444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Outsource Debt Collection Services market represents a vital sector within the broader financial industry, offering specialized services to businesses and financial institutions for the recovery of overdue debts. These services involve the outsourcing of debt collection activities to third-party agencies or service providers, relieving organizations of the burden of managing delinquent accounts internally. With the increasing complexity of debt recovery processes, stringent regulatory requirements, and the rising volume of non-performing loans, the demand for outsourced debt collection services is experiencing steady growth.

Meaning

Outsource Debt Collection Services involve the transfer of delinquent accounts or overdue debts from creditors to specialized agencies or service providers for the purpose of recovery. These services encompass a range of activities, including contacting debtors, negotiating repayment arrangements, and pursuing legal action if necessary. Outsourcing debt collection allows creditors to focus on core business operations while leveraging the expertise and resources of external partners to recover outstanding debts in a timely and efficient manner.

Executive Summary

The Outsource Debt Collection Services market is witnessing increased demand as businesses and financial institutions seek to improve liquidity, reduce credit risk, and optimize cash flow by outsourcing debt recovery activities. Outsourced debt collection offers benefits such as cost savings, scalability, and compliance with regulatory requirements. However, challenges such as reputation risk, data security concerns, and regulatory compliance must be addressed to ensure the success of outsourced debt collection initiatives.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Key insights driving the Outsource Debt Collection Services market include:

Market Drivers

Drivers fueling the growth of the Outsource Debt Collection Services market include:

Market Restraints

Challenges restraining market growth include:

Market Opportunities

Opportunities for growth in the Outsource Debt Collection Services market include:

Market Dynamics

Dynamic factors shaping the Outsource Debt Collection Services market include regulatory changes, economic conditions, technological advancements, and consumer behavior. Outsourced debt collection providers must navigate these dynamics by adopting a customer-centric approach, ensuring compliance with regulatory requirements, and leveraging technology to enhance operational efficiency and effectiveness.

Regional Analysis

Regional variations in economic conditions, legal frameworks, and cultural norms influence the demand for outsourced debt collection services. While developed markets such as North America and Europe lead in terms of market maturity and regulatory oversight, emerging markets in Asia Pacific and Latin America offer significant growth opportunities for outsourced debt collection providers.

Competitive Landscape

Leading companies Outsource Debt Collection Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

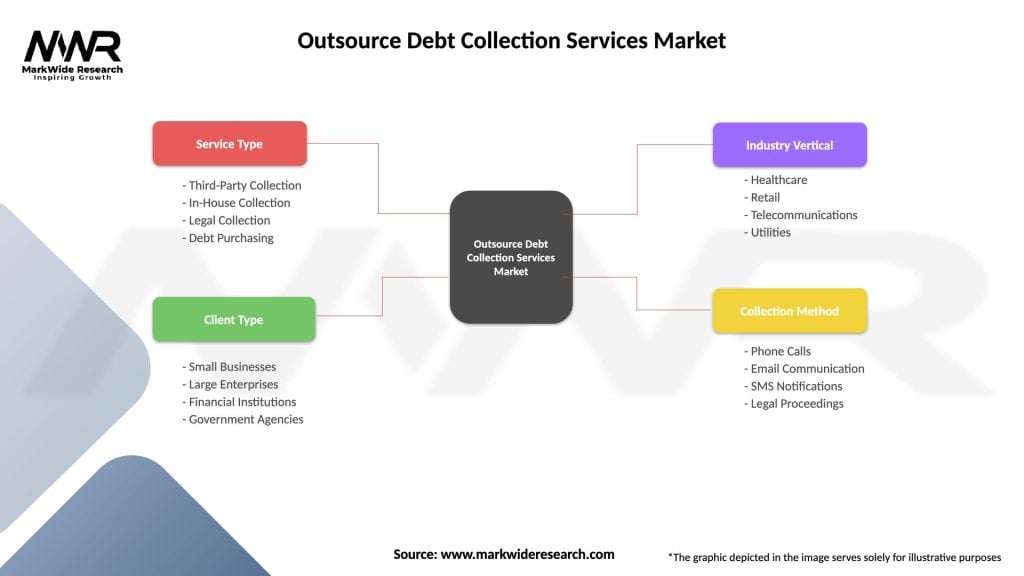

Segmentation

Segmentation of the Outsource Debt Collection Services market can be based on factors such as industry vertical, debt type, geographic region, and service offering. Understanding the unique needs and preferences of different customer segments enables outsourced debt collection providers to tailor their solutions and value propositions for maximum impact.

Category-wise Insights

Outsource Debt Collection Services encompass a range of activities and solutions tailored to specific customer needs:

Key Benefits for Industry Participants and Stakeholders

Benefits of outsourcing debt collection services include:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats of outsourcing debt collection services, guiding strategic decision-making for industry participants.

Market Key Trends

Trends shaping the Outsource Debt Collection Services market’s trajectory include:

Covid-19 Impact

The Covid-19 pandemic has had significant implications for the Outsource Debt Collection Services market, including:

Key Industry Developments

Recent developments in the Outsource Debt Collection Services market include:

Analyst Suggestions

Recommendations for businesses and financial institutions considering outsourcing debt collection services include:

Future Outlook

The Outsource Debt Collection Services market is poised for continued growth and evolution as businesses and financial institutions seek to optimize debt recovery processes, mitigate credit risk, and enhance customer experiences. Key trends such as digital transformation, regulatory compliance, and alternative debt recovery methods will shape the future of outsourced debt collection services.

Conclusion

Outsource Debt Collection Services play a critical role in the financial ecosystem, providing specialized expertise, resources, and technology solutions for the recovery of overdue debts and non-performing loans. Despite challenges such as regulatory compliance, data security, and reputation risk, outsourced debt collection offers benefits such as improved recovery rates, reduced operational costs, and enhanced compliance. By partnering with experienced outsourced debt collection providers and adopting best practices in debt recovery management, businesses and financial institutions can optimize their debt collection processes and achieve better outcomes in an increasingly complex and challenging operating environment.

What is Outsource Debt Collection Services?

Outsource Debt Collection Services refer to the practice of hiring third-party agencies to manage and recover outstanding debts on behalf of businesses. These services can include various methods of debt recovery, such as phone calls, letters, and legal actions, aimed at improving cash flow and reducing the burden on internal resources.

What are the key players in the Outsource Debt Collection Services Market?

Key players in the Outsource Debt Collection Services Market include companies like Convergent Outsourcing, Inc., CBE Group, and Encore Capital Group, which provide a range of debt recovery solutions. These companies often specialize in different sectors, such as healthcare, retail, and financial services, among others.

What are the main drivers of growth in the Outsource Debt Collection Services Market?

The growth of the Outsource Debt Collection Services Market is driven by increasing consumer debt levels, the need for businesses to improve cash flow, and the rising complexity of debt recovery processes. Additionally, advancements in technology and data analytics are enhancing the efficiency of collection strategies.

What challenges does the Outsource Debt Collection Services Market face?

The Outsource Debt Collection Services Market faces challenges such as regulatory compliance issues, negative consumer perceptions, and the potential for high operational costs. These factors can hinder the effectiveness of collection efforts and impact the reputation of service providers.

What opportunities exist in the Outsource Debt Collection Services Market?

Opportunities in the Outsource Debt Collection Services Market include the integration of advanced technologies like artificial intelligence and machine learning to optimize collection processes. Additionally, expanding into emerging markets and offering specialized services for different industries can drive growth.

What trends are shaping the Outsource Debt Collection Services Market?

Trends in the Outsource Debt Collection Services Market include the increasing use of digital communication channels, such as email and text messaging, for debt collection. There is also a growing emphasis on ethical collection practices and customer-centric approaches to improve recovery rates and maintain positive relationships.

Outsource Debt Collection Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Third-Party Collection, In-House Collection, Legal Collection, Debt Purchasing |

| Client Type | Small Businesses, Large Enterprises, Financial Institutions, Government Agencies |

| Industry Vertical | Healthcare, Retail, Telecommunications, Utilities |

| Collection Method | Phone Calls, Email Communication, SMS Notifications, Legal Proceedings |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies Outsource Debt Collection Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at