444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Oman electric motor for household appliances market represents a dynamic and rapidly evolving sector within the Sultanate’s broader industrial landscape. This specialized market encompasses the production, distribution, and integration of electric motors specifically designed for residential appliances including refrigerators, washing machines, air conditioners, vacuum cleaners, and various kitchen appliances. Market dynamics indicate robust growth driven by increasing urbanization, rising disposable incomes, and growing consumer preference for energy-efficient home appliances.

Regional development in Oman has significantly influenced the household appliances sector, with the government’s Vision 2040 initiative promoting industrial diversification and technological advancement. The market demonstrates substantial growth potential with increasing penetration of modern appliances in both urban and rural areas. Consumer behavior patterns show a marked shift toward premium, energy-efficient appliances, directly impacting the demand for advanced electric motor technologies.

Technological advancement remains a key driver, with manufacturers increasingly focusing on developing motors that offer improved efficiency ratings of up to 92% energy efficiency compared to traditional models. The market benefits from Oman’s strategic geographic location, serving as a gateway between Asian manufacturing hubs and Middle Eastern consumer markets. Infrastructure development and smart city initiatives across major Omani cities have further accelerated the adoption of modern household appliances, consequently boosting the electric motor market.

The Oman electric motor for household appliances market refers to the comprehensive ecosystem encompassing the design, manufacturing, import, distribution, and servicing of electric motors specifically engineered for residential appliance applications within the Sultanate of Oman. This market includes various motor types such as AC induction motors, brushless DC motors, universal motors, and stepper motors that power essential household devices.

Market scope extends beyond simple motor units to include integrated motor systems, control electronics, and smart motor technologies that enable IoT connectivity and energy management features. The definition encompasses both original equipment manufacturer (OEM) applications and aftermarket replacement motors, serving the diverse needs of Omani households and the growing appliance service industry.

Industry classification includes motors ranging from fractional horsepower units used in small appliances to larger motors powering major appliances like central air conditioning systems and industrial-grade washing machines. The market also covers specialized motors for emerging appliance categories including smart home devices, robotic vacuum cleaners, and energy-efficient heat pump systems that are gaining popularity in Oman’s evolving residential sector.

Strategic analysis reveals that the Oman electric motor for household appliances market is experiencing unprecedented growth, driven by rapid urbanization and increasing consumer awareness of energy efficiency. The market demonstrates remarkable resilience with consistent demand across multiple appliance categories, supported by government initiatives promoting energy conservation and sustainable living practices.

Key market drivers include the expanding middle class, rising per capita income, and growing preference for modern lifestyle amenities. The market shows particular strength in the air conditioning segment, which accounts for approximately 35% of total motor demand due to Oman’s climate conditions. Refrigeration applications represent another significant segment, driven by increasing food storage needs and the growth of modern retail formats.

Competitive landscape features a mix of international manufacturers and local distributors, with increasing focus on establishing regional service networks and technical support capabilities. The market benefits from Oman’s stable economic environment and supportive regulatory framework that encourages technological innovation and energy efficiency improvements. Future prospects remain highly positive, with emerging opportunities in smart appliances and IoT-enabled motor systems expected to drive next-phase growth.

Market intelligence reveals several critical insights that define the current and future trajectory of Oman’s electric motor market for household appliances:

Economic prosperity serves as the primary catalyst driving the Oman electric motor for household appliances market. The Sultanate’s stable economic environment, supported by diversification efforts beyond oil revenues, has created favorable conditions for consumer spending on modern appliances. Rising disposable income levels enable Omani families to invest in quality household appliances, directly translating to increased demand for reliable electric motors.

Urbanization trends significantly impact market growth, with increasing numbers of Omani citizens moving to urban centers and adopting modern lifestyles. This demographic shift creates substantial demand for household appliances and, consequently, the electric motors that power them. Government initiatives promoting energy efficiency and sustainable living practices further accelerate market expansion through incentives and awareness programs.

Climate considerations play a crucial role in driving demand, particularly for air conditioning and refrigeration applications. Oman’s hot climate necessitates reliable cooling systems, making efficient electric motors essential for comfortable living. Infrastructure development projects, including new residential complexes and commercial developments, create consistent demand for appliance installations and motor replacements.

Technological advancement drives market evolution, with consumers increasingly seeking smart, connected appliances that offer enhanced functionality and energy savings. The growing awareness of environmental sustainability encourages adoption of energy-efficient motors that reduce electricity consumption and carbon footprint. Retail expansion and improved distribution networks make modern appliances more accessible to consumers across different regions of Oman.

Import dependency represents a significant constraint for the Oman electric motor market, creating vulnerability to supply chain disruptions and currency fluctuations. The heavy reliance on international suppliers can lead to delivery delays and increased costs, particularly during global economic uncertainties or shipping disruptions. Limited local manufacturing capabilities restrict the market’s ability to respond quickly to changing demand patterns or customize products for specific regional requirements.

High initial costs associated with premium, energy-efficient motors can deter price-sensitive consumers, particularly in the residential replacement market. While these motors offer long-term savings through reduced energy consumption, the upfront investment barrier remains significant for many households. Technical complexity of modern motor systems requires specialized knowledge for installation and maintenance, creating dependency on skilled technicians who may be in limited supply.

Economic volatility related to oil price fluctuations can impact consumer spending patterns, as Oman’s economy remains partially dependent on hydrocarbon revenues. During economic downturns, consumers may defer appliance purchases or opt for lower-cost alternatives, affecting demand for premium motor solutions. Regulatory compliance requirements and changing energy efficiency standards can create additional costs for manufacturers and distributors.

Competition from refurbished and second-hand appliances in certain market segments can limit demand for new motors. Additionally, seasonal demand fluctuations create inventory management challenges for distributors and retailers, potentially leading to stock imbalances and increased carrying costs.

Smart home technology presents unprecedented opportunities for the Oman electric motor market, with increasing consumer interest in IoT-enabled appliances and automated home systems. The integration of smart motors with home automation platforms creates new revenue streams and higher-value product offerings. Energy management systems that optimize motor performance based on usage patterns and grid conditions represent a growing opportunity segment.

Government sustainability initiatives create favorable conditions for energy-efficient motor adoption through potential subsidies, tax incentives, and awareness campaigns. The Oman Vision 2040 emphasis on environmental sustainability aligns perfectly with high-efficiency motor technologies. Green building standards and LEED certification requirements in new construction projects drive demand for energy-efficient appliances and motors.

Emerging appliance categories such as robotic vacuum cleaners, smart kitchen appliances, and home wellness devices create new market segments requiring specialized motor solutions. The growing popularity of premium appliance brands among affluent Omani consumers opens opportunities for high-performance, feature-rich motor systems. Service sector expansion offers opportunities for motor manufacturers to develop comprehensive maintenance and support programs.

Regional export potential exists for companies establishing operations in Oman, leveraging the country’s strategic location to serve broader GCC and regional markets. Technology partnerships with international manufacturers can facilitate knowledge transfer and local capability development, creating long-term competitive advantages in the regional market.

Supply chain dynamics in the Oman electric motor market reflect a complex interplay between international manufacturers, local distributors, and end-user demand patterns. The market operates within a framework of established import relationships, with major suppliers from Asia, Europe, and North America maintaining consistent presence through local partnerships and distribution agreements. Inventory management strategies have evolved to accommodate seasonal demand variations and ensure adequate stock levels during peak periods.

Pricing dynamics demonstrate sensitivity to global commodity prices, currency exchange rates, and shipping costs. The market has shown remarkable adaptability to price fluctuations, with distributors implementing flexible pricing strategies to maintain competitiveness while preserving margins. Value proposition increasingly focuses on total cost of ownership rather than initial purchase price, reflecting growing consumer sophistication and awareness of energy efficiency benefits.

Technology adoption patterns reveal accelerating acceptance of advanced motor technologies, particularly in urban markets where consumers demonstrate higher willingness to invest in premium solutions. The market shows increasing differentiation between basic and premium segments, with premium motors offering enhanced features such as variable speed control, noise reduction, and smart connectivity capabilities.

Competitive dynamics feature intensifying competition among established players while creating opportunities for innovative newcomers offering specialized solutions. Market consolidation trends suggest potential for strategic partnerships and acquisitions as companies seek to strengthen their market positions and expand service capabilities.

Comprehensive market analysis for the Oman electric motor for household appliances market employed a multi-faceted research approach combining primary and secondary data collection methodologies. Primary research included structured interviews with key industry stakeholders, including motor manufacturers, appliance distributors, retail partners, and end-users across different demographic segments in Oman.

Secondary research encompassed extensive analysis of industry reports, government publications, trade statistics, and regulatory documents specific to Oman’s electrical equipment and appliance sectors. Market intelligence was gathered through systematic monitoring of industry trends, technological developments, and competitive activities within the regional market context.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews with industry experts, and applying statistical analysis techniques to ensure accuracy and reliability of findings. Quantitative analysis incorporated market sizing methodologies, trend analysis, and forecasting models specifically calibrated for the Omani market conditions.

Regional expertise was leveraged through collaboration with local market research partners and industry associations to ensure cultural and regulatory nuances were properly incorporated into the analysis. Continuous monitoring systems were established to track market developments and validate research findings against real-time market conditions and emerging trends.

Geographic distribution of the Oman electric motor for household appliances market reveals distinct regional patterns influenced by population density, economic development, and infrastructure availability. Muscat Governorate dominates market demand, accounting for approximately 42% of total consumption, driven by its status as the capital region with the highest concentration of urban households and commercial developments.

Dhofar Governorate, anchored by Salalah, represents the second-largest regional market with 18% market share, benefiting from its role as a major commercial hub and tourist destination. The region shows particular strength in hospitality-related appliance demand and seasonal variations linked to the Khareef season. Al Batinah regions collectively account for 22% of market demand, reflecting their industrial development and growing residential populations.

Interior regions including Al Dakhiliyah and Al Sharqiyah demonstrate steady growth potential with increasing urbanization and infrastructure development projects. These areas show 15% combined market share with particular opportunities in the replacement and upgrade segments. Northern governorates including Al Buraimi and Musandam represent emerging markets with 3% current share but showing rapid growth rates as development projects expand.

Regional preferences vary significantly, with coastal areas showing higher demand for air conditioning motors due to humidity considerations, while interior regions focus more on refrigeration and general appliance motors. Distribution network development continues to expand into smaller cities and towns, improving market accessibility and service coverage across all governorates.

Market leadership in the Oman electric motor for household appliances sector is characterized by a diverse mix of international manufacturers and established local distributors. The competitive environment demonstrates healthy competition across different market segments, with companies differentiating through technology innovation, service quality, and pricing strategies.

Competitive strategies increasingly emphasize local service capabilities, technical support, and rapid response to customer requirements. Market positioning varies from premium technology leaders to cost-effective volume providers, creating opportunities for different customer segments and application requirements.

Application-based segmentation reveals distinct market categories within the Oman electric motor for household appliances sector, each with unique characteristics and growth patterns:

By Application:

By Motor Type:

Air conditioning motors represent the most dynamic segment within the Oman market, driven by extreme climate conditions and increasing focus on energy efficiency. This category shows consistent year-round demand with seasonal peaks during summer months. Inverter technology adoption has accelerated significantly, with variable-speed motors becoming standard in premium air conditioning systems. The segment benefits from government energy efficiency initiatives and consumer awareness of electricity cost savings.

Refrigeration motor applications demonstrate steady growth patterns aligned with household formation rates and appliance replacement cycles. Energy efficiency standards drive technology upgrades, with manufacturers focusing on improved compressor motor designs that reduce energy consumption while maintaining performance. The category shows particular strength in the premium segment, where consumers prioritize quiet operation and advanced features.

Washing machine motors reflect changing consumer preferences toward larger capacity, energy-efficient models with advanced wash programs. Direct drive technology gains market acceptance due to reduced noise levels and improved reliability. The segment shows increasing sophistication with smart connectivity features and load-sensing capabilities becoming more common in urban markets.

Kitchen appliance motors encompass a diverse range of applications, from high-power dishwasher pumps to precision motors in food processors. This category benefits from lifestyle changes and increasing adoption of modern kitchen appliances among Omani households. Noise reduction and energy efficiency remain key differentiators in this segment.

Manufacturers operating in the Oman electric motor market benefit from stable demand patterns and growing consumer sophistication that values quality and efficiency over price alone. The market offers predictable revenue streams through both OEM partnerships and aftermarket sales, with opportunities for premium pricing on advanced technology solutions. Brand loyalty development through superior performance and service support creates sustainable competitive advantages.

Distributors and retailers enjoy expanding market opportunities driven by urbanization and rising living standards. The market provides diverse product portfolios that cater to different customer segments and price points, enabling flexible business strategies. Service revenue opportunities through maintenance contracts and technical support services create additional income streams beyond product sales.

End consumers benefit from increasing product availability, competitive pricing, and improved energy efficiency that reduces operating costs. Technology advancement provides enhanced appliance performance, reliability, and smart features that improve daily life quality. Warranty coverage and local service support reduce ownership risks and maintenance concerns.

Government stakeholders benefit from reduced energy consumption through efficient motor adoption, supporting national sustainability goals and reducing electricity grid strain. Economic diversification objectives are supported through technology transfer and potential local assembly operations. Consumer satisfaction improvements contribute to overall quality of life enhancements aligned with Vision 2040 objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Energy efficiency optimization emerges as the dominant trend shaping the Oman electric motor market, with consumers increasingly prioritizing motors that deliver superior performance while minimizing electricity consumption. This trend aligns with global sustainability initiatives and local government policies promoting energy conservation. Smart motor integration represents another significant trend, with IoT-enabled motors gaining traction in premium appliance segments.

Digitalization and connectivity trends drive demand for motors that can interface with home automation systems and provide real-time performance monitoring. Predictive maintenance capabilities built into modern motors appeal to consumers seeking reduced service costs and improved reliability. The trend toward variable speed control continues expanding across different appliance categories, offering enhanced user experience and energy savings.

Miniaturization and power density improvements enable motor manufacturers to develop more compact solutions without compromising performance, particularly important for space-constrained appliance designs. Noise reduction technology becomes increasingly important as consumers demand quieter appliance operation, especially in urban living environments.

Sustainability focus extends beyond energy efficiency to include recyclable materials and environmentally responsible manufacturing processes. Customization trends see manufacturers offering more specialized motor solutions tailored to specific appliance requirements and regional preferences. Service digitization trends include mobile apps for motor diagnostics and remote troubleshooting capabilities.

Recent technological breakthroughs in the Oman electric motor market include the introduction of advanced magnetic materials that improve motor efficiency and reduce size requirements. Regulatory developments include updated energy efficiency standards that align with international best practices, driving market transformation toward higher-performance solutions.

Strategic partnerships between international motor manufacturers and local distributors have strengthened market presence and service capabilities. Several companies have established regional service centers in Oman to provide faster response times and technical support for complex motor systems. Digital transformation initiatives include the launch of online platforms for motor selection, ordering, and technical support services.

Investment announcements in regional manufacturing capabilities suggest potential for local assembly operations that could reduce costs and improve supply chain resilience. Training programs developed in partnership with technical institutes aim to address skilled labor shortages in motor installation and maintenance services.

Product innovations include the introduction of modular motor designs that simplify maintenance and reduce inventory requirements for service providers. Sustainability initiatives encompass motor recycling programs and take-back schemes that address end-of-life environmental concerns. Market expansion activities include new distribution agreements and retail partnerships that improve product accessibility across different regions of Oman.

Strategic recommendations for market participants include focusing on energy efficiency as a primary value proposition, given the strong consumer response to electricity cost savings and environmental benefits. MarkWide Research analysis suggests that companies should prioritize local service capability development to differentiate from competitors and build customer loyalty through superior support.

Investment priorities should emphasize smart motor technologies and IoT integration capabilities, as these segments show the highest growth potential and premium pricing opportunities. Partnership strategies with local distributors and service providers can accelerate market penetration while reducing operational complexity for international manufacturers.

Market positioning recommendations include developing clear segmentation strategies that address different customer needs, from cost-conscious consumers to premium technology adopters. Service excellence should be emphasized as a key differentiator, with comprehensive training programs for technical staff and rapid response capabilities for customer support.

Innovation focus should prioritize noise reduction, energy efficiency, and smart connectivity features that align with evolving consumer preferences. Supply chain optimization strategies should include regional inventory management and alternative sourcing options to improve resilience and reduce costs. Regulatory compliance preparation for potential energy efficiency mandates should begin early to ensure competitive advantage when new standards are implemented.

Long-term prospects for the Oman electric motor for household appliances market remain highly positive, supported by sustained economic growth, urbanization trends, and increasing consumer sophistication. Market evolution is expected to accelerate toward smart, connected motor systems that integrate seamlessly with home automation platforms and energy management systems.

Technology advancement will likely focus on further efficiency improvements, with next-generation motors achieving 95%+ efficiency ratings while incorporating advanced control algorithms and predictive maintenance capabilities. MWR projections indicate that the smart motor segment could represent 30% of total market demand within the next five years, driven by increasing consumer adoption of connected appliances.

Regulatory environment evolution may include mandatory energy efficiency standards that accelerate the transition away from basic motor technologies toward premium solutions. Market consolidation trends suggest potential for strategic acquisitions and partnerships as companies seek to strengthen their competitive positions and expand service capabilities.

Emerging opportunities include potential for local assembly operations that could reduce costs and improve supply chain resilience while supporting Oman’s economic diversification objectives. Regional expansion possibilities position Oman as a strategic hub for serving broader Middle Eastern markets, creating additional growth opportunities for established market participants.

Comprehensive analysis of the Oman electric motor for household appliances market reveals a dynamic, growing sector with substantial opportunities for both established players and new entrants. The market demonstrates strong fundamentals supported by economic stability, urbanization trends, and increasing consumer focus on energy efficiency and smart technology integration.

Key success factors include emphasis on energy efficiency, local service capabilities, and smart technology integration that aligns with evolving consumer preferences. The market’s strategic importance extends beyond domestic demand to include potential regional hub opportunities that leverage Oman’s geographic advantages and stable business environment.

Future growth trajectory appears highly favorable, with multiple drivers supporting sustained expansion across different market segments and applications. Technology evolution toward smarter, more efficient motor systems creates opportunities for premium positioning and enhanced customer value propositions. The market’s resilience and adaptability position it well for continued success in meeting the evolving needs of Omani households and the broader regional market.

What is Electric Motor for Household Appliances?

Electric motors for household appliances are devices that convert electrical energy into mechanical energy to power various appliances such as washing machines, refrigerators, and vacuum cleaners. They are essential components that enable the functionality of these everyday items.

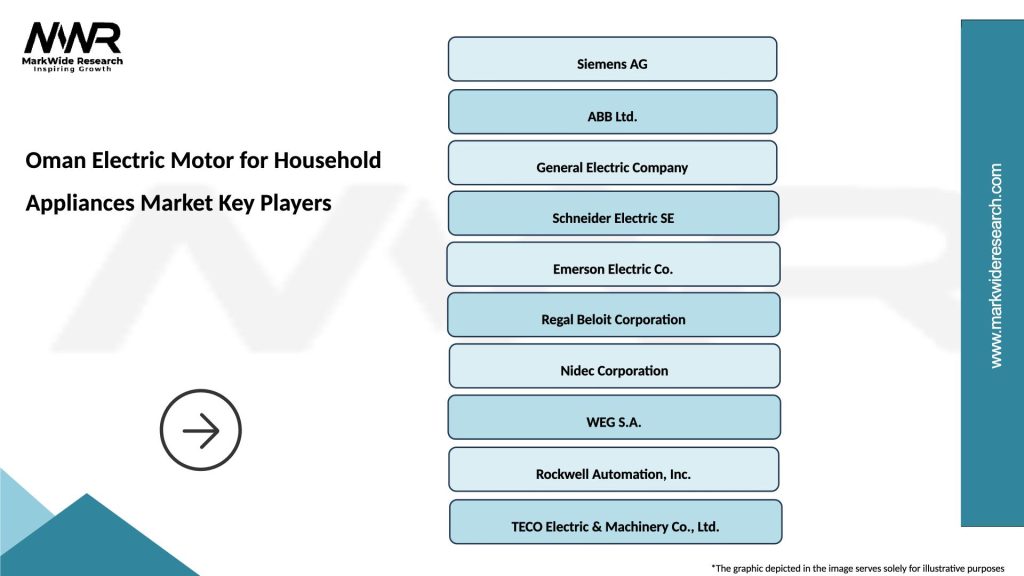

What are the key players in the Oman Electric Motor for Household Appliances Market?

Key players in the Oman Electric Motor for Household Appliances Market include companies like Siemens, ABB, and Schneider Electric, which are known for their innovative motor technologies and solutions for household applications, among others.

What are the growth factors driving the Oman Electric Motor for Household Appliances Market?

The growth of the Oman Electric Motor for Household Appliances Market is driven by increasing consumer demand for energy-efficient appliances, rising urbanization, and advancements in motor technology that enhance performance and reduce energy consumption.

What challenges does the Oman Electric Motor for Household Appliances Market face?

Challenges in the Oman Electric Motor for Household Appliances Market include the high cost of advanced motor technologies, competition from alternative energy solutions, and regulatory compliance related to energy efficiency standards.

What opportunities exist in the Oman Electric Motor for Household Appliances Market?

Opportunities in the Oman Electric Motor for Household Appliances Market include the growing trend towards smart home technologies, increasing investments in renewable energy sources, and the potential for innovation in motor design and efficiency.

What trends are shaping the Oman Electric Motor for Household Appliances Market?

Trends in the Oman Electric Motor for Household Appliances Market include the shift towards brushless motors for improved efficiency, the integration of IoT technologies for enhanced appliance functionality, and a focus on sustainability in motor manufacturing processes.

Oman Electric Motor for Household Appliances Market

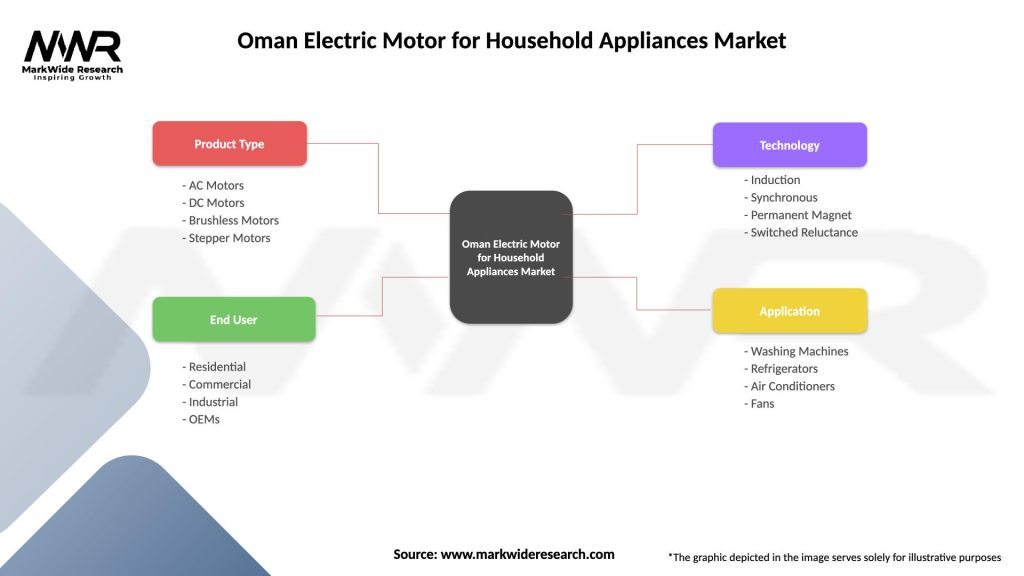

| Segmentation Details | Description |

|---|---|

| Product Type | AC Motors, DC Motors, Brushless Motors, Stepper Motors |

| End User | Residential, Commercial, Industrial, OEMs |

| Technology | Induction, Synchronous, Permanent Magnet, Switched Reluctance |

| Application | Washing Machines, Refrigerators, Air Conditioners, Fans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Oman Electric Motor for Household Appliances Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at