444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Oily Water Separator (OWS) Marine Sales Market involves the global trade and utilization of systems designed to separate oil from water in marine environments, ensuring compliance with international regulations and environmental standards. These systems are crucial aboard ships and vessels to prevent pollution of oceans and water bodies.

Meaning

Oily Water Separators (OWS) are specialized marine equipment used to remove oil and other contaminants from bilge water onboard ships. This process ensures that discharged water meets regulatory requirements for oil content, minimizing environmental impact and adhering to stringent maritime pollution prevention laws.

Executive Summary

The Oily Water Separator (OWS) Marine Sales Market is driven by regulatory requirements mandating ships to implement effective pollution control measures, coupled with technological advancements enhancing system efficiency and performance. Key players focus on innovation and compliance to capitalize on market opportunities amid growing environmental concerns and maritime industry expansion.

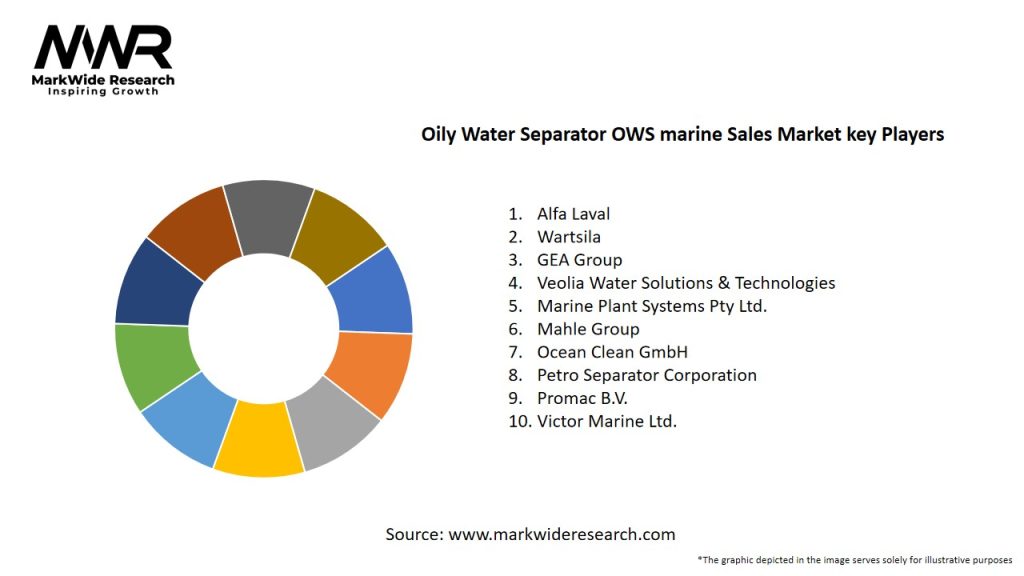

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Oily Water Separator (OWS) Marine Sales Market dynamics are influenced by regulatory frameworks, technological advancements, market expansion in emerging economies, and industry efforts towards environmental sustainability.

Regional Analysis

Competitive Landscape

Leading Companies in Oily Water Separator (OWS) Marine Sales Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented based on technology type (gravity-based OWS, centrifugal OWS), vessel type (tankers, bulk carriers, container ships), and end-user (shipping companies, naval fleets) to cater to diverse maritime applications.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths: Effective pollution control, compliance with international regulations, and technological advancements enhancing system efficiency.

Weaknesses: High initial costs, operational complexities, and regulatory compliance challenges.

Opportunities: Technological innovation, market expansion in emerging economies, and partnerships to drive sustainable practices.

Threats: Economic downturns affecting maritime investments, regulatory uncertainties, and competition from alternative pollution control solutions.

Market Key Trends

Covid-19 Impact

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Oily Water Separator (OWS) Marine Sales Market is optimistic, driven by stringent environmental regulations, technological advancements, and increasing maritime trade. Market participants focusing on innovation, sustainability, and regulatory compliance are well-positioned to capitalize on growth opportunities and contribute to global efforts towards cleaner oceans and sustainable shipping practices.

Conclusion

In conclusion, the Oily Water Separator (OWS) Marine Sales Market is poised for growth, driven by regulatory mandates, technological innovation, and expanding maritime activities. Despite challenges such as high costs and operational complexities, investments in sustainable practices, market diversification, and collaborative partnerships will propel market expansion and environmental stewardship in the marine industry.

What is Oily Water Separator OWS?

An Oily Water Separator (OWS) is a device used in marine applications to separate oil from water, ensuring compliance with environmental regulations. It plays a crucial role in preventing oil pollution in oceans and waterways by treating bilge water and other oily discharges.

What are the key players in the Oily Water Separator OWS marine Sales Market?

Key players in the Oily Water Separator OWS marine Sales Market include Alfa Laval, Wärtsilä, and GEA Group, which are known for their innovative separation technologies and solutions for marine applications, among others.

What are the growth factors driving the Oily Water Separator OWS marine Sales Market?

The growth of the Oily Water Separator OWS marine Sales Market is driven by increasing environmental regulations, the rising demand for efficient waste management solutions in the shipping industry, and the growing awareness of marine pollution.

What challenges does the Oily Water Separator OWS marine Sales Market face?

Challenges in the Oily Water Separator OWS marine Sales Market include stringent regulatory compliance requirements, the high cost of advanced separation technologies, and the need for regular maintenance and operational training for crew members.

What opportunities exist in the Oily Water Separator OWS marine Sales Market?

Opportunities in the Oily Water Separator OWS marine Sales Market include the development of more efficient and compact separation technologies, the expansion of the maritime industry in emerging markets, and the increasing focus on sustainability and eco-friendly practices.

What trends are shaping the Oily Water Separator OWS marine Sales Market?

Trends in the Oily Water Separator OWS marine Sales Market include the integration of digital technologies for monitoring and control, advancements in membrane separation techniques, and a shift towards more sustainable and environmentally friendly solutions.

Oily Water Separator OWS marine Sales Market

| Segmentation Details | Description |

|---|---|

| Product Type | Gravity Separators, Centrifugal Separators, Coalescing Filters, Membrane Systems |

| End User | Shipping Companies, Offshore Platforms, Marine Service Providers, Environmental Agencies |

| Installation Type | Onboard Systems, Shore-based Facilities, Mobile Units, Fixed Installations |

| Technology | Physical Separation, Chemical Treatment, Biological Treatment, Hybrid Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at