444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The PET compounds market is witnessing substantial growth, driven by the increasing demand for PET (polyethylene terephthalate) materials in various end-use industries such as packaging, automotive, textiles, and electronics. PET compounds, which are blends of PET resin with additives and fillers, offer enhanced properties such as strength, durability, thermal stability, and chemical resistance, making them suitable for a wide range of applications. With the growing emphasis on sustainability, recyclability, and product performance, the market for PET compounds is expected to continue its upward trajectory. Key players are focusing on innovation, product development, and strategic partnerships to meet the evolving needs of customers and gain a competitive edge in the global PET compounds market.

Meaning

PET compounds refer to blends of PET resin with additives, fillers, and other materials to modify or enhance the properties of PET for specific applications. PET, a thermoplastic polymer resin, is widely used in various industries due to its excellent mechanical properties, clarity, and chemical resistance. PET compounds are formulated to meet specific performance requirements such as strength, stiffness, impact resistance, heat resistance, and barrier properties, making them suitable for diverse applications such as packaging, automotive parts, textiles, and electronic components. By incorporating additives such as colorants, stabilizers, reinforcing agents, and flame retardants, PET compounds can be customized to meet the needs of different end-use industries and applications.

Executive Summary

The PET compounds market is experiencing robust growth, driven by the increasing demand for PET materials in packaging, automotive, textiles, and electronics. PET compounds offer enhanced properties such as strength, durability, thermal stability, and chemical resistance, making them suitable for a wide range of applications. Key market players are investing in innovation, product development, and strategic partnerships to meet the evolving needs of customers and gain a competitive edge in the global PET compounds market. The market is characterized by technological advancements, regulatory compliance, and a focus on sustainability and recyclability.

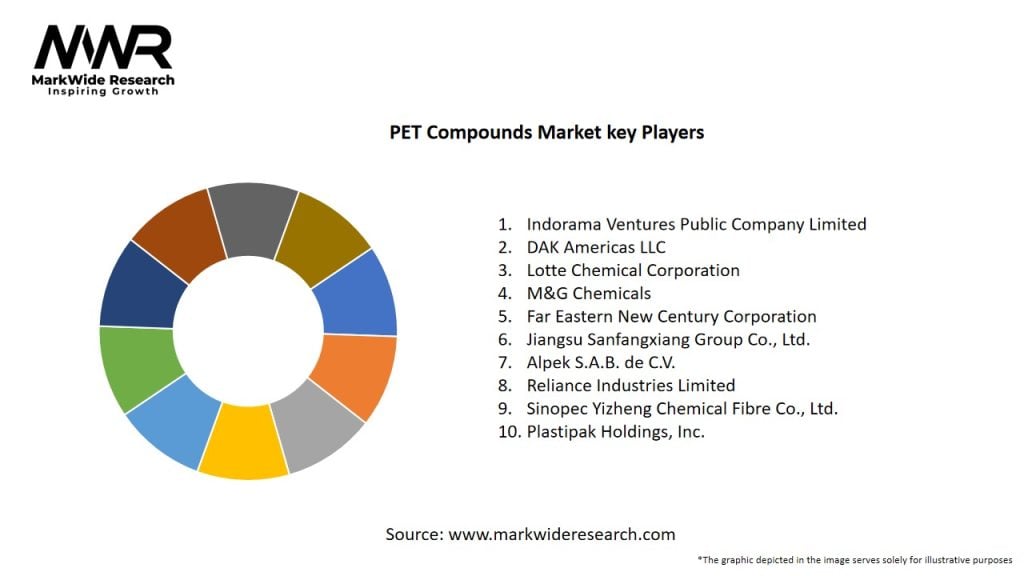

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the PET compounds market, including:

Market Restraints

Despite the promising growth prospects, the PET compounds market faces certain challenges, including:

Market Opportunities

The PET compounds market presents significant opportunities for growth and innovation, including:

Market Dynamics

The PET compounds market is characterized by dynamic trends and evolving market dynamics, including:

Regional Analysis

The PET compounds market is geographically diverse, with key production and consumption centers located in regions such as:

Competitive Landscape

Leading Companies in the PET Compounds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

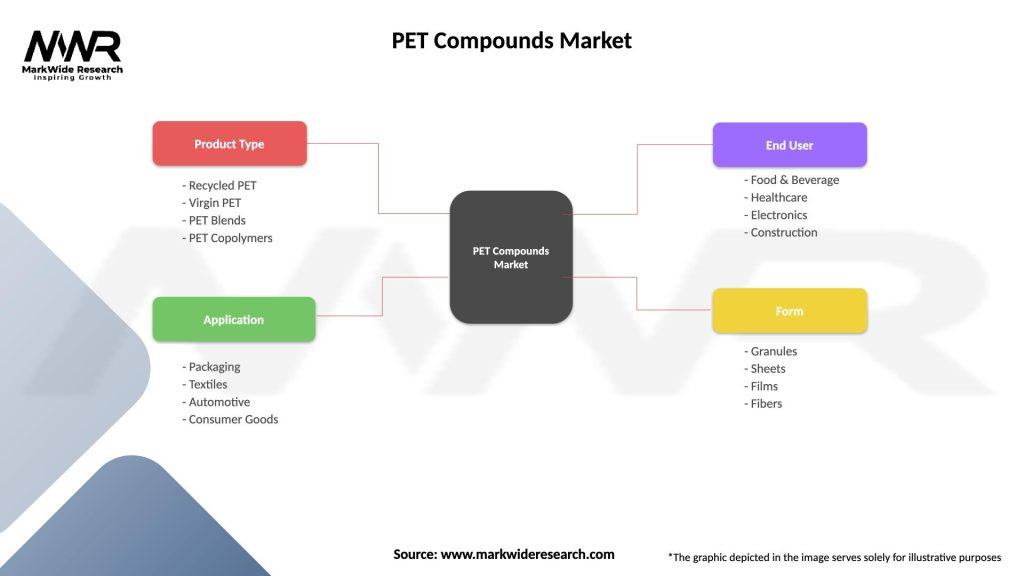

The PET compounds market can be segmented based on various factors, including:

Category-wise Insights

Different categories of PET compounds offer unique properties and applications, including:

Key Benefits for Industry Participants and Stakeholders

The PET compounds market offers several key benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the PET compounds market reveals the following strengths, weaknesses, opportunities, and threats:

Market Key Trends

Key trends shaping the PET compounds market include:

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the PET compounds market. While certain segments such as packaging, textiles, and electronics experienced increased demand due to stockpiling, e-commerce growth, and consumer behavior changes, other segments such as automotive saw a decline in demand due to supply chain disruptions and economic uncertainties. However, the pandemic also accelerated certain trends such as sustainability and digitalization, driving demand for PET compounds in sustainable packaging solutions, online shopping packaging, and electronic devices. As industries adapt to the evolving market landscape and consumer preferences in the post-pandemic recovery period, the demand for PET compounds is expected to rebound, supported by the growing emphasis on technological innovation, sustainability, and circular economy initiatives.

Key Industry Developments

Recent developments in the PET compounds market include:

Analyst Suggestions

Analysts suggest several strategies for industry participants and stakeholders looking to capitalize on the opportunities in the PET compounds market, including:

Future Outlook

The future outlook for the PET compounds market is positive, driven by the increasing demand for PET materials in packaging, automotive, textiles, electronics, and other industries. As industries continue to invest in technological innovation, sustainability, and circular economy initiatives, the demand for PET compounds is expected to continue its upward trajectory. Key players in the market are focusing on innovation, product development, and strategic partnerships to meet the evolving needs of customers and gain a competitive edge in the global PET compounds market. With growing regulatory scrutiny and consumer awareness of environmental and social issues, sustainable practices and responsible sourcing are likely to play an increasingly important role in shaping the future of the PET compounds market.

Conclusion

In conclusion, the PET compounds market is experiencing significant growth, driven by the increasing demand for PET materials in packaging, automotive, textiles, electronics, and other industries. PET compounds offer enhanced properties such as strength, durability, thermal stability, and chemical resistance, making them suitable for a wide range of applications. Key players in the market are investing in innovation, product development, and strategic partnerships to meet the evolving needs of customers and gain a competitive edge in the global PET compounds market. The market is characterized by technological advancements, regulatory compliance, and a focus on sustainability and recyclability. As industries continue to prioritize technological innovation, sustainability, and circular economy initiatives, the PET compounds market is poised for long-term growth and success in meeting the evolving needs of global markets.

What is PET Compounds?

PET Compounds refer to a category of materials made from polyethylene terephthalate, commonly used in various applications such as packaging, textiles, and automotive components. These compounds are known for their durability, chemical resistance, and recyclability.

What are the key players in the PET Compounds Market?

Key players in the PET Compounds Market include companies like BASF, DuPont, and Eastman Chemical Company, which are known for their innovative solutions and extensive product portfolios in the field of polymer compounds, among others.

What are the main drivers of growth in the PET Compounds Market?

The main drivers of growth in the PET Compounds Market include the increasing demand for lightweight materials in the automotive industry, the rise in sustainable packaging solutions, and the growing consumer preference for recyclable products.

What challenges does the PET Compounds Market face?

The PET Compounds Market faces challenges such as fluctuating raw material prices, competition from alternative materials, and regulatory pressures regarding environmental impact and recycling practices.

What opportunities exist in the PET Compounds Market?

Opportunities in the PET Compounds Market include advancements in recycling technologies, the development of bio-based PET compounds, and the expansion of applications in the electronics and medical sectors.

What trends are shaping the PET Compounds Market?

Trends shaping the PET Compounds Market include the increasing focus on sustainability, innovations in compound formulations for enhanced performance, and the growing adoption of PET in various end-use industries such as food and beverage packaging.

PET Compounds Market

| Segmentation Details | Description |

|---|---|

| Product Type | Recycled PET, Virgin PET, PET Blends, PET Copolymers |

| Application | Packaging, Textiles, Automotive, Consumer Goods |

| End User | Food & Beverage, Healthcare, Electronics, Construction |

| Form | Granules, Sheets, Films, Fibers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the PET Compounds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at