444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The PCs and Laptops MLCC market represents a critical segment within the broader multilayer ceramic capacitor industry, specifically focused on components designed for personal computing devices. Multilayer ceramic capacitors (MLCCs) serve as essential electronic components that store and regulate electrical energy in modern computing systems, enabling stable power delivery and signal integrity across various circuit applications.

Market dynamics indicate substantial growth potential driven by increasing demand for high-performance computing devices, miniaturization trends, and advancing semiconductor technologies. The market experiences robust expansion as manufacturers integrate more sophisticated electronic components into increasingly compact laptop and desktop designs. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 8.2% over the forecast period, reflecting strong underlying demand fundamentals.

Technology evolution continues to shape market development as computing devices require higher capacitance values, improved temperature stability, and enhanced reliability. Modern PCs and laptops incorporate hundreds of MLCCs across motherboards, graphics cards, power management units, and peripheral interfaces. Industry adoption of advanced MLCC technologies reaches approximately 78% penetration in premium computing segments, demonstrating the critical role these components play in contemporary device architecture.

The PCs and Laptops MLCC market refers to the specialized segment of multilayer ceramic capacitor manufacturing and distribution focused exclusively on components designed for personal computing applications. These electronic components consist of multiple ceramic dielectric layers alternating with metallic electrode layers, creating compact capacitors capable of storing electrical charge and filtering electromagnetic interference in computing circuits.

Functional significance extends beyond simple energy storage, as MLCCs in computing applications provide power supply filtering, signal coupling and decoupling, timing circuit stabilization, and electromagnetic interference suppression. Modern computing devices rely on these components to maintain stable voltage levels, reduce electrical noise, and ensure reliable operation of sensitive semiconductor components including processors, memory modules, and graphics processing units.

Market scope encompasses various MLCC types including X7R, X5R, C0G, and Y5V dielectric formulations, each optimized for specific computing applications. The segment includes both surface-mount and through-hole configurations, with surface-mount technology dominating due to space constraints and manufacturing efficiency requirements in contemporary PC and laptop designs.

Strategic analysis reveals the PCs and Laptops MLCC market as a dynamic growth sector driven by continuous innovation in computing technology and increasing performance requirements. The market benefits from sustained demand for portable computing devices, gaming systems, and professional workstations that require advanced power management and signal integrity solutions.

Key market drivers include the proliferation of high-performance processors requiring sophisticated power delivery networks, increasing adoption of discrete graphics solutions, and growing demand for ultrabook and gaming laptop categories. Market penetration of advanced MLCC technologies in premium computing segments reaches 85% adoption rates, indicating strong market maturity and technology acceptance.

Competitive landscape features established ceramic capacitor manufacturers expanding their computing-focused product portfolios alongside specialized suppliers developing application-specific solutions. Market consolidation trends and strategic partnerships between MLCC manufacturers and computing original equipment manufacturers (OEMs) shape competitive dynamics and supply chain relationships.

Future prospects remain positive as emerging technologies including artificial intelligence processors, 5G connectivity modules, and advanced graphics processing units create new demand categories for specialized MLCC solutions. MarkWide Research analysis indicates sustained growth momentum supported by technological advancement and expanding computing device markets.

Market intelligence reveals several critical insights shaping the PCs and Laptops MLCC landscape:

Market maturity indicators suggest the segment has reached a stable growth phase with established supply chains, standardized specifications, and predictable demand patterns. However, innovation cycles continue to drive product development as computing performance requirements evolve rapidly.

Primary growth drivers propelling the PCs and Laptops MLCC market include several interconnected technological and market factors that create sustained demand for advanced capacitor solutions.

Computing Performance Evolution represents the most significant driver as modern processors require increasingly sophisticated power delivery networks. Advanced CPUs and GPUs demand stable, low-noise power supplies with rapid transient response capabilities, necessitating high-performance MLCCs for power supply filtering and decoupling applications. Performance improvements in computing devices directly correlate with MLCC specification requirements, driving demand for premium components.

Miniaturization Trends continue accelerating as manufacturers develop thinner laptops and more compact desktop systems. This trend requires MLCCs with higher capacitance density and smaller form factors, pushing technological boundaries and creating opportunities for advanced ceramic capacitor solutions. Size reduction demands drive innovation in dielectric materials and manufacturing processes.

Gaming and Professional Markets expansion creates demand for high-performance computing systems requiring specialized MLCC solutions. Gaming laptops, workstations, and content creation systems incorporate powerful graphics processing units and high-speed memory systems that depend on advanced power management and signal integrity components. Market segment growth in gaming reaches 12% annually, supporting premium MLCC demand.

Connectivity Requirements including WiFi 6, Bluetooth, and emerging 5G capabilities require additional RF filtering and signal processing components. These connectivity features increase MLCC content per device and drive demand for specialized high-frequency capacitor solutions optimized for wireless communication applications.

Market challenges facing the PCs and Laptops MLCC sector include several factors that may limit growth potential or create operational difficulties for market participants.

Raw Material Volatility represents a significant constraint as ceramic capacitor manufacturing depends on specialized materials including barium titanate, precious metals, and rare earth elements. Price fluctuations in these materials can impact manufacturing costs and profit margins, particularly affecting smaller manufacturers with limited purchasing power and inventory management capabilities.

Supply Chain Complexity creates challenges as the market relies heavily on Asian manufacturing centers while serving global computing markets. Geopolitical tensions, trade restrictions, and logistics disruptions can affect component availability and pricing stability. Supply chain risks have increased following recent global events, prompting diversification strategies among major buyers.

Technology Transition Costs burden manufacturers as advancing computing requirements necessitate continuous investment in new production capabilities and quality systems. Developing next-generation MLCC technologies requires substantial research and development expenditures alongside manufacturing equipment upgrades, creating financial pressure on market participants.

Competitive Pricing Pressure intensifies as computing OEMs seek cost reductions to maintain competitive positioning in price-sensitive market segments. This pressure can limit profit margins and reduce investment capacity for technology development, particularly affecting specialized suppliers serving niche applications.

Quality and Reliability Standards continue increasing as computing applications become more demanding, requiring enhanced testing procedures and quality assurance systems that increase manufacturing costs and complexity.

Growth opportunities within the PCs and Laptops MLCC market present significant potential for expansion and innovation across multiple dimensions.

Emerging Computing Architectures including artificial intelligence processors, quantum computing interfaces, and edge computing systems create new application categories requiring specialized MLCC solutions. These advanced computing platforms demand components with enhanced performance characteristics, creating opportunities for premium product development and market differentiation.

Automotive-Grade Computing applications represent an expanding opportunity as vehicles incorporate more sophisticated computing systems for autonomous driving, infotainment, and connectivity features. Automotive computing growth reaches 15% annually, creating demand for MLCCs meeting automotive reliability and temperature specifications while serving computing applications.

Industrial and IoT Integration opportunities emerge as industrial computing systems and Internet of Things devices require reliable, long-life components capable of operating in challenging environments. These applications often command premium pricing while offering stable, long-term demand patterns that benefit MLCC manufacturers.

Sustainability and Green Technology initiatives create opportunities for manufacturers developing environmentally friendly MLCC solutions and manufacturing processes. Computing companies increasingly prioritize sustainable supply chains, creating competitive advantages for suppliers demonstrating environmental responsibility and material innovation.

Customization and Application-Specific Solutions present opportunities for manufacturers capable of developing tailored MLCC products for specific computing applications. Close collaboration with computing OEMs can result in design wins and long-term supply relationships that provide stable revenue streams and competitive positioning.

Market dynamics within the PCs and Laptops MLCC sector reflect complex interactions between technological advancement, supply chain management, competitive positioning, and evolving customer requirements.

Demand-Supply Balance fluctuates based on computing device production cycles, seasonal purchasing patterns, and technology transition periods. The market experiences periodic tightness during new product launches or capacity constraints, followed by normalization as production scales and alternative suppliers enter the market. Capacity utilization across major manufacturers typically ranges between 75-85%, indicating healthy demand levels without excessive strain on production capabilities.

Technology Innovation Cycles drive market dynamics as computing performance requirements evolve continuously. New processor generations, graphics architectures, and connectivity standards create waves of demand for updated MLCC specifications, requiring manufacturers to balance current production with future technology development. Innovation investment represents approximately 6-8% of revenue for leading manufacturers, supporting continuous product advancement.

Competitive Intensity varies across market segments, with commodity applications experiencing price-based competition while specialized, high-performance applications support premium pricing and differentiation strategies. Market consolidation trends and strategic partnerships influence competitive dynamics and customer relationships.

Customer Relationship Evolution shows increasing collaboration between MLCC manufacturers and computing OEMs, with joint development programs and long-term supply agreements becoming more common. This trend supports market stability while requiring increased technical capabilities and customer service investments from suppliers.

Research approach for analyzing the PCs and Laptops MLCC market employs comprehensive methodologies combining primary research, secondary analysis, and industry expertise to provide accurate market insights and projections.

Primary Research Components include structured interviews with industry executives, technical specialists, and procurement professionals across the computing and electronic components value chain. Survey methodologies capture quantitative data regarding market trends, purchasing patterns, and technology preferences from representative sample groups including OEM manufacturers, distributive partners, and end-user organizations.

Secondary Research Analysis incorporates extensive review of industry publications, technical specifications, patent filings, and regulatory documentation to understand technology trends and market development patterns. Financial analysis of public companies provides insights into market size, growth rates, and competitive positioning within the broader electronic components industry.

Market Modeling Techniques utilize statistical analysis and forecasting methodologies to project market growth, segment development, and regional trends. Econometric modeling incorporates macroeconomic factors, technology adoption curves, and industry-specific variables to generate reliable market projections and scenario analysis.

Data Validation Processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and cross-reference verification with established industry benchmarks. Quality assurance procedures include peer review, statistical validation, and continuous monitoring of market developments to maintain research relevance and accuracy.

Geographic distribution of the PCs and Laptops MLCC market reflects global computing device manufacturing patterns and regional technology adoption characteristics.

Asia-Pacific Region dominates market activity with approximately 68% market share, driven by concentrated computing device manufacturing in China, Taiwan, South Korea, and Japan. The region benefits from integrated supply chains, manufacturing expertise, and proximity to major computing OEMs. Regional growth continues at 9.1% annually, supported by expanding domestic computing markets and export manufacturing capabilities.

North America represents a significant market segment focused on high-performance computing applications, gaming systems, and professional workstations. The region emphasizes premium MLCC solutions with advanced specifications and reliability requirements. Market concentration in specialized applications reaches 23% regional share, reflecting strong demand for differentiated products and technical innovation.

Europe maintains steady market presence with emphasis on industrial computing, automotive applications, and sustainability requirements. European manufacturers focus on high-quality, environmentally responsible MLCC solutions serving demanding applications. Regional market share approximates 15% with growth driven by industrial digitization and automotive electronics integration.

Emerging Markets including Latin America, Middle East, and Africa show increasing potential as computing device adoption expands and local manufacturing capabilities develop. These regions currently represent smaller market shares but demonstrate accelerating growth rates as infrastructure development and economic advancement support technology adoption.

Market competition within the PCs and Laptops MLCC sector features established ceramic capacitor manufacturers alongside specialized suppliers focused on computing applications.

Competitive strategies emphasize technology differentiation, manufacturing efficiency, customer relationship development, and geographic expansion. Leading manufacturers invest heavily in production capacity, quality systems, and technical support capabilities to maintain competitive positioning in this demanding market segment.

Market segmentation analysis reveals distinct categories within the PCs and Laptops MLCC market based on various classification criteria.

By Dielectric Type:

By Application:

By Device Type:

Detailed analysis of market categories reveals distinct characteristics and growth patterns within the PCs and Laptops MLCC segment.

Desktop PC Category maintains steady demand despite declining unit sales as remaining systems incorporate more sophisticated components requiring advanced MLCC solutions. Gaming desktops and professional workstations drive premium component demand with higher MLCC content per system. Average MLCC content in high-end desktop systems increases 25% annually due to enhanced power management requirements.

Laptop Category represents the largest and fastest-growing segment as portable computing continues expanding globally. Ultrabooks and premium laptops require miniaturized components with enhanced performance characteristics, driving demand for advanced MLCC technologies. Laptop market penetration of high-capacitance MLCCs reaches 82% in premium segments, reflecting technology adoption trends.

Gaming Systems Category shows exceptional growth as gaming popularity increases worldwide. Gaming laptops and desktops incorporate powerful graphics processing units and high-performance processors requiring sophisticated power delivery networks with extensive MLCC implementation. Gaming segment growth exceeds 14% annually, supporting premium MLCC demand.

Professional Workstation Category emphasizes reliability and performance, creating demand for automotive-grade and high-reliability MLCC solutions. These systems often operate continuously in demanding environments, requiring components with enhanced specifications and extended operational life.

Market participation in the PCs and Laptops MLCC sector provides numerous advantages for various stakeholder categories.

For MLCC Manufacturers:

For Computing OEMs:

For Supply Chain Partners:

Strategic assessment of the PCs and Laptops MLCC market reveals key strengths, weaknesses, opportunities, and threats affecting market development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the PCs and Laptops MLCC market reflect technological advancement and evolving industry requirements.

Miniaturization Acceleration continues as computing devices become thinner and more compact while incorporating additional functionality. This trend drives demand for smaller MLCC case sizes with higher capacitance density, pushing manufacturing technology boundaries and creating opportunities for advanced ceramic formulations and processing techniques.

High-Frequency Performance Enhancement becomes increasingly important as computing systems operate at higher speeds and incorporate advanced connectivity features. MLCCs must provide excellent high-frequency characteristics with low equivalent series resistance and inductance to support signal integrity in modern computing applications.

Automotive-Grade Reliability Adoption spreads beyond automotive applications as computing systems require enhanced reliability and extended operational life. Premium computing segments increasingly specify automotive-grade MLCC components to ensure system reliability and reduce warranty costs.

Sustainability and Environmental Responsibility gain importance as computing companies implement green supply chain initiatives. MLCC manufacturers invest in environmentally friendly manufacturing processes, recyclable materials, and reduced environmental impact throughout product lifecycles.

Supply Chain Diversification accelerates as computing OEMs seek to reduce supply chain risks through multiple sourcing strategies and geographic diversification. This trend creates opportunities for regional manufacturers and alternative supply chain configurations.

Customization and Application-Specific Solutions increase as computing applications become more specialized. MWR analysis indicates growing demand for tailored MLCC solutions optimized for specific computing applications rather than general-purpose components.

Recent developments within the PCs and Laptops MLCC market demonstrate ongoing innovation and strategic positioning by industry participants.

Manufacturing Capacity Expansion initiatives by major MLCC manufacturers reflect confidence in long-term market growth and commitment to meeting increasing demand. Several leading companies have announced significant capacity investments in advanced production facilities capable of producing next-generation MLCC technologies for computing applications.

Technology Partnerships between MLCC manufacturers and computing OEMs strengthen collaborative development programs for application-specific solutions. These partnerships enable joint development of optimized components while providing manufacturers with deeper market insights and customer requirements understanding.

Material Innovation Programs focus on developing advanced dielectric materials with enhanced performance characteristics including higher capacitance density, improved temperature stability, and reduced aging effects. These developments support next-generation computing requirements while addressing cost and reliability objectives.

Quality System Enhancements include implementation of advanced testing methodologies, statistical process control systems, and predictive quality management approaches. These improvements support higher reliability requirements in computing applications while reducing manufacturing costs and defect rates.

Sustainability Initiatives encompass environmental management system improvements, waste reduction programs, and development of environmentally friendly manufacturing processes. Leading manufacturers pursue sustainability certifications and implement circular economy principles in their operations.

Geographic Expansion strategies include establishment of regional manufacturing facilities, technical support centers, and distribution networks to serve growing global computing markets while reducing supply chain risks and logistics costs.

Strategic recommendations for market participants in the PCs and Laptops MLCC sector focus on positioning for sustained growth and competitive advantage.

Technology Investment Priorities should emphasize development of smaller case sizes with higher capacitance density, improved high-frequency performance characteristics, and enhanced reliability specifications. Manufacturers should allocate R&D resources toward next-generation dielectric materials and advanced manufacturing processes that support future computing requirements.

Customer Relationship Development represents a critical success factor as computing OEMs increasingly value technical collaboration and application-specific solutions. Manufacturers should invest in technical support capabilities, application engineering resources, and customer service systems that differentiate their offerings beyond basic product specifications.

Supply Chain Optimization strategies should address raw material sourcing diversification, manufacturing flexibility, and logistics efficiency. Companies should develop multiple sourcing options for critical materials while implementing lean manufacturing principles and demand forecasting systems that improve responsiveness to market changes.

Market Segment Focus should prioritize high-growth, high-value applications including gaming systems, professional workstations, and emerging computing categories such as AI processors and edge computing devices. These segments typically offer premium pricing opportunities and longer-term growth potential compared to commodity computing applications.

Geographic Expansion should consider emerging markets with growing computing adoption rates while maintaining strong positions in established markets. Companies should evaluate regional manufacturing capabilities, local partnership opportunities, and regulatory requirements that affect market entry and expansion strategies.

Long-term prospects for the PCs and Laptops MLCC market remain positive, supported by fundamental technology trends and expanding computing applications across multiple sectors.

Technology Evolution will continue driving demand for advanced MLCC solutions as computing performance requirements increase and device designs become more sophisticated. Artificial intelligence processors, quantum computing interfaces, and advanced graphics systems will create new application categories requiring specialized capacitor technologies with enhanced performance characteristics.

Market Growth Projections indicate sustained expansion at compound annual growth rates exceeding 8% over the next five years, driven by increasing computing device adoption, performance enhancement requirements, and emerging application categories. MarkWide Research forecasts particularly strong growth in gaming, professional computing, and automotive computing segments.

Industry Consolidation trends may accelerate as manufacturers seek scale advantages and technology capabilities required to serve evolving market requirements. Strategic partnerships, acquisitions, and joint ventures will likely reshape competitive dynamics while supporting technology development and market expansion initiatives.

Sustainability Integration will become increasingly important as environmental regulations strengthen and customer preferences shift toward sustainable supply chains. Manufacturers investing in green technologies and sustainable practices will gain competitive advantages in serving environmentally conscious computing companies.

Regional Market Development will support global expansion as emerging economies increase computing adoption and develop local manufacturing capabilities. This geographic diversification will create new growth opportunities while reducing supply chain concentration risks that currently characterize the market.

The PCs and Laptops MLCC market represents a dynamic and essential segment within the broader electronic components industry, characterized by steady growth, continuous technological advancement, and evolving customer requirements. Market fundamentals remain strong, supported by increasing computing performance demands, device miniaturization trends, and expanding application categories that require sophisticated capacitor solutions.

Strategic positioning for success in this market requires balanced focus on technology innovation, customer relationship development, operational efficiency, and market expansion. Leading manufacturers demonstrate the importance of investing in advanced manufacturing capabilities, application-specific product development, and technical support services that differentiate their offerings in competitive market segments.

Future opportunities emerge from emerging computing applications, sustainability initiatives, and geographic market expansion that create new demand categories and competitive positioning possibilities. Companies capable of anticipating technology trends, developing innovative solutions, and building strong customer partnerships will be best positioned to capitalize on market growth and achieve sustained competitive advantage in the evolving PCs and Laptops MLCC market.

What is PCs and Laptops MLCC?

PCs and Laptops MLCC refers to Multi-Layer Ceramic Capacitors used in personal computers and laptops. These components are essential for stabilizing voltage and filtering noise in electronic circuits, enhancing the performance and reliability of devices.

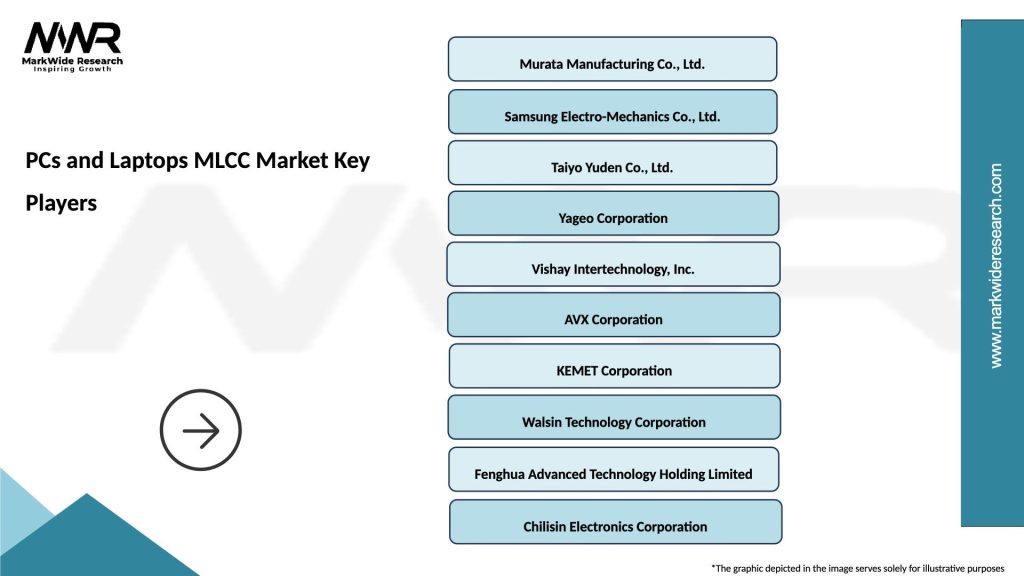

What are the key players in the PCs and Laptops MLCC Market?

Key players in the PCs and Laptops MLCC Market include Murata Manufacturing Co., Ltd., TDK Corporation, and Yageo Corporation, among others. These companies are known for their innovative capacitor technologies and extensive product portfolios.

What are the growth factors driving the PCs and Laptops MLCC Market?

The growth of the PCs and Laptops MLCC Market is driven by the increasing demand for high-performance computing devices, the rise of portable electronics, and advancements in technology that require efficient power management solutions.

What challenges does the PCs and Laptops MLCC Market face?

The PCs and Laptops MLCC Market faces challenges such as supply chain disruptions, fluctuating raw material prices, and the need for continuous innovation to meet evolving consumer demands.

What opportunities exist in the PCs and Laptops MLCC Market?

Opportunities in the PCs and Laptops MLCC Market include the growing trend of miniaturization in electronics, the expansion of the Internet of Things (IoT), and the increasing adoption of electric vehicles that require advanced capacitor technologies.

What trends are shaping the PCs and Laptops MLCC Market?

Trends in the PCs and Laptops MLCC Market include the development of high-capacitance and low-profile capacitors, the integration of MLCCs in emerging technologies like artificial intelligence, and a focus on sustainability in manufacturing processes.

PCs and Laptops MLCC Market

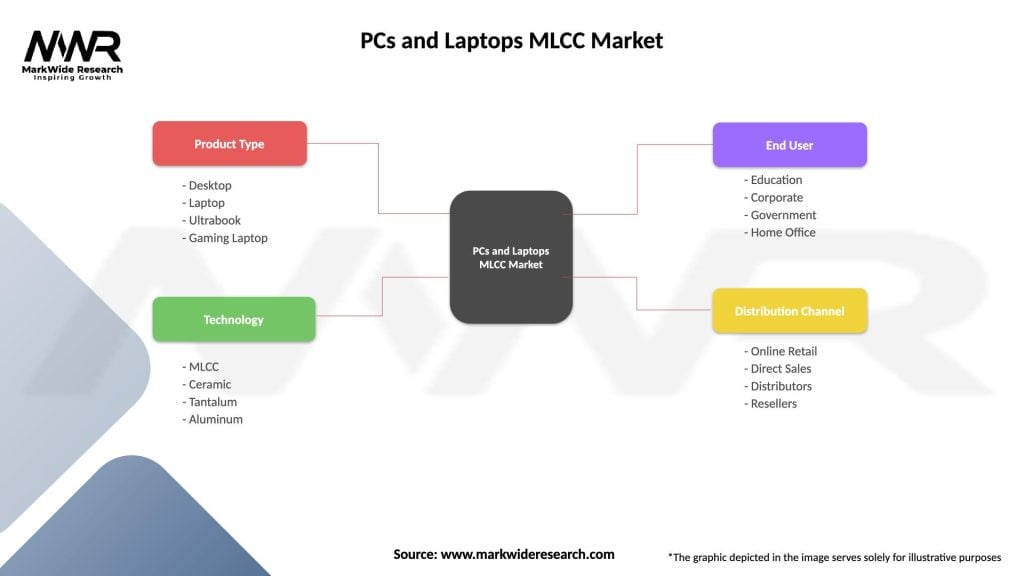

| Segmentation Details | Description |

|---|---|

| Product Type | Desktop, Laptop, Ultrabook, Gaming Laptop |

| Technology | MLCC, Ceramic, Tantalum, Aluminum |

| End User | Education, Corporate, Government, Home Office |

| Distribution Channel | Online Retail, Direct Sales, Distributors, Resellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the PCs and Laptops MLCC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at