444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview: The oral surgery motor market comprises devices used by oral surgeons and dentists to perform various surgical procedures in the oral cavity, including dental implant placement, bone grafting, and tooth extraction. These motorized systems provide precise control, high torque, and variable speed settings, enabling clinicians to perform complex oral surgeries with accuracy and efficiency. The market for oral surgery motors is driven by factors such as the increasing prevalence of dental disorders, technological advancements in dental equipment, and growing demand for minimally invasive surgical techniques.

Meaning: Oral surgery motors are specialized devices designed for use in oral and maxillofacial surgeries to provide power and control during procedures such as dental implant placement, bone augmentation, and soft tissue management. These motors are equipped with handpieces, contra-angles, and attachments that allow for precise cutting, drilling, and manipulation of oral tissues while minimizing trauma and discomfort for patients. Oral surgery motors play a crucial role in modern dental practice, facilitating the delivery of high-quality care and optimal treatment outcomes.

Executive Summary: The oral surgery motor market is experiencing significant growth driven by the rising demand for advanced dental equipment, increasing adoption of dental implant procedures, and expanding applications of oral surgery in restorative and cosmetic dentistry. Key market players are focusing on product innovation, ergonomic design, and integration of digital technologies to enhance surgical precision, patient comfort, and clinical outcomes. With the growing emphasis on minimally invasive techniques and patient-centered care, the oral surgery motor market is poised for continued expansion in the dental industry.

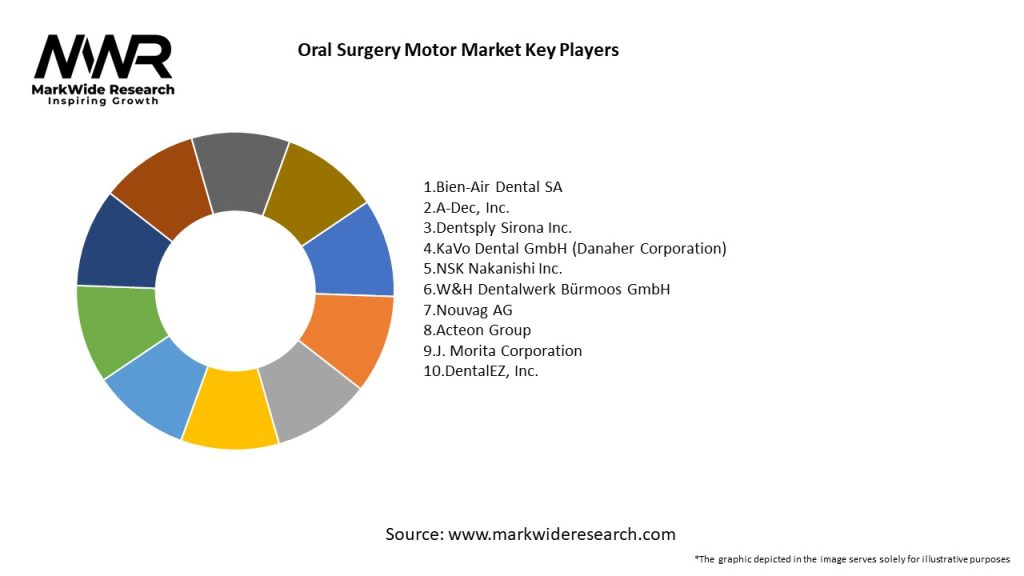

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The oral surgery motor market is characterized by dynamic interactions between technological advancements, clinical practices, regulatory requirements, and market dynamics. Market players need to navigate these dynamics by leveraging innovation, education, and strategic partnerships to capitalize on emerging opportunities and address evolving challenges in the global dental industry.

Regional Analysis: The oral surgery motor market exhibits regional variations influenced by factors such as population demographics, healthcare infrastructure, reimbursement policies, and regulatory frameworks. Developed regions such as North America and Europe lead the market in terms of technology adoption, dental expenditures, and clinical expertise. Emerging economies in Asia Pacific, Latin America, and the Middle East offer significant growth potential driven by rising dental tourism, healthcare investments, and oral health awareness initiatives.

Competitive Landscape:

Leading Companies in Oral Surgery Motor Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The oral surgery motor market can be segmented based on product type, technology, application, end-user, and geography. Product types include electric motors, pneumatic motors, and ultrasonic motors. Technologies encompass brushless motors, electric micromotors, and piezoelectric systems. Applications range from dental implantology and periodontal surgery to endodontic procedures and oral cancer treatment. End-users encompass dental clinics, hospitals, ambulatory surgical centers, and academic institutions.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has affected the oral surgery motor market by disrupting dental services, elective surgeries, and supply chains worldwide. While the pandemic has led to challenges such as practice closures, patient cancellations, and financial uncertainties, it has also highlighted the importance of infection control, safety protocols, and digital technologies in ensuring the continuity of dental care delivery. The pandemic has accelerated trends such as telemedicine, teledentistry, and digital workflows, driving innovation, resilience, and adaptation in the dental industry.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The oral surgery motor market is poised for significant growth driven by increasing demand for dental implant procedures, technological advancements in dental equipment, and expanding applications of oral surgery in restorative and cosmetic dentistry. Emerging trends such as digital dentistry, minimally invasive surgery, and interdisciplinary collaboration are expected to shape the future landscape of the oral surgery motor market, driving innovation, market expansion, and transformation in the global dental industry. By embracing innovation, education, and patient-centered care, stakeholders can capitalize on emerging opportunities and address evolving challenges in oral surgery practice and implant dentistry.

Conclusion: The oral surgery motor market represents a vital segment of the global dental industry, offering advanced motorized systems for precision, efficiency, and safety in oral and maxillofacial surgeries. With their ergonomic design, high torque, and variable speed settings, oral surgery motors play a crucial role in modern dental practice, enabling clinicians to perform complex procedures with accuracy and confidence. By investing in innovation, education, and patient-centered care, stakeholders can drive sustainable growth, enhance clinical outcomes, and advance oral surgery practice and implant dentistry in the 21st century.

What is Oral Surgery Motor?

Oral Surgery Motor refers to specialized surgical instruments used in dental procedures, particularly in oral and maxillofacial surgeries. These motors provide precision and control for various applications, including tooth extractions, implant placements, and bone surgeries.

What are the key players in the Oral Surgery Motor Market?

Key players in the Oral Surgery Motor Market include companies like NSK, KaVo Dental, and Dentsply Sirona, which are known for their innovative surgical solutions and advanced technologies in dental care, among others.

What are the growth factors driving the Oral Surgery Motor Market?

The Oral Surgery Motor Market is driven by factors such as the increasing prevalence of dental disorders, advancements in surgical technologies, and a growing demand for minimally invasive procedures. Additionally, the rise in cosmetic dentistry is contributing to market growth.

What challenges does the Oral Surgery Motor Market face?

Challenges in the Oral Surgery Motor Market include high costs associated with advanced surgical equipment and the need for skilled professionals to operate these devices. Furthermore, regulatory hurdles can also impact market entry for new technologies.

What opportunities exist in the Oral Surgery Motor Market?

Opportunities in the Oral Surgery Motor Market include the development of innovative motor technologies and the expansion of dental services in emerging markets. Additionally, increasing awareness about oral health is likely to boost demand for surgical motors.

What trends are shaping the Oral Surgery Motor Market?

Trends in the Oral Surgery Motor Market include the integration of digital technologies, such as computer-assisted surgery, and the growing preference for electric motors over traditional handpieces. These innovations are enhancing precision and efficiency in oral surgeries.

Oral Surgery Motor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Motors, Pneumatic Motors, Battery-Powered Motors, Hybrid Motors |

| Application | Implant Surgery, Extractions, Bone Grafting, Periodontal Procedures |

| End User | Dental Clinics, Hospitals, Research Institutions, Private Practices |

| Technology | Micromotor Technology, Piezoelectric Technology, Electromechanical Technology, Robotics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Oral Surgery Motor Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at