444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Personal Financial Management (PFM) Tools Market encompasses a range of digital platforms, applications, and services designed to help individuals manage their finances effectively. These tools offer features such as budgeting, expense tracking, goal setting, investment management, and financial planning, empowering users to take control of their money, make informed decisions, and achieve their financial goals. With the increasing adoption of digital banking, mobile payments, and online financial services, the demand for PFM tools has surged, driving innovation, competition, and growth in the market.

Meaning

Personal Financial Management Tools refer to software applications, mobile apps, and online platforms that enable individuals to track, manage, and optimize their finances. These tools aggregate financial data from various accounts, analyze spending patterns, categorize expenses, and provide insights and recommendations to help users make informed financial decisions. PFM tools empower users to set budgets, track expenses, save money, invest wisely, and plan for the future, promoting financial literacy, responsibility, and well-being.

Executive Summary

The Personal Financial Management Tools Market has experienced rapid growth in recent years, fueled by increasing digitization, changing consumer behavior, and the need for financial empowerment and autonomy. PFM tools offer convenience, accessibility, and customization, catering to the diverse needs and preferences of users across different demographics and life stages. As individuals seek to improve their financial health, the demand for PFM tools is expected to continue growing, driving innovation, investment, and competition in the market.

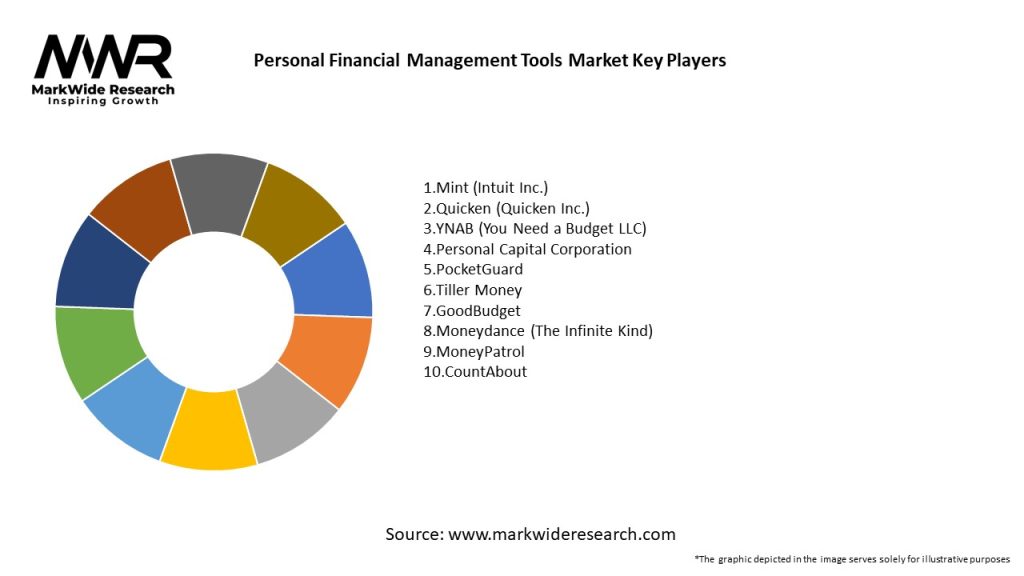

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Personal Financial Management Tools Market operates in a dynamic and competitive environment shaped by technological innovations, regulatory changes, consumer preferences, and market trends. To stay competitive and meet the evolving needs of users, PFM providers must continuously innovate, differentiate, and adapt their offerings, while also addressing challenges related to privacy, security, integration, and affordability.

Regional Analysis

The adoption and usage of PFM tools vary by region, influenced by factors such as digital infrastructure, financial literacy, regulatory environment, and cultural norms. In developed economies with mature financial markets and high levels of digital penetration, such as North America and Europe, PFM tools are widely used and integrated into mainstream banking and financial services. In contrast, in emerging markets with lower digital adoption rates and limited access to traditional financial services, such as parts of Africa, Asia, and Latin America, the growth potential for PFM tools is significant, driven by increasing smartphone penetration, rising internet connectivity, and growing demand for digital financial solutions.

Competitive Landscape

Leading Companies in the Personal Financial Management Tools Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Personal Financial Management Tools Market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Users

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the Personal Financial Management Tools Market, accelerating digital adoption, changing consumer behavior, and highlighting the importance of financial resilience and planning. Some key impacts of COVID-19 on the market include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Personal Financial Management Tools Market is expected to continue growing in the coming years, driven by increasing digitization, changing consumer behavior, and the growing need for financial empowerment and autonomy. Advances in technology, regulatory changes, and shifting market dynamics will shape the future of the market, presenting both opportunities and challenges for PFM providers. By focusing on innovation, differentiation, and customer-centricity, PFM providers can position themselves for success in an increasingly competitive and dynamic market landscape.

Conclusion

The Personal Financial Management Tools Market is poised for significant growth and innovation as it continues to evolve in response to changing consumer needs, technological advancements, and market dynamics. With the rise of digital banking, fintech disruption, and increasing awareness of financial wellness, PFM tools play a crucial role in empowering individuals to take control of their finances, achieve their goals, and build a secure financial future.

Moreover, partnerships and collaborations with banks, fintech startups, and other ecosystem players will enable PFM providers to offer integrated and seamless financial solutions that address the holistic needs of users, from banking and payments to budgeting and investing.

With the right strategies, investments, and partnerships, the Personal Financial Management Tools Market has the potential to transform the way individuals manage their finances, enabling them to achieve their short-term goals and long-term aspirations with confidence and peace of mind.

What is Personal Financial Management Tools?

Personal Financial Management Tools are software applications designed to help individuals manage their finances, track spending, create budgets, and plan for future financial goals. These tools often include features such as expense tracking, investment management, and financial reporting.

What are the key players in the Personal Financial Management Tools Market?

Key players in the Personal Financial Management Tools Market include Intuit, which offers TurboTax and Mint, and Personal Capital, known for its investment tracking services. Other notable companies are YNAB (You Need A Budget) and PocketGuard, among others.

What are the main drivers of growth in the Personal Financial Management Tools Market?

The growth of the Personal Financial Management Tools Market is driven by increasing consumer awareness of financial literacy, the rise of mobile banking, and the demand for automated financial solutions. Additionally, the growing trend of personal budgeting and investment tracking contributes to market expansion.

What challenges does the Personal Financial Management Tools Market face?

Challenges in the Personal Financial Management Tools Market include data security concerns, as users are often wary of sharing sensitive financial information. Additionally, the market faces competition from free tools and apps that may limit the adoption of paid solutions.

What opportunities exist in the Personal Financial Management Tools Market?

Opportunities in the Personal Financial Management Tools Market include the integration of artificial intelligence for personalized financial advice and the expansion into emerging markets where financial literacy is on the rise. Furthermore, partnerships with financial institutions can enhance service offerings.

What trends are shaping the Personal Financial Management Tools Market?

Trends in the Personal Financial Management Tools Market include the increasing use of mobile applications for on-the-go financial management and the incorporation of gamification elements to engage users. Additionally, there is a growing focus on sustainability and ethical investing within these tools.

Personal Financial Management Tools Market

| Segmentation Details | Description |

|---|---|

| Product Type | Budgeting Software, Expense Trackers, Investment Management, Debt Reduction Tools |

| End User | Individuals, Small Businesses, Financial Advisors, Corporations |

| Deployment | Cloud-Based, On-Premises, Mobile Applications, Desktop Software |

| Feature | Automated Reporting, Goal Setting, Financial Forecasting, Tax Planning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Personal Financial Management Tools Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at