444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Oman poultry meat market represents a vital component of the Sultanate’s agricultural sector and food security framework. As one of the fastest-growing protein markets in the Gulf Cooperation Council region, Oman’s poultry industry has experienced remarkable transformation over the past decade. The market encompasses various segments including chicken, turkey, duck, and other poultry products, with chicken meat dominating consumption patterns across the country.

Market dynamics indicate robust growth driven by increasing population, rising disposable incomes, and changing dietary preferences toward protein-rich foods. The sector has witnessed significant modernization with the introduction of advanced breeding techniques, automated processing facilities, and improved cold chain infrastructure. Local production capabilities have expanded substantially, though imports continue to play a crucial role in meeting domestic demand.

Consumer preferences in Oman show a strong inclination toward fresh poultry products, with approximately 78% of consumers preferring locally produced chicken over imported alternatives. The market benefits from government initiatives promoting food security and self-sufficiency, including subsidies for local producers and investments in modern farming technologies. Retail distribution channels have evolved significantly, with hypermarkets and supermarkets accounting for nearly 65% of total poultry meat sales in urban areas.

The Oman poultry meat market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and consumption of poultry-based protein products within the Sultanate of Oman. This market includes all aspects of the poultry value chain, from breeding and farming operations to retail sales and food service applications.

Market scope extends beyond traditional chicken meat to include various poultry species, processed products, and value-added offerings such as marinated cuts, ready-to-cook items, and specialty preparations. The definition encompasses both domestic production facilities and import operations that serve the local market demand. Stakeholders include commercial poultry farms, processing plants, distributors, retailers, restaurants, and end consumers across residential and institutional segments.

Economic significance of the market extends to employment generation, foreign exchange considerations, and contribution to the country’s food security objectives. The market operates within regulatory frameworks established by Oman’s Ministry of Agriculture, Fisheries and Water Resources, ensuring food safety standards and sustainable production practices.

Strategic positioning of Oman’s poultry meat market reflects the country’s commitment to achieving greater food security while meeting evolving consumer demands. The market demonstrates strong fundamentals with consistent growth patterns driven by demographic trends and economic development. Production capacity has expanded significantly through private sector investments and government support programs, reducing dependency on imports from approximately 85% to 62% over the past five years.

Key market characteristics include a preference for halal-certified products, growing demand for organic and free-range options, and increasing adoption of modern retail formats. The sector benefits from Oman’s strategic location as a trade hub, facilitating efficient import operations when needed to supplement domestic production. Technology adoption has accelerated across the value chain, with automated processing systems and digital supply chain management becoming standard practices among leading operators.

Market challenges include climate-related production constraints, feed cost volatility, and competition from alternative protein sources. However, opportunities abound in export potential to neighboring markets, value-added product development, and integration of sustainable farming practices. The market outlook remains positive with projected growth rates reflecting continued urbanization and rising protein consumption per capita.

Consumer behavior analysis reveals distinct preferences shaping market dynamics in Oman’s poultry sector. The following insights provide comprehensive understanding of market fundamentals:

Population growth serves as the primary driver for Oman’s poultry meat market expansion. The country’s population has been growing steadily, creating sustained demand for affordable protein sources. Urbanization trends have accelerated consumption patterns, with urban households consuming significantly more poultry products than rural counterparts. The shift toward nuclear family structures has increased demand for convenient, portion-controlled poultry products.

Economic development and rising disposable incomes have enabled consumers to diversify their protein consumption beyond traditional sources. Government initiatives promoting food security have resulted in substantial investments in domestic production capabilities. Infrastructure development including modern cold storage facilities, transportation networks, and processing plants has enhanced market efficiency and product availability.

Health and nutrition awareness has positioned poultry meat as a preferred protein source due to its lean profile and versatility. Cultural and religious factors favor halal-certified poultry products, creating a stable demand base. Tourism industry growth has increased demand from hotels, restaurants, and catering services, particularly in major cities and tourist destinations. The expanding expatriate population has introduced diverse culinary preferences, driving demand for various poultry cuts and preparations.

Climate challenges pose significant constraints to poultry production in Oman’s arid environment. High temperatures and limited water resources increase production costs and affect bird welfare, requiring substantial investments in climate-controlled facilities. Feed cost volatility represents a major challenge, as most feed ingredients are imported, making production costs susceptible to global commodity price fluctuations and currency exchange rates.

Regulatory compliance requirements, while necessary for food safety, create additional operational costs for producers and importers. Stringent import regulations and quality standards can limit supply flexibility during peak demand periods. Limited skilled workforce in specialized areas such as veterinary services, modern farming techniques, and processing operations constrains industry growth potential.

Competition from alternative proteins including fish, lamb, and plant-based options affects market share growth. Traditional consumption patterns favoring red meat in certain demographic segments limit poultry adoption. Infrastructure limitations in rural areas restrict market penetration and increase distribution costs. Environmental concerns related to intensive farming practices and waste management create sustainability challenges that require ongoing investment and innovation.

Export potential presents significant opportunities for Oman’s poultry industry, particularly to neighboring GCC countries and African markets. The country’s strategic location and modern port facilities provide competitive advantages for regional trade. Value-added product development offers substantial growth potential, including ready-to-eat meals, marinated products, and specialty preparations catering to diverse consumer preferences.

Organic and free-range segments represent high-growth opportunities as consumer awareness of sustainable farming practices increases. Premium positioning in these segments can command higher margins while meeting evolving consumer demands. Technology integration opportunities include precision farming, automated processing systems, and digital supply chain management to improve efficiency and reduce costs.

Public-private partnerships in research and development can accelerate innovation in breeding programs, feed efficiency, and disease management. E-commerce platforms and direct-to-consumer sales channels offer new revenue streams and improved customer engagement. The growing food service sector presents opportunities for specialized products and bulk supply contracts. Sustainable farming initiatives supported by government incentives can position Omani producers as leaders in environmentally responsible poultry production.

Supply chain dynamics in Oman’s poultry market reflect the interplay between domestic production capabilities and import requirements. Local producers have invested heavily in modernizing facilities, resulting in improved efficiency and product quality. Demand fluctuations driven by seasonal patterns, economic conditions, and consumer preferences create dynamic pricing mechanisms throughout the value chain.

Competitive landscape features a mix of large integrated operations and smaller specialized producers, each serving different market segments. Price competition remains intense, particularly in commodity segments, while premium products offer better margin opportunities. Distribution channels have evolved significantly with modern retail formats gaining market share from traditional wet markets and small retailers.

Regulatory environment continues to evolve with enhanced food safety standards and sustainability requirements. Import policies balance food security objectives with support for domestic producers. Technology adoption varies across market participants, with larger operations leading in automation and digital systems implementation. Consumer preferences increasingly influence production decisions, with producers adapting to demand for specific cuts, packaging formats, and quality attributes. Market integration with regional and global supply chains provides both opportunities and challenges in terms of competitiveness and supply security.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Oman’s poultry meat market. Primary research involved extensive interviews with industry stakeholders including producers, processors, distributors, retailers, and consumers across different regions of the Sultanate. Survey methodology incorporated both quantitative and qualitative approaches to capture market dynamics and consumer behavior patterns.

Secondary research utilized government statistics, industry reports, trade publications, and academic studies to establish market baselines and historical trends. Data validation processes ensured consistency and accuracy across multiple sources. Field research included visits to production facilities, processing plants, retail outlets, and food service establishments to observe operational practices and market conditions firsthand.

Statistical analysis employed advanced modeling techniques to project market trends and identify growth opportunities. Regional analysis incorporated demographic data, economic indicators, and consumption patterns to understand market variations across different governorates. Expert consultations with industry professionals, government officials, and academic researchers provided additional insights and validation of findings. The research methodology ensured comprehensive coverage of all market segments and stakeholder perspectives while maintaining objectivity and analytical rigor.

Muscat Governorate dominates Oman’s poultry meat market, accounting for the largest share of consumption and retail infrastructure. The capital region benefits from higher disposable incomes, diverse consumer preferences, and extensive modern retail networks. Urban concentration in Muscat has attracted major poultry processors and distributors, creating a competitive marketplace with diverse product offerings.

Dhofar Governorate represents the second-largest regional market, driven by its significant population and agricultural activities. The region’s cooler climate provides some advantages for poultry production, though transportation costs to other markets remain a consideration. Al Batinah regions combine substantial consumption with significant production capabilities, housing several major poultry farms and processing facilities.

Interior regions including Ad Dakhiliyah and Ash Sharqiyah show growing demand patterns as infrastructure development improves market access. Traditional consumption patterns in these areas are gradually shifting toward increased poultry consumption. Northern governorates benefit from proximity to UAE markets and cross-border trade opportunities. According to MarkWide Research analysis, regional distribution shows Muscat accounting for 42% of market share, Dhofar at 18%, and Al Batinah regions combined representing 25% of total consumption. Rural areas present growth opportunities as cold chain infrastructure expands and consumer preferences evolve toward convenient protein sources.

Market leadership in Oman’s poultry sector is characterized by a combination of established local producers and international suppliers. The competitive environment has intensified as domestic production capabilities have expanded and consumer expectations have evolved. Key market participants include:

Competitive strategies vary across market participants, with some focusing on cost leadership through scale economies while others pursue differentiation through premium products and specialized offerings. Market consolidation trends have emerged as larger players acquire smaller operations to achieve greater efficiency and market coverage. Technology investments and supply chain optimization have become key competitive differentiators, particularly in maintaining product quality and reducing costs.

Product segmentation in Oman’s poultry meat market reflects diverse consumer preferences and application requirements. The market can be analyzed across multiple dimensions:

By Product Type:

By Distribution Channel:

By Consumer Segment:

Fresh chicken category dominates market consumption with strong consumer preference for locally produced products. This segment benefits from perception of superior quality and freshness compared to frozen alternatives. Price sensitivity varies within this category, with premium free-range and organic products commanding significant price premiums while maintaining steady demand growth.

Frozen chicken imports serve as a crucial supply buffer during peak demand periods and provide cost-effective options for price-conscious consumers. This category has evolved to include higher-quality frozen products that compete effectively with fresh alternatives. Processed products represent the fastest-growing category, driven by urbanization, changing lifestyles, and demand for convenience foods.

Value-added segments including marinated cuts, ready-to-cook products, and specialty preparations show strong growth potential. These categories typically offer higher margins for producers and retailers while meeting evolving consumer preferences. Organic and free-range categories remain niche but demonstrate consistent growth as health consciousness increases among consumers. The food service category shows distinct requirements for specific cuts, portion sizes, and packaging formats, creating opportunities for specialized suppliers.

Producers benefit from growing domestic demand, government support for food security initiatives, and opportunities for export expansion. Modern production facilities enable improved efficiency, better product quality, and enhanced profitability. Economies of scale achieved through industry growth allow for reduced per-unit costs and improved competitiveness against imports.

Retailers gain from steady demand growth, improved supply chain reliability, and opportunities to develop private label products. The expanding market supports store traffic and provides cross-selling opportunities with complementary products. Distributors benefit from increased trade volumes, improved infrastructure, and growing market reach across different regions and customer segments.

Consumers enjoy improved product availability, enhanced quality standards, competitive pricing, and greater variety in product offerings. Food safety improvements and regulatory oversight provide confidence in product quality. Economic benefits extend to employment generation, skill development, and contribution to GDP growth. The industry supports related sectors including feed production, equipment manufacturing, and logistics services, creating multiplier effects throughout the economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives are gaining prominence across Oman’s poultry industry, with producers investing in environmentally friendly practices and animal welfare improvements. Consumer awareness of production methods is driving demand for certified organic, free-range, and antibiotic-free products, creating premium market segments with higher profit margins.

Technology adoption continues accelerating with automated feeding systems, climate control technologies, and data analytics improving operational efficiency. Digital transformation includes supply chain management systems, traceability solutions, and direct-to-consumer platforms enhancing market reach and customer engagement.

Product innovation focuses on convenience foods, ethnic flavors, and health-conscious formulations meeting diverse consumer preferences. Packaging evolution emphasizes sustainability, portion control, and extended shelf life to reduce food waste and improve consumer convenience. Cold chain expansion supports market penetration in remote areas and enables longer distribution distances. Halal certification remains crucial for market access, with enhanced standards and verification processes becoming standard practice. Integration of e-commerce platforms and home delivery services has accelerated, particularly following global digitalization trends.

Infrastructure investments have transformed Oman’s poultry industry with new processing facilities, expanded cold storage capacity, and improved transportation networks. Major producers have completed facility upgrades incorporating international best practices and advanced technologies. Government initiatives including the National Food Security Strategy have provided framework and funding support for industry expansion.

Strategic partnerships between local producers and international technology providers have accelerated knowledge transfer and capability development. Regulatory enhancements have strengthened food safety standards, import controls, and quality assurance requirements, improving overall industry standards and consumer confidence.

Market consolidation activities have created larger, more efficient operations capable of competing effectively with imports. Research and development investments in breeding programs, nutrition optimization, and disease prevention have improved production efficiency and product quality. Export initiatives have begun establishing Omani poultry products in regional markets, creating new revenue streams and reducing domestic market dependency. MWR data indicates that industry modernization efforts have resulted in 25% improvement in production efficiency over the past three years.

Strategic recommendations for industry participants focus on sustainable growth and competitive positioning. Producers should prioritize technology investments to improve efficiency and reduce production costs while maintaining quality standards. Diversification strategies including value-added products and export market development can reduce dependency on domestic commodity segments.

Supply chain optimization through vertical integration or strategic partnerships can improve cost structure and market responsiveness. Brand development initiatives focusing on quality, sustainability, and local production can command premium pricing and build consumer loyalty. Investment in research and development for breeding programs, feed efficiency, and disease management will provide long-term competitive advantages.

Market expansion strategies should target underserved regions and emerging consumer segments while building distribution capabilities. Sustainability initiatives including environmental management and animal welfare programs will become increasingly important for market access and consumer acceptance. Digital transformation investments in supply chain management, customer engagement, and operational efficiency will be crucial for future competitiveness. Collaboration with government agencies and industry associations can help address common challenges and promote industry development.

Long-term prospects for Oman’s poultry meat market remain highly positive, supported by fundamental demand drivers and ongoing industry development initiatives. MarkWide Research projects continued growth reflecting population expansion, economic development, and evolving consumer preferences toward protein-rich diets.

Production capabilities are expected to expand further through continued investments in modern facilities and technology adoption. Market maturation will likely result in increased focus on value-added products, premium segments, and export opportunities. The industry is positioned to achieve greater self-sufficiency while maintaining competitive pricing and quality standards.

Innovation trends including sustainable farming practices, alternative protein integration, and digital supply chain management will shape industry evolution. Regional integration opportunities may emerge through trade agreements and market access improvements, creating larger addressable markets for Omani producers. Consumer trends toward health consciousness, sustainability, and convenience will continue driving product development and market segmentation. The outlook suggests a maturing industry with improved efficiency, enhanced quality standards, and stronger competitive positioning in regional markets, supported by projected growth rates of 8-10% annually over the next five years.

Oman’s poultry meat market represents a dynamic and rapidly evolving sector with strong fundamentals and promising growth prospects. The industry has successfully transformed from heavy import dependence to a more balanced supply structure incorporating significant domestic production capabilities. Strategic investments in modern infrastructure, technology adoption, and quality improvements have positioned the market for continued expansion and enhanced competitiveness.

Key success factors include government support for food security initiatives, growing consumer demand, and industry commitment to modernization and quality improvement. The market benefits from Oman’s strategic location, stable economic environment, and supportive regulatory framework. Future growth will likely be driven by continued urbanization, rising disposable incomes, and evolving consumer preferences toward convenient, high-quality protein products.

Industry participants who focus on efficiency improvements, product innovation, and market diversification are well-positioned to capitalize on emerging opportunities. The sector’s contribution to food security, economic development, and employment generation underscores its strategic importance to Oman’s overall development objectives. With continued investment and strategic focus, the poultry meat market is expected to play an increasingly important role in the country’s agricultural sector and food system resilience.

What is Poultry Meat?

Poultry meat refers to the flesh of domesticated birds, primarily chickens, turkeys, ducks, and geese, raised for human consumption. It is a significant source of protein and is widely consumed across various cultures.

What are the key players in the Oman Poultry Meat Market?

Key players in the Oman Poultry Meat Market include Al-Fakher Poultry, A’Saffa Foods, and Oman Poultry Company, among others. These companies are involved in various aspects of poultry production, processing, and distribution.

What are the growth factors driving the Oman Poultry Meat Market?

The growth of the Oman Poultry Meat Market is driven by increasing consumer demand for protein-rich foods, rising health consciousness, and the expansion of modern retail channels. Additionally, government initiatives to boost local poultry production contribute to market growth.

What challenges does the Oman Poultry Meat Market face?

The Oman Poultry Meat Market faces challenges such as fluctuating feed prices, disease outbreaks among poultry, and competition from imported meat products. These factors can impact production costs and market stability.

What opportunities exist in the Oman Poultry Meat Market?

Opportunities in the Oman Poultry Meat Market include the potential for value-added products, such as processed and ready-to-cook poultry items, and the growing trend of organic and free-range poultry farming. Additionally, expanding export markets present further growth potential.

What trends are shaping the Oman Poultry Meat Market?

Trends in the Oman Poultry Meat Market include a shift towards sustainable farming practices, increased consumer preference for locally sourced products, and innovations in poultry breeding and feed technology. These trends are influencing production methods and consumer choices.

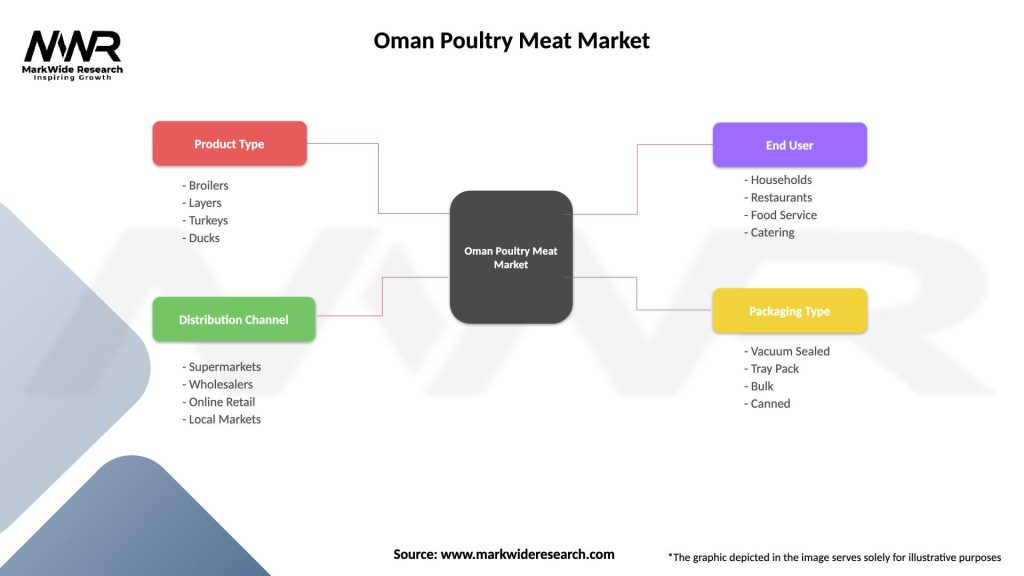

Oman Poultry Meat Market

| Segmentation Details | Description |

|---|---|

| Product Type | Broilers, Layers, Turkeys, Ducks |

| Distribution Channel | Supermarkets, Wholesalers, Online Retail, Local Markets |

| End User | Households, Restaurants, Food Service, Catering |

| Packaging Type | Vacuum Sealed, Tray Pack, Bulk, Canned |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Oman Poultry Meat Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at