Key Market Insights

-

Oleate esters deliver high biodegradability (often over 90% in standard tests), meeting stringent environmental regulations in Europe and North America.

-

Branched-chain oleate esters (e.g., 2-ethylhexyl oleate) dominate lubricant and cosmetics applications due to improved low-temperature performance and oxidative stability.

-

Linear alcohol oleates (e.g., methyl oleate) retain significance as solvent carriers and intermediate feedstocks for biodiesel and polymer additives.

-

Asia Pacific leads consumption growth, driven by expanding automotive, personal care, and homecare sectors in China and India.

-

Technological advancements in enzymatic and reactive distillation processes are enhancing yield and reducing production costs.

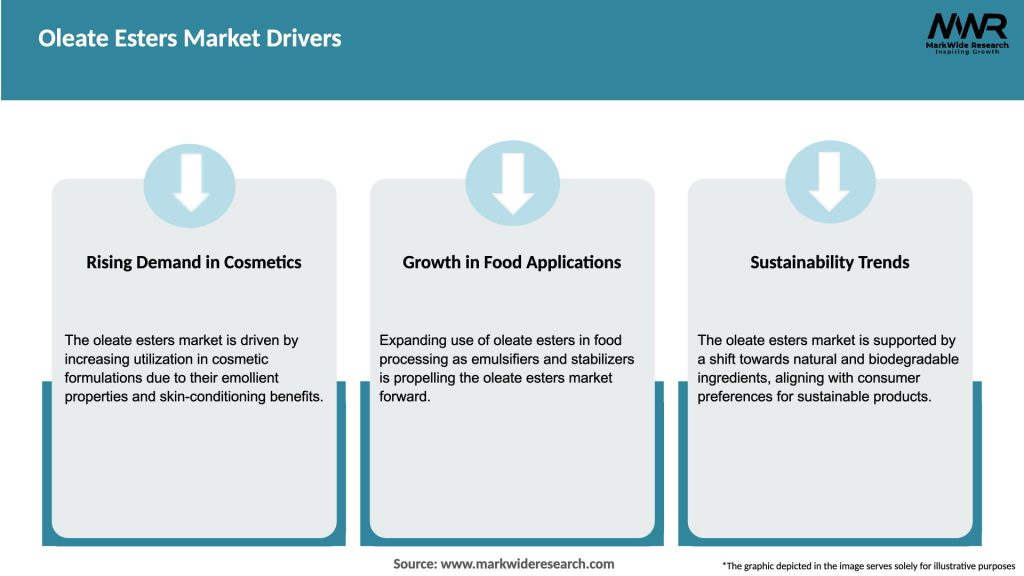

Market Drivers

-

Biodegradability Regulations: Legislation such as EU Detergents Regulation (EC 648/2004) and U.S. EPA VOC limits push formulators toward readily biodegradable esters.

-

Sustainable Sourcing: Rising preference for vegetable-oil feedstocks aligns with corporate sustainability goals and consumer demand for “green” products.

-

Lubricant Performance: Oleate esters improve wear protection and energy efficiency in metalworking and industrial lubrication fluids, supporting Industry 4.0 initiatives.

-

Personal Care Growth: Global cosmetics market expansion fuels demand for mild, skin-friendly emollients—roles effectively served by oleate esters.

-

Cost Competitiveness: Enhanced production methods and increased feedstock availability are driving down ester prices relative to synthetic alternatives.

Market Restraints

-

Feedstock Volatility: Fluctuations in vegetable oil prices, driven by weather and crop yields, introduce cost uncertainty.

-

Competition from Mineral Oils: In price-sensitive lubricant segments, cheaper petroleum-derived fluids can undercut ester‐based formulations.

-

Technical Complexity: Achieving consistent product quality requires stringent control of esterification parameters and purification steps.

-

Narrow Grade Differentiation: Overlapping performance among various oleate esters can limit premium pricing opportunities.

-

Regulatory Barriers: Tariffs and import restrictions on oleochemical raw materials can hinder regional market growth.

Market Opportunities

-

Advanced Ester Blends: Tailored mixtures of oleate esters with other bio‐esters or synthetic oils to optimize performance across temperature ranges.

-

Enzymatic Catalysis: Adoption of biocatalysts for milder, energy-efficient esterification processes that improve selectivity and reduce byproducts.

-

High-Value Derivatives: Functionalization of oleate esters (e.g., epoxidation, ethoxylation) to access specialty plasticizers, lubricity enhancers, and surfactants.

-

Circular Feedstocks: Integration of used cooking oil and other waste lipids as oleic acid sources to strengthen circular economy credentials.

-

Emerging Applications: Exploration in bio-based metal forming fluids, biodegradable hydraulic fluids, and eco-friendly phase change materials.

Market Dynamics

-

Feedstock Shifts: Growing palm and sunflower oil production diversifies oleic acid supply, reducing dependency on single-source oils.

-

Capacity Expansions: Major oleochemical groups are investing in new esterification plants in Southeast Asia and Latin America to meet local demand and improve logistics.

-

Strategic Alliances: Partnerships between chemical majors and catalyst technology providers accelerate development of high-efficiency processes.

-

Product Standardization: Development of industry specifications (e.g., ISO, ASTM) for oleate ester grades fosters wider acceptance in industrial applications.

-

Digitalization in Manufacturing: Advanced process control systems optimize reaction conditions, minimize waste, and ensure consistent product quality.

Regional Analysis

-

Asia Pacific: Largest and fastest-growing market, led by China and India’s robust manufacturing and personal care sectors; local ester plants reduce import reliance.

-

North America: Strong demand tied to automotive and industrial lubrication, with manufacturers benefiting from proximity to soy oil feedstock.

-

Europe: Stringent environmental regulations drive high adoption in detergents, cleaners, and cosmetic applications; Germany, France, and Italy lead consumption.

-

Latin America: Emerging market with potential in bio-lubricants and renewable plasticizers; Brazil’s large oilseed industry offers strategic feedstock advantages.

-

Middle East & Africa: Nascent adoption primarily in lubricants and specialty chemicals; growth constrained by limited local feedstock processing capacity.

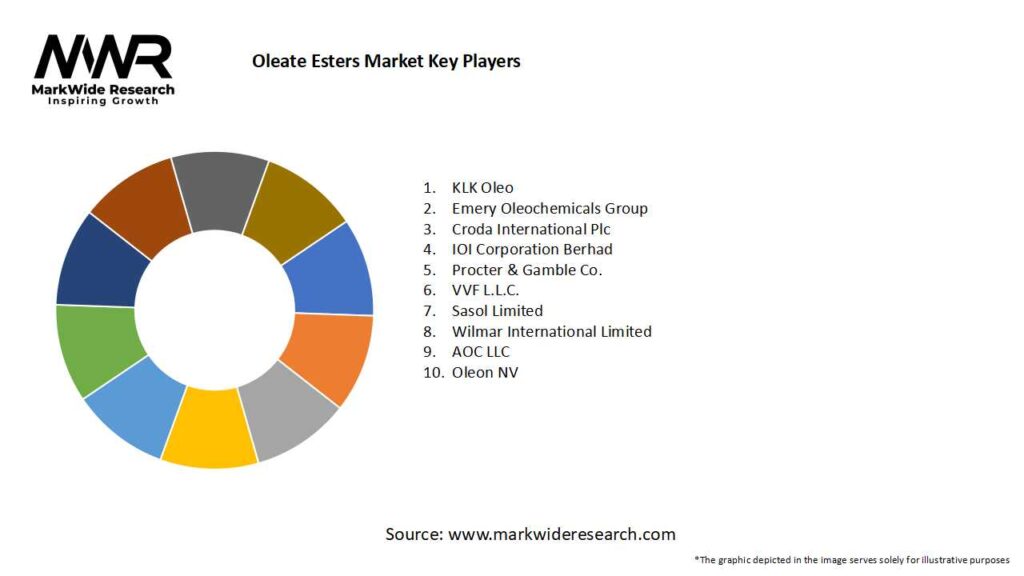

Competitive Landscape

Leading Companies in the Oleate Esters Market:

- KLK Oleo

- Emery Oleochemicals Group

- Croda International Plc

- IOI Corporation Berhad

- Procter & Gamble Co.

- VVF L.L.C.

- Sasol Limited

- Wilmar International Limited

- AOC LLC

- Oleon NV

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

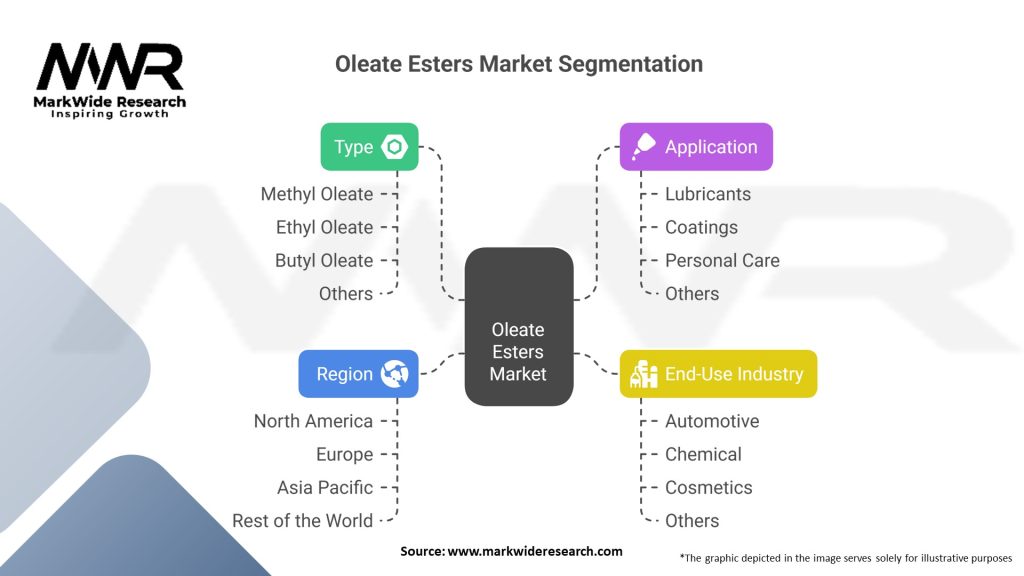

Segmentation

-

By Alcohol Type: Methyl Oleate, Ethyl Oleate, Isopropyl Oleate, 2-Ethylhexyl Oleate, Others

-

By Application: Lubricants & Metalworking, Personal Care & Cosmetics, Surfactants & Detergents, Plasticizers & Polymers, Others

-

By Production Process: Chemical Esterification, Enzymatic Esterification

-

By Region: Asia Pacific, North America, Europe, Latin America, Middle East & Africa

Category-wise Insights

-

Methyl and Ethyl Oleate: Widely used as biodiesel precursors and solvent carriers; lower viscosity and good solvent power make them ideal in fuel additives.

-

Isopropyl Oleate: Favored in cosmetics for its fast-absorbing emollient properties and nongreasy skin feel.

-

2-Ethylhexyl Oleate: Leading role in metalworking fluids and high-performance lubricants due to superior low-temperature fluidity and oxidative stability.

-

Specialty Grades: Ethoxylated and epoxidized oleate esters serve as high-value surfactants and polymer stabilizers.

Key Benefits for Industry Participants and Stakeholders

-

Regulatory Compliance: Biodegradable profile ensures adherence to environmental and occupational safety regulations.

-

Performance Enhancement: Tailored ester grades offer optimized viscosity, thermal stability, and solubility across applications.

-

Sustainability Credentials: Renewable feedstocks and potential closed-loop sourcing strengthen ESG narratives.

-

Cost Efficiency: Localized production and improved process yields reduce logistics and manufacturing expenses over time.

-

Innovation Platform: Versatile chemistry of oleate esters enables downstream functionalization into a wide array of specialty additives.

SWOT Analysis

Strengths

-

High biodegradability and low toxicity

-

Versatility across multiple industries

Weaknesses

-

Feedstock price volatility

-

Technical complexity in specialty grade production

Opportunities

-

Expansion in bio-lubricants and green chemistries

-

Development of circular bio-economy models

Threats

-

Competition from petroleum-derived esters in cost-sensitive segments

-

Geopolitical risks impacting agricultural feedstock supply

Market Key Trends

-

Circular Feedstock Integration: Increasing use of waste oils—such as used cooking oil—as oleic acid sources to lower carbon footprint.

-

Functional Derivatives: Growth of epoxidized and ethoxylated oleate esters as eco-friendly surfactants and plasticizer alternatives.

-

Enzymatic Processes: Rising adoption of lipase-based catalysis for energy-efficient, selective esterification under mild conditions.

-

Digital Twin Modeling: Virtual simulation of esterification reactors to optimize reaction kinetics and maximize throughput.

-

Customized Ester Blends: Tailored mixtures designed for specific OEM performance requirements in industrial machinery and personal care.

Covid-19 Impact

The pandemic disrupted supply chains and temporarily dampened industrial demand for lubricants, delaying some oleate ester consumption in metalworking and automotive sectors. Conversely, increased demand for hand sanitizers and household cleaners bolstered oleate-based surfactant applications. Recovery in manufacturing and renewed focus on hygienic formulations have led to a strong market rebound, reinforcing the strategic importance of diversified ester portfolios.

Key Industry Developments

-

Capacity Expansion: Major oleochemical players commissioning new esterification units in Southeast Asia to meet surging regional demand.

-

Partnerships: Joint ventures between catalyst technology providers and oleochemical producers to commercialize novel enzymatic esterification platforms.

-

Sustainability Initiatives: Launch of certified “renewable” oleate ester lines with verified mass-balance accounting under RSPO and ISCC schemes.

-

Product Innovation: Introduction of high-viscosity oleate esters for biodegradable hydraulic fluids and bio-based anti-wear additives.

Analyst Suggestions

-

Diversify Feedstocks: Secure contracts for alternate high-oleic oils (e.g., sunflower, canola) and recycled oils to hedge against price swings.

-

Invest in Biocatalysis: Collaborate with enzyme specialists to scale up enzymatic esterification, reducing energy costs and byproduct formation.

-

Target High-Growth Niches: Focus R&D on specialty esters for rapidly expanding sectors like e-mobility lubrication and eco-cosmetics.

-

Develop Circular Solutions: Implement traceable, closed-loop sourcing and recycling programs to enhance sustainability credentials.

Future Outlook

The Oleate Esters market is set for sustained growth as end-use industries intensify the shift toward renewable, biodegradable chemicals. Innovations in feedstock diversification, enzymatic processing, and functionalized derivatives will unlock new applications and premium pricing opportunities. As regional production capacities expand and digital manufacturing optimizes efficiencies, oleate esters will continue to cement their role as versatile, eco-friendly ingredients in lubricants, personal care, surfactants, and beyond.

Conclusion

Oleate esters represent a strategic intersection of performance and sustainability, offering formulators a biodegradable, high-performing alternative to conventional petrochemical components. While feedstock volatility and technical complexity present challenges, ongoing technological advances and circular economy initiatives promise to strengthen market resilience and profitability. Stakeholders who invest in process innovation, feedstock diversification, and targeted application development will lead the growth trajectory of this dynamic bio‐based chemicals market.