444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Optical Gas Imaging (OGI) Equipment market encompasses advanced technologies used for detecting and visualizing fugitive gas emissions in industrial environments. These specialized devices utilize infrared cameras to detect gases such as methane, sulfur hexafluoride (SF6), and volatile organic compounds (VOCs) that are invisible to the naked eye. OGI equipment plays a crucial role in enhancing safety, minimizing environmental impact, and ensuring regulatory compliance across industries such as oil and gas, chemical processing, and environmental monitoring.

Meaning

Optical Gas Imaging Equipment refers to sophisticated tools equipped with infrared cameras designed to detect and visualize gas leaks and emissions in real-time. By capturing thermal images of gases that absorb infrared light, OGI equipment enables swift identification and localization of leaks, facilitating prompt remediation actions to prevent potential safety hazards and environmental contamination.

Executive Summary

The Optical Gas Imaging Equipment market is driven by stringent environmental regulations, increasing emphasis on industrial safety, and technological advancements in sensor technologies. Key market players focus on enhancing detection accuracy, expanding application capabilities, and integrating data analytics for comprehensive gas leak detection and mitigation solutions.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Optical Gas Imaging Equipment market is characterized by evolving regulatory landscapes, technological innovations, and strategic collaborations aimed at expanding market penetration and addressing industry-specific challenges.

Regional Analysis

Competitive Landscape

Leading companies in the Optical Gas Imaging Equipment market focus on product innovation, strategic partnerships, and geographic expansion to strengthen market presence and capitalize on growing demand for advanced gas detection solutions.

Segmentation

The Optical Gas Imaging Equipment market segments by technology (cooled vs. uncooled cameras), application (oil and gas, chemical processing, utilities), and end-user (industrial, commercial, environmental agencies), offering tailored solutions for diverse operational requirements and regulatory compliance needs.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

Key Industry Developments

Analyst Suggestions

Based on market trends and industry dynamics, analysts recommend the following strategies for industry participants:

Future Outlook

The future outlook for the Optical Gas Imaging Equipment market is promising, driven by regulatory mandates, technological advancements, and increasing awareness of environmental sustainability. Manufacturers and developers prioritizing innovation, regulatory compliance, and sustainability initiatives are well-positioned to capitalize on emerging opportunities and sustain long-term growth in the global market.

Conclusion

In conclusion, Optical Gas Imaging Equipment plays a critical role in industrial safety, environmental compliance, and operational efficiency by enabling real-time detection and visualization of fugitive gas emissions. Despite challenges such as high costs and technological complexities, the market continues to evolve through innovation, strategic partnerships, and regulatory advancements. By focusing on innovation, market expansion, and collaborative industry initiatives, stakeholders can navigate market dynamics, capitalize on growth opportunities, and drive sustainable development in the global Optical Gas Imaging Equipment market.

What is Optical Gas Imaging Equipment?

Optical Gas Imaging Equipment refers to specialized devices used to detect and visualize gas leaks in various industrial applications. These instruments utilize infrared technology to identify gases that are otherwise invisible to the naked eye, making them essential for safety and environmental monitoring.

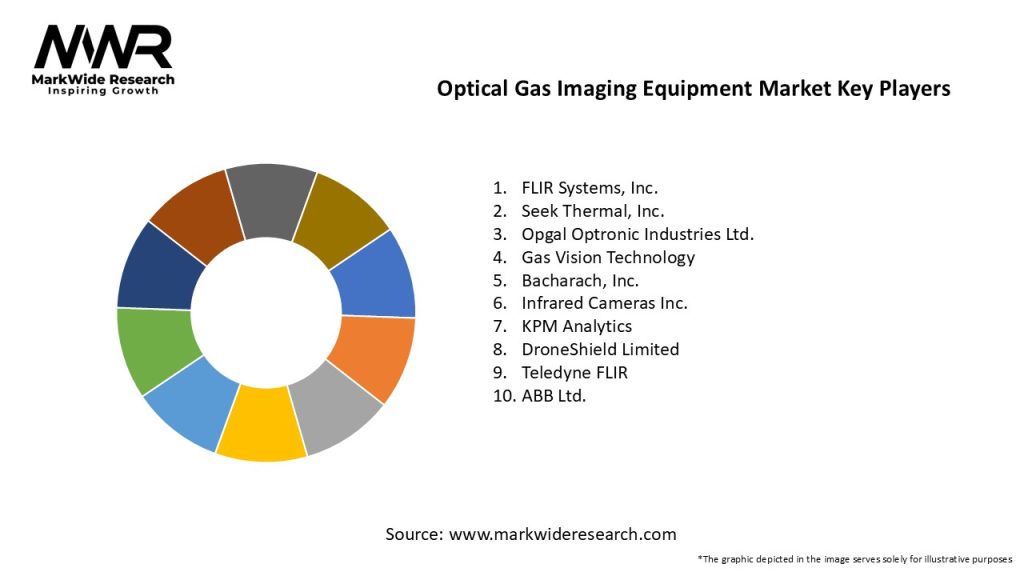

What are the key players in the Optical Gas Imaging Equipment Market?

Key players in the Optical Gas Imaging Equipment Market include FLIR Systems, Inc., ABB Ltd., and Teledyne Technologies Incorporated, among others. These companies are known for their innovative technologies and comprehensive product offerings in gas detection and imaging.

What are the growth factors driving the Optical Gas Imaging Equipment Market?

The growth of the Optical Gas Imaging Equipment Market is driven by increasing regulatory requirements for emissions monitoring, the rising demand for safety in industrial operations, and advancements in imaging technology. Additionally, the growing focus on environmental sustainability is propelling market expansion.

What challenges does the Optical Gas Imaging Equipment Market face?

The Optical Gas Imaging Equipment Market faces challenges such as high initial costs of equipment and the need for skilled personnel to operate these systems. Furthermore, competition from alternative gas detection technologies can hinder market growth.

What opportunities exist in the Optical Gas Imaging Equipment Market?

Opportunities in the Optical Gas Imaging Equipment Market include the development of portable and more efficient imaging devices, as well as expanding applications in sectors like oil and gas, chemical manufacturing, and waste management. The increasing adoption of smart technologies also presents new avenues for growth.

What trends are shaping the Optical Gas Imaging Equipment Market?

Trends shaping the Optical Gas Imaging Equipment Market include the integration of artificial intelligence for enhanced leak detection and analysis, as well as the growing use of drones equipped with imaging technology for remote inspections. Additionally, there is a shift towards more user-friendly interfaces and real-time data analytics.

Optical Gas Imaging Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Thermal Cameras, Infrared Sensors, Gas Detectors, Imaging Systems |

| Application | Leak Detection, Environmental Monitoring, Safety Inspections, Emission Control |

| End User | Oil & Gas, Chemical Manufacturing, Power Generation, Utilities |

| Technology | Optical Sensors, Infrared Technology, Digital Imaging, Remote Sensing |

Leading Companies in the Optical Gas Imaging Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at