444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The pension funding market serves as a critical component of retirement planning, providing individuals and organizations with financial resources to support post-employment life. Pension funding encompasses a range of investment vehicles, including pension plans, retirement accounts, and annuities, designed to accumulate wealth and generate income during retirement years. As populations age and retirement needs evolve, the pension funding market plays a vital role in ensuring financial security and stability for retirees worldwide.

Meaning

Pension funding refers to the process of setting aside funds and making investments to finance future retirement benefits for employees or individuals. It involves contributions from employers, employees, or both, which are managed and invested by pension funds, asset managers, or financial institutions. Pension funding aims to build a pool of assets that can generate income or provide lump-sum payouts to retirees, ensuring their financial well-being during retirement.

Executive Summary

The pension funding market is shaped by demographic trends, economic conditions, regulatory changes, and investment performance. As life expectancies increase and retirement ages extend, the need for adequate pension funding becomes more pronounced. However, challenges such as funding shortfalls, market volatility, and regulatory complexities pose significant hurdles for pension providers and beneficiaries alike. Understanding the key drivers, trends, and dynamics of the pension funding market is essential for stakeholders to navigate these challenges and optimize retirement outcomes.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The pension funding market operates in a dynamic environment shaped by macroeconomic trends, regulatory changes, demographic shifts, and investment dynamics. These dynamics influence pension funding strategies, asset allocation decisions, and retirement outcomes for individuals and organizations.

Regional Analysis

The pension funding market exhibits regional variations in pension system design, funding models, regulatory frameworks, and retirement income adequacy. Developed economies typically have well-established pension systems with defined benefit plans, while emerging economies are witnessing shifts towards defined contribution schemes and private pension provision. Regional analysis enables stakeholders to understand market dynamics, regulatory environments, and retirement challenges specific to each region.

Competitive Landscape

Leading Companies in the Pension Funding Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The pension funding market can be segmented based on various factors such as pension plan type, funding model, asset allocation strategy, participant demographics, and geographical location. Common segmentation categories include defined benefit plans, defined contribution plans, public pension schemes, private pension schemes, corporate pensions, individual retirement accounts (IRAs), and annuities. Segmentation provides insights into market dynamics, customer preferences, and growth opportunities across different segments of the pension funding market.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had significant implications for the pension funding market, affecting investment performance, funding levels, retirement savings, and regulatory priorities. Market participants have faced challenges such as market volatility, funding shortfalls, economic uncertainty, and remote work disruptions, highlighting the importance of robust risk management, financial resilience, and long-term retirement planning.

Key Industry Developments

Analyst Suggestions

Future Outlook

The pension funding market is poised for continued growth and innovation, driven by demographic trends, regulatory reforms, technological advancements, and evolving retirement needs. Market participants must adapt to changing dynamics, embrace digitalization, prioritize sustainability, and innovate in retirement income solutions to meet the evolving needs of retirees and ensure financial security and stability in retirement.

Conclusion

The pension funding market plays a critical role in retirement planning, providing individuals and organizations with financial resources to support post-employment life. Despite challenges such as funding shortfalls, market volatility, and regulatory complexities, the market offers opportunities for innovation, digital transformation, and retirement income solutions to enhance retirement security and optimize pension outcomes. By prioritizing diversification, risk management, digital innovation, and sustainability, stakeholders can navigate market challenges, seize growth opportunities, and shape the future of pension funding and retirement planning.

What is Pension Funding?

Pension funding refers to the financial strategies and mechanisms used to accumulate and manage funds for future pension liabilities. This includes contributions from employers and employees, investment returns, and the management of pension assets to ensure sufficient resources for retirement payouts.

What are the key players in the Pension Funding Market?

Key players in the Pension Funding Market include large financial institutions such as Vanguard Group, BlackRock, and State Street Global Advisors, which manage pension assets and provide investment solutions. Additionally, pension funds themselves, such as public and private sector pension plans, play a crucial role in this market, among others.

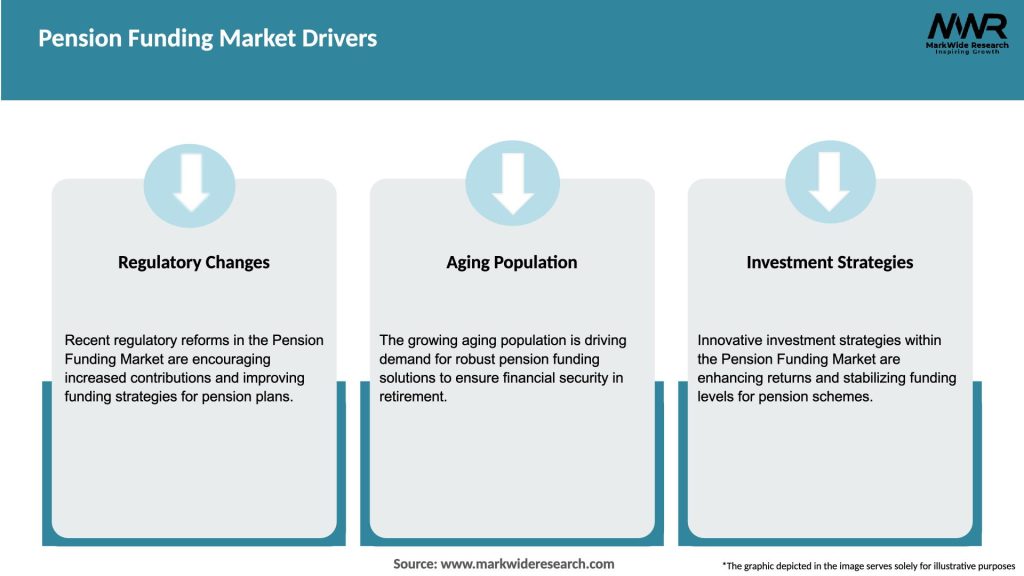

What are the main drivers of growth in the Pension Funding Market?

The main drivers of growth in the Pension Funding Market include increasing life expectancy, which raises the demand for sustainable retirement income, and the growing awareness of the need for adequate retirement planning. Additionally, regulatory changes and the shift towards defined contribution plans are influencing funding strategies.

What challenges does the Pension Funding Market face?

The Pension Funding Market faces several challenges, including market volatility that can impact investment returns and the underfunding of pension plans due to insufficient contributions. Additionally, changing demographics and economic conditions can complicate funding strategies.

What opportunities exist in the Pension Funding Market?

Opportunities in the Pension Funding Market include the development of innovative pension products that cater to changing workforce dynamics and the integration of technology for better fund management. Furthermore, there is potential for increased collaboration between public and private sectors to enhance pension sustainability.

What trends are shaping the Pension Funding Market?

Trends shaping the Pension Funding Market include a growing emphasis on environmental, social, and governance (ESG) criteria in investment decisions and the rise of target-date funds that automatically adjust asset allocations. Additionally, there is an increasing focus on financial literacy and education regarding retirement planning.

Pension Funding Market

| Segmentation Details | Details |

|---|---|

| Type | Public Pension Funds, Private Pension Funds |

| Application | Government Sector, Corporate Sector, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Pension Funding Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at