444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The orthokeratology market is witnessing significant growth due to advancements in vision correction technology. Orthokeratology, also known as Ortho-K or corneal reshaping therapy, is a non-surgical approach to correct refractive errors such as myopia (nearsightedness). It involves the use of specially designed gas-permeable contact lenses that gently reshape the cornea overnight, providing clear vision during the day without the need for glasses or traditional contact lenses.

Meaning

Orthokeratology offers a revolutionary alternative to conventional vision correction methods. By temporarily altering the shape of the cornea, Ortho-K lenses help correct refractive errors. This safe and reversible procedure is particularly popular among individuals who wish to reduce their dependence on glasses or contact lenses during daily activities.

Executive Summary

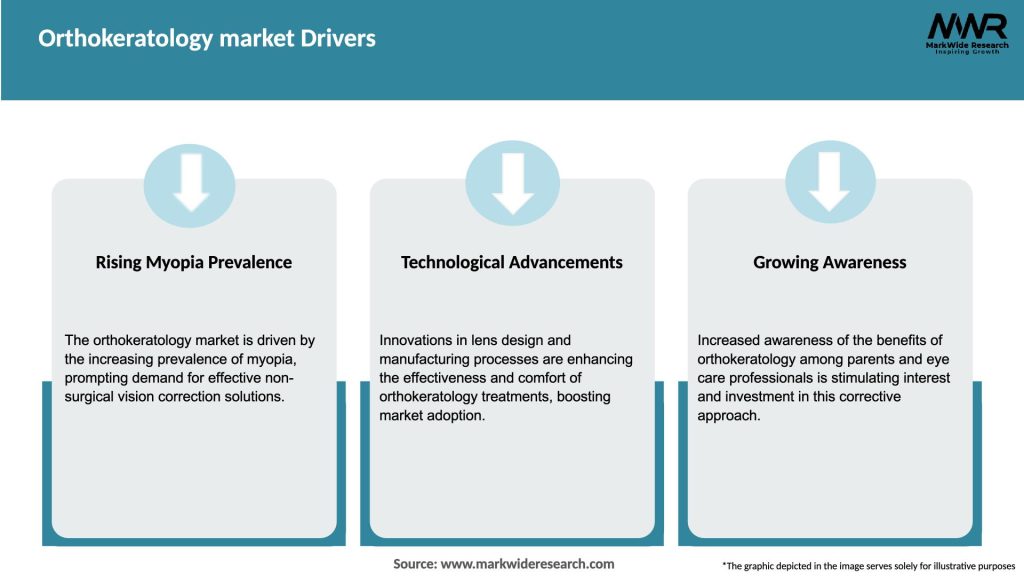

The orthokeratology market is experiencing robust growth, driven by the increasing prevalence of myopia worldwide and the rising demand for non-invasive vision correction solutions. This executive summary provides a concise overview of the market, highlighting key insights and trends that are shaping the industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The orthokeratology market is dynamic and influenced by various factors, including changing demographics, technological advancements, and shifting consumer preferences. The increasing demand for non-invasive vision correction methods and the rising prevalence of myopia are the primary drivers behind the market’s growth. However, limited availability of skilled practitioners and the initial cost of Ortho-K lenses act as restraints. Nonetheless, emerging markets and ongoing technological advancements present significant opportunities for market expansion.

Regional Analysis

The orthokeratology market exhibits regional variations in terms of adoption and market size. North America and Europe have witnessed substantial growth due to high awareness and advanced healthcare infrastructure. Asia Pacific, particularly countries like China, Japan, and South Korea, holds immense potential due to the large population and a high prevalence of myopia. The market in Latin America and the Middle East is also expected to grow steadily as awareness increases.

Competitive Landscape

Leading Companies in the Orthokeratology Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

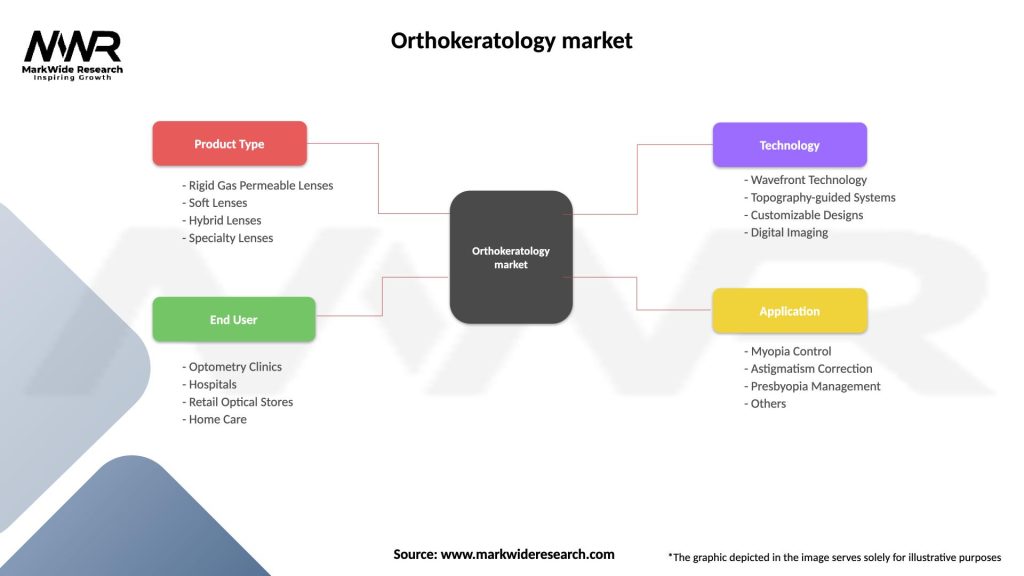

Segmentation

The orthokeratology market can be segmented by:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths: Ortho-K provides an effective solution for myopia correction, offering clear vision during the day without the need for glasses. It also helps slow down the progression of myopia, making it a valuable option for patients and eye care professionals.

Weaknesses: The limited availability of skilled practitioners and the initial cost of Ortho-K lenses can be perceived as barriers to adoption. Moreover, the treatment requires strict compliance and regular follow-up visits, which may not suit everyone’s lifestyle.

Opportunities: The growing prevalence of myopia, particularly in emerging markets, presents significant growth opportunities for the orthokeratology market. Technological advancements and ongoing research can further enhance the effectiveness and comfort of Ortho-K lenses.

Threats: Surgical alternatives such as LASIK surgery and the development of alternative vision correction methods may pose a threat to the orthokeratology market. Additionally, stringent regulations and reimbursement policies in some regions can impact market growth.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the orthokeratology market. While the initial phase of the pandemic led to temporary disruptions in manufacturing and supply chains, the market quickly rebounded as restrictions eased. The increased adoption of online platforms for purchasing lenses and remote consultations with eye care professionals also contributed to market growth during the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the orthokeratology market looks promising, with sustained growth expected in the coming years. The increasing prevalence of myopia, coupled with advancements in lens technology and myopia control research, will drive market expansion. As awareness grows and more skilled practitioners enter the field, Ortho-K is likely to become a mainstream vision correction option globally.

Conclusion

The orthokeratology market is experiencing significant growth driven by factors such as the rising prevalence of myopia, increasing demand for non-invasive vision correction, and technological advancements in lens design. While challenges such as limited availability of skilled practitioners and the initial cost of Ortho-K lenses exist, the market presents lucrative opportunities in emerging markets and ongoing technological advancements. With a focus on myopia control, collaboration, and expanding awareness, the future outlook for the orthokeratology market is promising, with Ortho-K poised to transform vision correction worldwide.

What is Orthokeratology?

Orthokeratology is a non-surgical procedure that uses specially designed gas-permeable contact lenses to reshape the cornea temporarily. This treatment is primarily used to correct myopia and is often sought by individuals looking for an alternative to glasses or traditional contact lenses.

What are the key players in the Orthokeratology market?

Key players in the Orthokeratology market include companies like Bausch + Lomb, Johnson & Johnson Vision, and CooperVision, which are known for their innovative lens designs and technologies. These companies focus on developing advanced products to enhance patient comfort and vision correction, among others.

What are the growth factors driving the Orthokeratology market?

The Orthokeratology market is driven by increasing awareness of myopia management, a growing preference for non-surgical vision correction options, and advancements in lens technology. Additionally, the rising prevalence of myopia among children and young adults contributes to market growth.

What challenges does the Orthokeratology market face?

Challenges in the Orthokeratology market include the need for proper patient education and compliance, as well as potential risks associated with lens wear, such as infections. Furthermore, competition from alternative vision correction methods can hinder market expansion.

What future opportunities exist in the Orthokeratology market?

Future opportunities in the Orthokeratology market include the development of new lens materials and designs that enhance comfort and effectiveness. Additionally, expanding awareness campaigns and partnerships with eye care professionals can help increase adoption rates among consumers.

What trends are currently shaping the Orthokeratology market?

Current trends in the Orthokeratology market include the increasing use of digital tools for patient management and the rise of personalized treatment plans. Moreover, there is a growing interest in sustainable practices within the industry, such as eco-friendly lens materials.

Orthokeratology market

| Segmentation Details | Description |

|---|---|

| Product Type | Rigid Gas Permeable Lenses, Soft Lenses, Hybrid Lenses, Specialty Lenses |

| End User | Optometry Clinics, Hospitals, Retail Optical Stores, Home Care |

| Technology | Wavefront Technology, Topography-guided Systems, Customizable Designs, Digital Imaging |

| Application | Myopia Control, Astigmatism Correction, Presbyopia Management, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Orthokeratology Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at