444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Oil & Gas Automation & Control Systems market encompasses a range of technological solutions designed to optimize operations, enhance safety, and improve efficiency within the oil and gas industry. These systems integrate advanced automation, instrumentation, and control technologies to monitor and manage various processes across upstream, midstream, and downstream sectors. With a focus on reducing operational costs, minimizing downtime, and ensuring regulatory compliance, automation and control systems play a critical role in modernizing the oil and gas infrastructure.

Meaning

Oil & Gas Automation & Control Systems refer to the application of advanced technologies such as SCADA (Supervisory Control and Data Acquisition), DCS (Distributed Control Systems), PLCs (Programmable Logic Controllers), and MES (Manufacturing Execution Systems) to automate and manage industrial processes within the oil and gas industry. These systems enable real-time monitoring, remote operation, predictive maintenance, and data-driven decision-making to optimize production, improve safety standards, and achieve operational excellence.

Executive Summary

The Oil & Gas Automation & Control Systems market is experiencing significant growth driven by increasing demand for energy, advancements in digital technologies, and a shift towards integrated and connected operations. Key market players are focusing on developing scalable solutions that enhance productivity, reduce environmental impact, and ensure operational reliability across complex and geographically dispersed facilities. As the industry navigates challenges such as fluctuating oil prices and regulatory pressures, automation and control systems offer strategic advantages in driving efficiency and resilience.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The growth of the Oil & Gas Automation & Control Systems market is driven by:

Market Restraints

Challenges in the Oil & Gas Automation & Control Systems market include:

Market Opportunities

Opportunities in the Oil & Gas Automation & Control Systems market include:

Market Dynamics

The Oil & Gas Automation & Control Systems market dynamics are influenced by evolving technological trends, regulatory landscapes, geopolitical factors, and industry-specific challenges. Continuous innovation, strategic investments, and partnerships are essential to navigate market dynamics, capitalize on emerging opportunities, and sustain competitive advantage.

Regional Analysis

Regional analysis of the Oil & Gas Automation & Control Systems market highlights variations in adoption rates, regulatory frameworks, and technological investments across key regions including North America, Europe, Asia Pacific, Middle East, and Latin America. Each region exhibits unique market dynamics shaped by local industry trends, energy policies, and economic conditions.

Competitive Landscape

Leading Companies in the Oil and Gas Automation and Control Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

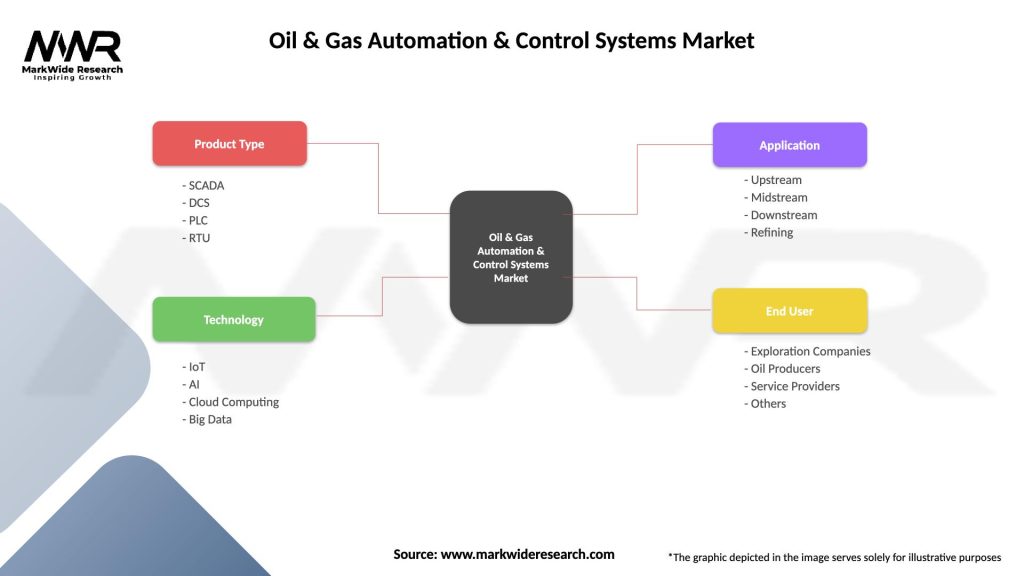

The Oil & Gas Automation & Control Systems market segmentation includes:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants benefit from Oil & Gas Automation & Control Systems through:

SWOT Analysis

Strengths: Enhanced operational efficiency, improved safety standards, and regulatory compliance.

Weaknesses: High initial investment costs, integration complexities, and cybersecurity vulnerabilities.

Opportunities: Digital transformation initiatives, smart sensor technologies, and partnerships for innovation and market expansion.

Threats: Economic volatility, cybersecurity threats, skills shortage, and regulatory uncertainties impacting market dynamics.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic accelerated digital transformation initiatives in the oil and gas industry, highlighting the importance of remote operations, automation, and data-driven decision-making. Companies invested in resilience measures, remote monitoring solutions, and workforce safety protocols to mitigate operational disruptions and ensure business continuity.

Key Industry Developments

Analyst Suggestions

Analysts suggest:

Future Outlook

The future outlook for the Oil & Gas Automation & Control Systems market is optimistic, driven by increasing digitalization, technological advancements, and strategic investments in energy transition initiatives. As the industry evolves towards integrated and sustainable operations, automation and control systems will play a pivotal role in enhancing efficiency, resilience, and competitiveness amidst evolving market dynamics and global energy demands.

Conclusion

In conclusion, the Oil & Gas Automation & Control Systems market represents a critical enabler of operational excellence, safety, and sustainability in the oil and gas industry. Despite challenges such as high upfront costs and cybersecurity risks, adoption of advanced automation technologies and digital transformation initiatives offers substantial benefits in terms of efficiency gains, cost optimization, and regulatory compliance. By leveraging AI, IoT, and collaborative partnerships, industry stakeholders can navigate complexities, capitalize on emerging opportunities, and drive long-term value creation in the evolving global energy landscape.

What is Oil & Gas Automation & Control Systems?

Oil & Gas Automation & Control Systems refer to the technologies and processes used to control and automate operations in the oil and gas industry. This includes systems for monitoring, controlling, and optimizing production, refining, and distribution processes.

What are the key players in the Oil & Gas Automation & Control Systems Market?

Key players in the Oil & Gas Automation & Control Systems Market include companies like Siemens, Honeywell, and Schneider Electric. These companies provide a range of solutions for process automation, control systems, and safety management, among others.

What are the main drivers of growth in the Oil & Gas Automation & Control Systems Market?

The main drivers of growth in the Oil & Gas Automation & Control Systems Market include the increasing demand for operational efficiency, the need for enhanced safety measures, and the adoption of advanced technologies such as IoT and AI in oil and gas operations.

What challenges does the Oil & Gas Automation & Control Systems Market face?

Challenges in the Oil & Gas Automation & Control Systems Market include the high initial investment costs, the complexity of integrating new technologies with existing systems, and the need for skilled personnel to manage and maintain these advanced systems.

What opportunities exist in the Oil & Gas Automation & Control Systems Market?

Opportunities in the Oil & Gas Automation & Control Systems Market include the growing trend towards digital transformation, the increasing focus on sustainability and reducing carbon emissions, and the potential for expanding automation solutions in emerging markets.

What trends are shaping the Oil & Gas Automation & Control Systems Market?

Trends shaping the Oil & Gas Automation & Control Systems Market include the rise of smart technologies, the integration of cloud computing for data management, and the increasing use of predictive analytics to enhance decision-making processes.

Oil & Gas Automation & Control Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | SCADA, DCS, PLC, RTU |

| Technology | IoT, AI, Cloud Computing, Big Data |

| Application | Upstream, Midstream, Downstream, Refining |

| End User | Exploration Companies, Oil Producers, Service Providers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Oil and Gas Automation and Control Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at