444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The paper packaging materials market is witnessing steady growth due to increasing demand for sustainable packaging solutions across various industries. As businesses and consumers embrace eco-friendly alternatives, paper packaging materials have emerged as a viable and environmentally-conscious choice. This comprehensive market analysis provides insights into the current state of the paper packaging materials industry, its key drivers, challenges, opportunities, regional dynamics, and future outlook. The paper packaging materials market refers to the production, distribution, and use of paper-based materials for packaging purposes. These materials include corrugated boxes, paper bags, cartons, wrapping paper, and other forms of packaging made primarily from paper and cardboard. The market has experienced significant growth in recent years, driven by the increasing focus on sustainable packaging solutions and rising awareness of the environmental impact of non-biodegradable alternatives.

Paper packaging materials play a vital role in safeguarding products during transportation, enhancing shelf appeal, and providing a sustainable alternative to plastic-based packaging. By utilizing renewable resources and being easily recyclable, paper packaging materials contribute to reducing carbon emissions and minimizing waste generation, making them an environmentally responsible choice for businesses and consumers alike.

Executive Summary

The paper packaging materials market is expected to witness steady growth in the coming years, driven by factors such as increased consumer awareness of sustainability, stringent regulations on plastic packaging, and the rising demand for eco-friendly solutions. This executive summary provides a concise overview of the market’s key findings, highlighting the market’s potential, growth opportunities, and challenges that industry participants need to navigate.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Corrugated board accounts for over 60% of paper packaging volume but is innovating with micro-flutes and recycled-content grades to reduce weight and carbon footprint.

Folding cartons are expanding in pharmaceuticals and personal care, where high-quality graphics and shelf-presence matter most.

Barrier-coated papers for liquids and grease-resistant food wraps are growing at 8–10% annually, capturing share from polyethylene-lined alternatives.

Digital printing on paper packaging enables shorter runs, versioning, and rapid turnaround, appealing to e-tailers and premium brands.

Europe and North America lead regulatory pushes on plastic reduction, while Asia-Pacific sees fastest volume gains due to e-commerce and organized retail growth.

Market Drivers

Regulatory Bans and Taxes: Government mandates on single-use-plastic reduction and landfill levies incentivize paper alternatives across retail and foodservice.

Consumer Sustainability Preferences: Surveys show over 70% of shoppers prefer brands using recyclable or compostable packaging, steering brand strategies toward paper.

E-Commerce Proliferation: Online sales require robust yet lightweight shipping cartons and mailers, boosting corrugated and paperboard demand.

Circular Economy Initiatives: Brand commitments to 100% recyclable or reusable packaging by 2025–2030 are accelerating paper adoption.

Technological Advancements: Development of water-based barrier coatings, adhesive systems, and digital print finishing enhances paper’s performance parity with plastics.

Market Restraints

Raw Material Volatility: Fluctuations in pulp and recovered fiber prices can impact paperboard cost structures and profitability.

Infrastructure Gaps: In emerging markets, limited recycling and corrugated box converting capacity can constrain supply and lead times.

Performance Limitations: Although improving, paper still trails plastics in moisture and gas barrier performance for certain sensitive products.

Capital Expenditure Needs: Upgrading converting lines for coated or digitally printed paper can require significant investment.

Weight and Durability Trade-Offs: Lightweighting efforts can sometimes compromise stacking strength or protective cushioning in corrugated packaging.

Market Opportunities

Next-Gen Barrier Coatings: Bio-based and recyclable barrier lamination technologies will open new food, beverage, and chemical packaging segments.

Smart Packaging Integration: Embedding QR codes, NFC tags, and augmented-reality artwork on paperboard can enhance consumer engagement without plastics.

Recycled-Content Premiumization: Brands are willing to pay slight price premiums for paper with certified high recycled fiber content (90%+).

Growth in Flexible Paper: Paper pouches and lined paper bags with compostable films are capturing share in snack, coffee, and liquid milk packaging.

Regional Converting Hubs: Building local corrugators and carton plants in high-growth regions—South America, Southeast Asia, Africa—reduces logistics cost and lead times.

Market Dynamics

Consolidation and Partnerships: Paper producers and specialty converters are forming joint ventures to co-develop barrier materials and digital finishing capabilities.

Digital Transformation: Advanced automation, robotics, and IoT monitoring in mills and converting lines improve efficiency and quality control.

Brand-Led Innovation: Major consumer goods companies are co-innovating with paper suppliers to design package formats that reduce material use while maintaining shelf impact.

Recycling Ecosystem Development: Investment in collection, sorting, and pulping infrastructure supports closed-loop systems and stable recovered fiber supply.

Sustainability Reporting: Public disclosure of packaging environmental impact (via EPDs, carbon labeling) is influencing purchasing decisions and regulation.

Regional Analysis

The paper packaging materials market exhibits regional variations, influenced by factors like consumer demographics, economic growth, and sustainability initiatives. Key regional insights include:

Competitive Landscape

Leading Companies in the Paper Packaging Materials Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

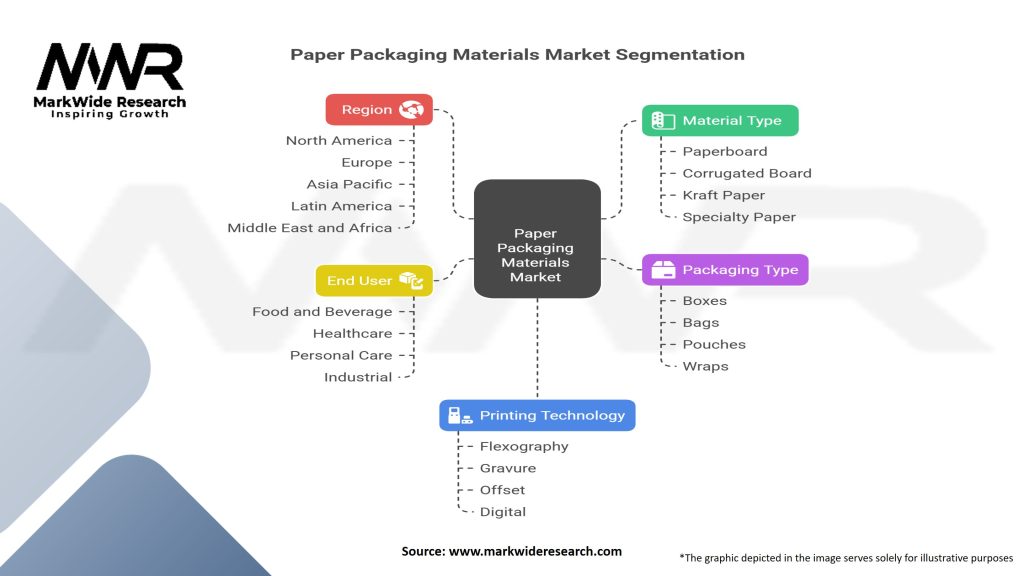

Segmentation

The paper packaging materials market can be segmented based on various factors, including material type, end-use industry, and geographical region. This segmentation provides a deeper understanding of market trends and helps identify targeted opportunities. The main segments include:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a mixed impact on the paper packaging materials market. While certain sectors, such as food and healthcare, witnessed increased demand, others, like retail and hospitality, faced temporary setbacks. Overall, the pandemic highlighted the importance of resilient and sustainable packaging solutions to maintain supply chains and ensure product safety.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the paper packaging materials market looks promising, driven by the global shift towards sustainable and eco-friendly practices. The industry will witness continuous innovation, collaborations, and regulatory support to meet the growing demand for environmentally responsible packaging solutions. As consumer awareness increases, the paper packaging materials market is expected to experience steady growth, providing ample opportunities for industry participants.

Conclusion

The paper packaging materials market offers a sustainable and eco-friendly alternative to conventional packaging materials. With increasing consumer demand, regulatory support, and technological advancements, the market is poised for growth. Industry participants can leverage these opportunities by focusing on innovation, market diversification, and strategic partnerships. By adopting sustainable practices and offering environmentally conscious packaging solutions, businesses can position themselves at the forefront of the evolving paper packaging materials market.

What are Paper Packaging Materials?

Paper packaging materials refer to various types of packaging made from paper products, including boxes, bags, and wraps. These materials are widely used for their lightweight, recyclable, and biodegradable properties, making them suitable for a range of applications in food, retail, and consumer goods.

What are the key companies in the Paper Packaging Materials Market?

Key companies in the Paper Packaging Materials Market include International Paper, WestRock, Smurfit Kappa, and Mondi Group, among others.

What are the growth factors driving the Paper Packaging Materials Market?

The growth of the Paper Packaging Materials Market is driven by increasing consumer demand for sustainable packaging solutions, the rise of e-commerce, and the need for eco-friendly alternatives to plastic packaging. Additionally, regulatory pressures to reduce plastic waste are also contributing to market expansion.

What challenges does the Paper Packaging Materials Market face?

The Paper Packaging Materials Market faces challenges such as fluctuating raw material prices, competition from alternative packaging materials, and the need for continuous innovation to meet changing consumer preferences. These factors can impact profitability and market stability.

What opportunities exist in the Paper Packaging Materials Market?

Opportunities in the Paper Packaging Materials Market include the development of innovative packaging designs, the expansion of biodegradable and compostable materials, and the growing trend of sustainable packaging among brands. These factors can enhance market growth and attract new investments.

What trends are shaping the Paper Packaging Materials Market?

Trends shaping the Paper Packaging Materials Market include the increasing adoption of digital printing technologies, the rise of minimalistic packaging designs, and a focus on circular economy practices. These trends reflect a shift towards more sustainable and efficient packaging solutions.

Paper Packaging Materials Market:

| Segmentation | Details |

|---|---|

| Material Type | Paperboard, Corrugated Board, Kraft Paper, Specialty Paper, Others |

| Packaging Type | Boxes, Bags, Pouches, Wraps, Others |

| End User | Food and Beverage, Healthcare, Personal Care, Industrial, Others |

| Printing Technology | Flexography, Gravure, Offset, Digital, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Paper Packaging Materials Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at