444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Oman aquaculture market represents a rapidly expanding sector within the Sultanate’s diversified economic framework, driven by government initiatives to reduce dependence on oil revenues and enhance food security. Aquaculture development in Oman has gained significant momentum over the past decade, with the sector experiencing robust growth rates of approximately 12.5% annually. The country’s strategic location along the Arabian Sea and Gulf of Oman provides exceptional opportunities for both marine and freshwater aquaculture operations.

Government support through Vision 2040 has positioned aquaculture as a cornerstone of economic diversification, with substantial investments in infrastructure development and technology adoption. The sector benefits from Oman’s extensive coastline spanning over 3,165 kilometers, offering diverse marine environments suitable for various species cultivation. Fish farming operations have expanded beyond traditional methods to incorporate modern recirculating aquaculture systems and offshore cage farming technologies.

Market dynamics indicate strong domestic demand coupled with growing export potential to regional markets. The sector’s contribution to national food security has become increasingly important, with aquaculture production accounting for approximately 35% of total fisheries output. Sustainable practices and environmental considerations have become integral to market development, aligning with global trends toward responsible aquaculture management.

The Oman aquaculture market refers to the comprehensive ecosystem of fish and seafood farming operations, supporting infrastructure, and related services within the Sultanate of Oman. This market encompasses various cultivation methods including marine cage farming, land-based recirculating systems, and integrated multi-trophic aquaculture approaches designed to optimize production efficiency while maintaining environmental sustainability.

Aquaculture activities in Oman include the breeding, rearing, and harvesting of finfish species such as sea bream, sea bass, and grouper, alongside shellfish cultivation and seaweed farming. The market integrates traditional fishing knowledge with modern technological solutions, creating a hybrid approach that respects local practices while embracing innovation. Value chain components extend from hatchery operations and feed production to processing facilities and distribution networks serving both domestic and international markets.

Strategic positioning of Oman’s aquaculture sector reflects the government’s commitment to economic diversification and sustainable development goals. The market has demonstrated remarkable resilience and growth potential, supported by favorable geographic conditions and progressive regulatory frameworks. Investment flows from both public and private sectors have accelerated infrastructure development and technological advancement across the value chain.

Key performance indicators reveal strong market fundamentals with production volumes increasing at approximately 15% annually over the past five years. The sector’s integration with tourism and hospitality industries has created additional revenue streams while promoting local seafood consumption. Export capabilities have expanded significantly, with Omani aquaculture products gaining recognition in Gulf Cooperation Council markets and beyond.

Technological adoption has emerged as a critical success factor, with operators implementing advanced monitoring systems, automated feeding mechanisms, and water quality management solutions. The market’s evolution toward sustainable practices has attracted international partnerships and knowledge transfer opportunities, positioning Oman as a regional leader in responsible aquaculture development.

Market intelligence reveals several transformative trends shaping Oman’s aquaculture landscape. The sector’s rapid expansion has been facilitated by strategic government investments and regulatory support, creating an enabling environment for both domestic and international operators.

Economic diversification initiatives under Oman Vision 2040 serve as the primary catalyst for aquaculture market expansion. The government’s strategic focus on reducing oil dependency has created substantial opportunities for alternative economic sectors, with aquaculture positioned as a high-potential growth area. Food security concerns have intensified the importance of domestic seafood production, particularly in light of global supply chain disruptions and increasing population demands.

Geographic advantages provide Oman with exceptional natural resources for aquaculture development. The country’s extensive coastline offers diverse marine environments suitable for various species cultivation, while favorable water temperatures and quality support year-round production cycles. Government support through policy frameworks, financial incentives, and infrastructure investments has created an enabling environment for sector growth.

Rising consumer awareness regarding sustainable seafood consumption has increased demand for locally produced aquaculture products. The growing tourism sector has created additional market opportunities, with hotels and restaurants seeking high-quality local seafood to enhance their culinary offerings. Export potential to regional markets presents significant revenue opportunities, particularly for premium species and value-added products.

Technological advancement has made aquaculture operations more efficient and profitable, attracting increased investment from both domestic and international sources. The availability of modern farming systems, automated monitoring technologies, and improved feed formulations has enhanced production capabilities while reducing operational risks.

Capital intensity represents a significant barrier to entry for potential aquaculture operators, with initial investment requirements for infrastructure, equipment, and technology often exceeding available financing options. Technical expertise limitations pose challenges for effective operation management, particularly in areas such as fish health management, water quality control, and breeding program optimization.

Environmental considerations create regulatory complexities that can delay project implementation and increase compliance costs. Concerns regarding marine ecosystem impacts, waste management, and coastal zone utilization require careful planning and ongoing monitoring. Climate variability and extreme weather events pose operational risks that can affect production cycles and infrastructure integrity.

Market access challenges include limited processing facilities, inadequate cold chain infrastructure, and complex export procedures that can restrict market reach. Feed supply dependencies on imported ingredients create cost volatility and supply chain vulnerabilities that impact operational profitability. Competition from established fishing industries and imported seafood products presents ongoing market challenges for local aquaculture producers.

Premium species cultivation offers substantial revenue potential through targeting high-value markets both domestically and internationally. Species such as grouper, sea bass, and specialty shellfish command premium prices and align with growing consumer preferences for sustainable seafood options. Value addition through processing, packaging, and branding can significantly enhance profit margins while creating employment opportunities across the value chain.

Integrated aquaculture systems present opportunities for operational efficiency improvements and environmental sustainability enhancement. Multi-trophic approaches combining finfish, shellfish, and seaweed cultivation can optimize resource utilization while reducing environmental impacts. Agritourism development combining aquaculture operations with educational and recreational activities can create additional revenue streams while promoting sector awareness.

Technology partnerships with international companies offer opportunities for knowledge transfer, equipment access, and market expansion. Research collaboration with academic institutions can drive innovation in breeding programs, feed development, and sustainable farming practices. Export market development, particularly targeting Gulf Cooperation Council countries and Asian markets, presents significant growth potential for Omani aquaculture products.

Circular economy initiatives including waste-to-energy projects and nutrient recycling systems can improve operational sustainability while reducing costs. The integration of renewable energy sources such as solar power can enhance operational efficiency and environmental performance.

Supply chain evolution within Oman’s aquaculture market reflects the sector’s maturation and increasing sophistication. The development of integrated value chains from hatchery operations to retail distribution has improved product quality and market access. Demand patterns show increasing preference for locally produced seafood, driven by freshness considerations and sustainability awareness among consumers.

Competitive dynamics have intensified as more operators enter the market, leading to innovation in production methods and product differentiation strategies. Price volatility in feed ingredients and operational inputs creates ongoing challenges for profitability management, requiring sophisticated risk management approaches. According to MarkWide Research analysis, operational efficiency improvements of approximately 25% have been achieved through technology adoption and best practice implementation.

Regulatory evolution continues to shape market development through updated environmental standards, food safety requirements, and export certification processes. Investment flows have diversified beyond traditional sources to include international development funds, private equity, and strategic partnerships with global aquaculture companies.

Market integration with regional seafood markets has accelerated through improved logistics infrastructure and trade facilitation measures. The sector’s contribution to employment generation has become increasingly significant, particularly in coastal communities where alternative economic opportunities may be limited.

Comprehensive analysis of Oman’s aquaculture market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes structured interviews with industry stakeholders, government officials, and market participants to gather firsthand insights on market dynamics, challenges, and opportunities.

Secondary research incorporates analysis of government publications, industry reports, academic studies, and statistical databases to establish market baselines and trend analysis. Field observations at aquaculture facilities provide practical insights into operational practices, technology adoption, and production capabilities across different market segments.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Quantitative analysis includes statistical modeling of production trends, market growth patterns, and performance indicators to support strategic recommendations. Market segmentation analysis examines various cultivation methods, species categories, and geographic distribution patterns to provide comprehensive market understanding.

Stakeholder consultation with industry associations, research institutions, and international organizations provides broader context for market development trends and future prospects. Regular monitoring and updating of research findings ensure continued relevance and accuracy of market intelligence.

Muscat Governorate leads Oman’s aquaculture development with approximately 40% market share, benefiting from proximity to government institutions, research facilities, and export infrastructure. The region’s advanced logistics capabilities and skilled workforce availability support both large-scale commercial operations and innovative pilot projects. Al Batinah region has emerged as a significant production center, leveraging its extensive coastline and favorable marine conditions for cage farming operations.

Dhofar Governorate presents substantial growth potential with unique environmental conditions supporting different species cultivation compared to northern regions. The area’s monsoon climate creates distinct seasonal advantages for certain aquaculture applications. Al Sharqiyah region has developed specialized capabilities in integrated aquaculture systems, combining traditional fishing knowledge with modern farming techniques.

Coastal zone distribution reflects strategic planning to optimize marine resource utilization while minimizing environmental impacts. Inland aquaculture development in regions such as Al Dakhiliyah focuses on freshwater species and recirculating systems that reduce dependence on coastal resources. Regional specialization has emerged based on local advantages, infrastructure availability, and market access considerations.

Infrastructure development varies significantly across regions, with government investments prioritizing areas with highest growth potential and strategic importance. Transportation networks and processing facilities have been developed to support regional production centers and facilitate market access.

Market leadership in Oman’s aquaculture sector is distributed among several key players, each contributing unique capabilities and market positioning. The competitive environment reflects a mix of established operators and emerging companies leveraging different strategic approaches.

Strategic partnerships between local operators and international companies have become increasingly common, facilitating technology transfer and market expansion. Competitive differentiation focuses on species specialization, sustainability credentials, and value-added product development.

Species-based segmentation reveals diverse cultivation approaches across Oman’s aquaculture market. Marine finfish dominates production volumes, with sea bream and sea bass representing the largest segments due to favorable growing conditions and established market demand. Shellfish cultivation has gained momentum, particularly oyster and mussel farming, driven by premium market positioning and export potential.

Production system segmentation includes various technological approaches:

Market channel segmentation encompasses domestic retail, food service, export markets, and direct sales. Value-added segments include processed products, ready-to-cook items, and premium packaged seafood targeting specific consumer preferences.

Geographic segmentation reflects regional specialization and resource optimization strategies across Oman’s diverse coastal and inland environments.

Premium finfish category demonstrates the strongest growth trajectory, with species such as grouper and hammour commanding premium prices in both domestic and export markets. Production efficiency in this category has improved significantly through selective breeding programs and optimized feeding regimens. Market demand for premium species continues to exceed supply capacity, creating opportunities for expansion.

Shellfish category represents an emerging high-potential segment with growing consumer acceptance and export opportunities. Oyster cultivation has shown particular promise, with local varieties gaining recognition for their unique flavor profiles. Production techniques have evolved to incorporate modern filtration and monitoring systems while maintaining traditional cultivation knowledge.

Seaweed cultivation has emerged as a complementary category with applications in food, cosmetics, and pharmaceutical industries. Integration opportunities with finfish operations provide additional revenue streams while enhancing environmental sustainability. Research initiatives continue to explore new species and cultivation methods suitable for Oman’s marine environment.

Value-added products category shows increasing sophistication with development of branded products, specialty preparations, and export-oriented packaging. Processing capabilities have expanded to include filleting, smoking, and ready-to-cook product lines targeting specific market segments.

Economic benefits for industry participants include substantial revenue generation potential through premium product positioning and market diversification. Operational advantages stem from Oman’s favorable geographic location, supportive regulatory environment, and growing infrastructure development. Participants benefit from government incentives, tax advantages, and access to specialized financing programs designed to support sector growth.

Stakeholder value creation extends beyond direct participants to include local communities through employment generation, skills development, and economic multiplier effects. Supply chain participants benefit from expanding market opportunities in feed production, equipment supply, processing services, and logistics support. Research institutions gain access to practical application opportunities for aquaculture innovation and technology development.

Environmental stakeholders benefit from sustainable aquaculture practices that support marine ecosystem health while providing alternative livelihoods to traditional fishing communities. Consumer benefits include access to fresh, locally produced seafood with known provenance and quality standards. Export market development creates foreign exchange benefits for the national economy while enhancing Oman’s international trade profile.

Knowledge transfer benefits position Oman as a regional center for aquaculture expertise, attracting international partnerships and investment opportunities. The sector’s development contributes to food security objectives while supporting economic diversification goals outlined in national development strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has become a defining trend across Oman’s aquaculture market, with operators increasingly adopting environmentally responsible practices and certification standards. Circular economy principles are being implemented through waste reduction initiatives, nutrient recycling systems, and renewable energy integration. Consumer demand for sustainably produced seafood continues to drive market positioning and product development strategies.

Technology advancement represents a transformative trend with widespread adoption of IoT sensors, automated feeding systems, and real-time monitoring capabilities. Data analytics applications are enhancing production optimization, disease prevention, and operational efficiency. Artificial intelligence integration for predictive analytics and decision support systems is gaining traction among larger operators.

Market premiumization reflects growing consumer willingness to pay higher prices for quality, sustainability, and traceability. Brand development and direct-to-consumer marketing strategies are becoming more sophisticated, particularly for premium species and value-added products. MWR data indicates that premium product segments are experiencing growth rates of approximately 20% annually.

Integration trends include vertical integration along value chains and horizontal integration across species and production systems. Partnership development with international companies, research institutions, and technology providers is accelerating knowledge transfer and market access opportunities.

Infrastructure expansion projects have significantly enhanced Oman’s aquaculture capabilities, including new hatchery facilities, processing plants, and specialized port infrastructure. Government initiatives have established aquaculture development zones with dedicated infrastructure and streamlined regulatory processes. The completion of several major cage farming installations has increased production capacity and demonstrated commercial viability.

Technology partnerships with international companies have introduced advanced farming systems, monitoring technologies, and best practice methodologies. Research collaborations with universities and international institutions have advanced breeding programs, feed development, and sustainable farming techniques. The establishment of specialized training centers has begun addressing skills development needs across the sector.

Regulatory developments include updated environmental standards, food safety protocols, and export certification procedures that align with international requirements. Financial innovations such as specialized aquaculture financing products and insurance schemes have improved access to capital for sector development. Market access improvements through trade agreements and export facilitation measures have expanded international opportunities.

Industry organization development includes the formation of aquaculture associations, cooperative structures, and industry advocacy groups that support sector interests and development objectives.

Strategic focus should prioritize sustainable production practices and environmental stewardship to ensure long-term sector viability and market acceptance. Investment allocation toward technology adoption, skills development, and infrastructure enhancement will support competitive positioning and operational efficiency improvements. Operators should consider species diversification strategies that leverage Oman’s unique marine environment while targeting premium market segments.

Market development efforts should emphasize brand building, quality certification, and traceability systems that differentiate Omani aquaculture products in competitive markets. Partnership strategies with international companies, research institutions, and export market intermediaries can accelerate growth and knowledge transfer. Value chain integration opportunities should be evaluated to capture additional margins and improve market control.

Risk management approaches should address environmental uncertainties, market volatility, and operational challenges through diversification, insurance coverage, and contingency planning. Regulatory compliance systems should be established to meet evolving standards and maintain market access. According to MarkWide Research projections, operators implementing comprehensive risk management strategies achieve 30% better long-term sustainability outcomes.

Innovation investment in breeding programs, feed development, and production optimization technologies will support competitive advantages and operational improvements. Human capital development through training programs, educational partnerships, and knowledge sharing initiatives is essential for sector growth and sustainability.

Growth trajectory for Oman’s aquaculture market remains highly positive, with production capacity expected to expand significantly over the next decade. Government commitment to economic diversification and food security objectives ensures continued policy support and infrastructure investment. The sector’s integration with national development strategies positions aquaculture as a priority area for sustained growth and development.

Technology evolution will continue transforming production methods, operational efficiency, and market capabilities. Automation advancement and smart farming systems adoption are expected to accelerate, driven by labor optimization needs and precision management requirements. Sustainability standards will become increasingly important for market access and consumer acceptance.

Market expansion opportunities in export markets, premium segments, and value-added products present substantial revenue potential. Regional leadership positioning in sustainable aquaculture practices could establish Oman as a preferred supplier for quality-conscious international markets. Production growth rates are projected to maintain double-digit expansion through strategic investments and market development initiatives.

Innovation ecosystem development through research partnerships, technology transfer, and entrepreneurship support will drive continued sector evolution. Circular economy integration and environmental sustainability will become defining characteristics of successful operations, aligning with global trends and consumer preferences.

Oman’s aquaculture market represents a dynamic and rapidly evolving sector with substantial growth potential and strategic importance for national economic diversification. The combination of favorable geographic conditions, government support, and increasing market demand creates an enabling environment for sustained sector development. Technology adoption and sustainable practices have emerged as critical success factors, positioning forward-thinking operators for competitive advantages in both domestic and international markets.

Strategic opportunities in premium species cultivation, value-added product development, and export market expansion offer significant revenue potential for industry participants. The sector’s contribution to food security, employment generation, and economic diversification aligns with national development objectives while supporting community development in coastal regions. Continued investment in infrastructure, technology, and human capital development will be essential for realizing the market’s full potential and maintaining competitive positioning in regional and global markets.

What is Aquaculture?

Aquaculture refers to the farming of aquatic organisms, including fish, mollusks, crustaceans, and aquatic plants. It involves various practices such as breeding, rearing, and harvesting in controlled environments, contributing significantly to food production and economic development.

What are the key players in the Oman Aquaculture Market?

Key players in the Oman Aquaculture Market include Oman Fisheries Company, Dhofar Fisheries Company, and Al Bahja Fisheries, among others. These companies are involved in various aquaculture activities, including fish farming and seafood processing.

What are the growth factors driving the Oman Aquaculture Market?

The Oman Aquaculture Market is driven by increasing demand for seafood, government support for aquaculture initiatives, and advancements in aquaculture technology. Additionally, the focus on sustainable practices and food security further propels market growth.

What challenges does the Oman Aquaculture Market face?

The Oman Aquaculture Market faces challenges such as water quality management, disease outbreaks in farmed species, and competition from wild-caught seafood. These factors can impact production efficiency and profitability.

What opportunities exist in the Oman Aquaculture Market?

Opportunities in the Oman Aquaculture Market include the potential for expanding into new species cultivation, increasing export capabilities, and leveraging technology for better farm management. The growing interest in sustainable seafood also presents new avenues for growth.

What trends are shaping the Oman Aquaculture Market?

Trends in the Oman Aquaculture Market include the adoption of integrated multi-trophic aquaculture systems, increased focus on organic aquaculture, and the use of digital technologies for monitoring and management. These trends aim to enhance sustainability and productivity in the sector.

Oman Aquaculture Market

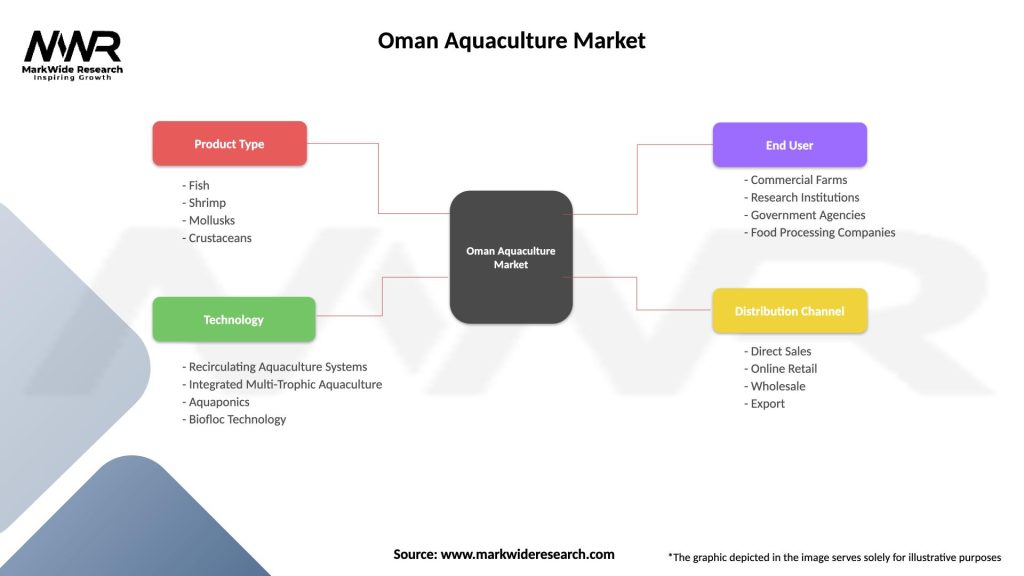

| Segmentation Details | Description |

|---|---|

| Product Type | Fish, Shrimp, Mollusks, Crustaceans |

| Technology | Recirculating Aquaculture Systems, Integrated Multi-Trophic Aquaculture, Aquaponics, Biofloc Technology |

| End User | Commercial Farms, Research Institutions, Government Agencies, Food Processing Companies |

| Distribution Channel | Direct Sales, Online Retail, Wholesale, Export |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Oman Aquaculture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at