444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The penetrant testing equipment market is witnessing steady growth driven by the increasing demand for non-destructive testing (NDT) solutions across various industries such as aerospace, automotive, manufacturing, and oil & gas. Penetrant testing equipment, also known as liquid penetrant inspection (LPI) or dye penetrant inspection (DPI) equipment, is used to detect surface defects, cracks, and discontinuities in components and materials. As industries strive to ensure product quality, safety, and compliance with regulatory standards, the penetrant testing equipment market is expected to continue its expansion, offering advanced solutions for defect detection and quality assurance.

Meaning

Penetrant testing equipment is a type of non-destructive testing (NDT) equipment used to detect surface-breaking defects in materials and components. This inspection method involves applying a liquid penetrant, typically a colored dye or fluorescent dye, to the surface of the test specimen. After a specified dwell time, excess penetrant is removed, and a developer is applied to draw the penetrant out of any surface defects. The resulting indications are then evaluated to identify and characterize defects such as cracks, porosity, and discontinuities, enabling quality assessment and defect analysis without damaging the test specimen.

Executive Summary

The penetrant testing equipment market is experiencing steady growth driven by the increasing emphasis on product quality, safety, and reliability across industries. Penetrant testing is widely used as a cost-effective and versatile inspection method for detecting surface defects and discontinuities in a variety of materials, including metals, plastics, ceramics, and composites. As industries adopt stringent quality standards and regulatory requirements, the demand for advanced penetrant testing equipment is expected to rise, driving market expansion and technological innovation.

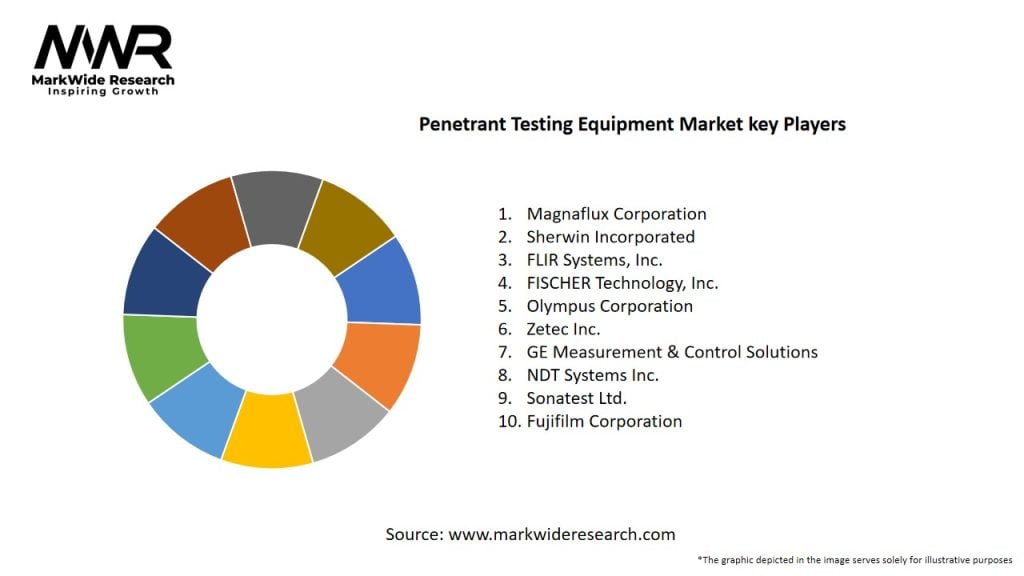

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The penetrant testing equipment market is characterized by technological innovation, regulatory compliance, and industry collaboration. Market players are focusing on product development, customer service, and strategic partnerships to address evolving customer needs and market trends in the dynamic NDT industry.

Regional Analysis

Key regions driving growth in the penetrant testing equipment market include North America, Europe, Asia-Pacific, and regions with significant manufacturing, aerospace, automotive, and oil & gas industries. These regions have high demand for penetrant testing solutions to ensure product quality, safety, and compliance with regulatory standards, driving investments in NDT technologies and infrastructure.

Competitive Landscape

Leading Companies in the Penetrant Testing Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The penetrant testing equipment market can be segmented based on equipment type, technology, application, and geography. Equipment types include manual testing systems, automated inspection systems, portable inspection kits, and accessories such as penetrant materials, developers, and cleaners. Technologies range from visible dye penetrant inspection (DPI) and fluorescent penetrant inspection (FPI) to ultrasonic penetrant inspection (UPI) and magnetic particle inspection (MPI). Applications span industries such as aerospace, automotive, manufacturing, oil & gas, power generation, and infrastructure, covering a wide range of materials, components, and structures requiring surface defect detection and quality assurance.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had mixed effects on the penetrant testing equipment market, with disruptions in global supply chains, project delays, and economic uncertainties impacting market growth in the short term. However, the pandemic has also highlighted the importance of quality assurance, safety, and reliability in critical industries such as healthcare, infrastructure, and transportation, driving investments in NDT technologies and equipment to ensure product integrity and regulatory compliance.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the penetrant testing equipment market is promising, driven by factors such as increasing demand for product quality, safety, and regulatory compliance across industries, technological advancements in NDT solutions, and growing awareness of the importance of preventive maintenance and asset integrity management. Market players are expected to capitalize on these opportunities by expanding product portfolios, enhancing performance and reliability, and leveraging digitalization and connectivity to enable smarter, more efficient, and more sustainable inspection processes in the global penetrant testing equipment market.

Conclusion

In conclusion, the penetrant testing equipment market is poised for steady growth and innovation, driven by the increasing demand for non-destructive testing solutions, stringent quality and safety requirements, and technological advancements in inspection technologies. Penetrant testing equipment plays a critical role in detecting surface defects and ensuring the integrity and reliability of components and structures across industries such as aerospace, automotive, manufacturing, and oil & gas. By focusing on innovation, collaboration, and education, industry stakeholders can unlock new opportunities and drive sustainable growth in the dynamic global penetrant testing equipment market landscape.

What is Penetrant Testing Equipment?

Penetrant Testing Equipment refers to tools and devices used in non-destructive testing to detect surface-breaking defects in materials. This equipment is essential in various industries, including aerospace, automotive, and manufacturing, to ensure the integrity and safety of components.

What are the key players in the Penetrant Testing Equipment Market?

Key players in the Penetrant Testing Equipment Market include companies like Magnaflux, NDT Systems, and Chemtronics, which provide a range of penetrant testing solutions. These companies are known for their innovative technologies and comprehensive product offerings, among others.

What are the growth factors driving the Penetrant Testing Equipment Market?

The growth of the Penetrant Testing Equipment Market is driven by increasing demand for quality assurance in manufacturing processes and the rising need for safety in critical applications. Additionally, advancements in testing technologies and the expansion of industries such as aerospace and automotive contribute to market growth.

What challenges does the Penetrant Testing Equipment Market face?

The Penetrant Testing Equipment Market faces challenges such as the high cost of advanced testing equipment and the need for skilled personnel to operate these systems. Furthermore, regulatory compliance and the availability of alternative testing methods can also pose challenges to market growth.

What opportunities exist in the Penetrant Testing Equipment Market?

Opportunities in the Penetrant Testing Equipment Market include the development of eco-friendly testing materials and the integration of automation in testing processes. As industries continue to prioritize safety and efficiency, there is potential for growth in innovative testing solutions.

What trends are shaping the Penetrant Testing Equipment Market?

Trends in the Penetrant Testing Equipment Market include the increasing adoption of digital technologies and automation in testing procedures. Additionally, there is a growing emphasis on sustainability, leading to the development of non-toxic penetrants and more efficient testing methods.

Penetrant Testing Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fluorescent Penetrants, Visible Penetrants, Solvent Removable Penetrants, Water Washable Penetrants |

| Application | Aerospace, Automotive, Manufacturing, Oil & Gas |

| End User | Defense, Energy, Transportation, Construction |

| Technology | Manual Testing, Automated Testing, Digital Testing, Non-Destructive Testing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Penetrant Testing Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at