444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Peru commercial vehicle market represents a dynamic and rapidly evolving sector within South America’s automotive landscape. Commercial vehicles in Peru encompass a diverse range of transportation solutions including light commercial vehicles, medium-duty trucks, heavy-duty trucks, buses, and specialized utility vehicles. The market has demonstrated remarkable resilience and growth potential, driven by expanding infrastructure development, mining operations, and urbanization trends across the country.

Peru’s strategic location as a gateway between the Pacific and Atlantic economies has positioned the commercial vehicle sector as a critical component of the nation’s economic infrastructure. The market serves various industries including construction, mining, agriculture, logistics, and public transportation, each contributing to the sustained demand for reliable commercial transportation solutions. Growth projections indicate the market is expanding at a robust CAGR of 6.2%, reflecting the country’s economic development and increasing commercial activities.

Infrastructure investments and government initiatives supporting transportation modernization have created favorable conditions for commercial vehicle adoption. The market benefits from Peru’s position as a major mining hub, with mining operations accounting for approximately 28% of commercial vehicle demand. Additionally, the growing e-commerce sector and urban development projects continue to drive demand for last-mile delivery vehicles and construction equipment.

The Peru commercial vehicle market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of commercial transportation vehicles within Peru’s borders. This market includes various vehicle categories designed for business and commercial applications, ranging from light-duty pickup trucks to heavy-duty mining vehicles and public transportation buses.

Commercial vehicles in this context are specifically engineered for cargo transportation, passenger transport, construction activities, and specialized industrial applications. The market encompasses both domestically assembled vehicles and imported units, serving diverse sectors including logistics, construction, mining, agriculture, and public transportation. Market participants include international automotive manufacturers, local assembly operations, dealership networks, financing institutions, and aftermarket service providers.

Key characteristics of Peru’s commercial vehicle market include its dependence on economic cycles, sensitivity to commodity prices, and strong correlation with infrastructure development projects. The market operates within a regulatory framework that emphasizes safety standards, emission controls, and import regulations, while being influenced by Peru’s unique geographical challenges and diverse industrial requirements.

Peru’s commercial vehicle market stands as a cornerstone of the country’s transportation and logistics infrastructure, experiencing steady growth driven by economic expansion and industrial development. The market demonstrates strong fundamentals with increasing demand across multiple sectors, particularly in mining, construction, and urban transportation segments. Market dynamics reflect Peru’s position as a rapidly developing economy with substantial infrastructure needs and growing commercial activities.

Key growth drivers include government infrastructure investments, expanding mining operations, urbanization trends, and the development of logistics networks supporting international trade. The market benefits from favorable economic conditions with GDP growth supporting commercial vehicle purchases and fleet expansions. Technology adoption rates show 35% of fleet operators are investing in advanced vehicle technologies and telematics systems.

Competitive landscape features a mix of established international brands and emerging local players, creating a dynamic environment for innovation and market expansion. The market’s resilience during economic fluctuations demonstrates its essential role in Peru’s economic ecosystem, with commercial vehicle registrations showing consistent growth patterns aligned with broader economic indicators.

Strategic market insights reveal several critical factors shaping Peru’s commercial vehicle landscape. The market exhibits strong segmentation across vehicle types, with each category serving specific industry needs and demonstrating unique growth patterns. Light commercial vehicles dominate urban markets, while heavy-duty trucks serve mining and long-haul transportation requirements.

Market maturity indicators suggest Peru’s commercial vehicle sector is transitioning from a developing to an established market, with increasing sophistication in customer requirements and technology adoption. Fleet modernization trends show operators prioritizing fuel efficiency, reliability, and total cost of ownership considerations.

Economic expansion serves as the primary catalyst driving Peru’s commercial vehicle market growth. The country’s stable economic performance and growing GDP create favorable conditions for business investments and fleet expansions. Mining industry growth particularly contributes to heavy-duty vehicle demand, with Peru’s position as a leading global copper producer requiring substantial transportation infrastructure.

Infrastructure development projects represent another significant market driver, with government investments in roads, bridges, and urban development creating sustained demand for construction vehicles and equipment. Urbanization trends contribute to increased demand for public transportation vehicles and urban delivery solutions, as Peru’s cities continue expanding and modernizing their transportation networks.

International trade growth drives demand for long-haul trucks and logistics vehicles, as Peru strengthens its position as a regional trade hub. The development of logistics corridors connecting Pacific ports to inland regions creates opportunities for commercial vehicle operators and fleet expansion. E-commerce growth adds another dimension to market demand, with online retail requiring efficient last-mile delivery capabilities.

Government policies supporting transportation modernization and emission standards create replacement demand for older vehicles. Financing accessibility improvements through banking sector development enable more businesses to acquire commercial vehicles, expanding the addressable market and supporting growth across all vehicle segments.

Economic volatility poses significant challenges to Peru’s commercial vehicle market, with commodity price fluctuations directly impacting key industries like mining and agriculture. Currency fluctuations affect import costs for vehicles and components, creating pricing pressures and uncertainty for both manufacturers and customers. These economic factors can lead to delayed purchase decisions and reduced fleet expansion plans.

High vehicle costs relative to local income levels limit market accessibility for smaller businesses and individual operators. Import duties and taxes on commercial vehicles increase total ownership costs, potentially restricting market growth and favoring used vehicle markets over new vehicle sales. Financing constraints for smaller operators and businesses with limited credit history create barriers to market entry and expansion.

Infrastructure limitations in certain regions affect vehicle utilization and operational efficiency, potentially reducing demand for certain vehicle types. Regulatory complexity surrounding vehicle imports, emissions standards, and operational permits can create compliance challenges for market participants. Skills shortages in vehicle maintenance and operation may limit market growth in specialized vehicle segments.

Competition from used vehicles and informal market segments can impact new vehicle sales, particularly in price-sensitive market segments. Geographic challenges including mountainous terrain and remote locations create unique operational requirements that may limit vehicle options and increase operational costs for fleet operators.

Emerging market segments present substantial growth opportunities for Peru’s commercial vehicle sector. Electric and hybrid commercial vehicles represent a significant opportunity as environmental awareness increases and government policies support cleaner transportation solutions. The transition toward sustainable transportation creates opportunities for manufacturers and operators to differentiate through environmental performance.

Technology integration opportunities include telematics, fleet management systems, and autonomous driving technologies that can improve operational efficiency and safety. Digitalization trends in logistics and transportation create demand for connected vehicles and smart transportation solutions. Data analytics and predictive maintenance technologies offer opportunities to reduce operational costs and improve vehicle uptime.

Regional expansion opportunities exist as Peru strengthens economic ties with neighboring countries and develops cross-border trade relationships. Infrastructure corridor development creates opportunities for specialized transportation services and vehicle configurations. Mining sector expansion continues to offer opportunities for heavy-duty vehicle manufacturers and specialized equipment providers.

Aftermarket services represent growing opportunities as the vehicle population increases and operators focus on maximizing asset utilization. Financing innovation through leasing, subscription models, and alternative financing structures can expand market accessibility and create new business models for industry participants.

Supply chain dynamics in Peru’s commercial vehicle market reflect the country’s dependence on imported vehicles and components, creating complex relationships between international manufacturers, local assemblers, and distribution networks. Manufacturing capabilities within Peru focus primarily on assembly operations, with most components sourced from international suppliers, creating sensitivity to global supply chain disruptions.

Demand patterns show strong correlation with economic cycles and commodity prices, particularly copper and other minerals that drive Peru’s export economy. Seasonal variations affect certain market segments, with construction and agriculture-related vehicle demand showing cyclical patterns aligned with weather and project timelines. Regional demand distribution shows 42% concentration in Lima and coastal regions, with mining regions accounting for significant heavy-duty vehicle demand.

Competitive dynamics feature intense competition among international brands seeking market share in Peru’s growing economy. Price competition remains significant, particularly in light commercial vehicle segments where multiple brands compete for cost-conscious customers. Service network development has become a key competitive differentiator, with manufacturers investing in dealer networks and aftermarket support capabilities.

Technology adoption rates vary significantly across market segments, with larger fleet operators leading in advanced technology integration while smaller operators focus on basic reliability and cost considerations. Market consolidation trends show increasing cooperation between manufacturers and local partners to improve market penetration and customer service capabilities.

Comprehensive market analysis for Peru’s commercial vehicle sector employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry stakeholders, including vehicle manufacturers, dealers, fleet operators, and government officials involved in transportation policy and regulation.

Secondary research encompasses analysis of government statistics, industry publications, trade association reports, and economic indicators relevant to commercial vehicle demand. Data triangulation methods ensure consistency and accuracy across multiple information sources, while statistical analysis identifies trends and correlations within market data.

Market segmentation analysis examines vehicle categories, end-user industries, geographic regions, and technology adoption patterns to provide comprehensive market understanding. Competitive intelligence gathering includes analysis of manufacturer strategies, product portfolios, pricing structures, and market positioning approaches.

Economic modeling incorporates macroeconomic indicators, industry-specific factors, and regulatory considerations to project market trends and growth patterns. Validation processes include expert consultations and cross-referencing with industry benchmarks to ensure research accuracy and reliability. MarkWide Research methodologies emphasize both quantitative analysis and qualitative insights to provide actionable market intelligence.

Lima Metropolitan Area dominates Peru’s commercial vehicle market, accounting for approximately 45% of total vehicle registrations due to its concentration of economic activity, logistics operations, and urban transportation needs. Coastal regions including Callao, Trujillo, and Arequipa represent significant market segments driven by port activities, manufacturing, and agricultural processing operations.

Mining regions including Cajamarca, Ancash, and Cusco demonstrate strong demand for heavy-duty vehicles and specialized mining equipment, with mining-related vehicle purchases representing 32% of heavy-duty truck sales. These regions require vehicles capable of operating in challenging terrain and extreme conditions, creating demand for specialized vehicle configurations.

Amazon region presents unique market characteristics with demand for vehicles suitable for tropical conditions and challenging road infrastructure. Regional connectivity improvements through infrastructure projects are expanding commercial vehicle opportunities in previously underserved areas. Cross-border regions with Ecuador, Colombia, and Brazil show growing demand for international transport vehicles.

Southern regions including Tacna and Moquegua benefit from trade relationships with Chile and Bolivia, creating demand for cross-border transportation vehicles. Agricultural regions in the central highlands require specialized vehicles for crop transportation and rural logistics, with seasonal demand patterns affecting market dynamics. Regional market share distribution shows 23% concentration in mining regions, reflecting the sector’s importance to commercial vehicle demand.

International manufacturers dominate Peru’s commercial vehicle market through established dealer networks and local assembly operations. The competitive environment features both global automotive giants and specialized commercial vehicle manufacturers competing across different market segments and price points.

Market competition focuses on product reliability, service network coverage, financing options, and total cost of ownership. Local assembly operations provide competitive advantages through reduced import duties and improved customer proximity. Dealer network strength has become increasingly important for market success, particularly in remote regions requiring specialized service support.

Competitive strategies include technology differentiation, customization capabilities, and comprehensive aftermarket support. Partnership approaches with local businesses and government entities help international manufacturers establish stronger market positions and better understand local requirements.

Vehicle type segmentation reveals distinct market characteristics and growth patterns across Peru’s commercial vehicle landscape. Light commercial vehicles including pickup trucks and small delivery vans represent the largest segment by volume, serving urban businesses, small enterprises, and individual operators requiring versatile transportation solutions.

By Vehicle Type:

By End-User Industry:

By Technology Level:

Light commercial vehicles demonstrate the strongest growth momentum, driven by e-commerce expansion, urban development, and small business growth. Pickup truck popularity reflects Peru’s diverse terrain and multi-purpose vehicle requirements, with pickup trucks accounting for 38% of light commercial vehicle sales. These vehicles serve both commercial and personal use applications, creating broad market appeal.

Heavy-duty trucks show strong correlation with mining activity and infrastructure projects, with demand patterns closely following commodity price cycles and government investment programs. Mining truck specifications require specialized features for high-altitude operation, extreme conditions, and heavy payload requirements. Long-haul trucks benefit from Peru’s position as a trade corridor connecting Pacific and Atlantic markets.

Bus segment reflects urban transportation modernization and public transit development, with urban bus renewal programs driving replacement demand for older vehicles. Inter-city buses serve Peru’s extensive passenger transportation network connecting remote regions to major cities. School bus demand grows with educational infrastructure development and safety regulation enforcement.

Specialized vehicles including construction equipment, agricultural machinery, and purpose-built vehicles serve specific industry requirements. Construction vehicle demand correlates with infrastructure investment cycles and urban development projects. Agricultural vehicles support Peru’s diverse agricultural sector, from coastal farming to highland crop production.

Manufacturers benefit from Peru’s growing economy and expanding commercial vehicle demand across multiple sectors. Market diversification opportunities allow manufacturers to reduce dependence on single industries while serving various customer segments with different vehicle requirements. Local assembly advantages include reduced import duties, improved customer proximity, and enhanced service capabilities.

Dealers and distributors benefit from expanding market opportunities and growing aftermarket services demand. Service network development creates recurring revenue streams and strengthens customer relationships. Financing partnerships enable dealers to offer comprehensive solutions and expand market accessibility for customers with varying credit profiles.

Fleet operators benefit from improved vehicle technology, financing options, and service support that enhance operational efficiency and reduce total cost of ownership. Technology integration provides opportunities for operational optimization, fuel savings, and improved safety performance. Leasing and subscription models offer flexible vehicle acquisition options without large capital investments.

Government stakeholders benefit from commercial vehicle market growth through tax revenues, employment creation, and improved transportation infrastructure. Environmental benefits result from fleet modernization and adoption of cleaner vehicle technologies. Economic development benefits include improved logistics capabilities and enhanced regional connectivity supporting trade and commerce.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a major trend reshaping Peru’s commercial vehicle market, with fleet operators increasingly adopting telematics, GPS tracking, and digital fleet management systems. Technology integration rates show 41% of medium and large fleets have implemented some form of digital fleet management, improving operational efficiency and cost control.

Sustainability focus is driving interest in alternative fuel vehicles and emission reduction technologies. Electric vehicle adoption in urban commercial applications is beginning to gain traction, particularly for last-mile delivery and urban transportation. Government incentives for cleaner vehicles are expected to accelerate this trend in coming years.

Customization demand reflects Peru’s diverse operational requirements, with customers seeking vehicles tailored to specific applications and operating conditions. Modular vehicle designs allow manufacturers to offer customized solutions while maintaining production efficiency. Specialized configurations for mining, agriculture, and construction applications continue to evolve.

Service-oriented business models are emerging as manufacturers and dealers expand beyond vehicle sales to offer comprehensive transportation solutions. Maintenance contracts, leasing programs, and mobility-as-a-service concepts are gaining acceptance among fleet operators seeking to optimize operational costs and reduce capital requirements.

Regional connectivity improvements through infrastructure development are expanding market opportunities in previously underserved areas. Cross-border trade facilitation is creating demand for vehicles capable of international operations and compliance with multiple regulatory frameworks.

Manufacturing expansion initiatives by several international companies reflect growing confidence in Peru’s commercial vehicle market potential. Local assembly capacity increases help reduce costs and improve market responsiveness while creating employment opportunities and technology transfer benefits.

Dealer network expansion continues across Peru’s regions, with manufacturers investing in service capabilities and parts distribution to better serve customers in remote areas. Service center development focuses on specialized capabilities for mining and construction vehicles requiring expert maintenance and repair services.

Technology partnerships between vehicle manufacturers and technology companies are introducing advanced features like predictive maintenance, autonomous driving capabilities, and enhanced safety systems. Digital platform development enables better customer service and operational support through connected vehicle technologies.

Financing innovation includes new leasing programs, flexible payment structures, and partnerships with financial institutions to improve vehicle accessibility. Government policy developments regarding emission standards, safety regulations, and import procedures continue to shape market dynamics and competitive positioning.

Sustainability initiatives include pilot programs for electric commercial vehicles, alternative fuel infrastructure development, and vehicle recycling programs. MarkWide Research analysis indicates these developments are positioning Peru’s commercial vehicle market for long-term sustainable growth aligned with global environmental trends.

Market participants should focus on developing comprehensive service networks and aftermarket capabilities to differentiate their offerings and create sustainable competitive advantages. Investment in local assembly and parts distribution can help reduce costs and improve market responsiveness while building stronger customer relationships.

Technology integration strategies should balance advanced features with cost considerations, recognizing that different market segments have varying technology adoption rates and budget constraints. Customization capabilities will become increasingly important as customers seek vehicles tailored to specific operational requirements and local conditions.

Partnership development with local businesses, government entities, and financial institutions can help international manufacturers better understand market requirements and expand their reach. Financing solutions development should address the needs of smaller operators and businesses with limited access to traditional vehicle financing.

Sustainability positioning will become increasingly important as environmental regulations tighten and customer awareness grows. Alternative fuel vehicle development should consider Peru’s specific infrastructure and operational requirements while building toward long-term market transition.

Regional market development strategies should recognize the diverse requirements and opportunities across Peru’s different geographic and economic regions. Cross-border capabilities will become more valuable as regional trade relationships strengthen and logistics networks expand.

Long-term growth prospects for Peru’s commercial vehicle market remain positive, supported by continued economic development, infrastructure investment, and industrial expansion. Market maturation is expected to bring increased sophistication in customer requirements, technology adoption, and service expectations, creating opportunities for differentiation and value-added services.

Technology evolution will continue reshaping the market, with electric vehicle adoption projected to reach 15% of urban commercial vehicle sales within the next decade. Autonomous driving technologies and advanced safety systems will gradually penetrate the market, starting with premium segments and large fleet operators.

Infrastructure development will expand market opportunities in currently underserved regions while improving operational efficiency for existing fleet operators. Regional integration trends will create new opportunities for cross-border transportation and logistics services, requiring vehicles capable of meeting multiple regulatory requirements.

Market consolidation may occur as smaller players struggle to compete with established manufacturers offering comprehensive solutions and extensive service networks. Service-oriented business models will become more prevalent as customers seek total transportation solutions rather than just vehicle purchases.

Environmental regulations will continue driving fleet modernization and technology adoption, creating replacement demand and opportunities for manufacturers offering cleaner, more efficient vehicles. MWR projections suggest the market will maintain steady growth while evolving toward greater sustainability and technological sophistication.

Peru’s commercial vehicle market represents a dynamic and growing sector with substantial opportunities for manufacturers, dealers, and service providers. The market benefits from strong economic fundamentals, diverse end-user industries, and government support for infrastructure development and transportation modernization. Growth drivers including mining expansion, urbanization, and e-commerce development create sustained demand across multiple vehicle segments.

Market challenges including economic volatility, import dependence, and infrastructure limitations require strategic approaches and local market understanding. However, the overall outlook remains positive with technology adoption, sustainability trends, and regional integration creating new opportunities for market participants willing to invest in long-term market development.

Success factors in Peru’s commercial vehicle market include comprehensive service networks, customization capabilities, competitive financing solutions, and strong local partnerships. Future market evolution will favor companies that can balance advanced technology offerings with cost-effective solutions while building sustainable competitive advantages through service excellence and customer relationships. The Peru commercial vehicle market is positioned for continued growth and evolution, offering significant opportunities for well-positioned industry participants.

What is Commercial Vehicle?

Commercial vehicles are motor vehicles used for transporting goods or passengers for commercial purposes. They include trucks, vans, buses, and other vehicles designed for business use.

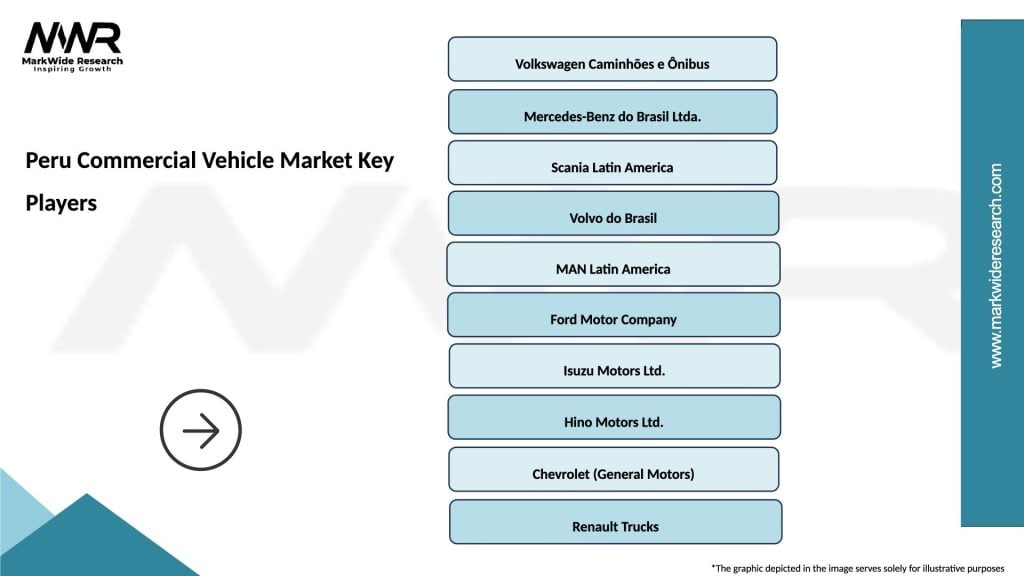

What are the key players in the Peru Commercial Vehicle Market?

Key players in the Peru Commercial Vehicle Market include companies like Toyota, Volkswagen, and Ford, which offer a range of commercial vehicles tailored to local needs, among others.

What are the main drivers of growth in the Peru Commercial Vehicle Market?

The growth of the Peru Commercial Vehicle Market is driven by increasing urbanization, rising demand for logistics and transportation services, and government investments in infrastructure development.

What challenges does the Peru Commercial Vehicle Market face?

Challenges in the Peru Commercial Vehicle Market include regulatory hurdles, fluctuating fuel prices, and competition from alternative transportation modes, which can impact market stability.

What opportunities exist in the Peru Commercial Vehicle Market?

Opportunities in the Peru Commercial Vehicle Market include the expansion of e-commerce, which increases demand for delivery vehicles, and advancements in electric vehicle technology that can enhance sustainability.

What trends are shaping the Peru Commercial Vehicle Market?

Trends in the Peru Commercial Vehicle Market include the growing adoption of telematics for fleet management, a shift towards electric and hybrid vehicles, and increasing focus on safety features and driver assistance technologies.

Peru Commercial Vehicle Market

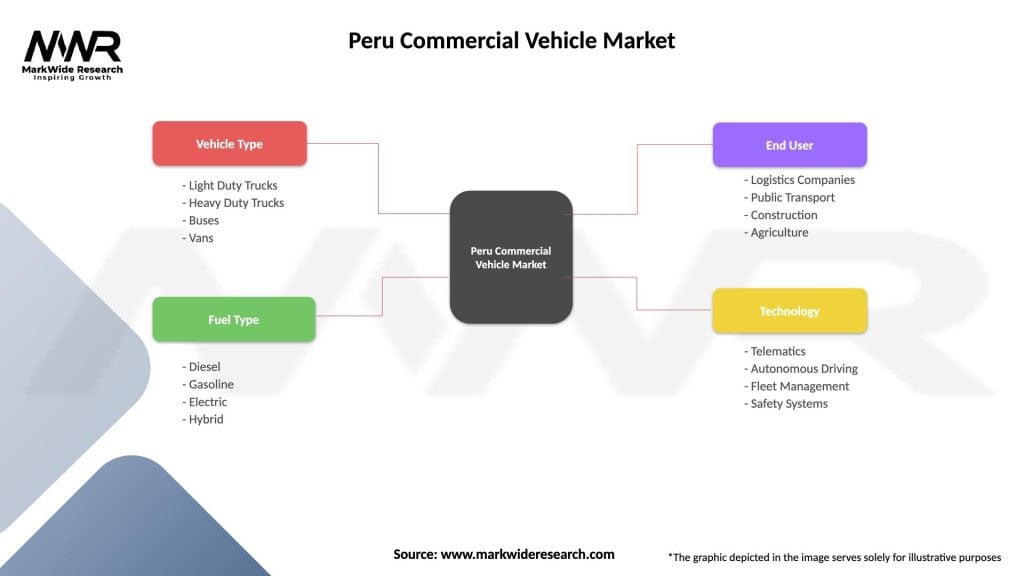

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Light Duty Trucks, Heavy Duty Trucks, Buses, Vans |

| Fuel Type | Diesel, Gasoline, Electric, Hybrid |

| End User | Logistics Companies, Public Transport, Construction, Agriculture |

| Technology | Telematics, Autonomous Driving, Fleet Management, Safety Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Peru Commercial Vehicle Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at