444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Peru telecom market represents a dynamic and rapidly evolving telecommunications landscape in South America, characterized by significant infrastructure development and increasing digital transformation initiatives. Peru’s telecommunications sector has experienced substantial growth driven by expanding mobile penetration, fiber optic network deployments, and government initiatives promoting digital inclusion across urban and rural areas.

Market dynamics in Peru’s telecom industry reflect a competitive environment with multiple service providers competing for market share across mobile, fixed-line, and broadband services. The sector demonstrates robust growth potential with mobile subscription rates reaching approximately 125% penetration, indicating multiple device ownership among consumers and businesses.

Infrastructure modernization remains a key focus area, with telecommunications companies investing heavily in 4G network expansion and 5G technology preparation. The market benefits from favorable regulatory frameworks and government support for digital infrastructure development, particularly in underserved regions where connectivity gaps persist.

Digital transformation trends are reshaping service offerings, with operators expanding beyond traditional voice and data services to include cloud computing, Internet of Things (IoT) solutions, and enterprise digital services. This evolution positions Peru’s telecom market as a critical enabler of economic growth and technological advancement across various industry sectors.

The Peru telecom market refers to the comprehensive telecommunications ecosystem encompassing mobile network operators, fixed-line service providers, internet service providers, and related infrastructure companies operating within Peru’s national boundaries. This market includes all forms of electronic communication services, from traditional voice telephony to advanced data transmission, broadband internet, and emerging technologies like 5G networks.

Telecommunications services in Peru span multiple technology platforms including GSM, 3G, 4G LTE networks for mobile communications, fiber optic and copper-based infrastructure for fixed broadband, and satellite communications for remote area connectivity. The market encompasses both consumer and enterprise segments, serving individual subscribers, small businesses, large corporations, and government entities.

Regulatory oversight is provided by OSIPTEL (Organismo Supervisor de Inversión Privada en Telecomunicaciones), which ensures fair competition, consumer protection, and quality service standards across all telecommunications operators. The market operates under a liberalized framework that encourages private investment while maintaining universal service obligations.

Peru’s telecommunications market demonstrates strong growth momentum driven by increasing smartphone adoption, expanding internet penetration, and government initiatives supporting digital infrastructure development. The market exhibits healthy competition among major operators while experiencing technological evolution toward next-generation networks and services.

Key market characteristics include high mobile penetration rates, growing demand for high-speed broadband services, and increasing enterprise adoption of cloud-based telecommunications solutions. Rural connectivity improvement programs have expanded service availability, contributing to overall market expansion and digital inclusion objectives.

Investment patterns show significant capital allocation toward network modernization, with operators prioritizing 4G coverage expansion and 5G network preparation. According to MarkWide Research analysis, the market demonstrates resilience and adaptability in response to changing consumer preferences and technological advancements.

Future growth prospects remain positive, supported by Peru’s economic stability, favorable demographic trends, and continued government support for telecommunications infrastructure development. The market is positioned to benefit from increasing digitalization across industries and growing demand for advanced connectivity solutions.

Strategic market insights reveal several critical trends shaping Peru’s telecommunications landscape:

Primary growth drivers propelling Peru’s telecom market include increasing smartphone penetration, which has reached approximately 75% of the population, creating substantial demand for mobile data services and high-speed connectivity solutions.

Economic digitalization initiatives across government and private sectors drive demand for advanced telecommunications infrastructure. Businesses increasingly require reliable connectivity for digital transformation projects, cloud computing adoption, and remote work capabilities, particularly following accelerated digitalization trends.

Government support through national broadband plans and rural connectivity programs provides significant market stimulus. These initiatives include infrastructure subsidies, regulatory incentives, and public-private partnerships that expand service availability to previously underserved areas.

Demographic factors contribute to market growth, with Peru’s young population demonstrating high technology adoption rates and increasing data consumption patterns. Urban migration trends also concentrate demand in metropolitan areas where operators can achieve higher service penetration and revenue generation.

Technological advancement creates opportunities for service differentiation and revenue growth. The transition from 3G to 4G networks, preparation for 5G deployment, and integration of emerging technologies like IoT and artificial intelligence drive infrastructure investment and service innovation.

Infrastructure challenges pose significant constraints, particularly in Peru’s mountainous and remote regions where geographical barriers increase deployment costs and technical complexity. These challenges limit service expansion and maintain connectivity gaps in rural areas.

Economic constraints affect both operators and consumers, with high infrastructure investment requirements competing with limited capital availability. Economic volatility can impact consumer spending on telecommunications services and delay network modernization projects.

Regulatory complexity creates operational challenges, with evolving compliance requirements and licensing procedures potentially slowing market entry for new players and service launches. Spectrum allocation processes and environmental regulations can extend project timelines.

Competition intensity pressures profit margins and requires continuous investment in network quality and service differentiation. Price competition can limit revenue growth while maintaining pressure for capital expenditure on infrastructure improvements.

Digital divide issues persist between urban and rural areas, limiting overall market penetration and creating service delivery challenges. Income disparities affect service affordability and adoption rates in lower-income segments of the population.

5G network deployment presents substantial opportunities for revenue growth and service innovation. Early 5G adoption can enable new applications in smart cities, industrial automation, and enhanced mobile broadband services, creating competitive advantages for forward-thinking operators.

Enterprise digital transformation offers significant growth potential as businesses seek comprehensive telecommunications solutions including cloud services, cybersecurity, and managed IT infrastructure. This segment typically generates higher margins than consumer services.

Rural market expansion through government partnership programs provides opportunities to serve previously unconnected populations. These initiatives often include subsidies and regulatory incentives that improve project economics and social impact.

Fintech integration allows telecommunications operators to expand beyond traditional services into mobile payments, digital banking, and financial technology solutions. This diversification can increase customer lifetime value and create new revenue streams.

IoT and smart solutions development opens markets in agriculture, mining, manufacturing, and urban infrastructure management. Peru’s strong mining and agricultural sectors present particular opportunities for specialized IoT applications and connectivity solutions.

Competitive dynamics in Peru’s telecom market reflect intense rivalry among established operators, with market leaders continuously investing in network quality improvements and service innovation to maintain customer loyalty and market share positions.

Technology evolution drives market transformation, with operators balancing investments between maintaining existing 3G and 4G networks while preparing for 5G deployment. This technological transition creates both opportunities and challenges for service providers and equipment manufacturers.

Consumer behavior patterns show increasing data consumption, with mobile data usage growing at approximately 25% annually, driving demand for unlimited data plans and high-speed connectivity solutions. Video streaming and social media applications dominate traffic patterns.

Regulatory evolution continues shaping market structure through spectrum auctions, infrastructure sharing requirements, and consumer protection measures. Recent regulatory changes have promoted competition while ensuring service quality standards and universal access objectives.

Investment cycles demonstrate significant capital allocation toward network modernization and coverage expansion. Operators typically invest 15-20% of revenues in infrastructure development, reflecting the capital-intensive nature of telecommunications services.

Comprehensive market analysis employs multiple research methodologies including primary data collection through industry interviews, operator surveys, and regulatory consultations with key stakeholders across Peru’s telecommunications ecosystem.

Secondary research incorporates analysis of regulatory filings, operator financial reports, government statistics, and industry publications to establish market sizing, competitive positioning, and trend identification. Data validation ensures accuracy and reliability of market insights.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth, technology adoption rates, and competitive dynamics. Historical data analysis provides context for current market conditions and future projections.

Qualitative assessment includes expert interviews with telecommunications executives, regulatory officials, and technology vendors to understand market drivers, challenges, and strategic priorities. These insights complement quantitative data with contextual understanding.

Market segmentation analysis examines different service categories, customer segments, and geographical regions to provide detailed insights into market structure and growth opportunities across various telecommunications sectors.

Lima Metropolitan Area dominates Peru’s telecom market, accounting for approximately 35% of total subscribers and generating the highest revenue concentration. This region benefits from advanced infrastructure, high smartphone penetration, and strong demand for premium services including fiber broadband and enterprise solutions.

Northern regions including Trujillo, Chiclayo, and Piura demonstrate strong growth potential driven by economic development and increasing urbanization. These areas show growing mobile penetration and expanding 4G coverage as operators prioritize infrastructure investment in secondary cities.

Southern Peru markets, particularly around Arequipa and Cusco, benefit from tourism industry demand and mining sector requirements for reliable telecommunications services. These regions show steady growth in both consumer and enterprise segments.

Amazon region presents significant challenges and opportunities, with satellite and microwave technologies enabling connectivity in remote areas. Government programs specifically target these regions for digital inclusion initiatives and infrastructure development.

Central highlands experience gradual service expansion as operators balance investment costs with market potential. Mining industry presence in these areas creates demand for specialized telecommunications solutions and reliable connectivity infrastructure.

Market leadership is shared among several major operators competing across different service segments:

Competitive strategies focus on network quality improvements, service bundling, and customer experience enhancement. Operators invest heavily in brand differentiation and value-added services to maintain customer loyalty in an increasingly competitive environment.

Market consolidation trends show potential for strategic partnerships and infrastructure sharing agreements as operators seek to optimize capital efficiency while expanding coverage and service capabilities.

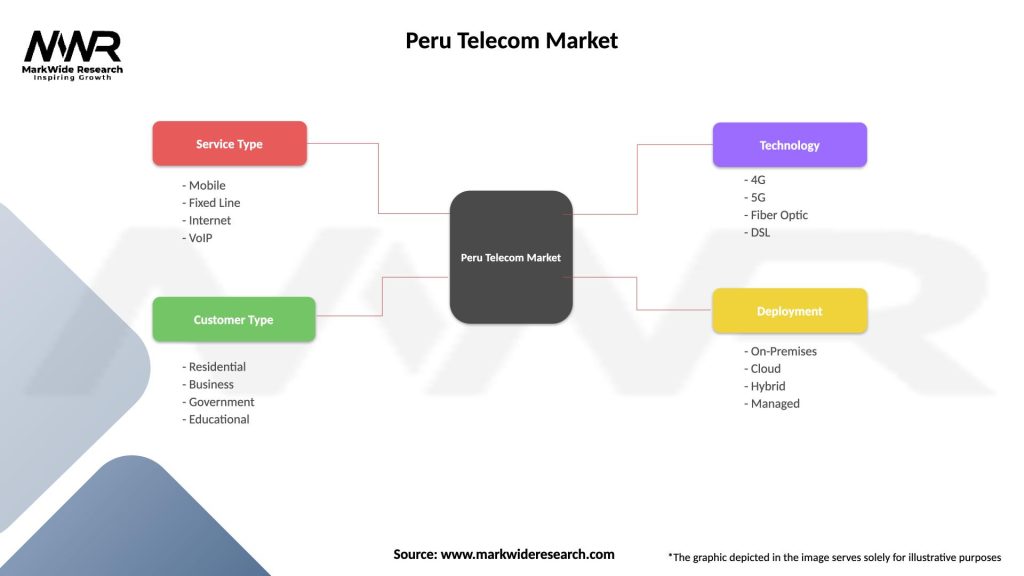

By Service Type:

By Customer Segment:

By Technology:

Mobile services represent the largest market segment, with prepaid services maintaining approximately 80% market share due to consumer preferences for flexible payment options and budget control. Postpaid growth accelerates among higher-income segments and business customers.

Fixed broadband adoption shows steady growth, particularly in urban areas where fiber deployment enables high-speed internet access. Residential broadband penetration reaches approximately 45% in metropolitan areas while remaining limited in rural regions.

Enterprise telecommunications demonstrate strong growth potential as businesses invest in digital transformation initiatives. Cloud services, managed IT solutions, and cybersecurity offerings represent high-margin opportunities for service providers.

Value-added services including mobile payments, content streaming, and IoT applications create additional revenue streams beyond traditional voice and data services. These services often generate higher margins and improve customer retention rates.

Wholesale services support market infrastructure through tower sharing, fiber leasing, and network interconnection agreements. These B2B services enable smaller operators to compete while optimizing infrastructure utilization across the industry.

Telecommunications operators benefit from expanding market opportunities, government support for infrastructure development, and growing demand for advanced services. Regulatory stability and spectrum availability support long-term investment planning and network expansion strategies.

Equipment vendors gain from ongoing network modernization requirements, 5G preparation activities, and infrastructure expansion projects. Local partnerships and technology transfer opportunities create additional value for international suppliers.

Consumers enjoy improved service quality, expanded coverage areas, and competitive pricing driven by market competition. Digital inclusion initiatives ensure broader access to telecommunications services and internet connectivity.

Businesses access advanced telecommunications solutions supporting digital transformation, productivity improvements, and market expansion capabilities. Reliable connectivity enables e-commerce growth, remote work adoption, and operational efficiency gains.

Government entities achieve digital governance objectives, improved public service delivery, and economic development goals through enhanced telecommunications infrastructure. Tax revenues and employment generation provide additional economic benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Network virtualization and software-defined networking adoption enable operators to improve service flexibility and reduce operational costs. These technologies support rapid service deployment and network optimization capabilities.

Edge computing integration brings processing capabilities closer to end users, reducing latency and enabling new applications in gaming, augmented reality, and industrial automation. This trend supports 5G service differentiation strategies.

Sustainability initiatives drive energy-efficient network designs and renewable energy adoption across telecommunications infrastructure. Environmental considerations increasingly influence technology selection and operational practices.

Artificial intelligence implementation enhances network management, customer service, and predictive maintenance capabilities. AI-powered solutions improve operational efficiency and enable personalized service offerings.

Partnership ecosystems expand beyond traditional telecommunications to include content providers, fintech companies, and technology vendors. These collaborations create comprehensive service portfolios and new revenue opportunities.

Spectrum auction activities have allocated additional frequency bands for mobile services, enabling operators to expand capacity and prepare for 5G deployment. Recent auctions generated significant government revenue while supporting network modernization.

Fiber infrastructure expansion accelerates through public-private partnerships and operator investments. Major cities experience rapid fiber deployment while rural areas benefit from government-subsidized connectivity programs.

5G pilot projects demonstrate next-generation network capabilities in selected urban areas. These trials test various use cases including enhanced mobile broadband, industrial IoT, and smart city applications.

Regulatory modernization adapts telecommunications laws to address emerging technologies and market dynamics. Recent updates focus on consumer protection, infrastructure sharing, and cybersecurity requirements.

International partnerships bring global expertise and investment to Peru’s telecommunications market. Strategic alliances with international operators and technology vendors accelerate innovation and service development.

Infrastructure investment should prioritize fiber deployment and 4G coverage expansion to address current connectivity gaps while preparing for 5G evolution. Operators must balance immediate market needs with long-term technology transition requirements.

Service diversification beyond traditional telecommunications offers opportunities for revenue growth and customer retention. MWR analysis suggests focusing on enterprise solutions, fintech services, and IoT applications to capture emerging market segments.

Rural market strategies require innovative approaches combining government partnerships, alternative technologies, and community-based service models. Satellite and wireless solutions can cost-effectively serve remote areas while generating reasonable returns.

Digital transformation support for enterprise customers represents a high-value opportunity requiring specialized capabilities and partnerships. Operators should develop comprehensive portfolios including cloud services, cybersecurity, and managed IT solutions.

Competitive differentiation through network quality, customer experience, and value-added services becomes increasingly important as market maturity increases. Investment in customer service capabilities and service innovation supports premium positioning strategies.

Market growth prospects remain positive with continued expansion expected across all service segments. Mobile data consumption growth of approximately 20% annually drives infrastructure investment and revenue opportunities for operators.

5G deployment will begin in major urban areas within the next few years, enabling new service categories and revenue streams. Early adopters may gain competitive advantages through superior network capabilities and innovative service offerings.

Digital inclusion initiatives will continue expanding service availability to underserved populations. Government programs and operator investments should reduce connectivity gaps and support national development objectives.

Technology convergence will blur traditional boundaries between telecommunications, IT services, and digital platforms. Successful operators will develop comprehensive digital service portfolios addressing evolving customer needs.

Regulatory evolution will adapt to technological changes and market dynamics while maintaining competitive balance and consumer protection. Policy frameworks will likely support innovation while ensuring universal service obligations.

Peru’s telecommunications market demonstrates strong fundamentals and positive growth trajectory supported by competitive dynamics, regulatory stability, and increasing digital adoption across consumer and enterprise segments. The market benefits from ongoing infrastructure modernization, government support for connectivity expansion, and growing demand for advanced telecommunications services.

Key success factors include strategic infrastructure investment, service innovation, and effective market positioning to capture opportunities in 5G deployment, enterprise digital transformation, and rural connectivity expansion. Operators that successfully balance traditional service excellence with emerging technology adoption will achieve sustainable competitive advantages.

Future market development will be shaped by technological evolution, regulatory adaptation, and changing customer expectations. The transition toward next-generation networks, integration of digital services, and expansion of connectivity access will drive continued market growth and transformation in Peru’s dynamic telecommunications landscape.

What is Telecom?

Telecom refers to the transmission of information over significant distances by electronic means. It encompasses various services such as telephone, internet, and broadcasting, which are essential for communication in today’s digital age.

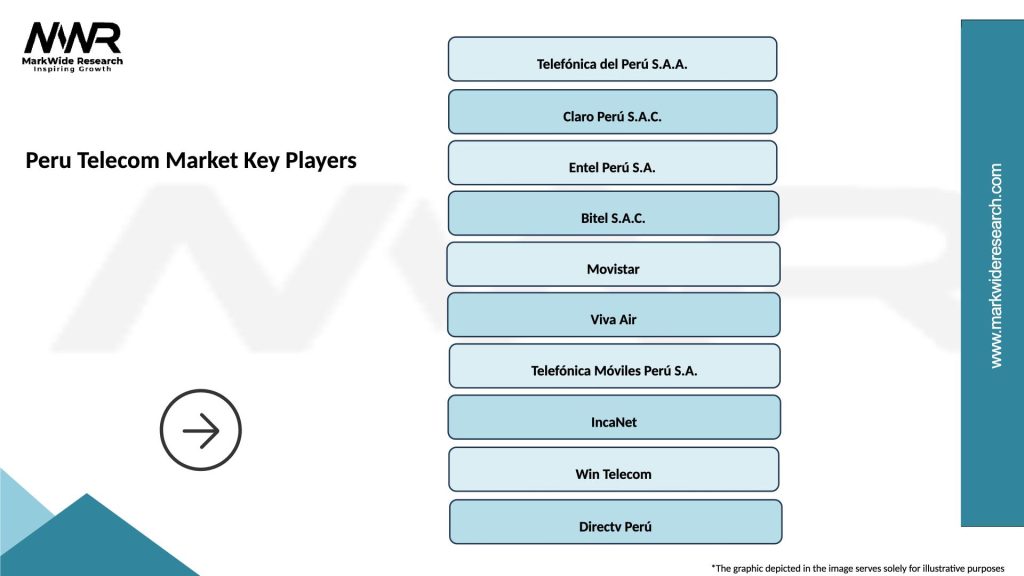

What are the key players in the Peru Telecom Market?

The Peru Telecom Market features several key players, including Telefónica, Claro, and Entel, which provide a range of services from mobile communications to broadband internet. These companies compete to enhance service quality and expand their customer base, among others.

What are the growth factors driving the Peru Telecom Market?

The Peru Telecom Market is driven by increasing smartphone penetration, rising demand for high-speed internet, and the expansion of mobile services in rural areas. Additionally, government initiatives to improve digital infrastructure contribute to market growth.

What challenges does the Peru Telecom Market face?

The Peru Telecom Market faces challenges such as regulatory hurdles, high competition among service providers, and the need for significant investment in infrastructure. These factors can hinder the growth and profitability of telecom companies.

What opportunities exist in the Peru Telecom Market?

Opportunities in the Peru Telecom Market include the expansion of fiber-optic networks, the growth of IoT applications, and the increasing demand for digital services among consumers and businesses. These trends present avenues for innovation and investment.

What trends are shaping the Peru Telecom Market?

Trends in the Peru Telecom Market include the shift towards mobile-first services, the rise of 5G technology, and the increasing importance of cybersecurity in telecom operations. These trends are influencing how companies develop and deliver their services.

Peru Telecom Market

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile, Fixed Line, Internet, VoIP |

| Customer Type | Residential, Business, Government, Educational |

| Technology | 4G, 5G, Fiber Optic, DSL |

| Deployment | On-Premises, Cloud, Hybrid, Managed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Peru Telecom Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at