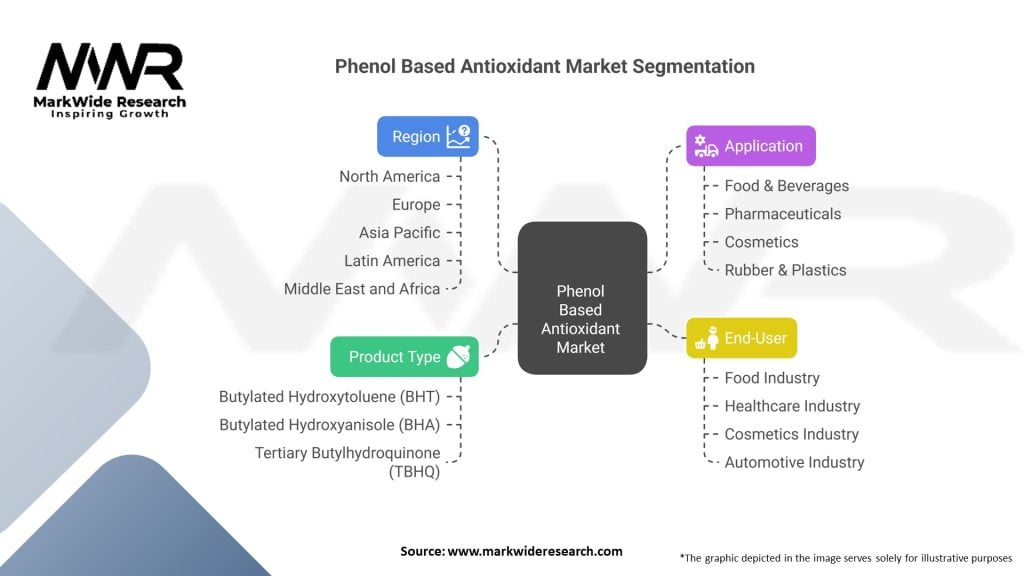

Segmentation

-

By Product Type: BHT, BHA, TBHQ, Propyl Gallate, Others (Octylated Phenols, Alkylated Diphenylamines)

-

By End-Use Industry: Food & Beverage, Plastics & Polymers, Lubricants & Fuels, Rubber, Cosmetics & Pharmaceuticals

-

By Function: Primary Antioxidants (Phenolic), Secondary/Synergists (Phosphites, Sulfides), Blends

-

By Region: Asia-Pacific, North America, Europe, Latin America, Middle East & Africa

Category-wise Insights

-

BHT: Widely used in edible oils and snack foods; also finds use in rubber and plastics to arrest early oxidation.

-

BHA: Employed in fatty foods with slow oxidation rates; often paired with BHT for synergistic effect.

-

TBHQ: Highly potent in low-fat matrices (spices, seasonings) and in fuel stabilization.

-

Propyl Gallate: Preferred in cosmetic and pharmaceutical formulations for its antimicrobial synergy.

-

Others: Octylphenols and diphenylamines niche in high-temperature polymer and lubricant domains.

Key Benefits for Industry Participants and Stakeholders

-

Extended Product Shelf Life: Prevents rancidity in oils and greases, reducing waste and recall risks.

-

Improved Processing Efficiency: Stabilizes polymers during extrusion and molding, minimizing color changes and property loss.

-

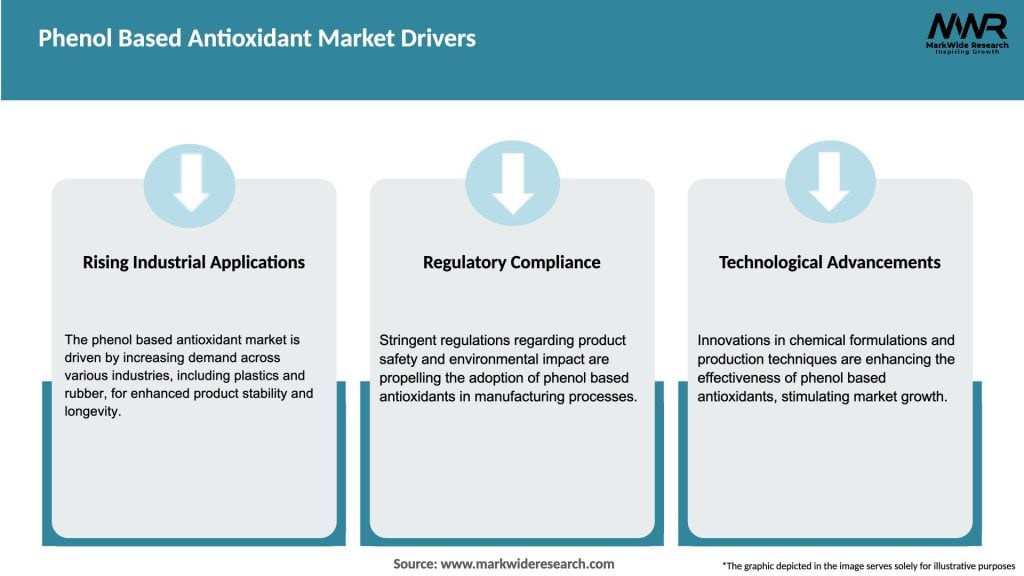

Regulatory Compliance: Widely recognized under global food-safety and chemical-registration frameworks.

-

Cost Optimization: Low-dose phenolics deliver strong performance, reducing overall additive costs.

-

Versatile Application: Suitable across multiple matrices—from food to fuel—simplifying supply-chain management.

SWOT Analysis

Strengths:

-

Proven technology with decades of performance history.

-

Broad legislative acceptance across major markets.

-

Synergy options with other stabilizers for optimized packages.

Weaknesses:

-

Consumer wariness of synthetic additives in clean-label segments.

-

Performance limits at very high temperatures or extreme oxidation conditions.

-

Dependency on petrochemical‐derived feedstocks.

Opportunities:

-

Scale pilots of natural phenolic antioxidants from lignin and other bio-residues.

-

Expand masterbatch offerings tailored for extrusion of recycled plastics.

-

Develop phenolic packages optimized for next-gen biofuels and synthetic lubricants.

Threats:

-

Tightening of food additive thresholds by health regulatory agencies.

-

Rise of alternative antioxidant classes (e.g., phosphonates, hindered amines) in specialty polymers.

-

Supply-chain disruptions for phenol intermediates due to feedstock fluctuations.

Market Key Trends

-

Synergistic Blends: Combination of phenolics with phosphites and thioesters to achieve broader thermal-oxidation protection.

-

Microencapsulation: Encasing phenols in polymeric shells to improve dispersion in hydrophobic and aqueous systems.

-

Natural Derivatives: Growth of gallic-acid esters and rosemary-extract analogues in food and cosmetics.

-

Digital Formulation Tools: AI-driven prediction of antioxidant efficacy in complex matrices accelerates R&D.

-

Sustainable Sourcing: Co-processing of lignin streams from pulping and biorefinery operations into phenolic antioxidants.

Covid-19 Impact

The pandemic disrupted supply chains for petrochemical intermediates, temporarily constraining antioxidant production. At the same time, demand for packaged foods and hand-sanitizer formulations spiked, elevating need for phenolic stabilizers. As industries adjusted, reliance on regional phenol sources increased, and manufacturers accelerated investments in local capacity and digital order-fulfillment systems.

Key Industry Developments

-

BASF’s Irganox® NextGen (2023): Launched a bio-based phenolic antioxidant derived from lignin for plastics applications.

-

Innospec’s TBHQ Expansion (2022): Commissioned a new TBHQ plant in Asia to meet rising food-stabilizer demand.

-

Eastman’s Masterbatch Launch (2021): Introduced pre-dispensed BHT/BHA masterbatches optimized for recycled-PET extrusion.

-

Songwon’s Phenol Derivative R&D (2024): Filed patents on novel alkoxy-phenols exhibiting improved thermal stability in engine oils.

Analyst Suggestions

-

Accelerate Natural Solutions: Scale up production of lignin‐derived phenolics to capture clean-label market share.

-

Enhance Synergy Platforms: Develop tailored phenol-phosphite-amine blends optimized for specific polymer and fuel chemistries.

-

Invest in Microencapsulation: Improve dispersibility in aqueous and polar systems, expanding application scope.

-

Diversify Feedstocks: Qualify alternative phenol precursors from renewable feedstocks to reduce cost volatility.

-

Engage Regulators Early: Proactively file dossiers for novel phenolics to secure approvals in key emerging markets.

Future Outlook

The Phenol Based Antioxidant market is forecast to grow at a CAGR of 5–7% through 2030, driven by rising demand for shelf-stable foods, performance plastics, and fuel-efficient lubricants. Natural-phenolic derivatives will capture incremental share in clean-label and sustainable segments, while specialty synthetic phenolics retain dominance in high-temperature and industrial applications. Suppliers who invest in R&D, downstream formulations, and regional production capacities will lead in a market balancing legacy performance with evolving consumer and regulatory preferences.

Conclusion

In conclusion, phenol based antioxidants remain foundational to oxidation control across diverse industries. Continued innovation in bio-sourcing, synergistic blends, and delivery technologies will expand their applicability and sustain market leadership. Manufacturers aligning product development with sustainability imperatives and digital-driven formulation will excel in meeting the dual demands of performance and environmental responsibility in the decades ahead.