444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Optical Biometry Devices Market represents a pivotal sector within the global ophthalmic industry. Optical biometry devices are sophisticated instruments that play a crucial role in accurately measuring the dimensions of the eye, particularly for intraocular lens (IOL) power calculations during cataract surgery. In this comprehensive guide, we will provide an extensive overview of the Optical Biometry Devices Market, delve into its meaning and significance, present an executive summary, and highlight key market insights.

Meaning

Optical biometry devices are sophisticated instruments that utilize light-based technology to measure ocular dimensions and characteristics. By capturing precise measurements, these devices enable healthcare professionals to assess the shape and size of the eye, particularly the cornea and the length of the eyeball. Such measurements play a crucial role in determining the correct intraocular lens (IOL) power and accurately predicting refractive outcomes for cataract surgery, leading to improved visual outcomes for patients.

Executive Summary

The optical biometry devices market has experienced substantial growth in recent years due to the increasing prevalence of cataract surgeries and the growing demand for advanced diagnostic tools in ophthalmology. Technological advancements, such as the integration of artificial intelligence (AI) and machine learning algorithms in these devices, have further enhanced their accuracy and efficiency. The market is expected to witness significant expansion in the coming years, driven by factors such as rising geriatric population, increasing incidence of eye disorders, and growing awareness about the benefits of optical biometry in surgical procedures.

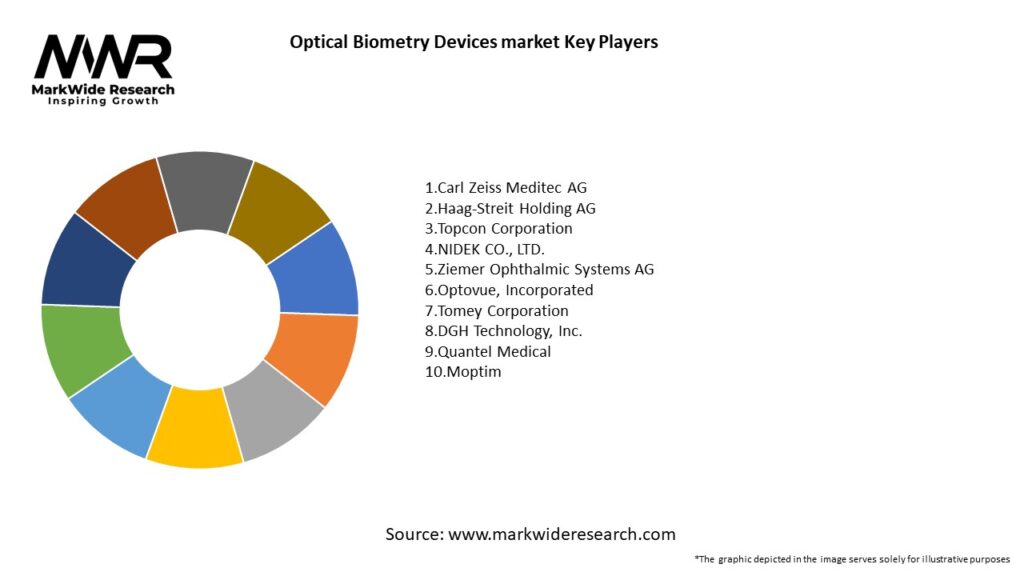

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

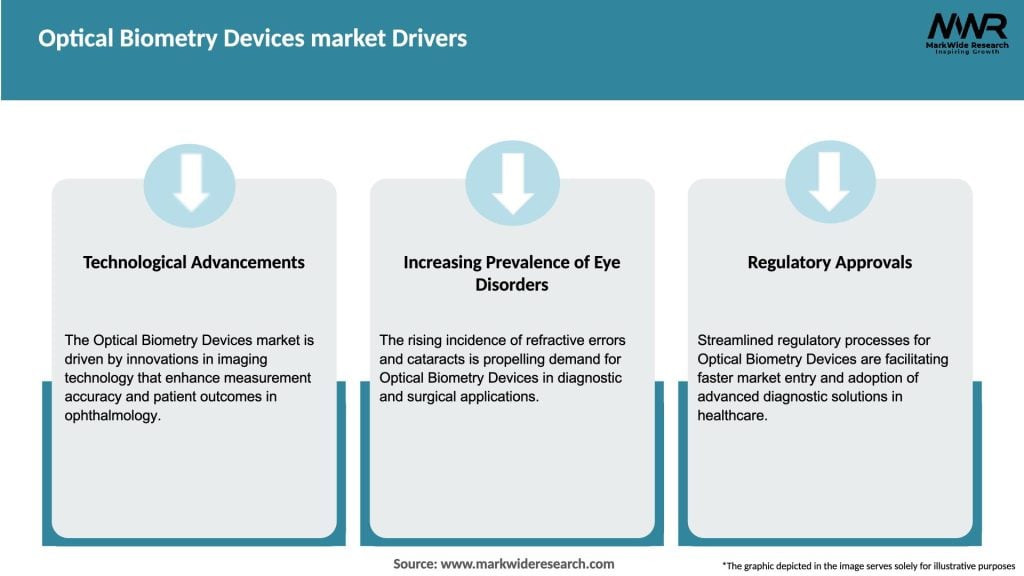

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The optical biometry devices market is characterized by intense competition among key players striving to gain a larger market share. Technological advancements and product innovations remain the primary focus for market players, enabling them to stay ahead in the competitive landscape. Strategic collaborations, mergers and acquisitions, and geographical expansions are common strategies employed to strengthen market presence. Additionally, the market is influenced by factors such as evolving healthcare regulations, changing reimbursement policies, and the introduction of new product launches.

Regional Analysis

The optical biometry devices market can be analyzed based on several key regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region exhibits distinct market dynamics influenced by factors such as healthcare infrastructure, reimbursement policies, prevalence of eye disorders, and technological advancements. North America currently holds a significant market share due to the presence of well-established healthcare systems and a high adoption rate of advanced medical technologies. However, Asia Pacific is expected to witness the fastest growth rate, driven by factors such as a large patient pool, rising disposable income, and increasing healthcare expenditure.

Competitive Landscape

Leading Companies in the Optical Biometry Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The optical biometry devices market can be segmented based on product type, end-user, and region.

By Product Type:

By End-User:

By Region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the optical biometry devices market. Due to the strain on healthcare systems and the focus on managing the pandemic, non-essential elective procedures, including cataract surgeries, were temporarily suspended in many regions. This led to a decline in the demand for optical biometry devices during the initial phases of the pandemic. However, as healthcare services resumed, the backlog of delayed surgeries created a surge in demand for these devices. Additionally, the increased focus on infection control and safety measures prompted the adoption of contactless or non-contact optical biometry devices. Overall, the market demonstrated resilience and is expected to witness steady growth in the post-pandemic period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The optical biometry devices market is expected to witness substantial growth in the coming years. Factors such as the increasing prevalence of eye disorders, growing demand for cataract surgeries, and technological advancements in optical biometry devices will drive market expansion. The integration of AI, machine learning, and telemedicine technologies will further enhance the accuracy, efficiency, and accessibility of these devices. Emerging markets, particularly in Asia Pacific, present significant growth opportunities for industry participants. However, addressing affordability concerns, investing in training and education, and navigating stringent regulatory requirements will be crucial for market success.

Conclusion

The optical biometry devices market plays a vital role in the field of ophthalmology, offering precise measurements and improving surgical outcomes. The market is driven by factors such as the increasing prevalence of eye disorders, technological advancements, and growing demand for minimally invasive surgeries. While affordability and skilled workforce remain challenges, opportunities lie in emerging markets, telemedicine integration, and research and development. With ongoing advancements and strategic collaborations, the optical biometry devices market is poised for significant growth in the foreseeable future.

What is Optical Biometry Devices?

Optical Biometry Devices are specialized instruments used to measure various ocular parameters, such as axial length, corneal curvature, and anterior chamber depth, which are essential for diagnosing and managing eye conditions, particularly in cataract and refractive surgery.

What are the key players in the Optical Biometry Devices market?

Key players in the Optical Biometry Devices market include Alcon, Carl Zeiss AG, and Topcon Corporation, which are known for their innovative technologies and comprehensive product offerings in the field of ophthalmic devices, among others.

What are the growth factors driving the Optical Biometry Devices market?

The Optical Biometry Devices market is driven by the increasing prevalence of eye disorders, advancements in optical measurement technologies, and the growing demand for precise surgical outcomes in cataract and refractive surgeries.

What challenges does the Optical Biometry Devices market face?

Challenges in the Optical Biometry Devices market include the high cost of advanced devices, the need for skilled professionals to operate them, and the competition from alternative measurement techniques that may limit market growth.

What opportunities exist in the Optical Biometry Devices market?

Opportunities in the Optical Biometry Devices market include the development of portable and user-friendly devices, increasing investments in ophthalmic research, and the expansion of telemedicine services that enhance access to eye care.

What trends are shaping the Optical Biometry Devices market?

Trends in the Optical Biometry Devices market include the integration of artificial intelligence for improved accuracy, the rise of minimally invasive surgical techniques, and the growing emphasis on personalized medicine in ophthalmology.

Optical Biometry Devices market

| Segmentation Details | Description |

|---|---|

| Product Type | Ophthalmic Ultrasound, Optical Coherence Tomography, Keratometers, A-Scan Devices |

| End User | Hospitals, Eye Clinics, Research Institutions, Optical Retailers |

| Technology | Non-Contact, Laser-Based, Digital Imaging, Automated |

| Application | Refractive Surgery, Cataract Surgery, Glaucoma Management, Vision Assessment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Optical Biometry Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at