444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The philanthropy funds market represents a crucial sector within the broader landscape of charitable giving and social impact investment. It encompasses various entities, including foundations, donor-advised funds, impact investors, and corporate social responsibility (CSR) initiatives, all aimed at mobilizing financial resources for social good. This market plays a vital role in addressing societal challenges, supporting charitable organizations, driving innovation, and promoting sustainable development.

Meaning

Philanthropy funds refer to financial resources allocated for charitable purposes, social impact investments, and community development initiatives. These funds are typically managed by foundations, trusts, wealth managers, impact investors, and corporate entities with a focus on creating positive social change. Philanthropy funds can support a wide range of causes, including education, healthcare, poverty alleviation, environmental conservation, arts and culture, and humanitarian aid.

Executive Summary

The philanthropy funds market has experienced significant growth in recent years, driven by increased awareness of social issues, rising wealth among high-net-worth individuals (HNWIs) and corporations, and a growing emphasis on corporate social responsibility (CSR) and sustainability. Key players in this market include philanthropic foundations, impact investors, wealth management firms, family offices, and corporate entities with dedicated philanthropic arms.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The philanthropy funds market operates within a dynamic ecosystem shaped by social, economic, technological, and regulatory factors. Key dynamics include:

Regional Analysis

The philanthropy funds market exhibits regional variations in terms of funding priorities, regulatory frameworks, donor behavior, and social impact priorities:

Competitive Landscape

Leading Companies in the Philanthropy Funds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

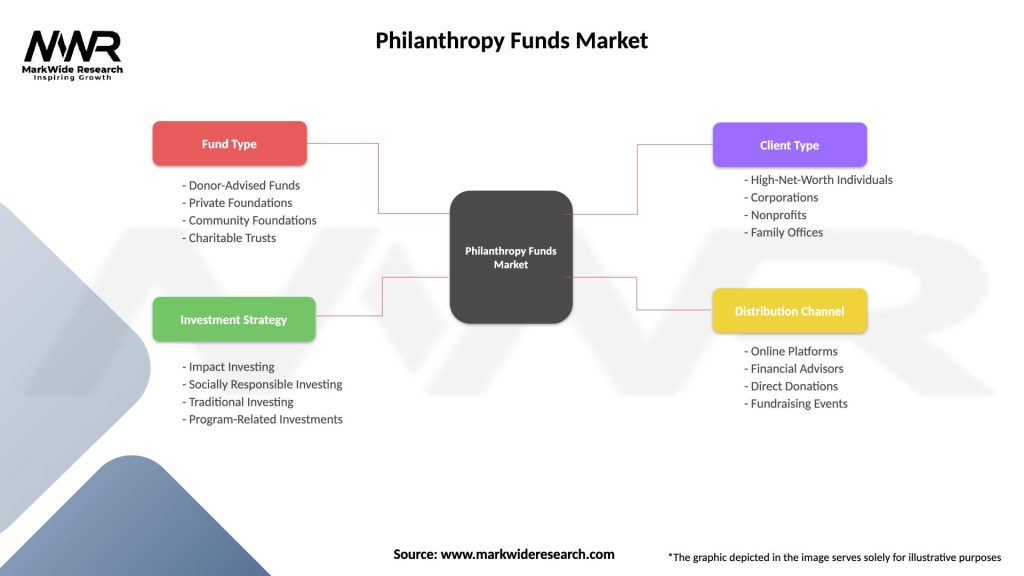

Segmentation

The philanthropy funds market can be segmented based on various criteria, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has underscored the importance of philanthropy funds in addressing global crises, supporting healthcare systems, providing humanitarian aid, and addressing socio-economic disparities. Key impacts include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the philanthropy funds market is optimistic, driven by increasing awareness, technological advancements, impact investing trends, and collaborative partnerships. Key trends shaping the future include:

Conclusion

The philanthropy funds market plays a pivotal role in driving positive social change, addressing global challenges, and promoting sustainable development. With increasing awareness, technological innovation, impact investing integration, and collaborative partnerships, philanthropy funds are well-positioned to make a meaningful impact in the years ahead. By focusing on impact measurement, collaborative ecosystems, innovative financing models, technology adoption, and long-term sustainability, philanthropy funds can navigate uncertainties, seize opportunities, and contribute to building a more inclusive, resilient, and equitable world.

What is Philanthropy Funds?

Philanthropy funds refer to financial resources allocated for charitable purposes, aimed at promoting social welfare, education, health, and community development. These funds can come from individuals, corporations, or foundations and are often used to support non-profit organizations and initiatives.

What are the key players in the Philanthropy Funds Market?

Key players in the Philanthropy Funds Market include organizations such as the Bill & Melinda Gates Foundation, the Ford Foundation, and the Rockefeller Foundation, among others. These entities are known for their significant contributions to various social causes and initiatives.

What are the growth factors driving the Philanthropy Funds Market?

The growth of the Philanthropy Funds Market is driven by increasing awareness of social issues, a rise in corporate social responsibility initiatives, and the growing trend of impact investing. Additionally, the demand for transparency and accountability in charitable giving is also influencing market dynamics.

What challenges does the Philanthropy Funds Market face?

The Philanthropy Funds Market faces challenges such as regulatory scrutiny, competition for donor funds, and the need for effective measurement of impact. Additionally, economic downturns can affect the availability of funds as donors may reduce their contributions during tough financial times.

What opportunities exist in the Philanthropy Funds Market?

Opportunities in the Philanthropy Funds Market include the potential for innovative funding models, such as social impact bonds and crowdfunding platforms. There is also a growing interest in addressing global challenges like climate change and inequality, which can attract new donors and investments.

What trends are shaping the Philanthropy Funds Market?

Trends shaping the Philanthropy Funds Market include the increasing use of technology for fundraising, the rise of donor-advised funds, and a focus on collaborative philanthropy. Additionally, there is a growing emphasis on data-driven decision-making to enhance the effectiveness of philanthropic efforts.

Philanthropy Funds Market

| Segmentation Details | Description |

|---|---|

| Fund Type | Donor-Advised Funds, Private Foundations, Community Foundations, Charitable Trusts |

| Investment Strategy | Impact Investing, Socially Responsible Investing, Traditional Investing, Program-Related Investments |

| Client Type | High-Net-Worth Individuals, Corporations, Nonprofits, Family Offices |

| Distribution Channel | Online Platforms, Financial Advisors, Direct Donations, Fundraising Events |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Philanthropy Funds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at