444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The personal finance software market is experiencing significant growth due to the increasing need for effective financial management tools. Personal finance software refers to digital applications and platforms designed to help individuals manage their finances, track expenses, set budgets, and plan for their financial future. These software solutions provide users with features such as account aggregation, bill payment reminders, investment tracking, and financial goal setting.

Meaning

Personal finance software plays a crucial role in helping individuals gain better control over their finances. These tools enable users to monitor their income and expenses, categorize transactions, generate financial reports, and analyze their spending patterns. By offering a comprehensive view of their financial situation, personal finance software empowers individuals to make informed decisions and take proactive steps towards achieving their financial goals.

Executive Summary

The personal finance software market has witnessed substantial growth in recent years, driven by the increasing adoption of digital financial management solutions. The ease of use, convenience, and accessibility offered by personal finance software have made it a popular choice among individuals of all age groups. Moreover, the rising awareness about the importance of financial planning and the need to track expenses has further fueled the demand for these software solutions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The personal finance software market is highly dynamic, driven by technological advancements, changing consumer preferences, and evolving regulatory frameworks. As new features and functionalities are introduced, market players continuously innovate to meet the evolving needs of users. Additionally, the market is witnessing collaborations and partnerships between personal finance software providers and financial institutions, leading to the development of more comprehensive financial management solutions.

Regional Analysis

The personal finance software market exhibits a global presence, with North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa being the key regions. North America holds a significant market share due to the high adoption of personal finance software among individuals and businesses in the region. Europe and Asia Pacific are also witnessing substantial growth, driven by the increasing digitalization of financial processes and rising disposable income levels.

Competitive Landscape

Leading Companies in the Personal Finance Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

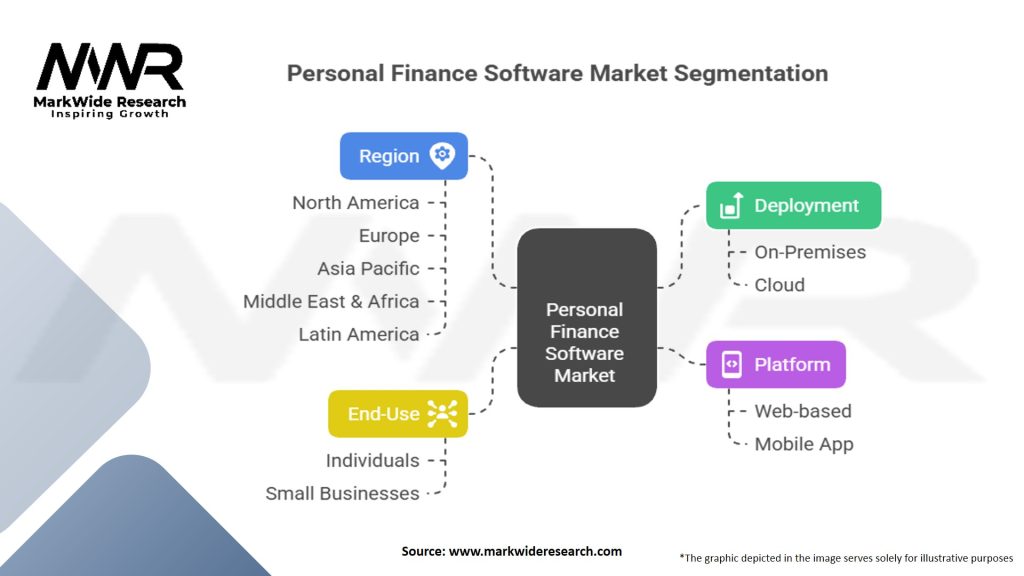

The personal finance software market can be segmented based on deployment mode, type, and end-user.

By deployment mode:

By type:

By end-user:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the personal finance software market. The economic uncertainty and financial challenges brought about by the pandemic have highlighted the need for individuals to effectively manage their finances. As a result, there has been an increased demand for personal finance software during the pandemic, as individuals seek tools to track expenses, monitor investments, and plan for their financial future in the face of economic volatility.

Key Industry Developments

Analyst Suggestions

Future Outlook

The personal finance software market is poised for continued growth in the coming years. As individuals become increasingly aware of the importance of financial management and seek digital solutions for their financial needs, the demand for personal finance software will rise. Technological advancements such as artificial intelligence, machine learning, and IoT integration will further enhance the capabilities of personal finance software, providing users with more accurate insights and personalized recommendations.

Conclusion

The personal finance software market is experiencing rapid growth due to the increasing need for effective financial management tools. These software solutions empower individuals and businesses to gain better control over their finances, track expenses, set budgets, and plan for their financial goals. Despite challenges related to data privacy and security, the market offers significant opportunities for growth through integration with IoT devices, expansion in emerging markets, and collaboration with financial institutions. With continuous advancements in technology and increasing adoption of digital financial processes, the personal finance software market is expected to thrive in the future, enabling individuals to achieve financial well-being and prosperity.

Personal Finance Software Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud |

| Platform | Web-based, Mobile App |

| End-Use | Individuals, Small Businesses |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Personal Finance Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at