies. Industrial applications beyond automotive, including marine and agricultural equipment, offer additional market expansion possibilities.

Supply chain dynamics in the Philippines automotive engine oil market reflect the complex interplay between global oil prices, local distribution networks, and consumer demand patterns. Import dependencies for base oils and additives create exposure to international price fluctuations and currency exchange rate variations.

Competitive pressures drive continuous innovation in product formulations and packaging solutions. Market consolidation trends see larger players acquiring regional distributors to strengthen market presence and improve supply chain efficiency. Technology adoption in manufacturing and quality control processes enhances product consistency and performance characteristics.

Regulatory environment evolution influences product specifications and marketing practices. Environmental regulations increasingly impact formulation requirements and disposal practices. Consumer behavior shifts toward value-based purchasing decisions rather than purely price-driven choices, creating opportunities for premium positioning strategies.

Comprehensive analysis of the Philippines automotive engine oil market employs multiple research methodologies to ensure accuracy and reliability. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, retailers, and end-users across various market segments and geographic regions.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial statements. Market surveys conducted among consumers provide insights into purchasing behavior, brand preferences, and satisfaction levels with current products and services.

Data validation processes involve cross-referencing multiple sources and conducting follow-up interviews to verify key findings. Statistical analysis techniques ensure representative sampling across demographic segments and geographic regions. Trend analysis incorporates historical data patterns to project future market developments and identify emerging opportunities.

Metro Manila dominates the Philippines automotive engine oil market, accounting for the largest consumption volume due to high vehicle density and commercial activity concentration. Urban centers in this region demonstrate strong preference for premium synthetic products, with adoption rates reaching 45% of total sales in key metropolitan areas.

Cebu Province represents the second-largest regional market, driven by robust economic activity and significant commercial transportation networks. Regional distribution shows 23% market share for Visayas region, reflecting growing industrial activity and tourism-related transportation demand.

Mindanao region exhibits strong growth potential, particularly in Davao and Cagayan de Oro, where infrastructure development and agricultural mechanization drive demand for specialized lubricants. Northern Luzon markets benefit from mining and agricultural activities requiring heavy-duty engine oil formulations. Rural markets across all regions show increasing sophistication in product selection, though price sensitivity remains a key consideration factor.

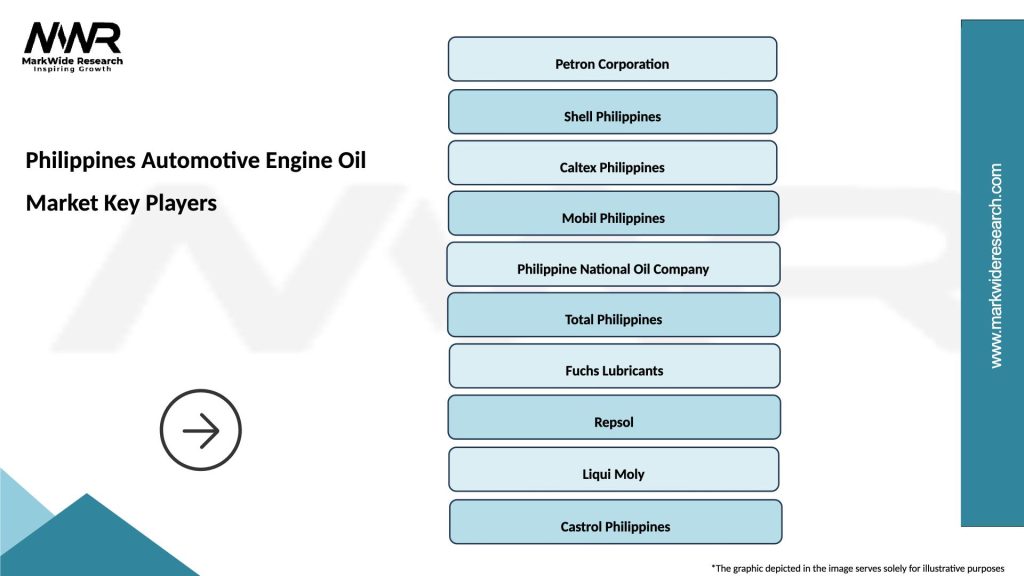

Market leadership in the Philippines automotive engine oil sector features a diverse mix of international and domestic players competing across various segments and price points:

Competitive strategies focus on brand differentiation, distribution network expansion, and customer education programs to drive premium product adoption.

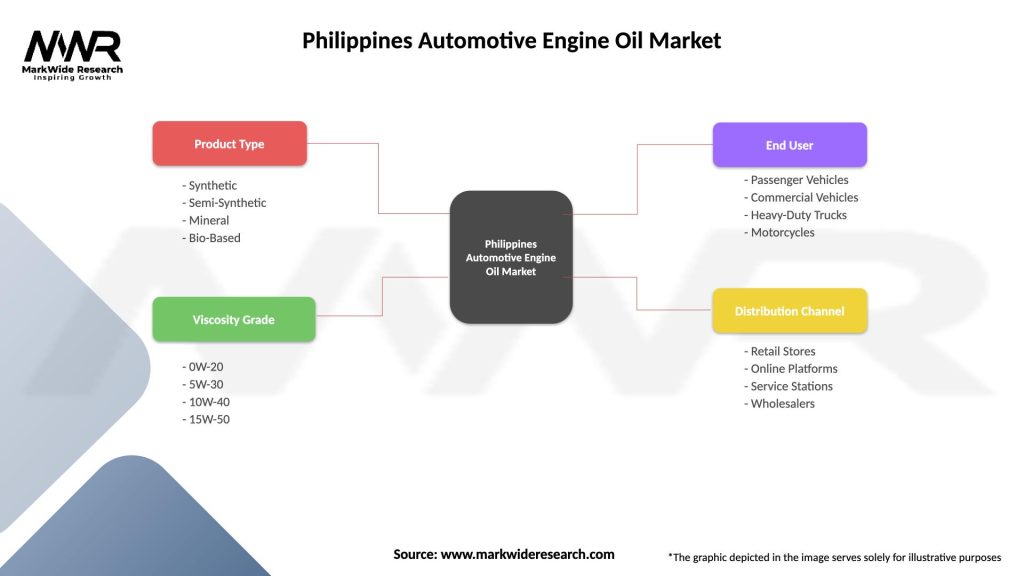

By Product Type:

By Vehicle Type:

By Distribution Channel:

Passenger Car Segment demonstrates increasing sophistication with consumers prioritizing engine protection and fuel efficiency benefits. Premium positioning strategies succeed among urban consumers willing to pay higher prices for synthetic formulations offering extended drain intervals and superior performance characteristics.

Motorcycle Category remains highly price-sensitive while showing gradual migration toward higher-quality products. Two-wheeler applications require specialized formulations addressing unique operating conditions including frequent stop-start cycles and air-cooled engine designs prevalent in the Philippine market.

Commercial Vehicle Segment prioritizes durability and cost-effectiveness, with fleet operators increasingly recognizing total cost of ownership benefits from premium lubricants. Heavy-duty applications drive demand for specialized formulations meeting international specifications for extended service intervals and equipment protection.

Industrial Applications represent a growing category as construction and mining activities expand. Equipment manufacturers increasingly specify particular lubricant brands and formulations, creating opportunities for technical partnerships and co-marketing initiatives.

Manufacturers benefit from the Philippines market’s growth potential and increasing consumer sophistication, enabling premium product positioning and margin expansion opportunities. Brand building initiatives in this market create long-term competitive advantages and customer loyalty.

Distributors and Retailers gain from expanding market size and increasing transaction values as consumers migrate toward higher-quality products. Service providers benefit from growing demand for professional maintenance services and technical expertise.

Consumers enjoy improved product availability, competitive pricing, and enhanced engine protection benefits from advancing lubricant technology. Fleet operators achieve reduced maintenance costs and improved equipment reliability through access to specialized commercial formulations.

Economic stakeholders benefit from job creation in manufacturing, distribution, and service sectors. Environmental benefits result from improved fuel efficiency and reduced emissions through advanced lubricant formulations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trends reshape consumer purchasing behavior with mobile apps and online platforms gaining traction among younger demographics. Subscription services for regular oil changes create recurring revenue streams while ensuring customer retention and brand loyalty.

Sustainability focus drives demand for environmentally friendly formulations and recycling programs. MWR analysis indicates that 31% of consumers consider environmental impact when selecting engine oil products, representing a significant shift in purchasing criteria.

Premium migration continues as consumers increasingly recognize the value proposition of synthetic lubricants. Extended drain intervals appeal to busy urban consumers seeking convenience and cost-effectiveness. Brand partnerships with automotive manufacturers create opportunities for co-marketing and technical validation.

Service integration trends see lubricant suppliers expanding into maintenance services and fleet management solutions. Data analytics applications enable predictive maintenance programs and customized service recommendations based on vehicle usage patterns.

Product innovations focus on advanced additive packages providing enhanced engine protection and fuel economy benefits. Packaging improvements include easy-pour spouts and recyclable containers addressing consumer convenience and environmental concerns.

Distribution network expansion sees major players investing in regional warehouses and logistics capabilities to improve market coverage and reduce delivery times. Strategic partnerships between international brands and local distributors strengthen market presence across the archipelago.

Technology adoption in manufacturing processes improves product consistency and quality control. Digital marketing initiatives leverage social media and influencer partnerships to reach younger consumer segments and build brand awareness.

Regulatory compliance efforts ensure products meet evolving environmental standards and performance specifications. Industry consolidation activities create larger, more efficient market participants capable of competing effectively in the evolving marketplace.

Market participants should prioritize digital transformation initiatives to capture growing online consumer segments and improve customer engagement. Investment strategies should focus on distribution network optimization and supply chain efficiency improvements to maintain competitive positioning.

Product development efforts should emphasize formulations specifically designed for tropical climate conditions and local driving patterns. Brand positioning strategies should balance premium product benefits with price sensitivity considerations across different market segments.

Partnership opportunities with automotive service providers and fleet management companies offer potential for market expansion and customer retention. Sustainability initiatives including recycling programs and eco-friendly formulations will become increasingly important for long-term competitiveness.

Regional expansion strategies should consider the unique characteristics and requirements of provincial markets while maintaining operational efficiency. Customer education programs can drive premium product adoption and build long-term brand loyalty among Filipino consumers.

Market projections indicate continued robust growth for the Philippines automotive engine oil sector, driven by expanding vehicle ownership and increasing consumer sophistication. Growth trajectory suggests sustained expansion at 6.8% CAGR over the next five years, supported by economic development and infrastructure investments.

Technology evolution will drive demand for advanced synthetic formulations offering superior performance and environmental benefits. Digital commerce channels are expected to capture 25% market share within the next decade, fundamentally changing distribution dynamics and customer relationships.

Regulatory developments will likely introduce stricter environmental standards, creating opportunities for innovative formulations and recycling solutions. MarkWide Research forecasts that premium segment penetration will reach 55% of total market by 2030, reflecting continued consumer migration toward higher-quality products.

Emerging opportunities in hybrid vehicle lubricants and industrial applications will provide additional growth avenues for market participants. Regional integration within ASEAN markets may create economies of scale and improved supply chain efficiency for Philippines-based operations.

The Philippines automotive engine oil market presents compelling opportunities for growth and expansion, driven by favorable economic conditions, increasing vehicle ownership, and evolving consumer preferences toward premium products. Market dynamics indicate a maturing sector with sophisticated consumers increasingly recognizing the value proposition of quality lubricants for engine protection and performance enhancement.

Strategic positioning in this market requires balancing premium product benefits with price sensitivity considerations while building robust distribution networks capable of serving the diverse geographic and demographic segments across the Philippine archipelago. Success factors include digital transformation capabilities, strong brand positioning, and comprehensive customer education programs that drive adoption of higher-value products.

Future prospects remain highly positive, with sustained economic growth, infrastructure development, and increasing automotive sophistication supporting continued market expansion. Industry participants who invest in innovation, distribution excellence, and customer relationships will be well-positioned to capitalize on the significant opportunities presented by this dynamic and evolving market landscape.

What is Automotive Engine Oil?

Automotive engine oil is a lubricant used in internal combustion engines to reduce friction, protect against wear, and help maintain optimal operating temperatures. It plays a crucial role in enhancing engine performance and longevity.

What are the key players in the Philippines Automotive Engine Oil Market?

Key players in the Philippines Automotive Engine Oil Market include Petron Corporation, Caltex, and Shell, among others. These companies offer a range of products catering to various vehicle types and engine specifications.

What are the growth factors driving the Philippines Automotive Engine Oil Market?

The growth of the Philippines Automotive Engine Oil Market is driven by increasing vehicle ownership, rising awareness of engine maintenance, and advancements in oil formulation technology. Additionally, the expansion of the automotive sector contributes to higher demand for quality engine oils.

What challenges does the Philippines Automotive Engine Oil Market face?

The Philippines Automotive Engine Oil Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and the availability of certain oil formulations.

What opportunities exist in the Philippines Automotive Engine Oil Market?

Opportunities in the Philippines Automotive Engine Oil Market include the growing trend towards synthetic oils and the increasing demand for high-performance lubricants. Additionally, the rise of electric vehicles presents new avenues for innovation in engine oil formulations.

What trends are shaping the Philippines Automotive Engine Oil Market?

Trends in the Philippines Automotive Engine Oil Market include a shift towards eco-friendly and biodegradable oils, as well as the development of oils that enhance fuel efficiency. The market is also seeing innovations in oil technology to meet the demands of modern engines.

Philippines Automotive Engine Oil Market

| Segmentation Details | Description |

|---|---|

| Product Type | Synthetic, Semi-Synthetic, Mineral, Bio-Based |

| Viscosity Grade | 0W-20, 5W-30, 10W-40, 15W-50 |

| End User | Passenger Vehicles, Commercial Vehicles, Heavy-Duty Trucks, Motorcycles |

| Distribution Channel | Retail Stores, Online Platforms, Service Stations, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Philippines Automotive Engine Oil Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at