444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The pet obesity management market represents a rapidly growing and increasingly critical segment within the companion animal healthcare industry, characterized by rising awareness of pet weight-related health issues and expanding therapeutic and preventive solutions. This dynamic sector encompasses prescription diet foods, weight management supplements, veterinary services, fitness programs, wearable activity trackers, and behavioral modification interventions designed to address the escalating pet obesity epidemic affecting dogs and cats globally. Pet obesity has emerged as a significant veterinary concern with clinical studies indicating that excess weight contributes to diabetes, arthritis, cardiovascular disease, and reduced life expectancy in companion animals. The market demonstrates robust growth momentum driven by increasing pet humanization trends, rising veterinary care expenditures, growing awareness among pet owners about obesity-related health risks, and expanding availability of specialized weight management products and services.

Obesity prevalence rates in companion animals have reached alarming levels with veterinary associations reporting that approximately 56% of dogs and 60% of cats in developed markets are classified as overweight or obese, creating substantial healthcare burden and quality of life impacts for affected animals and their owners. Regional dynamics reveal concentrated market development in North America and Europe where pet ownership rates, veterinary care standards, and consumer spending capacity align with premium product and service adoption while emerging markets demonstrate accelerating interest as pet ownership modernizes and veterinary infrastructure develops. According to MarkWide Research analysis, the sector is experiencing exceptional expansion with projected growth at a CAGR of 9.3% through the forecast period. Industry participants include specialized pet nutrition companies, pharmaceutical manufacturers, veterinary clinics and hospitals, pet fitness centers, technology companies developing activity monitoring devices, and integrated pet health platforms offering comprehensive weight management solutions serving the growing population of overweight companion animals globally.

The pet obesity management market refers to the global industry encompassing products, services, technologies, and interventions designed to prevent, diagnose, treat, and manage excessive body weight in companion animals. This includes therapeutic diet formulations, prescription weight loss foods, dietary supplements supporting metabolism and satiety, veterinary weight management programs, fitness and exercise services, wearable activity trackers, behavioral modification consulting, and comprehensive obesity treatment protocols addressing the medical, nutritional, and lifestyle factors contributing to unhealthy weight gain in dogs, cats, and other companion animals.

Market evolution in pet obesity management reflects fundamental shifts in pet ownership attitudes, veterinary medicine sophistication, and recognition of weight as a critical health determinant rather than merely cosmetic concern. The sector has progressed from limited specialty diet options to comprehensive ecosystems of products, services, and technologies supporting long-term weight management success. Key growth drivers include escalating obesity prevalence in companion animal populations, increasing pet humanization with owners willing to invest substantially in pet health, growing veterinary emphasis on preventive care and chronic disease management, and expanding scientific understanding of companion animal metabolism and weight regulation. The market landscape features diverse stakeholders including major pet food manufacturers, veterinary pharmaceutical companies, independent veterinary practices, specialty weight management clinics, pet fitness facilities, and technology startups developing innovative monitoring and intervention tools. Consumer behavior patterns increasingly mirror human weight management approaches with pet owners seeking comprehensive solutions combining nutrition, exercise, behavioral modification, and professional support rather than simple dietary restriction alone.

Veterinary engagement proves critical for successful outcomes with professional diagnosis, customized treatment plans, and ongoing monitoring significantly improving compliance and weight loss success rates. Treatment complexity requires addressing multiple factors including caloric intake, feeding behaviors, activity levels, metabolic conditions, and owner compliance challenges creating opportunities for integrated service models. Product innovation spans low-calorie therapeutic diets with enhanced satiety, supplements supporting healthy metabolism, palatability-optimized formulations improving adherence, and portion control tools helping owners implement feeding recommendations accurately. The manufacturing and service ecosystem demonstrates increasing sophistication with clinical research validating interventions, technology platforms enabling remote monitoring and coaching, and multi-disciplinary approaches combining veterinary medicine, nutrition science, and behavioral psychology to address the complex challenge of sustainable weight management in companion animals requiring long-term commitment from both pet owners and healthcare providers.

Critical market dynamics shaping the pet obesity management landscape include:

Multiple catalysts propel growth in the pet obesity management market. Rising obesity prevalence in companion animal populations creates expanding addressable market with veterinary associations documenting increasing percentages of overweight pets year-over-year across developed markets. Pet humanization trends see owners increasingly viewing pets as family members worthy of healthcare investments comparable to human medicine, elevating willingness to pursue weight management interventions. Veterinary care advancement with improved diagnostics, treatment protocols, and preventive medicine emphasis positions weight management as standard of care rather than optional intervention. Health consequence awareness grows among pet owners understanding connections between excess weight and diabetes, arthritis, heart disease, and shortened lifespan motivating preventive and therapeutic action. Premium pet food market expansion normalizes higher spending on specialized nutrition making therapeutic weight management diets more accessible to mainstream consumers. Aging pet populations with longer lifespans due to improved veterinary care create larger populations vulnerable to weight gain and obesity-related conditions.

Lifestyle changes including reduced outdoor activity, increased indoor living, and busy owner schedules contribute to declining pet exercise levels exacerbating weight gain trends. Breed predispositions toward obesity in popular dog breeds including Labrador Retrievers, Beagles, and Cocker Spaniels create concentrated at-risk populations. Technology adoption among pet owners comfortable using smartphones, wearables, and connected devices enables innovative monitoring and engagement approaches. Social media influence through pet health communities, veterinary influencers, and weight loss success stories raises awareness and motivates intervention. Insurance coverage expansion with pet health insurance policies increasingly covering obesity-related conditions and weight management programs reducing owner financial barriers. Professional service diversification through pet fitness centers, hydrotherapy facilities, and specialized weight management clinics creates accessible intervention options beyond traditional veterinary settings, with pet fitness facility growth exceeding 15% annually in major metropolitan markets as owners seek structured exercise programs for overweight companions.

Significant challenges constrain market growth despite favorable overall dynamics. Owner perception barriers prevent many pet owners from recognizing their animals as overweight, with studies indicating substantial percentages of owners consider overweight pets as normal weight delaying intervention. Emotional feeding behaviors where owners express love through food treats and indulgent feeding create resistance to dietary restriction recommendations. Compliance difficulties in implementing feeding and exercise recommendations consistently over months or years required for successful weight loss remain primary failure point. Cost sensitivity toward premium therapeutic diets, veterinary monitoring visits, and specialized services limits adoption among price-conscious pet owners facing competing financial priorities. Time constraints affecting busy owners reduce capacity for increased exercise, meal preparation, and program monitoring essential for success.

Multi-pet household challenges complicate feeding management when some animals require weight control while others maintain healthy weight in shared living environments. Palatability concerns about therapeutic diets create resistance when pets refuse or show reduced enthusiasm for prescribed foods affecting owner willingness to maintain programs. Slow visible progress in weight loss compared to human expectations can discourage owners despite veterinary recommendations for gradual weight reduction protecting lean muscle mass. Knowledge gaps among pet owners about appropriate portion sizes, caloric content of treats, and exercise requirements contribute to unintentional overfeeding. Veterinary communication challenges in discussing sensitive topics like pet obesity without offending owners require careful approach potentially limiting intervention frequency. Alternative product availability of conventional pet foods at lower prices creates temptation to discontinue therapeutic diets when visible results lag or costs accumulate. Limited insurance coverage for preventive weight management in many pet insurance policies reduces financial support for proactive interventions before medical complications develop.

Substantial opportunities exist for market participants across the value chain. Preventive program development targeting healthy weight maintenance from puppyhood or kittenhood captures larger populations before obesity develops requiring intensive intervention. Technology integration through activity trackers, automated feeders with portion control, and smartphone applications provides engagement tools improving compliance and outcomes. Subscription service models delivering therapeutic foods, supplements, and ongoing coaching creates recurring revenue while supporting long-term adherence essential for success. Telehealth services enabling remote weight monitoring, nutritional counseling, and behavioral support expands access beyond traditional veterinary clinic constraints. Workplace wellness programs for pets paralleling human corporate wellness initiatives as owners bring companions to pet-friendly offices creates institutional intervention opportunities. Breed-specific solutions targeting predisposed populations with customized nutrition and exercise recommendations addresses concentrated at-risk segments. Senior pet specialization addressing weight management in aging animals with mobility limitations and changing metabolic needs serves growing demographic.

Functional treat development providing low-calorie options satisfying owner desire to reward pets without compromising dietary programs. Group fitness classes and socialization programs combining exercise with community building enhance engagement and adherence through peer support. Veterinary hospital integration offering comprehensive in-clinic weight management services including nutritional counseling, fitness assessment, and behavioral modification creates differentiated practice offerings. Retail partnerships with pet specialty stores providing education, product demonstrations, and weight screening drives awareness and product trial. Corporate partnerships between food manufacturers and technology companies create integrated solutions combining optimized nutrition with activity monitoring.

Complex interactions between behavioral, economic, and healthcare forces shape market evolution. Pet humanization fundamentally alters spending patterns and healthcare expectations with owners increasingly willing to invest in pet wellbeing comparable to family member healthcare. Veterinary practice economics benefit from weight management services generating recurring revenue through follow-up visits, therapeutic diet sales, and ancillary services. Competition intensity in pet food markets drives innovation and marketing investment in weight management segments as manufacturers seek differentiation and premium positioning. Consumer education efforts by veterinary associations, pet food companies, and animal welfare organizations gradually improve owner awareness though behavioral change lags knowledge. Technology disruption through wearables, apps, and connected devices creates new intervention modalities and business models beyond traditional product and service approaches.

Regulatory environment around therapeutic diet claims, supplement marketing, and veterinary service standards varies across markets affecting product positioning and distribution strategies. Social influences through online communities, social media, and pet influencers shape owner attitudes toward pet weight and intervention willingness. Economic cycles impact discretionary spending on premium pet products and services though pet healthcare demonstrates relative resilience during downturns. Generational differences show younger pet owners particularly receptive to technology-enabled solutions and preventive healthcare approaches. Distribution channel evolution sees growing online sales of therapeutic diets and supplements alongside traditional veterinary clinic dispensing. Professional service competition emerges as pet trainers, nutritionists, and fitness specialists offer weight management services potentially outside veterinary oversight. Research advancement in companion animal metabolism, genetics, and nutrition science informs product development and treatment protocols, with clinical studies demonstrating 70-80% weight loss success rates in programs combining veterinary supervision, therapeutic nutrition, and owner compliance support over 6-12 month intervention periods.

Comprehensive research underpinning this analysis employed multiple methodologies ensuring accuracy and market insight. Primary research included structured interviews with veterinarians, veterinary nutritionists, pet food manufacturers, pet owners participating in weight management programs, and industry analysts providing firsthand perspectives on challenges, opportunities, and trends. Consumer surveys assessed pet owner awareness, attitudes, behaviors, and spending patterns related to pet weight management across demographic segments. Secondary research synthesized information from veterinary medical journals, pet industry publications, obesity prevalence studies, and company reports understanding market size, growth patterns, and competitive dynamics. Market sizing utilized pet population data, obesity prevalence statistics, product pricing, and veterinary service utilization rates building comprehensive demand models. Veterinary practice analysis examined weight management service offerings, protocol adoption, and revenue contribution across practice types and regions. Product category assessment evaluated therapeutic diet formulations, supplement ingredients, and technology features understanding differentiation and efficacy evidence. Distribution channel analysis mapped product flows from manufacturers through veterinary clinics, pet specialty retailers, and online platforms to end consumers.

Competitive landscape research examined major market participants analyzing product portfolios, pricing strategies, marketing approaches, and competitive positioning. Regional analysis investigated market characteristics across geographies considering pet ownership patterns, obesity prevalence, veterinary care standards, and consumer spending capacity. Technology trend evaluation assessed emerging digital health tools, wearables, and platforms potentially disrupting traditional weight management approaches. Expert validation involved consulting with board-certified veterinary nutritionists, practice management consultants, and pet industry specialists verifying findings and incorporating nuanced insights.

North America dominates the global market with approximately 48% market share, driven by high pet ownership rates, elevated obesity prevalence, established veterinary care infrastructure, and strong consumer spending on pet health. United States leads globally with substantial pet healthcare expenditures, widespread availability of therapeutic diets and weight management services, and growing integration of technology-enabled solutions. Pet obesity prevalence in North America reaches highest global rates creating massive addressable population for interventions. Canada demonstrates similar patterns with sophisticated veterinary care and health-conscious pet owners though smaller absolute market size. Europe represents the second-largest market with varying adoption patterns across countries reflecting differences in pet ownership culture, veterinary practice models, and consumer spending capacity. United Kingdom shows strong market development with veterinary associations actively promoting obesity awareness and weight management best practices. Germany and France demonstrate growing market sophistication with expanding therapeutic diet availability and specialized weight management services.

Scandinavia exhibits high per-pet spending and preventive care orientation supporting premium product and service adoption. Asia-Pacific demonstrates the fastest growth trajectory with CAGR exceeding 12%, led by rising pet ownership in urban areas, increasing obesity prevalence as pets adopt indoor lifestyles, and growing disposable income. China shows explosive growth with expanding middle class, urbanization concentrating pet populations, and emerging veterinary care sophistication. Japan maintains mature pet market with health-conscious owners and advanced veterinary medicine supporting weight management adoption. Australia demonstrates developed market characteristics similar to North America with high obesity awareness and comprehensive product availability. Latin America shows emerging potential with growing pet ownership and veterinary care development in major urban centers though economic constraints limit premium product penetration. Middle East demonstrates selective adoption particularly in Gulf countries with high disposable income and western-influenced pet care practices. Africa remains largely undeveloped for specialized weight management products and services though South Africa shows modest market presence.

The competitive environment features diverse participants with varying strategies and capabilities:

By Product Type: The market segments into therapeutic diet foods representing prescription weight management formulations available through veterinary channels, over-the-counter weight control foods sold in retail without prescription, dietary supplements supporting metabolism and satiety, treats and snacks formulated for calorie restriction, and portion control tools including measuring devices and automated feeders. Therapeutic diets dominate value while supplements demonstrate fastest growth as adjunct interventions.

By Animal Type: Classification includes dogs representing the larger market segment due to population size and higher obesity prevalence, cats with distinct nutritional requirements and weight management challenges, and other companion animals including rabbits and ferrets. Canine applications account for approximately 65% of market value while feline represents substantial and growing segment.

By Distribution Channel: Segments encompass veterinary clinics and hospitals representing primary distribution for prescription products and professional services, pet specialty retail stores offering over-the-counter weight management products, online channels providing convenient access to therapeutic diets and supplements, and mass market retail with limited weight management product presence. Veterinary channels maintain largest share though online demonstrates rapid growth.

By Service Type: Categories include veterinary consultation and monitoring services, nutritional counseling programs, fitness and exercise facilities, behavioral modification training, and technology-enabled monitoring and coaching platforms. Veterinary services remain foundational while technology platforms represent emerging segment.

By Intervention Stage: Market applications span prevention programs maintaining healthy weight in normal-weight animals, treatment interventions addressing established obesity, and maintenance programs sustaining achieved weight loss. Treatment currently dominates though prevention represents significant opportunity as awareness grows.

Therapeutic Weight Management Diets represent the largest product category combining calorie restriction with enhanced satiety and complete nutrition. Prescription formulations available exclusively through veterinary channels undergo clinical testing validating efficacy and safety. Nutrient profiles emphasize high protein maintaining lean muscle mass during weight loss, increased fiber promoting satiety, and controlled fat reducing caloric density. Palatability optimization remains critical ensuring pets willingly consume prescribed foods throughout extended weight loss programs. Customization approaches offer multiple protein sources, kibble sizes, and texture options accommodating individual preferences and sensitivities.

Dietary Supplements provide adjunct interventions supporting metabolism, reducing appetite, and enhancing weight loss outcomes. Ingredient categories include L-carnitine supporting fat metabolism, fiber supplements promoting satiety, green tea extract potentially enhancing metabolic rate, and conjugated linoleic acid. Evidence requirements vary across markets with regulatory scrutiny around efficacy claims intensifying. Veterinary guidance proves important ensuring appropriate supplement selection and dosing avoiding potential adverse effects or interactions. Compliance advantages through treat-format supplements improve adherence compared to adding powders to foods.

Activity Monitoring Technology enables objective exercise tracking replacing subjective owner estimates. Wearable devices attach to collars measuring steps, distance, active time, and calories burned providing data-driven insights. Smartphone integration through companion apps visualizes progress, sets goals, and provides motivational feedback. Social features enabling sharing and comparison with other pet owners enhance engagement through gamification and community support. Veterinary integration allows data sharing with healthcare providers informing treatment adjustments and outcome assessment. Battery life and durability remain critical practical considerations for devices worn continuously by active pets.

Veterinary Weight Management Programs provide structured interventions combining professional assessment, customized treatment plans, and ongoing monitoring. Initial evaluation includes body condition scoring, weight measurement, metabolic assessment, and identification of underlying medical conditions. Customized protocols specify target weight, calorie requirements, feeding schedules, and exercise recommendations tailored to individual circumstances. Follow-up visits typically scheduled every 2-4 weeks enable progress monitoring, program adjustment, and owner support maintaining adherence. Success metrics track weight loss rate, body condition improvement, and owner compliance with recommendations. Revenue opportunities for veterinary practices include consultation fees, therapeutic diet sales, and recurring visit income supporting practice economics.

Pet Fitness Services address exercise challenges through structured programs and specialized facilities. Hydrotherapy provides low-impact exercise particularly valuable for obese or arthritic pets unable to tolerate high-impact activity. Underwater treadmills enable controlled exercise with adjustable resistance and veterinary supervision. Group exercise classes combine physical activity with socialization opportunities enhancing owner engagement and pet enjoyment. Personal training services develop customized exercise programs considering individual capabilities, limitations, and goals. Facility-based programs overcome owner time constraints and weather limitations ensuring consistent exercise adherence, with participants achieving 25-30% better weight loss outcomes compared to home-based programs alone according to veterinary studies tracking intervention effectiveness.

Pet Food Manufacturers benefit from weight management products commanding premium pricing while creating brand differentiation in competitive markets. Therapeutic diet relationships with veterinary profession build professional credibility and secure distribution through high-value channels. Portfolio expansion into weight management captures growing market segment while serving existing customer base across life stages.

Veterinary Practices gain revenue opportunities through product sales, consultation fees, and ongoing monitoring visits while fulfilling professional responsibility for patient health. Client loyalty strengthens through successful weight management outcomes and sustained engagement over extended intervention periods. Practice differentiation through specialized weight management services attracts health-conscious clients willing to invest in preventive care.

Technology Companies access substantial pet care markets expanding addressable opportunities for wearables, apps, and connected devices beyond human health applications. Recurring revenue through subscription services and premium features supplements device sales creating sustainable business models. Data generation enables insights and analytics potentially valuable across pet health ecosystem.

Pet Owners ultimately benefit from improved pet health, enhanced quality of life, and potentially extended lifespan through successful weight management. Disease prevention reduces future veterinary expenses and emotional burden associated with obesity-related health complications. Enhanced relationship quality through increased activity and engagement strengthens human-animal bond.

Animal Welfare Organizations advance mission objectives through obesity reduction improving companion animal welfare and addressing significant health crisis affecting pet populations.

Pet Insurance Companies benefit from obesity prevention and management reducing claims for associated conditions including diabetes, arthritis, and cardiovascular disease, creating potential for wellness incentives and preventive care coverage expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized Nutrition Approaches tailor dietary recommendations to individual pet characteristics including breed, age, activity level, and metabolic factors. DNA testing services identify genetic predispositions to weight gain and metabolic conditions informing prevention strategies. Customized formulations adjust macronutrient ratios and ingredient selections based on individual response and preferences. Precision feeding calculates exact caloric requirements considering multiple variables beyond simple body weight. Continuous optimization adjusts protocols based on progress monitoring and changing needs throughout weight loss journey.

Technology-Enabled Engagement enhances owner participation and compliance through digital tools. Smartphone applications track food intake, weight progress, and activity levels providing comprehensive intervention monitoring. Automated feeding systems deliver precise portions at scheduled times removing owner discretion and improving adherence. Telehealth consultations enable remote monitoring and support between in-person veterinary visits. Artificial intelligence analyzes data patterns providing personalized recommendations and predicting intervention success. Social connectivity through online communities enables peer support and experience sharing motivating continued engagement.

Preventive Care Emphasis shifts focus toward maintaining healthy weight from early life rather than treating established obesity. Puppy and kitten programs educate new owners about appropriate feeding, exercise, and weight monitoring preventing obesity development. Life stage transitions including neutering, reduced activity, and aging receive targeted interventions addressing weight gain risk periods. Breed-specific guidance addresses predisposed populations with proactive management recommendations. Regular screening during routine veterinary visits enables early detection and intervention before significant obesity develops.

Functional Ingredient Innovation advances beyond simple calorie restriction toward metabolically active components. Satiety-enhancing fibers reduce hunger and begging behaviors improving owner and pet satisfaction with restricted feeding. Metabolism-supporting nutrients including L-carnitine and omega-3 fatty acids potentially enhance fat utilization and preserve lean muscle. Microbiome modulation through prebiotics and probiotics addresses gut health influences on weight regulation and metabolism. Novel proteins and limited ingredient formulations accommodate food sensitivities while supporting weight loss objectives.

Integrated Service Models combine multiple intervention modalities creating comprehensive support systems. Veterinary practice programs bundle nutritional counseling, therapeutic diets, fitness assessment, and behavioral support within structured protocols. Subscription services deliver products, coaching, and monitoring as integrated packages supporting long-term adherence. Multi-disciplinary teams including veterinarians, nutritionists, trainers, and behaviorists collaborate on complex cases. Outcome-based approaches align provider and client incentives around successful weight loss achievement rather than product sales alone, with bundled programs demonstrating 40% higher success rates compared to single-modality interventions according to veterinary practice data tracking intervention effectiveness.

Recent years have witnessed numerous significant developments influencing market trajectories. Major pet food manufacturers expanded therapeutic diet portfolios with improved palatability formulations addressing primary compliance obstacle. Veterinary associations launched obesity awareness campaigns educating pet owners and encouraging proactive screening by veterinary professionals. Technology companies entered pet health markets introducing activity trackers, smart feeders, and health monitoring platforms. Clinical research validated specific dietary formulations and intervention protocols through controlled studies published in veterinary journals. Pet insurance companies began covering weight management programs and obesity-related conditions expanding financial support for interventions. Retail innovations including in-store veterinary clinics and nutritional counseling services improved consumer access to professional guidance. Telehealth platforms emerged offering remote weight management support and monitoring between in-person veterinary visits. Celebrity pet influencers shared weight loss journeys raising awareness and motivating owner engagement through social media. Professional guidelines from veterinary nutrition specialists established evidence-based protocols for weight assessment and management improving clinical practice consistency. Partnership models between veterinary practices and pet fitness facilities created integrated service offerings combining medical oversight with structured exercise programs.

Strategic positioning for pet obesity management companies should emphasize holistic solutions addressing multiple intervention factors rather than single-product approaches. Consumer education investments building awareness about obesity health impacts and recognition of overweight body conditions prove essential for market development given widespread perception gaps. Veterinary partnership strategies securing professional endorsement and recommendation drive product adoption and enhance credibility with health-conscious pet owners. Technology integration incorporating activity monitoring, feeding management, and progress tracking differentiates offerings while improving compliance through engagement and accountability mechanisms.

Product development priorities should balance efficacy with palatability given that food refusal remains primary reason for therapeutic diet discontinuation. Formulation innovation enhancing satiety through fiber types, protein sources, and nutrient density reduces hunger-related behaviors improving owner and pet satisfaction. Format diversification including wet foods, dry kibble, treats, and supplements provides options accommodating individual preferences and feeding circumstances. Clinical validation through controlled studies and publication in veterinary journals establishes evidence-based credibility differentiating products from unsubstantiated marketing claims. Functional ingredients supporting metabolism, preserving lean muscle mass, and providing health benefits beyond weight loss create additional value propositions.

Distribution strategy decisions balance veterinary channel credibility against broader retail accessibility and online convenience. Veterinary-exclusive positioning maintains professional endorsement and enables direct practitioner engagement though limits market reach. Multi-channel approaches offering prescription products through veterinary channels while making over-the-counter options available through retail expands addressable market. E-commerce capabilities providing convenient delivery with subscription options improve adherence by ensuring therapeutic food availability without shopping trips. Direct-to-consumer models enable relationship building and data collection informing product improvements and service development.

Service model innovation creates differentiated offerings and recurring revenue streams beyond product sales alone. Subscription bundles combining food, supplements, coaching, and monitoring as integrated packages simplify purchasing while ensuring comprehensive support. Telehealth integration enabling remote consultations and progress monitoring improves accessibility particularly for rural owners or those with mobility constraints. Group programs leveraging peer support and social accountability enhance engagement and adherence through community involvement. Outcome guarantees or money-back assurances reduce perceived risk encouraging program initiation among hesitant owners.

Technology platform development should prioritize user experience and practical value over feature complexity. Seamless integration with existing veterinary practice systems enables efficient data sharing and workflow incorporation. Automated insights through artificial intelligence analysis provide actionable recommendations without requiring owner data interpretation expertise. Motivation mechanics through gamification, progress visualization, and achievement recognition maintain engagement throughout extended intervention periods. Privacy protection and data security build trust particularly given increasing consumer sensitivity around health information.

Market education initiatives addressing awareness gaps prove critical for category growth. Veterinary professional education equipping practitioners with communication strategies for discussing sensitive weight topics improves intervention frequency. Consumer campaigns through multiple channels including social media, veterinary clinics, and retail environments raise obesity awareness and intervention urgency. Body condition assessment tools enabling owners to objectively evaluate pet weight status reduce perception biases delaying intervention. Success story sharing through testimonials and case studies demonstrates achievable outcomes motivating action among reluctant owners.

Partnerships and collaborations leverage complementary capabilities accelerating market development. Veterinary association relationships secure professional endorsement and enable educational program development. Pet insurance company partnerships expand coverage for weight management services reducing financial barriers. Retail collaborations provide consumer access points and product visibility beyond veterinary channels. Technology integrations between activity trackers, smart feeders, and health platforms create seamless ecosystems enhancing user experience and value. Research institution partnerships enable clinical study design and execution establishing evidence base supporting product claims and treatment protocols.

Long-term prospects for the pet obesity management market remain exceptionally positive driven by rising obesity prevalence, increasing pet healthcare spending, and expanding intervention sophistication. MarkWide Research projects continued robust growth with the sector achieving sustained high single-digit to low double-digit expansion as awareness increases, products improve, and comprehensive service models mature. Obesity prevalence trends unfortunately continue upward trajectories despite intervention availability creating expanding addressable populations requiring therapeutic and preventive solutions.

Consumer awareness advancement through veterinary education, media coverage, and social influence gradually improves recognition of pet obesity as serious health concern rather than cosmetic issue. Body condition assessment becoming routine component of veterinary examinations enables earlier identification and intervention. Generational shifts toward younger pet owners more receptive to technology-enabled solutions and preventive healthcare approaches support market growth. Pet humanization continues intensifying with owners increasingly willing to invest in pet health and wellness comparable to family member healthcare expenditures.

Product innovation advances therapeutic diet palatability, nutritional optimization, and functional ingredient incorporation addressing historical limitations and improving outcomes. Personalized nutrition utilizing genetic testing, microbiome analysis, and individual response monitoring enables precision interventions optimizing efficacy. Novel ingredients including alternative proteins, satiety-enhancing compounds, and metabolism-supporting nutrients expand formulation possibilities. Format diversity through fresh, frozen, and customized meal services provides options beyond traditional dry and canned therapeutic diets appealing to premium market segments.

Technology integration transforms weight management from periodic veterinary visits to continuous monitoring and intervention. Wearable devices become increasingly sophisticated, affordable, and user-friendly expanding adoption beyond early adopter segments. Artificial intelligence analyzes activity patterns, feeding behaviors, and progress data providing personalized recommendations and predicting intervention success. Smart home integration through automated feeders, activity monitoring, and environmental controls creates comprehensive obesity management ecosystems. Telehealth platforms enable frequent remote monitoring and coaching supplementing in-person veterinary care improving outcomes through increased support.

Service model evolution sees comprehensive programs combining nutrition, exercise, behavioral modification, and ongoing support becoming standard rather than exceptional. Veterinary practices increasingly offer structured weight management protocols as core services rather than ad-hoc recommendations. Specialty clinics focusing exclusively on pet obesity management and related metabolic conditions emerge in major markets. Integrated facilities combining veterinary care, fitness services, and nutritional support under one roof provide convenient access to multi-modal interventions. Subscription models create ongoing customer relationships and recurring revenue supporting long-term engagement essential for sustained success.

Prevention emphasis grows as evidence demonstrates maintaining healthy weight from early life proves more effective and sustainable than treating established obesity. Puppy and kitten programs become standard veterinary offerings educating new owners about appropriate feeding and exercise. Life stage management addresses critical periods including neutering, maturity, and senior transitions where weight gain risks increase. Workplace wellness programs for pets in pet-friendly offices create institutional intervention opportunities paralleling human corporate wellness initiatives. Breeding considerations potentially incorporate obesity resistance in selection criteria as genetic influences become better understood.

Regional dynamics evolve with emerging markets demonstrating accelerating growth as pet ownership modernizes and veterinary care sophistication increases. Asia-Pacific particularly China and India show substantial potential as urban pet populations expand and disposable income rises. Latin America develops market infrastructure supporting weight management product distribution and veterinary service delivery. Middle East selective markets demonstrate strong growth particularly in countries with high per-capita income and western-influenced pet care practices. Market maturity in North America and Europe drives innovation toward premium services and technology-enabled solutions as basic product penetration reaches saturation.

Regulatory environment evolution potentially establishes clearer standards for therapeutic diet claims, supplement efficacy, and weight management service protocols. Clinical evidence requirements may intensify requiring controlled studies validating product and intervention effectiveness. Professional licensing for pet nutritionists and weight management specialists could emerge creating credentialing frameworks. Pet insurance regulations around coverage requirements and preventive care benefits influence financial accessibility of interventions. Advertising standards for pet health claims become more stringent protecting consumers from misleading marketing.

Research advancement in companion animal metabolism, genetics, and microbiome deepens understanding of obesity mechanisms informing targeted interventions. Pharmaceutical development potentially introduces appetite suppressants or metabolism-modifying medications analogous to human obesity treatments though careful safety evaluation required. Metabolic profiling identifying individual predispositions and response patterns enables precision medicine approaches. Longitudinal studies tracking long-term outcomes inform best practices and realistic expectations for sustained weight management. Comparative effectiveness research evaluates intervention modalities identifying optimal combinations for different patient populations achieving projected 5-year weight maintenance success rates improving from current 35-40% to potentially 55-60% through comprehensive multi-modal programs with ongoing support.

The pet obesity management market represents a critical and rapidly expanding segment addressing a significant companion animal health crisis affecting quality of life and longevity for millions of pets globally. Rising obesity prevalence in dogs and cats creates massive addressable populations requiring therapeutic intervention and preventive care despite challenges in owner awareness and behavioral change. Despite facing obstacles including compliance difficulties, emotional feeding behaviors, and cost sensitivities, the sector demonstrates remarkable innovation and growth through comprehensive solutions combining nutrition, exercise, behavioral modification, and professional support. Diverse stakeholders including pet food manufacturers, veterinary professionals, technology companies, and service providers collectively advance capabilities while expanding accessibility of evidence-based interventions.

Regional dynamics reveal developed market maturity in North America and Europe while emerging markets demonstrate accelerating growth as pet ownership modernizes and veterinary care sophistication increases globally. Product innovation continues improving therapeutic diet palatability, nutritional optimization, and functional ingredient incorporation addressing historical limitations and compliance challenges. Technology integration through wearables, smart feeders, and digital platforms transforms weight management from episodic veterinary interventions to continuous monitoring and engagement supporting long-term adherence. Service model evolution toward comprehensive programs bundling multiple intervention modalities creates integrated solutions addressing the complex, multi-factorial nature of pet obesity requiring sustained commitment. Prevention emphasis grows as evidence demonstrates maintaining healthy weight from early life proves more effective than treating established obesity reducing lifetime healthcare burdens and improving outcomes. Veterinary profession engagement remains foundational to market success providing professional credibility, diagnostic expertise, treatment oversight, and ongoing support essential for achieving sustainable weight management outcomes. Consumer education efforts gradually improve awareness about obesity health impacts and body condition recognition though substantial perception gaps persist requiring continued investment in communication and outreach.

The pet obesity management market exemplifies companion animal healthcare evolution toward preventive medicine, chronic disease management, and lifestyle interventions paralleling human healthcare trends and reflecting deepening human-animal bonds driving substantial health investments. As pet humanization intensifies, veterinary medicine advances, and intervention technologies mature, the sector appears positioned for sustained growth serving growing populations of overweight companion animals while improving outcomes through evidence-based, comprehensive, and accessible solutions. Industry participants demonstrating product efficacy through clinical validation, supporting owner compliance through engagement strategies, integrating technology enhancing monitoring and motivation, and partnering with veterinary professionals ensuring medical oversight appear best positioned to capitalize on substantial opportunities while contributing meaningfully to companion animal welfare through obesity prevention and management. The market’s outlook remains fundamentally positive supported by unfortunate obesity prevalence trends creating persistent demand, increasing consumer willingness to invest in pet health, expanding intervention sophistication enabling better outcomes, and growing recognition that weight management represents essential healthcare rather than optional intervention for millions of overweight companion animals globally requiring professional support, effective products, and comprehensive programs addressing this critical health challenge affecting beloved family members.

What is Pet Obesity Management?

Pet Obesity Management refers to the strategies and practices aimed at controlling and reducing obesity in pets, primarily through diet, exercise, and behavioral modifications. This includes weight management programs, nutritional counseling, and veterinary interventions.

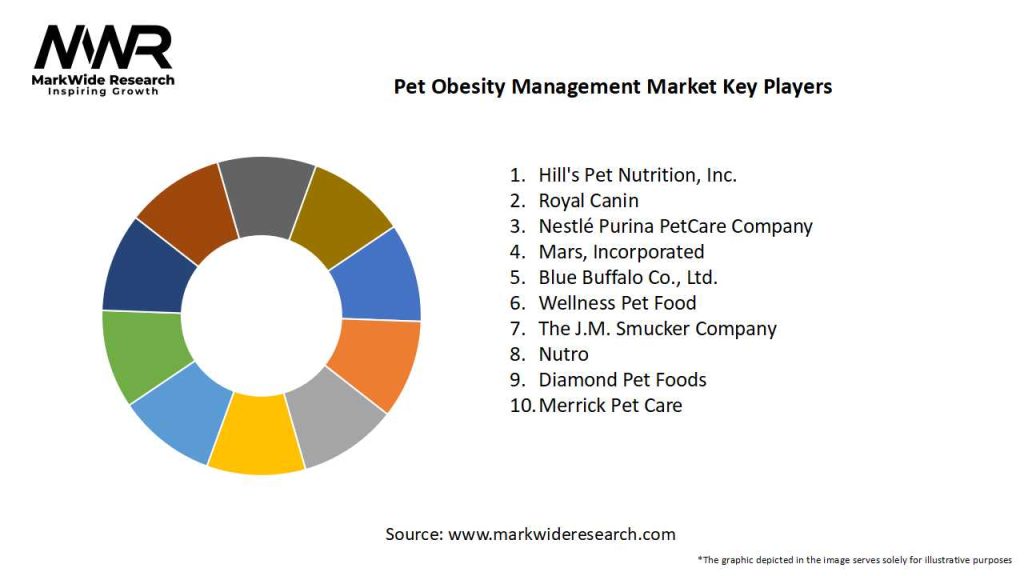

What are the key players in the Pet Obesity Management Market?

Key players in the Pet Obesity Management Market include companies like Hill’s Pet Nutrition, Nestlé Purina PetCare, and Mars Petcare, which offer specialized diets and weight management solutions for pets, among others.

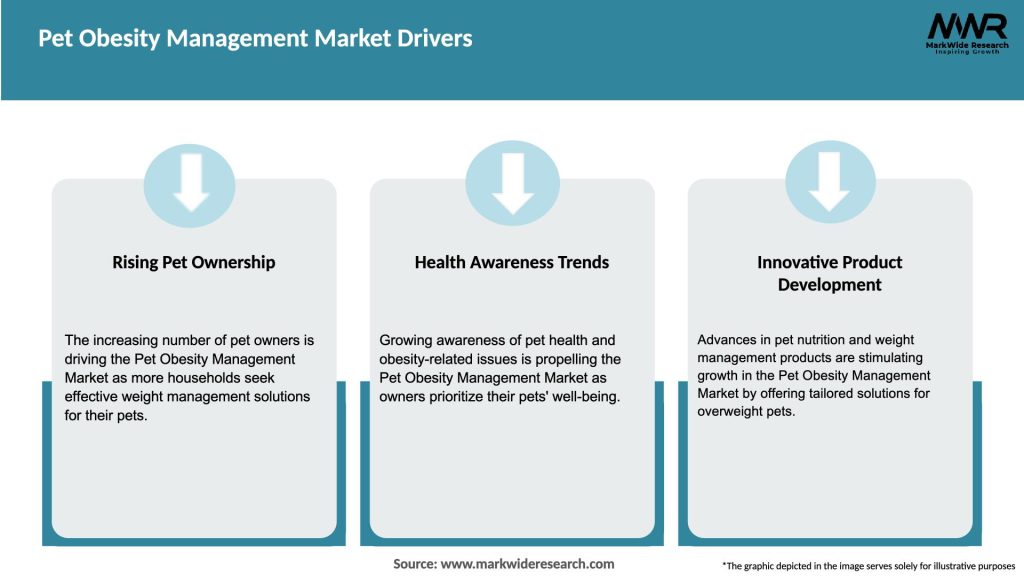

What are the main drivers of growth in the Pet Obesity Management Market?

The main drivers of growth in the Pet Obesity Management Market include the increasing awareness of pet health, the rising prevalence of obesity-related health issues in pets, and the growing demand for specialized pet diets and weight management products.

What challenges does the Pet Obesity Management Market face?

Challenges in the Pet Obesity Management Market include the lack of awareness among pet owners about obesity risks, the availability of low-quality pet food options, and the difficulty in changing pet behavior towards diet and exercise.

What opportunities exist in the Pet Obesity Management Market?

Opportunities in the Pet Obesity Management Market include the development of innovative weight management products, the integration of technology in pet health monitoring, and the potential for partnerships between pet food companies and veterinary clinics.

What trends are shaping the Pet Obesity Management Market?

Trends shaping the Pet Obesity Management Market include the increasing focus on holistic pet care, the rise of personalized nutrition plans for pets, and the growing use of mobile apps for tracking pet health and weight management.

Pet Obesity Management Market

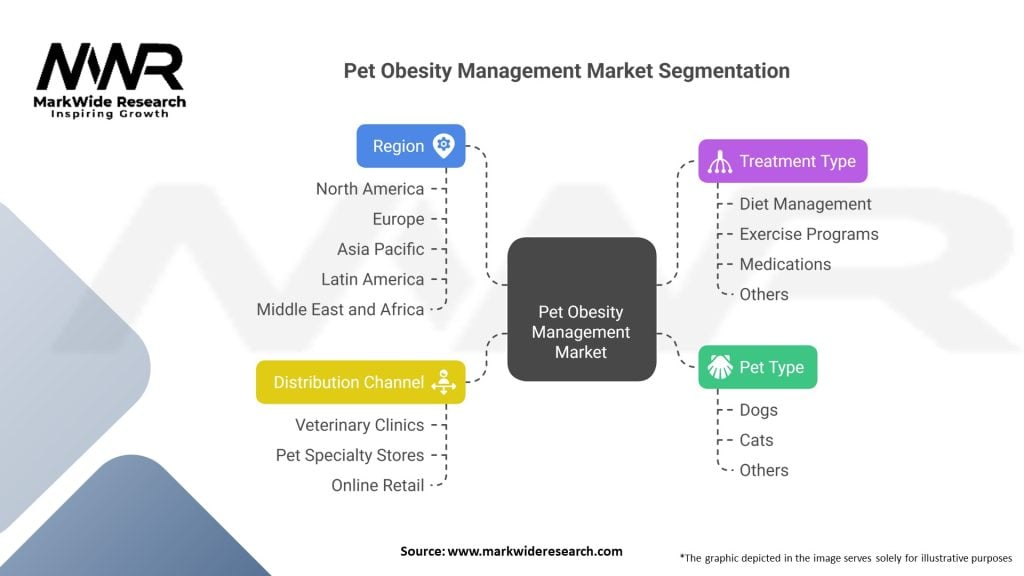

| Segmentation Details | Details |

|---|---|

| Pet Type | Dogs, Cats, Others |

| Treatment Type | Diet Management, Exercise Programs, Medications, Others |

| Distribution Channel | Veterinary Clinics, Pet Specialty Stores, Online Retail |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Pet Obesity Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at