444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The personal loans market has experienced significant growth in recent years, driven by the increasing need for financial flexibility among individuals. Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, medical expenses, and education. These loans are typically offered by banks, credit unions, and online lenders. The market for personal loans is highly competitive, with players striving to offer attractive interest rates, flexible repayment terms, and quick approval processes.

Meaning

Personal loans are a type of consumer credit that allows individuals to borrow money for personal use. Unlike mortgages or auto loans, personal loans are not tied to a specific asset. They are typically granted based on the borrower’s creditworthiness and income level. Personal loans can be either secured or unsecured, with unsecured loans being more common. Secured personal loans require collateral, such as a vehicle or property, while unsecured loans do not. These loans are typically repaid in fixed monthly installments over a predetermined period.

Executive Summary

The personal loans market has experienced robust growth in recent years, driven by factors such as increasing consumer demand for flexible financing options and the ease of online loan applications. The market is highly competitive, with a wide range of players offering personal loans with varying terms and interest rates. However, the market also faces challenges, including the risk of default and the impact of economic fluctuations on borrowers’ ability to repay their loans.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

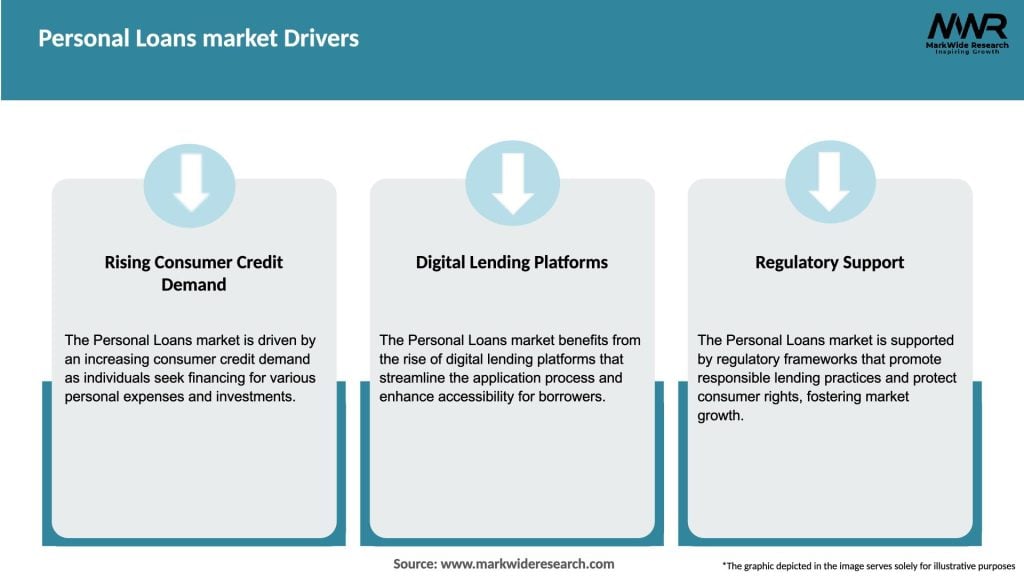

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The personal loans market is characterized by intense competition, technological advancements, changing consumer preferences, and evolving regulatory landscapes. Lenders need to stay agile and adapt to these dynamics to remain competitive and capture market share. Key dynamics shaping the market include:

Regional Analysis

The personal loans market exhibits regional variations influenced by factors such as economic conditions, regulatory environments, and cultural norms. The market can be analyzed based on regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its unique characteristics and market dynamics, which impact the demand for personal loans and the competitive landscape.

In North America, the personal loans market is mature, driven by the presence of established lenders and a high level of financial awareness among consumers. Europe has a diverse market with varying regulations and cultural preferences, leading to differences in loan products and interest rates. Asia Pacific is experiencing rapid growth in personal loans, fueled by increasing disposable income levels and the expanding middle class. Latin America is witnessing a growing demand for personal loans, driven by the need for consumer financing options. The Middle East and Africa have untapped market potential, with rising awareness of personal loans and a growing number of lenders entering the market.

Competitive Landscape

Leading Companies in the Personal Loans Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The personal loans market can be segmented based on various factors, including loan type, borrower profile, and loan amount. Common segmentation criteria include:

Segmentation enables lenders to customize their loan products based on specific borrower needs, risk profiles, and loan amounts, thereby catering to a diverse customer base.

Key Benefits for Industry Participants and Stakeholders

The personal loans market has become an integral part of the global financial landscape, offering a range of benefits for both industry participants and stakeholders. For individuals, personal loans provide access to much-needed funds for various purposes, including debt consolidation, home improvements, education expenses, and emergency situations. These loans offer flexibility in terms of repayment options, loan amounts, and interest rates, catering to diverse financial needs.

For financial institutions, personal loans represent a lucrative business opportunity, allowing them to earn interest on the funds lent out to borrowers. This lending activity contributes to the growth and stability of the banking sector, driving profitability and expanding customer bases. Moreover, the personal loans market enables lenders to diversify their portfolios and mitigate risks associated with other types of lending, such as mortgages or business loans.

Other key stakeholders, such as credit bureaus and credit scoring agencies, benefit from the personal loans market as well. As individuals engage in borrowing activities and make timely repayments, their creditworthiness improves, which in turn enhances their credit scores. This positive impact on credit scores not only benefits borrowers by increasing their chances of securing future loans at favorable terms but also strengthens the overall credit ecosystem.

SWOT Analysis

A comprehensive SWOT analysis of the personal loans market provides insights into its internal strengths and weaknesses, as well as external opportunities and threats. Understanding these factors helps industry participants and stakeholders navigate the competitive landscape effectively.

Strengths: The personal loans market enjoys several strengths, including its ability to cater to the diverse financial needs of individuals. With streamlined application processes and faster approvals, personal loans offer convenience to borrowers. Moreover, the market benefits from the extensive reach of financial institutions, allowing borrowers to access funds through multiple channels, including online platforms, branches, and mobile apps.

Weaknesses: Despite its strengths, the personal loans market faces certain weaknesses. One notable concern is the risk associated with unsecured loans. As personal loans are typically not backed by collateral, lenders are exposed to higher default risks compared to secured lending. This necessitates rigorous credit assessment and risk management practices to mitigate potential losses.

Opportunities: The personal loans market presents significant opportunities for growth. As the global economy expands, individuals seek financing for various purposes, such as education, travel, and weddings. The rising popularity of online lending platforms and the increasing adoption of digital payment systems create new avenues for lenders to reach untapped markets and attract tech-savvy borrowers. Additionally, partnerships with other industries, such as e-commerce and travel, can lead to innovative loan products and expanded customer bases.

Threats: The personal loans market also faces external threats that warrant attention. Economic downturns and financial crises can increase default rates and reduce borrowers’ ability to repay loans. Regulatory changes, particularly in consumer lending practices, can impact loan affordability and eligibility criteria. Furthermore, competition within the market, including both traditional financial institutions and emerging fintech companies, intensifies the need for differentiation and customer-centric strategies.

Market Key Trends

The personal loans market is constantly evolving, driven by various key trends that shape the industry landscape. Understanding these trends is crucial for industry participants and stakeholders to adapt their strategies effectively.

Covid-19 Impact

The Covid-19 pandemic had a profound impact on the personal loans market, presenting both challenges and opportunities. As the global economy contracted and individuals faced financial uncertainties, the demand for personal loans initially declined. Heightened risk aversion among lenders led to stricter eligibility criteria and reduced loan approvals. However, government stimulus packages and relief measures aimed at supporting businesses and individuals injected liquidity into the market, providing a temporary respite.

The pandemic also accelerated the adoption of digital lending platforms, as physical branch visits became challenging due to lockdowns and social distancing measures. Fintech companies offering contactless loan processing witnessed increased demand, and traditional lenders expedited their digital transformation initiatives to meet changing customer expectations.

Furthermore, the Covid-19 crisis highlighted the importance of robust risk management practices within the personal loans market. Lenders had to adapt their credit assessment models to account for the impact of the pandemic on borrowers’ financial stability. Enhanced monitoring and collection efforts were necessary to manage delinquencies and minimize loan defaults.

Key Industry Developments

The personal loans market has witnessed several key industry developments that have shaped its trajectory:

Analyst Suggestions

Based on the market analysis and key trends, analysts suggest several strategies for industry participants and stakeholders to thrive in the competitive personal loans market:

Future Outlook

The personal loans market is poised for continued growth and innovation in the coming years. Technological advancements, coupled with changing consumer preferences, will drive the market’s evolution. The adoption of digital lending platforms and personalized loan offerings will further streamline the borrowing process and enhance customer experience.

Furthermore, the focus on responsible lending practices and regulatory reforms will shape the market landscape. Stricter disclosure requirements, interest rate caps, and regulations promoting transparency will foster consumer trust and confidence in the personal loans market. The increasing collaboration between traditional financial institutions and fintech startups will lead to further advancements in loan origination processes, credit assessment models, and risk management practices. This collaboration will contribute to the development of more inclusive and efficient lending ecosystems.

Conclusion

The personal loans market offers numerous benefits for industry participants and stakeholders alike. Its flexibility, convenience, and accessibility make it a vital financial tool for individuals seeking funds for various purposes. However, the market also faces challenges such as default risks and regulatory changes. By understanding key industry trends, such as digital transformation, personalized offerings, and alternative credit scoring, industry participants can position themselves for success. Embracing technology, prioritizing customer experience, and strengthening risk management practices will be key drivers of growth and sustainability.

As the personal loans market continues to evolve, collaboration between traditional financial institutions and fintech startups will shape its future trajectory. By adopting innovative strategies and focusing on responsible lending, the market can effectively meet the evolving financial needs of individuals, contributing to their financial well-being and empowering their financial flexibility.

What is Personal Loans?

Personal loans are unsecured loans that individuals can use for various purposes, such as consolidating debt, financing large purchases, or covering unexpected expenses. They typically have fixed interest rates and repayment terms.

What are the key players in the Personal Loans market?

Key players in the Personal Loans market include companies like SoFi, LendingClub, and Marcus by Goldman Sachs, which offer a range of personal loan products to consumers. These companies compete on interest rates, loan terms, and customer service, among others.

What are the main drivers of growth in the Personal Loans market?

The growth of the Personal Loans market is driven by factors such as increasing consumer demand for flexible financing options, the rise of digital lending platforms, and a growing acceptance of personal loans for debt consolidation and major purchases.

What challenges does the Personal Loans market face?

The Personal Loans market faces challenges such as rising interest rates, regulatory scrutiny, and the potential for increased default rates among borrowers. These factors can impact lenders’ profitability and consumer access to loans.

What opportunities exist in the Personal Loans market?

Opportunities in the Personal Loans market include the expansion of online lending platforms, the development of personalized loan products, and the potential for partnerships with fintech companies to enhance customer experience and streamline the application process.

What trends are shaping the Personal Loans market?

Trends in the Personal Loans market include the growing use of artificial intelligence for credit assessments, the rise of peer-to-peer lending, and an increasing focus on financial wellness programs that educate consumers about responsible borrowing.

Personal Loans market

| Segmentation Details | Description |

|---|---|

| Loan Type | Secured, Unsecured, Peer-to-Peer, Payday |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Interest Rate Type | Fixed, Variable, Adjustable, Hybrid |

| Loan Purpose | Debt Consolidation, Home Improvement, Education, Medical Expenses |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Personal Loans Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at