444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Peru logistics market represents a dynamic and rapidly evolving sector that serves as the backbone of the country’s economic infrastructure. Peru’s strategic location along the Pacific coast positions it as a crucial gateway for trade between South America and Asia-Pacific markets. The logistics industry encompasses warehousing, transportation, freight forwarding, supply chain management, and distribution services that facilitate the movement of goods throughout the nation and internationally.

Market growth in Peru’s logistics sector has been driven by expanding mining operations, agricultural exports, and increasing e-commerce activities. The country’s logistics infrastructure has experienced substantial improvements, with investments in port facilities, road networks, and technological solutions enhancing operational efficiency by approximately 35% over recent years. Digital transformation initiatives have revolutionized traditional logistics processes, enabling real-time tracking, automated inventory management, and optimized route planning.

Regional connectivity remains a key strength, with Peru serving as a vital link in South American trade corridors. The logistics market benefits from the country’s diverse economic base, supporting sectors ranging from mining and agriculture to manufacturing and retail. Infrastructure development projects continue to expand capacity and improve service quality across urban and rural areas.

The Peru logistics market refers to the comprehensive ecosystem of services, infrastructure, and technologies that facilitate the efficient movement, storage, and distribution of goods within Peru and across international borders. This market encompasses various segments including freight transportation, warehousing solutions, supply chain management, customs clearance, and last-mile delivery services.

Logistics operations in Peru involve the coordination of multiple stakeholders including shipping companies, freight forwarders, customs brokers, warehouse operators, and technology providers. The market serves diverse industries such as mining, agriculture, manufacturing, retail, and e-commerce, each requiring specialized logistics solutions tailored to their unique requirements and regulatory compliance needs.

Modern logistics in Peru integrates traditional transportation methods with advanced technologies including GPS tracking, warehouse management systems, and digital platforms that optimize supply chain visibility and operational efficiency.

Peru’s logistics market demonstrates robust growth potential driven by expanding international trade, infrastructure modernization, and digital transformation initiatives. The sector plays a critical role in supporting the country’s export-oriented economy, particularly in mining and agricultural commodities that constitute significant portions of Peru’s international trade portfolio.

Key market drivers include government infrastructure investments, growing e-commerce penetration reaching approximately 28% of urban populations, and increasing demand for efficient supply chain solutions. The logistics industry has adapted to evolving customer expectations for faster delivery times, real-time tracking capabilities, and sustainable transportation options.

Technological adoption has accelerated across the logistics value chain, with companies implementing warehouse automation, route optimization software, and digital freight platforms. These innovations have contributed to operational efficiency improvements and cost reductions while enhancing service quality and customer satisfaction levels.

Market challenges include infrastructure limitations in remote regions, regulatory complexities, and the need for skilled workforce development. However, ongoing government initiatives and private sector investments continue to address these constraints while creating new opportunities for market expansion and modernization.

Strategic insights reveal several critical factors shaping Peru’s logistics landscape:

Economic expansion serves as the primary catalyst for logistics market growth in Peru. The country’s diverse economic base, anchored by mining, agriculture, and manufacturing sectors, generates consistent demand for transportation and distribution services. Export growth particularly drives logistics activity, with Peru’s mineral and agricultural products requiring efficient supply chain solutions to reach international markets competitively.

Infrastructure development initiatives significantly boost market potential. Government investments in port modernization, highway construction, and airport expansion create new opportunities for logistics service providers while improving overall operational efficiency. The development of logistics parks and distribution centers enhances warehousing capacity and enables more sophisticated supply chain operations.

Digital transformation accelerates market evolution through technology adoption. Companies increasingly implement warehouse management systems, transportation management platforms, and IoT-enabled tracking solutions that optimize operations and reduce costs. E-commerce expansion creates new demand patterns, with online retail growth of approximately 42% annually driving requirements for last-mile delivery capabilities and urban fulfillment centers.

Trade facilitation measures improve market conditions through streamlined customs procedures, reduced bureaucratic barriers, and enhanced border crossing efficiency. These improvements make Peru more attractive for international trade and logistics operations, supporting market expansion and competitiveness.

Infrastructure limitations pose significant challenges in certain regions of Peru. While major urban areas and coastal regions benefit from modern logistics infrastructure, remote and mountainous areas often lack adequate road networks, warehousing facilities, and technological connectivity. These limitations restrict market penetration and increase operational costs for logistics providers serving these regions.

Regulatory complexity creates operational challenges for logistics companies. Multiple government agencies oversee different aspects of logistics operations, leading to bureaucratic delays and compliance costs. Customs procedures, while improving, still involve lengthy processes that can impact supply chain efficiency and increase operational expenses.

Skilled workforce shortage constrains market growth potential. The logistics industry requires specialized skills in areas such as supply chain management, technology operations, and international trade procedures. Limited availability of trained professionals affects service quality and operational efficiency across the sector.

Security concerns in certain regions impact logistics operations. Issues related to cargo theft, route safety, and facility security require additional investments in protective measures, increasing operational costs and affecting service reliability in affected areas.

Regional integration presents substantial opportunities for Peru’s logistics market. The country’s participation in regional trade agreements and economic blocs creates potential for expanded cross-border logistics services. Pacific Alliance membership particularly enhances opportunities for trade facilitation and logistics cooperation with Mexico, Colombia, and Chile.

Technology advancement offers significant growth potential through automation, artificial intelligence, and blockchain applications. Companies investing in these technologies can achieve competitive advantages through improved efficiency, reduced costs, and enhanced service capabilities. Smart logistics solutions enable real-time optimization and predictive analytics that transform operational performance.

Sustainability initiatives create new market segments focused on environmentally responsible logistics solutions. Growing corporate and consumer awareness of environmental impacts drives demand for green logistics services, including electric vehicle fleets, carbon-neutral shipping options, and sustainable packaging solutions.

E-commerce expansion continues generating opportunities for specialized logistics services. The growth of online retail, particularly accelerated by changing consumer behaviors, requires innovative last-mile delivery solutions, urban micro-fulfillment centers, and flexible distribution networks that can adapt to evolving customer expectations.

Supply and demand dynamics in Peru’s logistics market reflect the country’s economic structure and trade patterns. Seasonal variations significantly impact logistics demand, particularly in agricultural sectors where harvest periods create peak shipping requirements. Mining operations provide more consistent demand patterns, supporting stable logistics capacity utilization throughout the year.

Competitive dynamics involve both domestic and international logistics providers competing across various service segments. Market consolidation trends show larger companies acquiring smaller operators to expand geographic coverage and service capabilities. This consolidation enables improved service integration and operational efficiency while creating challenges for smaller independent operators.

Pricing dynamics reflect fuel costs, infrastructure access fees, and competitive pressures. Cost optimization remains a critical focus, with companies implementing efficiency improvements that reduce operational expenses while maintaining service quality. Technology investments contribute to cost reductions through automation and process optimization.

Service evolution dynamics show increasing customer expectations for integrated logistics solutions. Clients increasingly demand end-to-end supply chain management rather than individual transportation or warehousing services, driving logistics providers to expand their service portfolios and develop comprehensive capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Peru’s logistics market. Primary research involves direct engagement with industry stakeholders including logistics service providers, shippers, government officials, and technology vendors through structured interviews and surveys.

Secondary research incorporates analysis of government statistics, industry reports, trade publications, and regulatory documents to establish market context and validate primary findings. Data triangulation methods ensure consistency and accuracy across multiple information sources.

Market modeling techniques analyze historical trends, current market conditions, and future projections using statistical methods and econometric analysis. Scenario analysis evaluates potential market developments under different economic and regulatory conditions to provide comprehensive market outlook perspectives.

Industry expert consultations provide specialized insights into market trends, technological developments, and regulatory changes affecting the logistics sector. These consultations enhance understanding of market dynamics and validate analytical conclusions through expert perspectives and experience-based insights.

Lima Metropolitan Area dominates Peru’s logistics market, accounting for approximately 55% of total logistics activity. The capital region benefits from concentrated economic activity, major port facilities at Callao, and extensive transportation infrastructure. Urban logistics in Lima faces challenges related to traffic congestion and last-mile delivery complexity, driving innovation in distribution strategies and technology solutions.

Northern regions including Piura, Lambayeque, and La Libertad represent significant logistics markets driven by agricultural exports and mining operations. These regions benefit from port facilities and agricultural processing centers that generate substantial freight volumes. Seasonal logistics patterns reflect agricultural cycles, creating peak demand periods during harvest seasons.

Southern regions encompass major mining areas including Arequipa, Cusco, and Tacna, generating substantial logistics demand for mineral transportation and export operations. The southern corridor connecting mining areas to ports requires specialized heavy-haul transportation capabilities and infrastructure investments to support efficient operations.

Eastern regions including the Amazon basin present unique logistics challenges due to geographic constraints and limited infrastructure. However, these regions offer opportunities for specialized logistics services supporting natural resource extraction, agricultural development, and eco-tourism activities. Multimodal transportation solutions combining road, river, and air transport address geographic challenges in these areas.

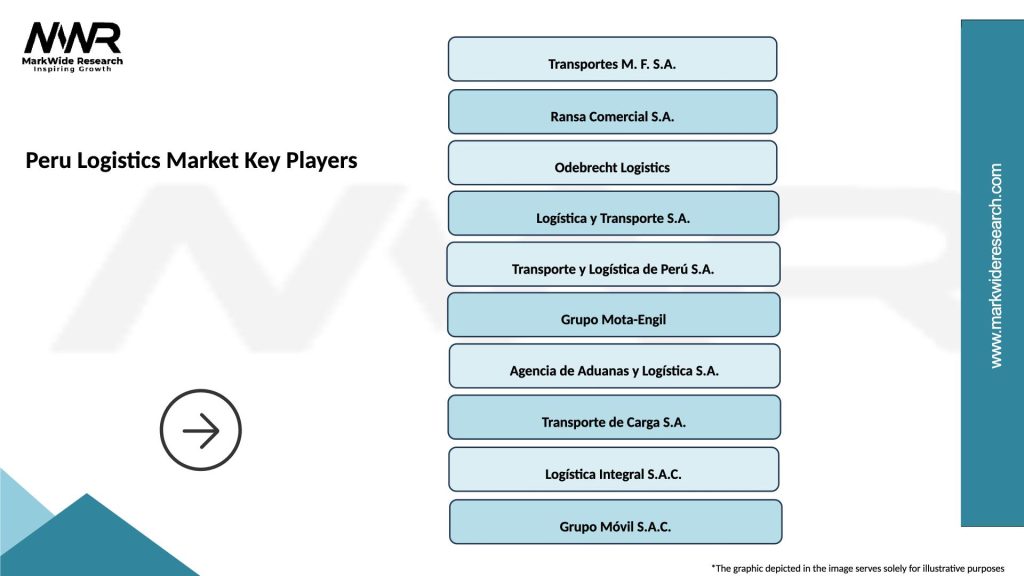

Market leadership in Peru’s logistics sector involves both international and domestic companies competing across various service segments:

Competitive strategies focus on technology investment, service diversification, and geographic expansion. Companies increasingly develop integrated service offerings that combine transportation, warehousing, and value-added services to meet evolving customer requirements and maintain competitive positioning.

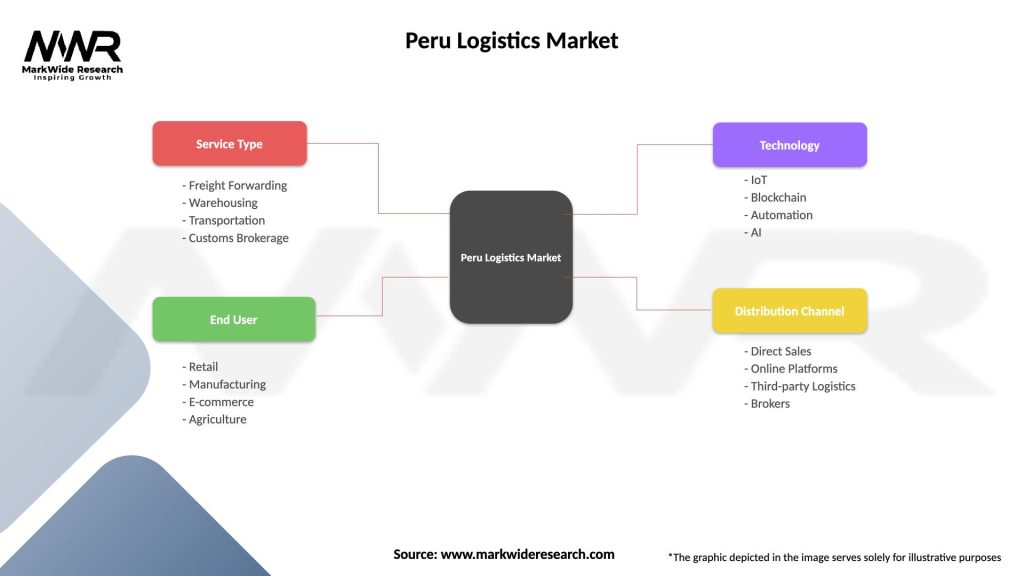

By Service Type:

By End-User Industry:

By Transportation Mode:

Freight Transportation represents the largest segment, driven by Peru’s export-oriented economy and domestic distribution requirements. Road transport dominates domestic freight movement, accounting for approximately 78% of inland cargo transport. The segment benefits from ongoing highway improvements and fleet modernization initiatives that enhance efficiency and service quality.

Warehousing and Storage experiences rapid growth driven by e-commerce expansion and supply chain optimization trends. Modern distribution centers incorporate advanced technologies including automated storage systems, warehouse management software, and robotics solutions. Cold storage facilities serve growing agricultural export markets and urban food distribution requirements.

Freight Forwarding plays a crucial role in Peru’s international trade, with companies providing specialized expertise in customs procedures, documentation, and international shipping coordination. Digital transformation in this segment includes online booking platforms, shipment tracking systems, and automated documentation processes that improve efficiency and customer experience.

Express and Courier services experience strong growth driven by e-commerce expansion and business-to-business express shipping requirements. Last-mile delivery innovations include urban micro-hubs, motorcycle delivery fleets, and technology-enabled route optimization that address urban delivery challenges and customer expectations for fast, reliable service.

Logistics Service Providers benefit from expanding market opportunities driven by economic growth, infrastructure development, and technology adoption. Revenue diversification opportunities exist across multiple service segments and industry verticals, enabling companies to build resilient business models and reduce dependency on single market segments.

Shippers and Manufacturers gain access to improved logistics services that enhance supply chain efficiency, reduce costs, and improve customer service levels. Technology integration provides better visibility, control, and optimization capabilities that support business growth and competitive positioning in domestic and international markets.

Government and Regulatory Bodies benefit from logistics sector development through increased tax revenues, employment creation, and enhanced trade facilitation capabilities. Economic development in logistics supports broader economic growth objectives and improves Peru’s competitiveness as a regional trade hub.

Technology Providers find significant opportunities in Peru’s logistics market through demand for warehouse management systems, transportation management platforms, and IoT solutions. Digital transformation initiatives create sustained demand for technology solutions that optimize operations and enable new service capabilities.

Investors and Financial Institutions benefit from attractive investment opportunities in logistics infrastructure, technology companies, and service providers. Market growth potential and infrastructure development needs create diverse investment options with strong return prospects and positive economic impact.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation accelerates across Peru’s logistics sector, with companies implementing advanced technologies to optimize operations and enhance customer service. Artificial intelligence and machine learning applications enable predictive analytics, route optimization, and demand forecasting that improve efficiency and reduce costs. According to MarkWide Research analysis, technology adoption rates have increased by approximately 45% among major logistics providers.

Sustainability Focus drives adoption of environmentally friendly logistics practices including electric vehicle fleets, carbon-neutral shipping options, and sustainable packaging solutions. Green logistics initiatives respond to corporate sustainability commitments and consumer environmental awareness, creating new market segments and competitive differentiators.

Last-Mile Innovation addresses urban delivery challenges through micro-fulfillment centers, alternative delivery methods, and technology-enabled solutions. Urban logistics solutions include drone delivery pilots, autonomous vehicle testing, and smart locker networks that improve delivery efficiency and customer convenience.

Supply Chain Integration trends show increasing demand for comprehensive logistics solutions that combine multiple services under single-provider relationships. End-to-end logistics offerings provide customers with simplified vendor management, improved service coordination, and enhanced supply chain visibility.

Cross-Border E-commerce growth creates new opportunities for international logistics services supporting online retail expansion. Digital trade facilitation includes automated customs procedures, electronic documentation, and streamlined cross-border processes that support e-commerce logistics requirements.

Infrastructure Investments continue transforming Peru’s logistics landscape through major port expansion projects, highway construction, and airport modernization initiatives. Callao Port expansion significantly increases container handling capacity and improves operational efficiency for international trade. New highway projects enhance connectivity between major economic centers and reduce transportation costs.

Technology Partnerships between logistics companies and technology providers accelerate digital transformation across the sector. Strategic alliances enable implementation of advanced warehouse management systems, IoT tracking solutions, and artificial intelligence applications that optimize operations and create competitive advantages.

Regulatory Modernization initiatives streamline customs procedures, reduce bureaucratic barriers, and improve trade facilitation. Digital customs platforms enable electronic documentation, automated processing, and faster clearance procedures that benefit logistics operations and international trade efficiency.

Market Consolidation activities include mergers and acquisitions that create larger, more capable logistics providers with expanded service portfolios and geographic coverage. Strategic acquisitions enable companies to achieve economies of scale, improve service integration, and strengthen competitive positioning.

Sustainability Initiatives include adoption of electric vehicle fleets, renewable energy systems, and carbon footprint reduction programs. Environmental commitments by major logistics companies drive industry-wide adoption of sustainable practices and create new market opportunities for green logistics solutions.

Technology Investment should remain a top priority for logistics companies seeking competitive advantages and operational efficiency improvements. Digital transformation initiatives including warehouse automation, transportation management systems, and customer-facing platforms provide substantial returns through cost reduction and service enhancement. Companies should develop comprehensive technology strategies that align with customer requirements and market trends.

Geographic Expansion strategies should focus on underserved regions where infrastructure improvements create new market opportunities. Regional development initiatives by government and private sectors create demand for logistics services in previously inaccessible areas. Companies should evaluate expansion opportunities while considering infrastructure constraints and investment requirements.

Service Integration approaches should emphasize comprehensive logistics solutions that address customer needs across the entire supply chain. End-to-end capabilities provide competitive advantages and higher customer retention rates compared to single-service offerings. Companies should develop integrated service portfolios through organic growth or strategic partnerships.

Sustainability Leadership positions companies advantageously as environmental concerns increasingly influence customer decisions and regulatory requirements. Green logistics initiatives should include measurable environmental impact reductions and transparent reporting that demonstrates commitment to sustainability goals.

Workforce Development programs should address skill shortages through training initiatives, educational partnerships, and talent retention strategies. Human capital investments ensure service quality and support business growth while addressing industry-wide workforce challenges.

Market expansion prospects for Peru’s logistics sector remain highly positive, driven by continued economic growth, infrastructure development, and technology adoption. Long-term growth projections indicate sustained expansion across all major market segments, with particularly strong growth expected in e-commerce logistics and technology-enabled services.

Infrastructure development will continue enhancing logistics capabilities through port expansions, highway improvements, and airport modernization projects. Government investments in logistics infrastructure support broader economic development objectives while creating new opportunities for private sector logistics providers. MWR projects infrastructure improvements will contribute to operational efficiency gains of approximately 25% over the next five years.

Technology integration will accelerate across the logistics value chain, with artificial intelligence, blockchain, and IoT solutions becoming standard operational tools. Digital logistics platforms will enable new service models, improve customer experiences, and create competitive advantages for early adopters. Automation technologies will address workforce constraints while improving operational efficiency and service quality.

Regional integration opportunities will expand through trade agreements, economic cooperation initiatives, and cross-border infrastructure projects. Pacific Alliance integration and other regional partnerships will create new market opportunities for Peruvian logistics providers while attracting international investment and expertise to the domestic market.

Sustainability requirements will increasingly influence logistics operations, customer decisions, and regulatory frameworks. Companies that proactively adopt sustainable practices will achieve competitive advantages while contributing to environmental protection and corporate responsibility objectives.

Peru’s logistics market presents exceptional growth opportunities driven by economic expansion, infrastructure development, and technological advancement. The sector’s strategic importance to the country’s export-oriented economy ensures continued investment and development support from both government and private sector stakeholders.

Market fundamentals remain strong, with diverse industry demand, improving infrastructure, and increasing technology adoption creating favorable conditions for sustained growth. The combination of traditional logistics strengths in mining and agriculture with emerging opportunities in e-commerce and digital services provides a balanced foundation for market expansion.

Competitive dynamics favor companies that invest in technology, develop integrated service capabilities, and maintain operational excellence across their service portfolios. Success factors include strategic positioning, customer focus, and adaptability to evolving market requirements and technological developments.

The Peru logistics market is well-positioned to capitalize on regional trade growth, infrastructure improvements, and digital transformation trends that will define the industry’s future development and competitive landscape.

What is Logistics?

Logistics refers to the detailed organization and implementation of complex operations involving the movement of goods, services, and information. It encompasses various activities such as transportation, warehousing, inventory management, and order fulfillment.

What are the key players in the Peru Logistics Market?

Key players in the Peru Logistics Market include companies like Ransa, Transcom, and DHL, which provide a range of logistics services such as freight forwarding, warehousing, and supply chain management, among others.

What are the growth factors driving the Peru Logistics Market?

The Peru Logistics Market is driven by factors such as the growth of e-commerce, increasing foreign investment, and the expansion of infrastructure projects. These elements enhance the efficiency of supply chains and improve connectivity across regions.

What challenges does the Peru Logistics Market face?

Challenges in the Peru Logistics Market include inadequate infrastructure, regulatory hurdles, and high transportation costs. These issues can hinder the efficiency and reliability of logistics operations in the country.

What opportunities exist in the Peru Logistics Market?

Opportunities in the Peru Logistics Market include the potential for technological advancements, such as automation and digitalization, and the growth of sustainable logistics practices. These trends can lead to improved operational efficiency and reduced environmental impact.

What trends are shaping the Peru Logistics Market?

Trends shaping the Peru Logistics Market include the rise of last-mile delivery solutions, increased use of data analytics for supply chain optimization, and a focus on sustainability. These trends are transforming how logistics services are delivered and managed.

Peru Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Freight Forwarding, Warehousing, Transportation, Customs Brokerage |

| End User | Retail, Manufacturing, E-commerce, Agriculture |

| Technology | IoT, Blockchain, Automation, AI |

| Distribution Channel | Direct Sales, Online Platforms, Third-party Logistics, Brokers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Peru Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at