444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Pay TV Operator market has experienced significant growth and transformation over the years. As technology continues to advance, the way we consume television has undergone a dramatic shift. Pay TV operators, also known as subscription television providers, have emerged as key players in this dynamic industry. They offer a wide range of television services, including cable TV, satellite TV, and internet protocol television (IPTV), among others. This comprehensive and SEO-optimized article delves into the Pay TV Operator market, exploring its meaning, key insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, benefits, SWOT analysis, industry trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a concluding note.

Meaning

Pay TV operators refer to companies that offer subscription-based television services to consumers. These operators enter into agreements with content providers, negotiate distribution rights, and deliver a diverse range of programming to subscribers. Pay TV services are typically provided via cable, satellite, or IPTV networks, enabling viewers to access a vast selection of channels and on-demand content.

Executive Summary

The Pay TV Operator market has witnessed remarkable growth in recent years, driven by technological advancements, increasing consumer demand for high-quality content, and the rise of streaming services. This market report provides a comprehensive analysis of the key factors shaping the industry landscape, including market drivers, restraints, and opportunities. Additionally, it explores the market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, market trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a concluding note.

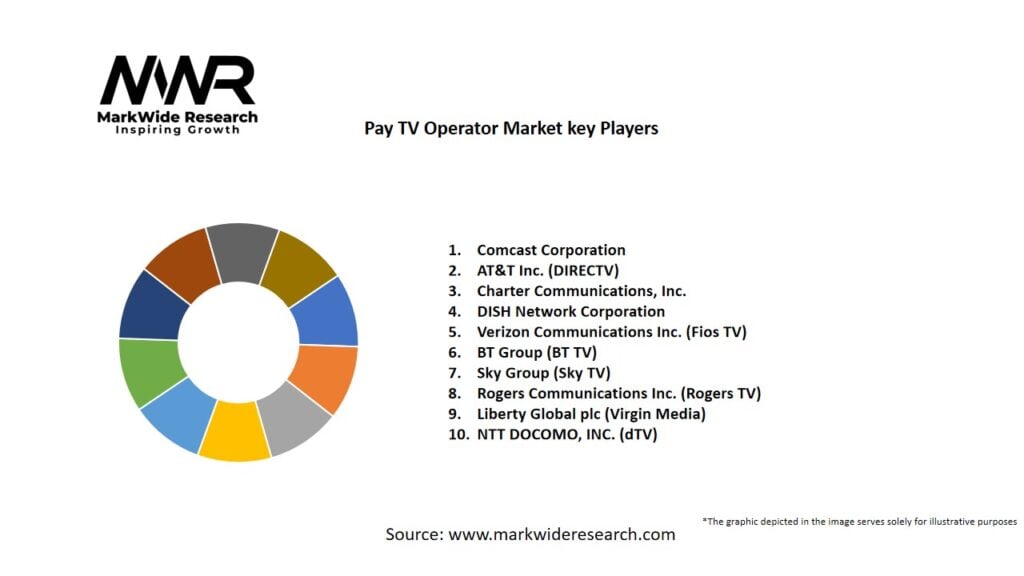

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

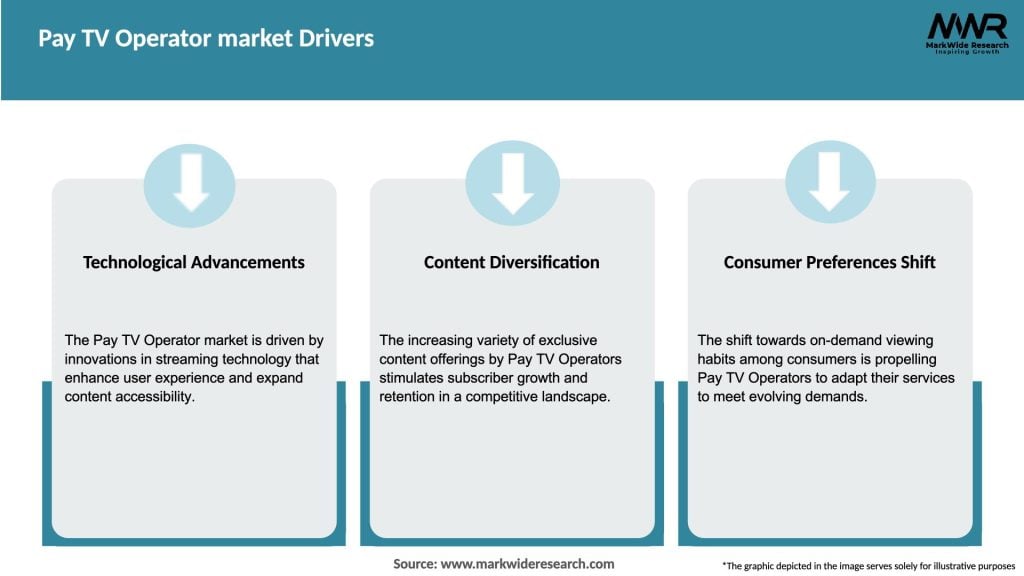

Market Drivers

The Pay TV Operator market is driven by several key factors:

Market Restraints

Despite the growth prospects, the Pay TV Operator market faces certain challenges:

Market Opportunities

The Pay TV Operator market presents several opportunities for growth and innovation:

Market Dynamics

Regional Analysis

The Pay TV Operator Market is growing across different regions, with distinct trends observed in developed and emerging markets. In Europe and North America, traditional Pay TV services still dominate, but the growth of IPTV and OTT services is reshaping the landscape. Meanwhile, in emerging markets such as Asia-Pacific, Africa, and Latin America, internet penetration and mobile TV adoption are driving the rapid expansion of Pay TV services, offering new growth opportunities for operators.

Competitive Landscape

Leading Companies in Pay TV Operator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

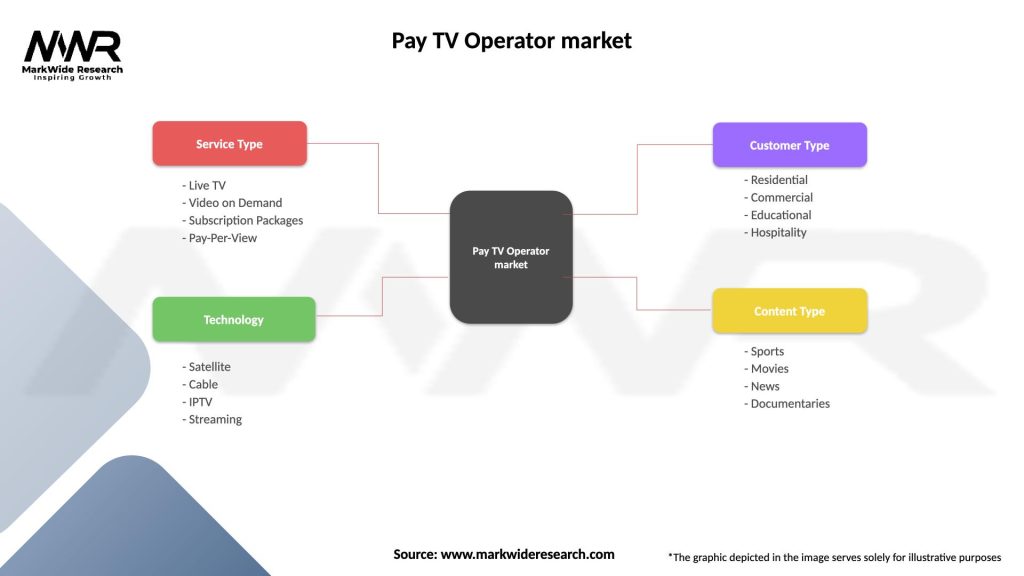

Segmentation

By Service Type

By Region

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Pay TV Operator market offers several benefits for industry participants and stakeholders:

SWOT Analysis

Market Key Trends

The Pay TV Operator market is shaped by several key trends:

Covid-19 Impact

The Covid-19 pandemic has accelerated the shift towards OTT and on-demand services as consumers seek more flexible entertainment options at home. Pay TV operators have had to adapt quickly, offering better value through digital platforms, pay-per-view content, and interactive features to cater to new consumer behaviors. The Covid-19 pandemic has had a profound impact on the Pay TV Operator market. With lockdowns and social distancing measures in place, the demand for in-home entertainment soared. Pay TV operators witnessed increased viewership, but also faced challenges related to content production, distribution, and advertising.

Key Industry Developments

The Pay TV Operator market has witnessed several significant developments:

Analyst Suggestions

Based on market trends and consumer insights, analysts suggest the following strategies for Pay TV operators:

Future Outlook

The future of the Pay TV Operator market holds immense potential and exciting possibilities. As technology continues to advance, Pay TV operators will need to adapt, innovate, and meet evolving consumer demands. Streaming services, personalized experiences, and technological integration are likely to drive the market forward.

Conclusion

The Pay TV Operator market is a dynamic and competitive industry that has witnessed significant growth and transformation. With the rise of streaming services, changing consumer preferences, and technological advancements, Pay TV operators must stay agile and adapt to the evolving landscape. By embracing new technologies, focusing on user experience, and capitalizing on market opportunities, Pay TV operators can revolutionize the television industry and continue to thrive in the digital era.

What is Pay TV Operator?

Pay TV Operator refers to companies that provide television services through subscription-based models, typically offering a range of channels and content to consumers. These operators may include cable, satellite, and IPTV services.

What are the key players in the Pay TV Operator market?

Key players in the Pay TV Operator market include Comcast, DirecTV, and Dish Network, among others. These companies compete by offering diverse programming packages and advanced technology solutions to attract subscribers.

What are the main drivers of growth in the Pay TV Operator market?

The main drivers of growth in the Pay TV Operator market include the increasing demand for high-definition content, the rise of on-demand viewing, and the expansion of bundled services that combine internet and television offerings.

What challenges do Pay TV Operators face in the current market?

Pay TV Operators face challenges such as intense competition from streaming services, changing consumer preferences towards on-demand content, and regulatory pressures that can impact pricing and service delivery.

What opportunities exist for growth in the Pay TV Operator market?

Opportunities for growth in the Pay TV Operator market include the integration of advanced technologies like artificial intelligence for personalized content recommendations and the potential for partnerships with streaming platforms to enhance service offerings.

What trends are shaping the Pay TV Operator market?

Trends shaping the Pay TV Operator market include the shift towards over-the-top (OTT) services, the increasing importance of mobile viewing, and the adoption of cloud-based solutions for content delivery and management.

Pay TV Operator market

| Segmentation Details | Description |

|---|---|

| Service Type | Live TV, Video on Demand, Subscription Packages, Pay-Per-View |

| Technology | Satellite, Cable, IPTV, Streaming |

| Customer Type | Residential, Commercial, Educational, Hospitality |

| Content Type | Sports, Movies, News, Documentaries |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Pay TV Operator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at