444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The pharmaceutical extruder market encompasses a range of specialized machinery used in the pharmaceutical industry for the manufacturing of various dosage forms such as tablets, capsules, pellets, and granules. Pharmaceutical extruders play a crucial role in the pharmaceutical manufacturing process by converting raw materials into uniform and consistent formulations with precise control over particle size, density, porosity, and release characteristics. The market is driven by factors such as increasing demand for oral solid dosage forms, advancements in extrusion technology, and the growing emphasis on pharmaceutical quality and efficiency.

Meaning

pharmaceutical extruders are sophisticated equipment used in the pharmaceutical manufacturing process to produce solid dosage forms such as tablets, capsules, and pellets through the extrusion process. Extruders consist of a barrel, screw, die, and other components designed to mix, compress, and shape pharmaceutical ingredients into desired forms with high precision and repeatability. Pharmaceutical extruders are versatile machines capable of processing a wide range of raw materials, including active pharmaceutical ingredients (APIs), excipients, binders, lubricants, and disintegrants, to produce pharmaceutical formulations with specific properties and performance characteristics.

Executive Summary

The pharmaceutical extruder market is experiencing steady growth, driven by the increasing demand for oral solid dosage forms, advancements in extrusion technology, and the growing emphasis on pharmaceutical quality and efficiency. Manufacturers are focusing on developing innovative extrusion solutions with enhanced capabilities such as continuous processing, real-time monitoring, and automation to meet the evolving needs of the pharmaceutical industry. With the rise of personalized medicine, complex drug formulations, and stringent regulatory requirements, pharmaceutical extruders are becoming indispensable tools for pharmaceutical companies seeking to improve their manufacturing processes and product quality.

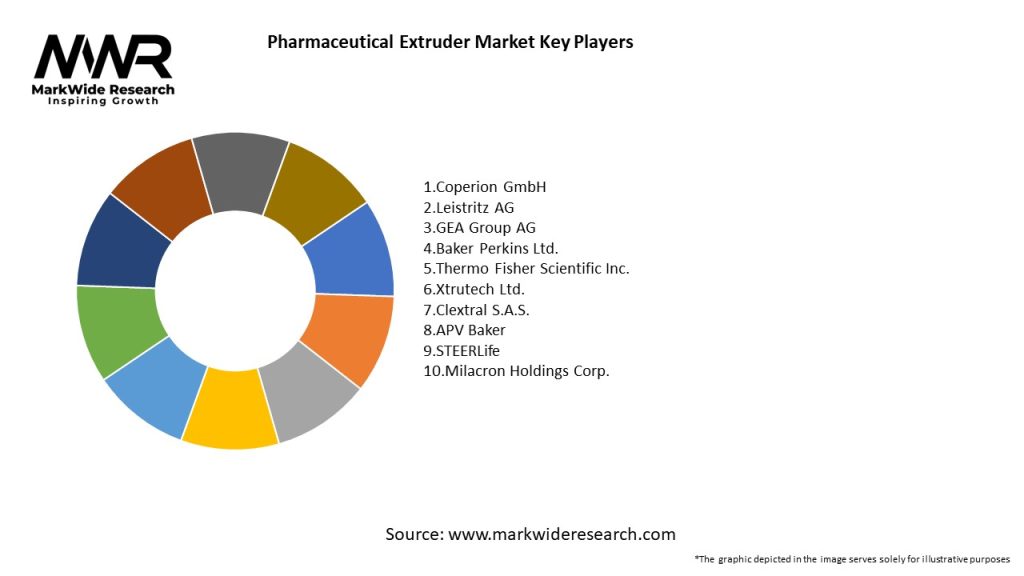

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The pharmaceutical extruder market is influenced by various dynamic factors, including technological advancements, regulatory requirements, market trends, competitive pressures, economic conditions, and industry collaborations. Manufacturers must stay abreast of market dynamics, anticipate future trends, and adapt their strategies, products, and services to meet the evolving needs of pharmaceutical customers and end-users in the competitive and highly regulated landscape of the pharmaceutical industry.

Regional Analysis

The pharmaceutical extruder market is global in scope, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its unique market dynamics, influenced by factors such as healthcare infrastructure, regulatory frameworks, industry regulations, economic conditions, and cultural preferences. While developed markets such as North America and Europe exhibit mature growth patterns, emerging economies in Asia Pacific and Latin America offer significant growth potential driven by increasing healthcare spending, pharmaceutical manufacturing activities, and demand for advanced manufacturing technologies such as pharmaceutical extrusion.

Competitive Landscape

Leading Companies in the Pharmaceutical Extruder Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The pharmaceutical extruder market can be segmented based on equipment type, process type, application, and end-user. Equipment types include twin-screw extruders, single-screw extruders, ram extruders, and hot-melt extruders, each with specific features, capabilities, and applications. Process types encompass wet extrusion, dry extrusion, hot-melt extrusion, and cold extrusion, depending on the physical state of the materials and processing conditions. Applications range from pharmaceutical granulation, drug layering, and tablet compression to pelletization, spheronization, and controlled-release coating, while end-users include pharmaceutical companies, contract manufacturers, research institutions, and academic centers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has underscored the importance of resilient and agile pharmaceutical manufacturing capabilities, driving the adoption of advanced manufacturing technologies such as pharmaceutical extrusion to enhance process efficiency, flexibility, and responsiveness to changing market demands and supply chain disruptions. While the pandemic has posed challenges such as supply chain disruptions, workforce shortages, and regulatory delays, it has also accelerated trends such as digitalization, automation, and remote monitoring in the pharmaceutical industry, paving the way for the widespread adoption of continuous manufacturing technologies and integrated manufacturing solutions in the post-pandemic era.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the pharmaceutical extruder market is promising, driven by factors such as the increasing demand for oral solid dosage forms, advancements in extrusion technology, and the growing emphasis on pharmaceutical quality and efficiency. As pharmaceutical companies continue to invest in advanced manufacturing technologies to improve their production processes and product quality, pharmaceutical extruders are expected to play an increasingly important role in the pharmaceutical manufacturing landscape, offering solutions for complex drug formulations, personalized medicines, and continuous manufacturing applications.

Conclusion

In conclusion, the pharmaceutical extruder market offers significant opportunities for manufacturers, suppliers, and stakeholders to capitalize on the growing demand for advanced manufacturing technologies in the pharmaceutical industry. By focusing on innovation, collaboration, and customer-centricity, companies can develop differentiated extrusion solutions, expand their market presence, and drive sustainable growth and success in the competitive and dynamic pharmaceutical extruder market.

What is Pharmaceutical Extruder?

A pharmaceutical extruder is a specialized machine used in the production of pharmaceutical products, facilitating processes such as mixing, melting, and shaping materials into desired forms. It plays a crucial role in the formulation of various dosage forms, including tablets and granules.

What are the key players in the Pharmaceutical Extruder Market?

Key players in the Pharmaceutical Extruder Market include companies like Coperion GmbH, Thermo Fisher Scientific, and GEA Group, which are known for their advanced extrusion technologies and solutions for pharmaceutical applications, among others.

What are the growth factors driving the Pharmaceutical Extruder Market?

The Pharmaceutical Extruder Market is driven by factors such as the increasing demand for advanced drug formulations, the rise in the production of complex pharmaceuticals, and the growing trend towards continuous manufacturing processes in the pharmaceutical industry.

What challenges does the Pharmaceutical Extruder Market face?

Challenges in the Pharmaceutical Extruder Market include the high initial investment costs for advanced extrusion equipment and the need for skilled personnel to operate these machines effectively. Additionally, regulatory compliance can pose hurdles for manufacturers.

What opportunities exist in the Pharmaceutical Extruder Market?

Opportunities in the Pharmaceutical Extruder Market include the development of novel drug delivery systems and the increasing adoption of extrusion technology in biopharmaceuticals. The growing focus on personalized medicine also presents new avenues for innovation.

What trends are shaping the Pharmaceutical Extruder Market?

Trends in the Pharmaceutical Extruder Market include the integration of automation and digital technologies in extrusion processes, as well as the increasing emphasis on sustainability and eco-friendly practices in pharmaceutical manufacturing.

Pharmaceutical Extruder Market

| Segmentation Details | Description |

|---|---|

| Product Type | Single-Screw Extruders, Twin-Screw Extruders, Multi-Screw Extruders, Batch Extruders |

| Application | Granulation, Coating, Pelletizing, Compounding |

| End User | Pharmaceutical Manufacturers, Contract Manufacturers, Research Institutions, Biopharmaceutical Companies |

| Technology | Hot Melt Extrusion, Cold Extrusion, Reactive Extrusion, Solvent-Based Extrusion |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Pharmaceutical Extruder Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at