444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The oil and gas industry is a vital sector that requires efficient processes and systems to ensure optimal productivity. Water treatment plays a crucial role in this industry, as water is used extensively in drilling, production, and refining operations. The oil and gas water treatment chemicals market encompasses a wide range of chemical compounds designed to address various water-related challenges in the industry.

Meaning

Oil and gas water treatment chemicals are substances used to treat and purify water used in the oil and gas sector. These chemicals aid in removing impurities, controlling microbial growth, and preventing corrosion, scale formation, and foaming. The treatment chemicals help maintain the quality of water, protect equipment from damage, and enhance overall operational efficiency.

Executive Summary

The oil and gas water treatment chemicals market has witnessed significant growth in recent years. The increasing demand for energy, coupled with the expansion of oil and gas exploration and production activities, has driven the need for effective water treatment solutions. The market offers a wide array of chemicals specifically formulated for different applications and water conditions in the oil and gas industry.

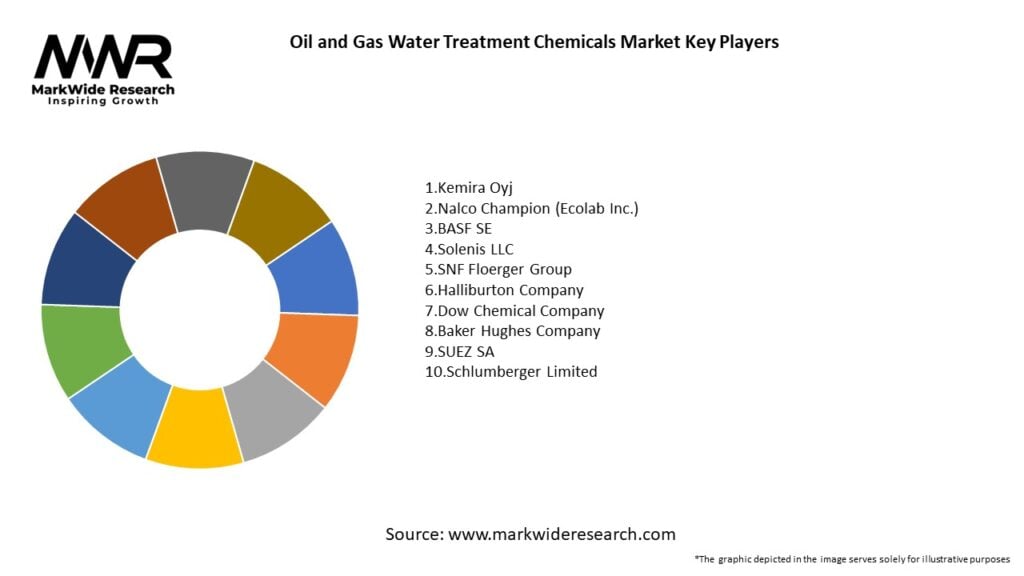

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The oil and gas water treatment chemicals market is characterized by intense competition, technological advancements, and evolving customer demands. Market players strive to develop new chemical formulations that are more effective, environmentally friendly, and economically viable. Additionally, partnerships, mergers, and acquisitions play a crucial role in expanding market reach and enhancing product portfolios.

Regional Analysis

The oil and gas water treatment chemicals market is geographically diverse, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market due to its large oil and gas industry, stringent regulations, and extensive shale gas production. The Asia Pacific region is experiencing rapid growth, driven by increasing energy demand, expanding exploration activities, and rising environmental awareness.

Competitive Landscape

Leading Companies in the Oil and Gas Water Treatment Chemicals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

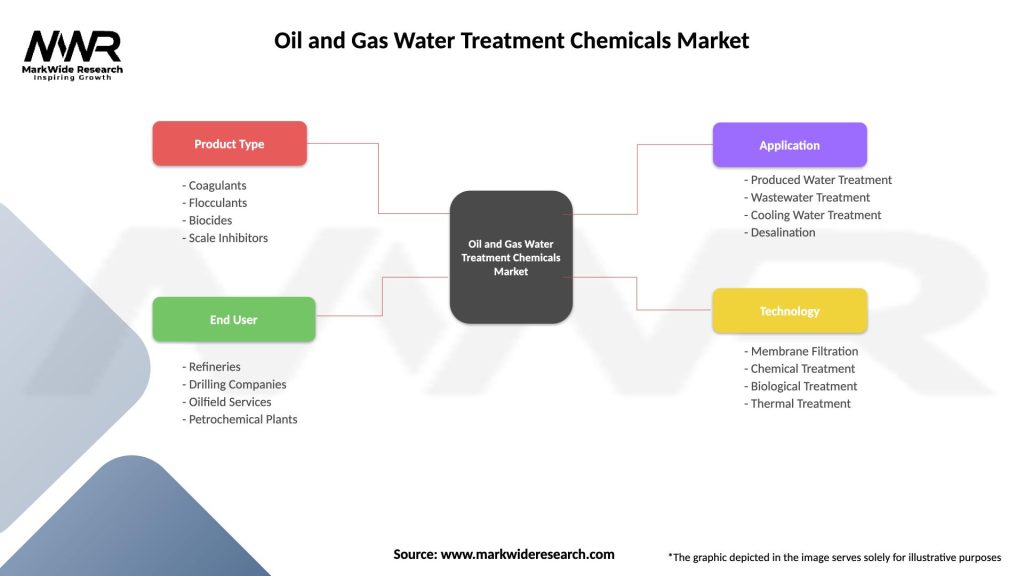

Segmentation

The market can be segmented based on chemical type, application, and region. By chemical type, the segments include corrosion inhibitors, biocides, scale inhibitors, foam control agents, and others. Application segments comprise upstream, midstream, and downstream operations.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the oil and gas industry, causing disruptions in production, supply chains, and demand. As a result, the oil and gas water treatment chemicals market experienced a temporary decline. However, as economies recover and energy demand rebounds, the market is expected to regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The oil and gas water treatment chemicals market is projected to witness steady growth in the coming years. Factors such as increasing energy demand, offshore exploration activities, and the need for sustainable practices will continue to drive market expansion. Technological advancements and a focus on environmental responsibility will shape the future of the industry.

Conclusion

The oil and gas water treatment chemicals market plays a crucial role in ensuring efficient and sustainable operations within the industry. The demand for effective water treatment solutions is driven by the growing energy needs, environmental regulations, and the industry’s commitment to sustainability. Market players must innovate, develop environmentally friendly products, and leverage digital technologies to meet evolving industry requirements and gain a competitive edge. With a focus on addressing challenges and embracing opportunities, the market is poised for steady growth in the coming years.

What is Oil and Gas Water Treatment Chemicals?

Oil and Gas Water Treatment Chemicals are specialized substances used to treat water produced during oil and gas extraction processes. These chemicals help in removing impurities, managing water quality, and ensuring compliance with environmental regulations.

What are the key players in the Oil and Gas Water Treatment Chemicals Market?

Key players in the Oil and Gas Water Treatment Chemicals Market include companies like Schlumberger, Halliburton, and BASF. These companies provide a range of chemical solutions for water treatment in the oil and gas industry, among others.

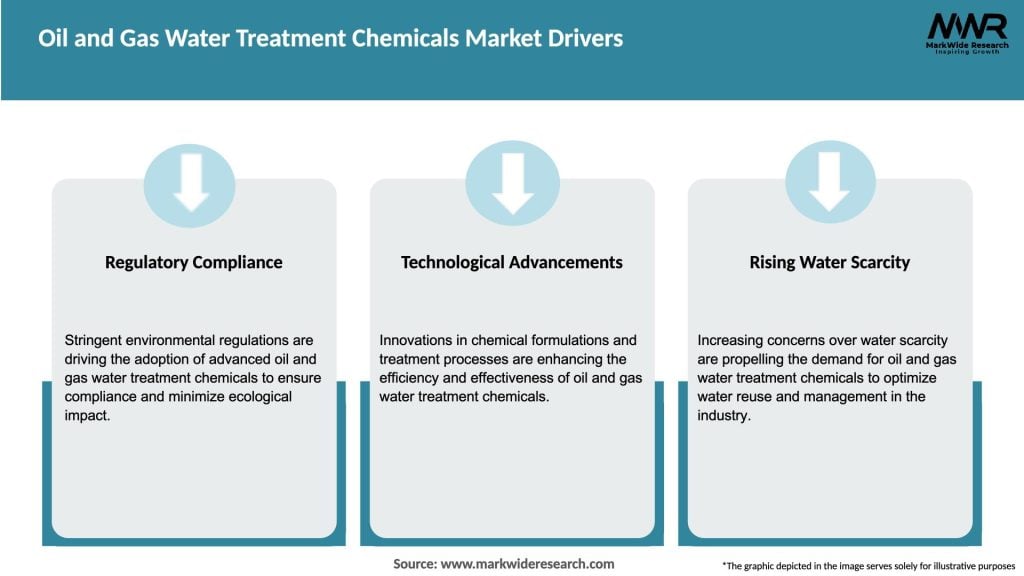

What are the main drivers of the Oil and Gas Water Treatment Chemicals Market?

The main drivers of the Oil and Gas Water Treatment Chemicals Market include the increasing demand for clean water in oil extraction, stringent environmental regulations, and the need for efficient water management solutions in the industry.

What challenges does the Oil and Gas Water Treatment Chemicals Market face?

Challenges in the Oil and Gas Water Treatment Chemicals Market include fluctuating raw material prices, regulatory compliance complexities, and the need for continuous innovation to meet evolving environmental standards.

What opportunities exist in the Oil and Gas Water Treatment Chemicals Market?

Opportunities in the Oil and Gas Water Treatment Chemicals Market include the development of eco-friendly chemicals, advancements in treatment technologies, and the growing focus on sustainable practices in the oil and gas sector.

What trends are shaping the Oil and Gas Water Treatment Chemicals Market?

Trends shaping the Oil and Gas Water Treatment Chemicals Market include the increasing adoption of digital technologies for monitoring water quality, the rise of biocides and biodegradable chemicals, and a shift towards more sustainable water treatment solutions.

Oil and Gas Water Treatment Chemicals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Coagulants, Flocculants, Biocides, Scale Inhibitors |

| End User | Refineries, Drilling Companies, Oilfield Services, Petrochemical Plants |

| Application | Produced Water Treatment, Wastewater Treatment, Cooling Water Treatment, Desalination |

| Technology | Membrane Filtration, Chemical Treatment, Biological Treatment, Thermal Treatment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Oil and Gas Water Treatment Chemicals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at