444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The pet food market in Russia has experienced remarkable transformation over the past decade, evolving from a niche segment to a substantial industry driven by changing consumer attitudes toward pet ownership and animal welfare. Russian pet owners are increasingly viewing their pets as family members, leading to heightened demand for premium and specialized pet nutrition products. The market demonstrates robust growth potential with expanding urbanization, rising disposable incomes, and growing awareness of pet health and nutrition requirements.

Market dynamics indicate significant shifts in consumer preferences, with pet owners moving away from traditional feeding practices toward scientifically formulated commercial pet foods. The sector encompasses various product categories including dry food, wet food, treats, and specialized dietary solutions for different life stages and health conditions. Growth rates in the premium segment have been particularly impressive, with super-premium products experiencing 12.5% annual growth as Russian consumers prioritize quality nutrition for their pets.

Regional distribution shows concentrated demand in major metropolitan areas, with Moscow and St. Petersburg accounting for approximately 35% of total market consumption. The market structure includes both international brands and domestic manufacturers, creating a competitive landscape that benefits consumers through diverse product offerings and competitive pricing strategies.

The pet food market in Russia refers to the comprehensive industry encompassing the production, distribution, and retail of nutritionally formulated food products specifically designed for companion animals, primarily dogs and cats, within the Russian Federation. This market includes various product formats, price segments, and specialized formulations catering to different pet demographics and health requirements.

Market scope extends beyond basic nutrition to include functional foods, therapeutic diets, organic options, and premium formulations that address specific health concerns or life stage requirements. The industry encompasses manufacturing facilities, supply chain networks, retail channels, and supporting services that facilitate the delivery of pet nutrition products to Russian consumers.

Consumer behavior within this market reflects evolving attitudes toward pet ownership, with increasing emphasis on pet health, longevity, and quality of life. The market serves as an indicator of broader socioeconomic trends, including urbanization, lifestyle changes, and growing disposable income allocation toward pet care expenses.

Strategic analysis reveals the Russian pet food market as a dynamic and rapidly evolving sector characterized by strong growth momentum and increasing sophistication in consumer preferences. The market benefits from fundamental demographic shifts, including rising pet ownership rates, urbanization trends, and changing household compositions that favor pet adoption.

Key performance indicators demonstrate sustained expansion across multiple product categories, with premium and super-premium segments leading growth trajectories. Market penetration of commercial pet foods has reached approximately 68% among urban pet owners, indicating substantial room for continued expansion, particularly in smaller cities and rural areas.

Competitive landscape features a balanced mix of international brands and domestic manufacturers, with foreign companies holding significant market share in premium segments while local producers maintain strong positions in economy and mid-tier categories. The market structure supports healthy competition and innovation, driving product development and quality improvements across all price points.

Future projections indicate continued robust growth supported by favorable demographic trends, increasing pet humanization, and expanding retail infrastructure. The market is positioned for sustained expansion with opportunities in specialized nutrition, e-commerce channels, and regional market development.

Consumer behavior analysis reveals significant insights into Russian pet owner preferences and purchasing patterns that shape market dynamics:

Market intelligence indicates that Russian pet owners are becoming increasingly educated about pet nutrition, leading to more informed purchasing decisions and higher expectations for product quality and transparency.

Demographic transformation serves as the primary catalyst for market expansion, with several interconnected factors driving sustained growth in the Russian pet food sector. Urbanization trends continue to accelerate, creating favorable conditions for pet ownership as urban dwellers seek companionship and emotional support through pet relationships.

Economic factors play a crucial role in market development, with rising disposable incomes enabling consumers to allocate larger portions of household budgets to pet care expenses. The growing middle class demonstrates increased willingness to invest in premium pet nutrition products, viewing these purchases as investments in pet health and longevity.

Cultural shifts toward pet humanization represent a fundamental driver, with Russian consumers increasingly treating pets as family members deserving high-quality nutrition and care. This cultural evolution translates directly into demand for premium products, specialized formulations, and innovative nutrition solutions.

Health awareness among pet owners continues to expand, driven by increased access to veterinary information and growing understanding of the connection between nutrition and pet health outcomes. Veterinary recommendations significantly influence purchasing decisions, with professional endorsements driving adoption of therapeutic and specialized diet products.

Retail infrastructure development facilitates market growth through improved product availability and consumer access. The expansion of pet specialty stores, supermarket pet sections, and online retail platforms creates multiple touchpoints for consumer engagement and purchase conversion.

Economic volatility presents ongoing challenges for market development, with currency fluctuations and economic uncertainty affecting consumer purchasing power and import costs for international brands. Price sensitivity remains a significant factor, particularly among economy segment consumers who may reduce pet food spending during economic downturns.

Regulatory complexities create barriers for market entry and product development, with evolving food safety standards and import regulations requiring significant compliance investments. Certification requirements for pet food products can delay market entry and increase operational costs for manufacturers.

Traditional feeding practices persist in certain demographic segments and geographic regions, limiting commercial pet food adoption rates. Cultural resistance to commercial pet foods, particularly among older consumers and rural populations, constrains market penetration in specific segments.

Supply chain challenges affect product availability and pricing, particularly for imported ingredients and finished products. Logistics constraints in vast Russian territory create distribution challenges and cost pressures that impact market development in remote regions.

Competition intensity from both domestic and international players creates margin pressure and requires significant marketing investments to maintain market position. The need for continuous innovation and product differentiation increases operational complexity and costs for market participants.

Regional expansion represents substantial growth opportunities as commercial pet food adoption rates remain relatively low in smaller cities and rural areas. Market penetration strategies targeting these underserved regions could unlock significant growth potential through education and improved distribution networks.

E-commerce development offers transformative opportunities for market expansion, with online retail channels providing access to broader consumer bases and enabling direct-to-consumer relationships. Digital marketing strategies can effectively reach younger demographics and tech-savvy pet owners who prefer online shopping convenience.

Product innovation in specialized nutrition segments presents opportunities for premium positioning and margin expansion. Functional foods addressing specific health conditions, age-related needs, and breed-specific requirements represent high-growth potential categories with limited current market penetration.

Private label development offers retailers opportunities to capture higher margins while providing consumers with value-oriented options. Retail partnerships can facilitate market entry for new brands and support expansion of existing players into new channels.

Sustainability trends create opportunities for environmentally conscious product development, with growing consumer interest in sustainable packaging, ethical sourcing, and environmentally friendly manufacturing processes. Organic and natural product segments show strong growth potential as health-conscious consumers seek cleaner nutrition options for their pets.

Supply and demand equilibrium in the Russian pet food market reflects complex interactions between consumer preferences, economic conditions, and competitive pressures. Demand patterns show consistent growth across most product categories, with premium segments experiencing the strongest expansion rates and economy segments maintaining stable but slower growth.

Pricing dynamics demonstrate market maturation, with consumers showing increased willingness to pay premium prices for perceived quality and health benefits. Value perception has evolved beyond simple cost considerations to encompass factors such as ingredient quality, brand reputation, and health outcomes.

Competitive interactions create dynamic market conditions where innovation, marketing effectiveness, and distribution capabilities determine market share gains and losses. Brand positioning strategies increasingly focus on differentiation through specialized formulations, premium ingredients, and targeted marketing messages.

Seasonal fluctuations influence market dynamics, with increased demand during winter months and holiday periods when pet owners may increase treat purchases and gift-giving. Inventory management becomes crucial for retailers and distributors to capitalize on seasonal demand patterns while minimizing carrying costs.

Regulatory influences shape market dynamics through evolving standards for product safety, labeling requirements, and import regulations. Compliance costs affect competitive positioning, particularly for smaller players who may struggle with regulatory burden compared to larger, well-resourced companies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Russian pet food market landscape. Primary research includes extensive consumer surveys, retailer interviews, and industry expert consultations to gather firsthand market intelligence and validate secondary research findings.

Data collection methods encompass both quantitative and qualitative approaches, including structured questionnaires, focus group discussions, and in-depth interviews with key market participants. Consumer behavior analysis utilizes purchase tracking, brand preference studies, and demographic segmentation to understand market dynamics and growth drivers.

Secondary research incorporates industry reports, government statistics, trade association data, and company financial information to provide comprehensive market context and historical trend analysis. Market sizing methodologies employ multiple validation approaches to ensure accuracy and reliability of growth projections and market assessments.

Competitive intelligence gathering includes product analysis, pricing studies, distribution channel mapping, and marketing strategy evaluation to provide complete competitive landscape understanding. Trend analysis incorporates global market developments, regulatory changes, and technological innovations that may impact the Russian market.

Quality assurance processes include data triangulation, expert validation, and cross-referencing multiple sources to ensure research reliability and minimize potential biases or inaccuracies in market analysis and projections.

Moscow metropolitan area dominates the Russian pet food market, accounting for approximately 22% of national consumption and serving as the primary entry point for international brands and premium products. Consumer sophistication in Moscow reaches the highest levels nationally, with strong adoption of premium and super-premium products reflecting higher disposable incomes and advanced pet care attitudes.

St. Petersburg region represents the second-largest market concentration, contributing roughly 13% of total market demand and demonstrating similar consumer preferences to Moscow with strong premium segment growth. Cultural factors in St. Petersburg support pet humanization trends and drive demand for high-quality nutrition products.

Regional centers including Yekaterinburg, Novosibirsk, and Kazan show emerging market potential with growing pet ownership rates and increasing commercial pet food adoption. Market development in these regions benefits from improved retail infrastructure and rising consumer awareness of pet nutrition importance.

Southern regions including Rostov-on-Don and Krasnodar demonstrate strong growth potential driven by favorable demographics and increasing urbanization. Climate considerations in southern regions influence seasonal demand patterns and product preferences, particularly for hydration and cooling products.

Siberian markets present unique challenges and opportunities, with harsh climate conditions creating specific nutritional requirements while vast distances complicate distribution logistics. Market penetration in Siberian regions remains below national averages, representing significant expansion opportunities for companies willing to invest in distribution infrastructure.

Market leadership in the Russian pet food sector features a diverse mix of international corporations and domestic manufacturers, creating a competitive environment that benefits consumers through innovation and competitive pricing. International players maintain strong positions in premium segments while domestic companies compete effectively in economy and mid-tier categories.

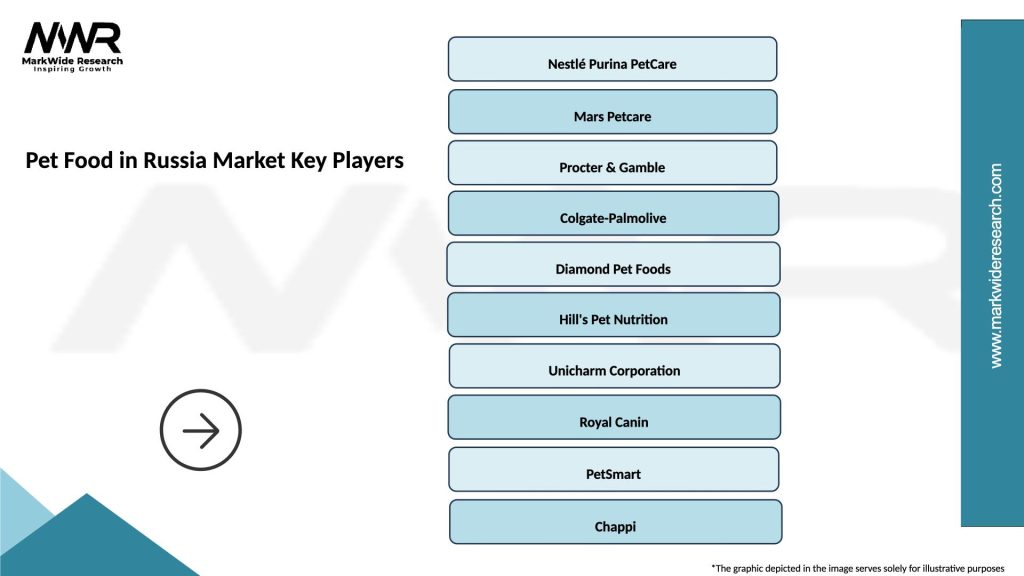

Leading market participants include:

Competitive strategies focus on product differentiation, brand building, distribution expansion, and pricing optimization to capture market share and build consumer loyalty. Innovation investments drive new product development and formulation improvements to meet evolving consumer demands and regulatory requirements.

Product category segmentation reveals distinct market dynamics across different pet food types, with each segment demonstrating unique growth patterns and consumer preferences:

By Product Type:

By Pet Type:

By Price Segment:

Dry food category maintains market dominance through convenience, shelf stability, and cost-effectiveness advantages that appeal to busy urban consumers. Innovation trends in dry food focus on improved palatability, specialized formulations, and premium ingredient inclusion to compete with wet food alternatives.

Wet food segment demonstrates strong growth potential driven by perceived quality benefits and palatability advantages, particularly among cat owners who prioritize hydration and taste preferences. Premium positioning enables higher margins and supports brand differentiation strategies.

Treats and snacks represent the fastest-growing category with annual growth rates exceeding 15%, driven by emotional purchasing decisions and gift-giving behaviors. Product innovation in treats focuses on functional benefits, natural ingredients, and interactive feeding experiences.

Specialized diet products show exceptional growth potential as pet owners become more health-conscious and veterinary recommendations influence purchasing decisions. Therapeutic formulations command premium pricing and build strong brand loyalty through proven health outcomes.

Organic and natural products emerge as high-growth subcategories across all main segments, reflecting consumer trends toward cleaner, more transparent nutrition options. Certification requirements and premium pricing create barriers to entry while supporting margin expansion for established players.

Manufacturers benefit from expanding market opportunities, growing consumer willingness to pay premium prices, and increasing brand loyalty development. Production efficiency improvements and scale economies enable cost optimization while maintaining quality standards and supporting competitive positioning.

Retailers gain from high-margin product categories, frequent purchase cycles, and strong consumer loyalty that drives repeat visits and cross-selling opportunities. Pet food categories serve as traffic drivers and contribute significantly to overall store profitability through consistent demand patterns.

Distributors capitalize on growing market demand, expanding geographic coverage requirements, and increasing product variety that supports business growth and relationship development with retail partners. Logistics expertise becomes a competitive advantage in serving diverse market segments and geographic regions.

Consumers receive improved product quality, greater variety, competitive pricing, and enhanced convenience through expanding retail channels and online availability. Pet health outcomes improve through access to scientifically formulated nutrition products and specialized dietary solutions.

Veterinary professionals benefit from improved pet health outcomes, enhanced client relationships through nutrition counseling, and additional revenue streams through therapeutic diet recommendations and retail partnerships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premium product adoption represents the most significant trend shaping the Russian pet food market, with consumers increasingly willing to invest in higher-quality nutrition products for their pets. Quality consciousness drives demand for products with superior ingredients, advanced formulations, and proven health benefits.

Health and wellness focus influences product development and marketing strategies, with functional ingredients, therapeutic formulations, and preventive nutrition gaining prominence. Veterinary partnerships become increasingly important for brand credibility and consumer education about specialized nutrition benefits.

Convenience orientation shapes packaging innovations and product formats, with consumers seeking easy-to-serve options, portion control features, and storage-friendly designs. Busy lifestyles drive demand for convenient feeding solutions that maintain nutrition quality while simplifying pet care routines.

Digital engagement transforms marketing and sales approaches, with social media influence, online reviews, and e-commerce platforms playing crucial roles in consumer decision-making processes. Brand storytelling through digital channels builds emotional connections and supports premium positioning strategies.

Sustainability consciousness emerges as an important consideration for environmentally aware consumers, driving demand for eco-friendly packaging, sustainable sourcing, and transparent supply chain practices. Corporate responsibility becomes a differentiating factor for brands targeting conscious consumers.

Manufacturing capacity expansion by both domestic and international players reflects confidence in long-term market growth potential and commitment to serving Russian consumers with locally produced products. Investment announcements indicate significant capital allocation toward production facilities and distribution infrastructure development.

Product portfolio diversification strategies focus on specialized nutrition segments, with companies launching therapeutic diets, breed-specific formulations, and life-stage products to capture premium market opportunities. Innovation investments support research and development activities targeting Russian consumer preferences and regulatory requirements.

Retail channel expansion includes both traditional pet specialty stores and modern retail formats, with hypermarkets and online platforms gaining importance in product distribution strategies. Omnichannel approaches integrate multiple touchpoints to enhance consumer convenience and brand accessibility.

Strategic partnerships between manufacturers, retailers, and veterinary professionals create value-added services and strengthen market positioning through professional endorsements and educational initiatives. Collaboration models support market development and consumer education efforts.

Regulatory compliance initiatives demonstrate industry commitment to food safety and quality standards, with companies investing in certification processes and quality assurance systems to meet evolving regulatory requirements and consumer expectations.

Market entry strategies should prioritize understanding regional preferences and distribution channel dynamics, with successful companies adapting global products to local tastes and market conditions. MarkWide Research analysis indicates that localization efforts significantly improve market acceptance and brand performance in Russian markets.

Investment priorities should focus on premium segment development, e-commerce capabilities, and regional expansion to capitalize on the highest-growth market opportunities. Brand building through consistent quality delivery and targeted marketing communications creates sustainable competitive advantages.

Partnership development with veterinary professionals, retail chains, and distribution partners accelerates market penetration and builds credibility with Russian consumers. Collaborative approaches leverage local expertise and established relationships to overcome market entry barriers.

Product innovation should address specific Russian consumer needs, including climate considerations, breed preferences, and health concerns prevalent in the local pet population. Research investments in understanding local market dynamics support successful product development and positioning strategies.

Digital transformation initiatives should encompass e-commerce platforms, social media engagement, and data analytics capabilities to reach younger demographics and build direct consumer relationships. Technology adoption enables more effective marketing and improved customer service delivery.

Long-term growth prospects for the Russian pet food market remain highly positive, supported by fundamental demographic trends, economic development, and evolving consumer attitudes toward pet ownership and care. Market maturation will likely continue with increasing sophistication in consumer preferences and product offerings.

Premium segment expansion is expected to accelerate, with super-premium products achieving growth rates exceeding 14% annually as Russian consumers prioritize pet health and nutrition quality. MWR projections indicate that premium segments will capture increasing market share from economy categories over the forecast period.

E-commerce development will transform distribution landscapes, with online sales potentially reaching 25% of total market volume within the next five years. Digital channels will become increasingly important for brand building, consumer education, and direct-to-consumer relationships.

Regional market development presents significant expansion opportunities, with smaller cities and rural areas expected to drive incremental growth as commercial pet food adoption rates increase. Infrastructure improvements and rising incomes in regional markets support optimistic growth projections.

Innovation focus will likely center on functional nutrition, sustainability, and personalized feeding solutions that address specific pet health needs and consumer lifestyle preferences. Technology integration may enable more sophisticated product customization and feeding management solutions.

The pet food market in Russia represents a dynamic and rapidly evolving sector with substantial growth potential driven by favorable demographic trends, economic development, and changing consumer attitudes toward pet ownership. Market fundamentals support continued expansion across all product categories, with premium segments leading growth trajectories and offering the most attractive opportunities for industry participants.

Strategic success in this market requires understanding of local consumer preferences, effective distribution channel management, and commitment to quality and innovation. Companies that invest in brand building, regional expansion, and digital capabilities are best positioned to capitalize on the significant growth opportunities present in the Russian pet food market.

Future market development will likely be characterized by increasing sophistication in consumer demands, continued premiumization trends, and expanding geographic coverage as commercial pet food adoption spreads throughout the Russian Federation. The market offers compelling opportunities for both established players and new entrants willing to invest in understanding and serving Russian pet owners’ evolving needs and preferences.

What is Pet Food?

Pet food refers to food specifically formulated and intended for consumption by pets, including dogs, cats, and other domesticated animals. It encompasses a variety of products such as dry kibble, wet food, treats, and specialized diets for health conditions.

What are the key companies in the Pet Food in Russia Market?

Key companies in the Pet Food in Russia Market include Mars Petcare, Nestlé Purina, and Unicharm, which offer a range of products catering to different pet needs and preferences, among others.

What are the growth factors driving the Pet Food in Russia Market?

The Pet Food in Russia Market is driven by increasing pet ownership, a growing trend towards premium and natural pet food products, and rising awareness of pet health and nutrition among consumers.

What challenges does the Pet Food in Russia Market face?

Challenges in the Pet Food in Russia Market include fluctuating raw material prices, regulatory compliance issues, and competition from local and international brands that can affect market dynamics.

What opportunities exist in the Pet Food in Russia Market?

Opportunities in the Pet Food in Russia Market include the expansion of e-commerce platforms for pet food sales, increasing demand for organic and specialty diets, and potential growth in the premium pet food segment.

What trends are shaping the Pet Food in Russia Market?

Trends in the Pet Food in Russia Market include a shift towards sustainable packaging, the introduction of innovative flavors and formulations, and a focus on health-oriented products that cater to specific dietary needs.

Pet Food in Russia Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dry Food, Wet Food, Treats, Supplements |

| Customer Type | Pet Owners, Retailers, Veterinarians, Breeders |

| Distribution Channel | Online, Supermarkets, Pet Stores, Specialty Shops |

| End Use Industry | Household, Veterinary Clinics, Animal Shelters, Zoos |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Pet Food in Russia Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at