444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The pharmaceutical fill and finish outsourcing market is a vital segment of the pharmaceutical industry that involves the final stages of drug manufacturing. Fill and finish outsourcing refers to the process of filling drug formulations into their respective containers, such as vials, ampoules, and syringes, and then finishing the products by adding labels, packaging, and ensuring quality control. This outsourcing practice allows pharmaceutical companies to focus on their core competencies while leveraging specialized expertise in fill and finish operations.

Meaning

Pharmaceutical fill and finish outsourcing involves the transfer of drug formulations from the manufacturing site to a contract manufacturing organization (CMO) or a contract development and manufacturing organization (CDMO) for the final stages of production. This arrangement enables pharmaceutical companies to optimize their operational efficiency, reduce costs, and enhance flexibility in meeting market demands. The CMOs and CDMOs offering fill and finish services possess advanced manufacturing capabilities and adhere to stringent regulatory guidelines to ensure the quality, safety, and efficacy of the final drug products.

Executive Summary

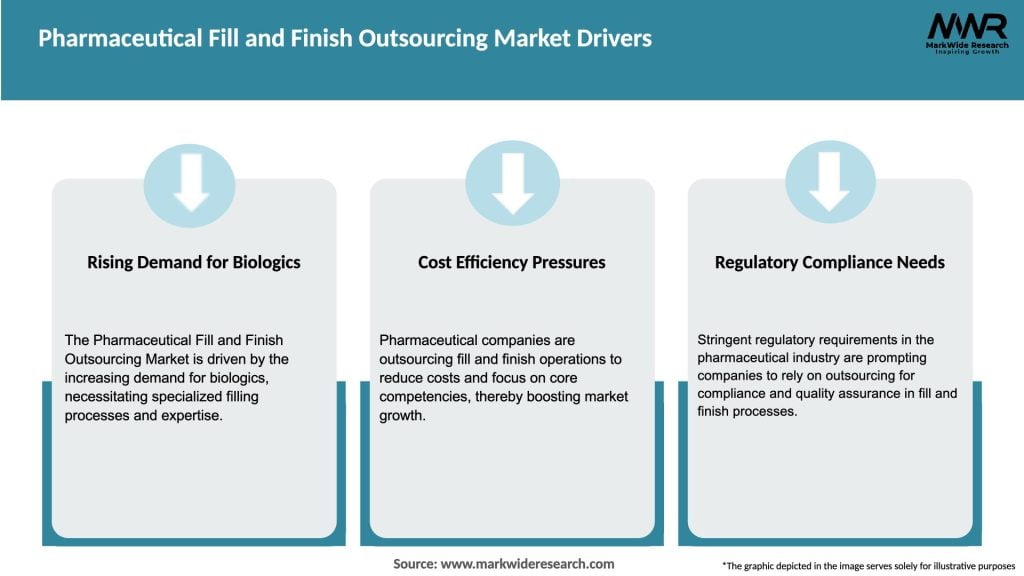

The pharmaceutical fill and finish outsourcing market has witnessed significant growth in recent years. The increasing complexity of drug formulations, rising demand for biologics, and the need for specialized packaging solutions are key factors driving the market. Outsourcing fill and finish operations allows pharmaceutical companies to tap into the expertise of specialized service providers, reduce capital investments, and enhance production efficiency. However, the market also faces challenges such as regulatory compliance, intellectual property protection, and supply chain management. Despite these challenges, the market presents numerous opportunities for both industry participants and stakeholders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The pharmaceutical fill and finish outsourcing market is characterized by dynamic factors that influence its growth and development. These dynamics include technological advancements, regulatory changes, market competition, and evolving consumer preferences. Understanding these dynamics is essential for industry participants and stakeholders to adapt to market trends, identify growth opportunities, and address potential challenges effectively.

Technological advancements play a crucial role in shaping the fill and finish outsourcing market. The development of advanced automation and robotic systems has significantly improved the efficiency and accuracy of the filling and packaging processes. Additionally, the introduction of innovative packaging technologies, such as smart packaging and tamper-evident solutions, has enhanced product safety and patient compliance.

Regulatory changes and compliance requirements also impact the fill and finish outsourcing market. Regulatory agencies constantly update guidelines and regulations to ensure the quality, safety, and efficacy of pharmaceutical products. Pharmaceutical companies and outsourcing service providers must stay updated with these regulatory changes to maintain compliance and avoid penalties.

Intense market competition drives service providers to continually enhance their capabilities and offer value-added services. This competition benefits pharmaceutical companies seeking outsourcing partners, as it encourages service providers to offer cost-effective solutions, improved efficiency, and innovative packaging options.

Consumer preferences and market trends play a vital role in shaping the fill and finish outsourcing market. Patients and healthcare providers increasingly demand user-friendly packaging solutions that enhance convenience and patient compliance. Service providers need to stay abreast of these preferences and tailor their offerings accordingly to remain competitive in the market.

Overall, the fill and finish outsourcing market is dynamic and influenced by various internal and external factors. Adapting to technological advancements, staying compliant with regulations, addressing market competition, and meeting evolving consumer preferences are critical for sustained growth and success in this industry.

Regional Analysis

The pharmaceutical fill and finish outsourcing market exhibits regional variations influenced by factors such as economic development, healthcare infrastructure, regulatory frameworks, and market demand. Understanding the regional dynamics is crucial for industry participants and stakeholders to identify market opportunities, plan expansion strategies, and tailor their offerings accordingly.

North America

North America dominates the pharmaceutical fill and finish outsourcing market due to its well-established healthcare infrastructure, strong regulatory framework, and significant presence of pharmaceutical companies. The region has a high demand for advanced fill and finish capabilities, especially for biologics and personalized medicines. The presence of prominent CDMOs and CMOs specializing in fill and finish operations further strengthens the market.

Europe

Europe holds a significant share in the fill and finish outsourcing market, driven by the presence of established pharmaceutical companies and a robust regulatory framework. The region is known for its advanced manufacturing capabilities, adherence to quality standards, and focus on patient-centric packaging solutions. Outsourcing fill and finish operations allows European pharmaceutical companies to optimize costs and access specialized expertise.

Asia Pacific

Asia Pacific is witnessing rapid growth in the pharmaceutical fill and finish outsourcing market, primarily driven by the increasing demand for healthcare services, a growing patient population, and the presence of a large pool of skilled labor. Countries such as China and India are emerging as major outsourcing hubs, offering cost advantages and advanced manufacturing capabilities. The region also benefits from a supportive regulatory environment and favorable government policies.

Latin America

Latin America presents opportunities for fill and finish outsourcing due to its expanding pharmaceutical industry, improving healthcare infrastructure, and rising investments in research and development. The region offers cost advantages, a skilled workforce, and proximity to the North American market, making it an attractive destination for outsourcing fill and finish operations.

Middle East and Africa

The Middle East and Africa region is experiencing a growing pharmaceutical industry and increasing investments in healthcare infrastructure. The presence of advanced manufacturing facilities, favorable government initiatives, and a rising focus on improving healthcare access drive the fill and finish outsourcing market in this region. However, challenges such as regulatory compliance and limited manufacturing expertise need to be addressed for sustained growth.

Competitive Landscape

Leading Companies in the Pharmaceutical Fill and Finish Outsourcing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

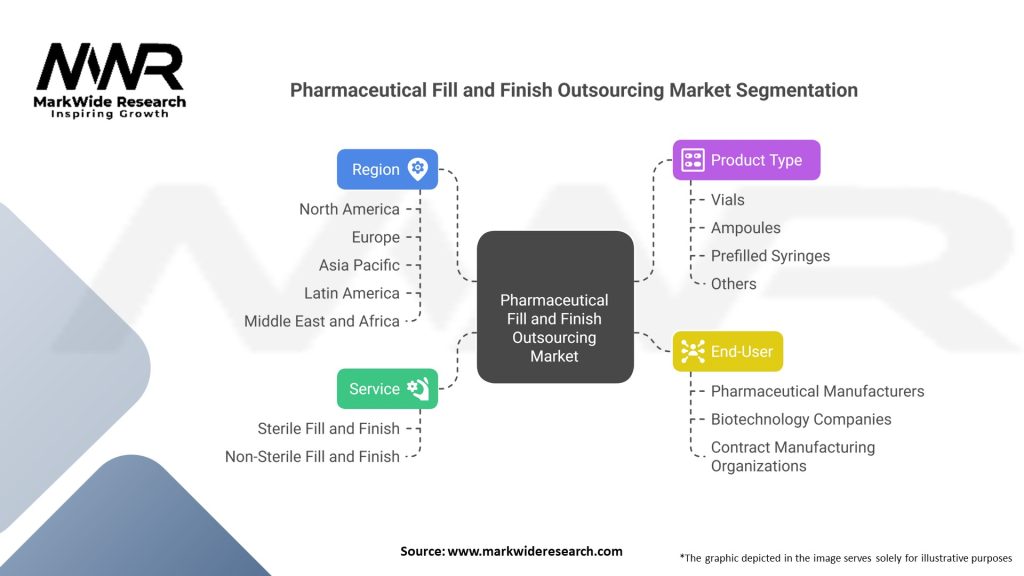

The pharmaceutical fill and finish outsourcing market can be segmented based on various factors, including type of service, type of container, therapeutic area, and end-user.

By Type of Service:

By Type of Container:

By Therapeutic Area:

By End-User:

Category-wise Insights

The fill and finish services category is the primary segment of the pharmaceutical fill and finish outsourcing market. It includes various activities such as aseptic filling, terminal sterilization, lyophilization, and inspection. Service providers in this category possess advanced manufacturing capabilities, cleanroom facilities, and rigorous quality control processes to ensure the integrity and sterility of the drug products.

Aseptic filling is a critical process in the pharmaceutical industry, especially for biologics and injectable drugs. It requires specialized equipment and expertise to maintain a sterile environment and prevent contamination. Service providers offering aseptic filling services employ advanced technologies such as isolators, restricted access barrier systems (RABS), and robotic systems to ensure accuracy and minimize human intervention.

Terminal sterilization is another important fill and finish service category, particularly for products that cannot undergo aseptic filling. This process involves the sterilization of packaged drug products using techniques such as steam sterilization, gamma irradiation, or ethylene oxide sterilization. Service providers specializing in terminal sterilization maintain compliance with regulatory requirements and industry standards to ensure the safety and efficacy of the sterilized products.

Lyophilization, also known as freeze-drying, is commonly used for the stabilization of biologics and sensitive drug formulations. This process involves freezing the product and removing water under controlled conditions, resulting in a stable and long-lasting dried product. Service providers offering lyophilization services possess advanced lyophilizers, monitoring systems, and expertise in cycle development and optimization.

Inspection is a critical step in fill and finish operations to ensure the quality and integrity of the final drug products. Visual inspection, automated inspection systems, and quality control processes are employed to detect any defects, particles, or abnormalities in the filled containers. Service providers in this category utilize advanced inspection technologies and adhere to strict quality control guidelines to deliver products that meet the highest quality standards.

Packaging services form an essential category in the pharmaceutical fill and finish outsourcing market. This category includes primary and secondary packaging activities, such as blister packaging, pouches, bottles, and cartons.

Blister packaging is widely used for solid oral dosage forms, providing individual unit-dose packaging and enhancing patient convenience. Service providers offering blister packaging services utilize advanced equipment and materials to ensure product protection, child resistance, and tamper-evidence.

Pouch packaging is gaining popularity for its flexibility, convenience, and ease of use. Pouches are commonly used for single-dose or multi-dose drug products, including powders, liquids, and oral solid dosage forms. Service providers in this category offer specialized pouch packaging solutions, such as unit-dose pouches, tearable pouches, and child-resistant pouches.

Bottle packaging is prevalent for various liquid formulations, including syrups, suspensions, and oral solutions. Service providers offering bottle packaging services ensure the integrity of the products, proper sealing, and compliance with regulatory requirements. They utilize automated bottle filling and capping machines, labelers, and quality control systems to optimize efficiency and maintain quality standards.

Carton packaging involves the packaging of primary containers, such as vials or ampoules, into secondary cartons. This packaging category includes labeling, serialization, and compliance with regulatory requirements. Service providers specializing in carton packaging offer customized solutions, such as tamper-evident cartons, patient information leaflets, and barcoding.

Packaging services also involve artwork design, product identification, and product information inserts. Service providers work closely with pharmaceutical companies to ensure accurate and compliant packaging design, artwork approval, and adherence to branding guidelines.

Labeling and serialization services play a crucial role in the pharmaceutical fill and finish outsourcing market, ensuring product identification, traceability, and regulatory compliance.

Labeling involves the application of labels to drug products, including primary containers and secondary packaging materials. Labels provide essential information such as product name, dosage instructions, warnings, batch details, and expiry dates. Service providers offering labeling services utilize advanced labeling equipment and employ quality control measures to ensure accurate and error-free labeling.

Serialization is the process of assigning a unique identification code or serial number to individual drug products, enabling traceability throughout the supply chain. Serialization helps in combating counterfeit drugs, detecting product diversion, and ensuring patient safety. Service providers specializing in serialization services employ track-and-trace systems, data management software, and regulatory expertise to comply with serialization requirements.

Labeling and serialization services involve close coordination with regulatory agencies to ensure compliance with local and international regulations, such as the Drug Supply Chain Security Act (DSCSA) in the United States or the Falsified Medicines Directive (FMD) in the European Union. Service providers maintain secure data management systems, implement tamper-evident solutions, and perform regular audits to protect data integrity and prevent counterfeit products.

Key Benefits for Industry Participants and Stakeholders

The pharmaceutical fill and finish outsourcing market offers several benefits for industry participants and stakeholders, including pharmaceutical companies, biotechnology companies, and contract manufacturing organizations.

For Pharmaceutical Companies:

For Biotechnology Companies:

For Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs):

SWOT Analysis

A SWOT analysis provides a comprehensive assessment of the strengths, weaknesses, opportunities, and threats in the pharmaceutical fill and finish outsourcing market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the pharmaceutical industry, including the fill and finish outsourcing market. The pandemic highlighted the importance of efficient supply chains, accelerated vaccine development and manufacturing, and increased the demand for pharmaceutical products worldwide.

The fill and finish outsourcing market played a crucial role in the production of Covid-19 vaccines, as contract manufacturing organizations partnered with pharmaceutical companies to meet the global demand. These partnerships facilitated the rapid scale-up of vaccine production, ensuring timely access to vaccines for populations worldwide.

The pandemic also highlighted the need for enhanced safety measures, such as maintaining sterile manufacturing environments and implementing rigorous quality control processes. Fill and finish service providers adapted to these challenges by implementing strict protocols, ensuring the safety and integrity of the manufactured products.

Furthermore, the pandemic emphasized the importance of global collaboration and strategic partnerships in addressing healthcare challenges. Pharmaceutical companies and contract manufacturing organizations collaborated to optimize production capacity, develop new manufacturing processes, and ensure equitable access to critical medications.

Overall, while the Covid-19 pandemic presented challenges to the pharmaceutical industry, it also showcased the resilience and adaptability of fill and finish outsourcing. The market responded to the increased demand, played a vital role in vaccine production, and reinforced the importance of efficient supply chains and robust manufacturing capabilities.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the pharmaceutical fill and finish outsourcing market appears promising, driven by technological advancements, increasing demand for biologics and personalized medicines, and the need for cost optimization and operational efficiency.Advancements in automation, robotics, and packaging technologies will continue to reshape fill and finish operations, enhancing efficiency, quality, and flexibility. The adoption of sustainable packaging solutions and digital technologies will gain prominence, driven by environmental concerns and the need for data-driven insights.

The demand for biologics and personalized medicines is expected to increase, driving the need for specialized fill and finish capabilities. Contract manufacturing organizations will continue to expand their services and strengthen their capabilities in this area, catering to the unique requirements of these products.Regulatory compliance will remain a critical focus, with companies and service providers continually enhancing their compliance capabilities and quality control processes. Data security and intellectual property protection will also gain increased attention, leading to the development of robust protocols and measures to safeguard sensitive information.

Collaborative partnerships and strategic alliances will play a vital role in the future, enabling companies to leverage complementary strengths, foster innovation, and expand market reach. These partnerships will facilitate the development of end-to-end solutions, from drug development to fill and finish operations.Overall, the pharmaceutical fill and finish outsourcing market is poised for steady growth, driven by technological advancements, increasing demand for specialized capabilities, and the continuous pursuit of cost optimization and operational efficiency.

Conclusion

The pharmaceutical fill and finish outsourcing market plays a crucial role in the final stages of drug manufacturing, providing fill and finish operations for drug formulations. Outsourcing these operations allows pharmaceutical companies to optimize costs, focus on core competencies, and access specialized expertise.

The market is driven by factors such as the increasing complexity of drug formulations, rising demand for biologics and personalized medicines, and the need for specialized packaging solutions. However, challenges such as intellectual property protection, regulatory compliance, and supply chain management need to be addressed.

The market presents opportunities in emerging markets, advancements in packaging technologies, personalized medicine, and strategic collaborations. By leveraging these opportunities, industry participants and stakeholders can benefit from cost optimization, enhanced efficiency, and market expansion.

What is Pharmaceutical Fill and Finish Outsourcing?

Pharmaceutical Fill and Finish Outsourcing refers to the process of contracting external companies to handle the final stages of drug manufacturing, which includes filling vials or syringes with the drug product and packaging it for distribution. This process is crucial for ensuring product quality and compliance with regulatory standards.

What are the key players in the Pharmaceutical Fill and Finish Outsourcing Market?

Key players in the Pharmaceutical Fill and Finish Outsourcing Market include companies like Catalent, Lonza, and Samsung Biologics, which provide comprehensive services from formulation to packaging. These companies are known for their advanced technologies and capabilities in handling various dosage forms, among others.

What are the main drivers of the Pharmaceutical Fill and Finish Outsourcing Market?

The main drivers of the Pharmaceutical Fill and Finish Outsourcing Market include the increasing demand for biologics and biosimilars, the need for cost-effective manufacturing solutions, and the growing focus on regulatory compliance. Additionally, the rise in contract manufacturing partnerships is also contributing to market growth.

What challenges does the Pharmaceutical Fill and Finish Outsourcing Market face?

Challenges in the Pharmaceutical Fill and Finish Outsourcing Market include stringent regulatory requirements, potential quality control issues, and the risk of supply chain disruptions. These factors can impact the efficiency and reliability of outsourcing arrangements.

What opportunities exist in the Pharmaceutical Fill and Finish Outsourcing Market?

Opportunities in the Pharmaceutical Fill and Finish Outsourcing Market include the expansion of personalized medicine and the increasing adoption of advanced manufacturing technologies. Additionally, the growing trend of outsourcing among small to mid-sized pharmaceutical companies presents significant growth potential.

What trends are shaping the Pharmaceutical Fill and Finish Outsourcing Market?

Trends shaping the Pharmaceutical Fill and Finish Outsourcing Market include the integration of automation and digital technologies in manufacturing processes, the rise of single-use systems, and an increased focus on sustainability practices. These trends are enhancing efficiency and reducing environmental impact.

Pharmaceutical Fill and Finish Outsourcing Market

| Segmentation Details | Details |

|---|---|

| Service | Sterile Fill and Finish, Non-Sterile Fill and Finish |

| Product Type | Vials, Ampoules, Prefilled Syringes, Others |

| End-User | Pharmaceutical Manufacturers, Biotechnology Companies, Contract Manufacturing Organizations |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Pharmaceutical Fill and Finish Outsourcing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at