444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The oil and gas water management services market represents a critical component of the global energy sector, encompassing comprehensive solutions for water treatment, recycling, and disposal throughout upstream, midstream, and downstream operations. Water management challenges have become increasingly complex as energy companies face stringent environmental regulations, water scarcity issues, and the need for sustainable operational practices.

Market dynamics indicate robust growth driven by expanding unconventional oil and gas exploration activities, particularly in shale formations where water usage can exceed traditional drilling methods by 300-500%. The sector encompasses various service categories including produced water treatment, flowback water management, drilling fluid recycling, and wastewater disposal solutions.

Technological advancement continues to reshape the landscape, with innovative treatment technologies achieving 95% water recovery rates in some applications. The integration of digital monitoring systems, advanced filtration technologies, and mobile treatment units has enhanced operational efficiency while reducing environmental impact. Regulatory compliance remains a primary driver, as governments worldwide implement stricter water quality standards and discharge regulations.

Regional variations in market development reflect different regulatory environments, water availability, and operational practices. North America leads in market maturity, while emerging markets in Asia-Pacific and Latin America present significant growth opportunities as exploration activities intensify.

The oil and gas water management services market refers to the comprehensive ecosystem of specialized services designed to handle, treat, and manage water resources throughout the entire oil and gas production lifecycle. This encompasses everything from initial drilling operations through production, processing, and final disposal or recycling of water resources.

Water management services include multiple interconnected processes such as water sourcing and transportation, treatment of produced water, management of flowback fluids from hydraulic fracturing operations, and safe disposal or beneficial reuse of treated water. These services are essential for maintaining operational efficiency, ensuring regulatory compliance, and minimizing environmental impact.

Service providers in this market offer integrated solutions combining equipment, technology, and expertise to address complex water challenges. The scope extends beyond basic treatment to include water quality monitoring, regulatory reporting, logistics coordination, and long-term water resource planning. Technological integration plays a crucial role, incorporating advanced treatment methods, real-time monitoring systems, and data analytics to optimize water management strategies.

Market transformation in oil and gas water management services reflects the industry’s evolution toward more sustainable and efficient operations. The sector has experienced significant growth driven by increasing water usage in unconventional drilling operations, stricter environmental regulations, and growing emphasis on water recycling and reuse.

Key growth drivers include the expansion of shale oil and gas production, which requires intensive water management solutions, and the implementation of zero liquid discharge policies in various regions. Technology adoption has accelerated, with advanced treatment systems achieving higher efficiency rates and lower operational costs compared to traditional methods.

Service diversification has become a defining characteristic, with providers expanding beyond basic treatment services to offer comprehensive water lifecycle management. This includes strategic consulting, regulatory compliance support, and integrated logistics solutions. Digital transformation initiatives have enhanced service delivery through remote monitoring, predictive maintenance, and automated reporting systems.

Market consolidation trends indicate increasing collaboration between service providers and technology companies, creating more comprehensive solution offerings. The focus on circular water economy principles has driven innovation in water recycling technologies, with some operations achieving 80-90% water reuse rates.

Operational efficiency improvements have become paramount as companies seek to optimize water management costs while maintaining compliance standards. The integration of mobile treatment units has reduced transportation costs and improved response times for remote operations.

Unconventional resource development serves as the primary catalyst for market growth, with shale oil and gas operations requiring extensive water management solutions. The hydraulic fracturing process demands significant water volumes, creating substantial produced water streams that require specialized treatment and disposal services.

Environmental regulations continue to tighten globally, mandating higher treatment standards and more stringent discharge requirements. These regulatory pressures have created consistent demand for advanced treatment technologies and comprehensive compliance management services. Water scarcity concerns in key production regions have elevated the importance of water recycling and reuse programs.

Technological advancement in treatment methods has made previously uneconomical water management solutions viable, expanding the addressable market. The development of mobile treatment units has enabled cost-effective solutions for remote operations, while automation has reduced labor requirements and improved safety outcomes.

Corporate sustainability initiatives have prioritized water stewardship, driving investment in advanced water management technologies. Companies are increasingly adopting circular water economy principles, viewing water as a valuable resource to be conserved and reused rather than simply disposed of after use.

High capital requirements for advanced treatment infrastructure present significant barriers to market entry and expansion. The substantial upfront investment needed for comprehensive water management facilities can strain project economics, particularly for smaller operators or in regions with volatile commodity prices.

Technical complexity associated with treating diverse water streams creates operational challenges. Produced water composition varies significantly across different formations and production methods, requiring customized treatment approaches that increase system complexity and operational costs.

Regulatory uncertainty in emerging markets can hinder long-term investment planning and service development. Inconsistent or evolving regulatory frameworks create compliance risks and may delay project implementation. Infrastructure limitations in remote production areas can constrain service delivery options and increase logistical costs.

Economic volatility in oil and gas markets directly impacts water management service demand. During commodity price downturns, operators often reduce spending on non-essential services, affecting water management investment priorities. Skilled labor shortages in specialized water treatment operations can limit service capacity and increase operational costs.

Emerging market expansion presents substantial growth opportunities as oil and gas exploration activities intensify in regions with developing regulatory frameworks. Countries in Asia-Pacific, Africa, and Latin America are implementing more stringent environmental standards, creating demand for comprehensive water management services.

Technology innovation continues to create new market segments and service opportunities. Advanced treatment technologies such as forward osmosis, electrocoagulation, and biological treatment systems offer improved efficiency and reduced operational costs. Digital integration opportunities include IoT-enabled monitoring systems, artificial intelligence for process optimization, and blockchain for regulatory reporting.

Circular economy initiatives are driving demand for integrated water recycling solutions that can achieve near-zero discharge operations. The development of beneficial reuse applications for treated produced water, including agricultural irrigation and industrial process water, creates additional revenue streams.

Strategic partnerships between service providers, technology companies, and operators can accelerate market development and innovation. Acquisition opportunities exist for companies seeking to expand geographic reach or technology capabilities through targeted mergers and acquisitions.

Supply chain integration has become increasingly important as operators seek comprehensive solutions from fewer vendors. This trend has driven service providers to expand their capabilities through organic growth and strategic acquisitions, creating more vertically integrated service offerings.

Competitive differentiation increasingly relies on technological innovation and service integration rather than price competition alone. Companies that can demonstrate superior treatment efficiency, regulatory compliance, and operational reliability command premium pricing and longer-term contracts.

Customer relationship evolution has shifted from transactional service provision to strategic partnership models. Operators increasingly prefer long-term agreements with service providers who can adapt to changing operational requirements and regulatory environments. Performance-based contracting has gained popularity, aligning service provider incentives with operator objectives.

Market consolidation continues as larger service companies acquire specialized technology providers and regional operators to expand capabilities and geographic reach. This consolidation has created more comprehensive service offerings while potentially reducing competition in some market segments.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary research methodologies. Primary research included structured interviews with industry executives, service providers, technology vendors, and regulatory officials across major oil and gas producing regions.

Secondary research encompassed analysis of industry reports, regulatory filings, company financial statements, and technical publications. Market data was validated through triangulation of multiple sources to ensure accuracy and reliability. Quantitative analysis included statistical modeling of market trends, growth projections, and competitive positioning.

Industry expert consultation provided insights into emerging technologies, regulatory developments, and market dynamics. Technical assessments of treatment technologies and operational practices were conducted through site visits and equipment evaluations. Regulatory analysis included review of environmental regulations, discharge standards, and compliance requirements across key markets.

Market segmentation analysis was performed based on service type, technology, application, and geographic region. Competitive landscape assessment included evaluation of market share, service capabilities, and strategic positioning of major market participants.

North America maintains market leadership with the most mature water management services sector, driven by extensive shale oil and gas development and stringent environmental regulations. The region accounts for approximately 45-50% of global market activity, with the United States leading in technology adoption and service innovation.

Permian Basin operations represent the largest concentration of water management activity, with operators implementing large-scale recycling programs and advanced treatment technologies. Regulatory frameworks in Texas, North Dakota, and Pennsylvania have established comprehensive standards that drive consistent demand for professional water management services.

Asia-Pacific represents the fastest-growing regional market, with countries like China, India, and Australia expanding oil and gas exploration activities while implementing stricter environmental standards. The region’s growth rate exceeds 12-15% annually in many markets, driven by increasing energy demand and regulatory development.

Middle East and Africa markets are evolving rapidly as traditional oil-producing countries diversify their energy portfolios and implement enhanced environmental standards. Water scarcity issues in many regional markets have elevated the importance of water recycling and conservation programs.

Europe maintains steady demand driven by North Sea operations and emerging unconventional resource development. Strict environmental regulations and limited disposal options have created strong demand for advanced treatment and recycling technologies.

Market leadership is distributed among several major service providers, each with distinct competitive advantages and geographic focus areas. The competitive environment has evolved from price-based competition to value-based differentiation through technology innovation and service integration.

Strategic positioning varies among competitors, with some focusing on comprehensive service integration while others emphasize technological innovation or geographic specialization. Partnership strategies have become increasingly important for accessing new markets and technologies.

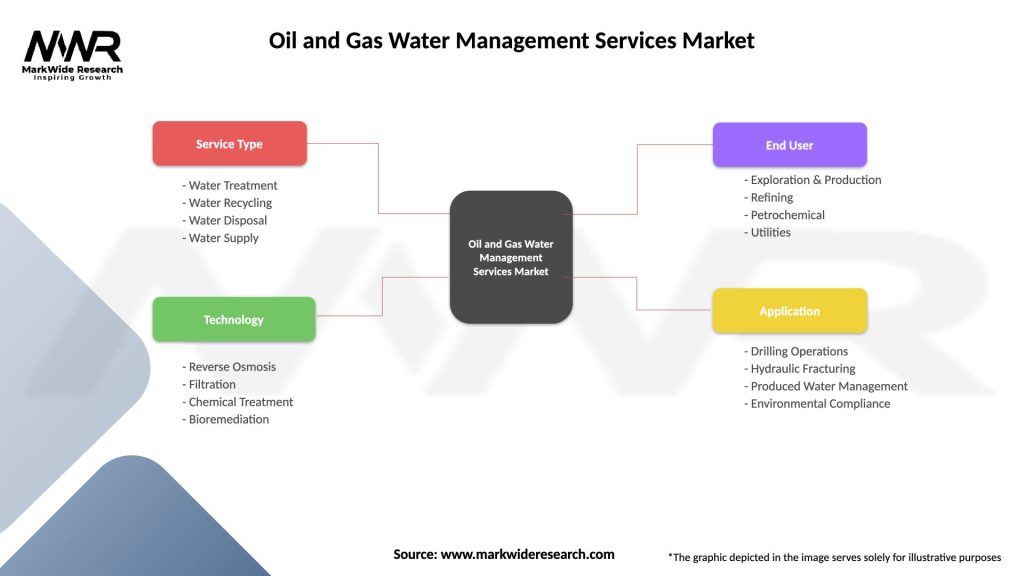

Service type segmentation reveals distinct market dynamics across different water management activities. Treatment services represent the largest segment, followed by transportation and disposal services. Technology-based segmentation shows growing demand for advanced treatment methods and mobile solutions.

By Service Type:

By Technology:

By Application:

Produced water treatment represents the largest service category, driven by the continuous generation of water throughout the production lifecycle. Advanced treatment technologies have achieved significant efficiency improvements, with some systems capable of treating complex produced water streams to discharge standards or reuse quality.

Flowback water management has emerged as a critical service category for unconventional operations. The high volumes and variable composition of flowback water require specialized treatment approaches and flexible service delivery models. Mobile treatment units have become increasingly popular for managing flowback water at remote well sites.

Drilling fluid management encompasses the treatment and recycling of water-based and oil-based drilling fluids. Closed-loop systems have gained adoption for their ability to minimize waste generation and reduce freshwater consumption. Advanced separation technologies enable high recovery rates of both water and drilling fluid components.

Beneficial reuse applications are expanding beyond traditional disposal methods to include agricultural irrigation, dust suppression, and industrial process water. Regulatory acceptance of treated produced water for beneficial uses has created new market opportunities and revenue streams for service providers.

Operators benefit from comprehensive water management services through reduced operational complexity, improved regulatory compliance, and cost optimization. Professional service providers offer specialized expertise and equipment that would be prohibitively expensive for operators to maintain internally.

Environmental compliance is significantly enhanced through professional water management services, reducing regulatory risk and potential penalties. Operational efficiency improvements include reduced downtime, optimized water logistics, and improved safety performance through specialized equipment and procedures.

Cost reduction opportunities include economies of scale in treatment operations, optimized transportation logistics, and reduced freshwater acquisition costs through recycling programs. Technology access enables operators to benefit from advanced treatment methods without significant capital investment.

Service providers benefit from stable, long-term revenue streams and opportunities for service expansion. Technology companies gain market access through partnerships with established service providers, while investors benefit from the sector’s growth potential and defensive characteristics during commodity price volatility.

Communities benefit from reduced environmental impact, improved water resource conservation, and economic development through local service operations. Regulatory agencies benefit from improved compliance rates and reduced environmental monitoring requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing water management services through IoT sensors, real-time monitoring, and predictive analytics. These technologies enable proactive maintenance, optimized treatment processes, and automated regulatory reporting. Artificial intelligence applications are emerging for process optimization and predictive modeling.

Sustainability focus has intensified across the industry, driving adoption of circular water economy principles and zero liquid discharge policies. Water recycling rates have improved significantly, with some operations achieving 85-90% reuse of produced water through advanced treatment technologies.

Mobile treatment solutions continue gaining popularity for their flexibility and cost-effectiveness in remote operations. These systems enable on-site treatment and reduce transportation costs while providing rapid deployment capabilities. Modular treatment systems offer scalability and adaptability to changing operational requirements.

Regulatory harmonization efforts are creating more consistent standards across jurisdictions, facilitating service standardization and technology deployment. Performance-based regulations are shifting focus from prescriptive requirements to outcome-based standards, encouraging innovation in treatment approaches.

Partnership models are evolving toward long-term strategic alliances rather than transactional service relationships. These partnerships enable better resource planning, technology development, and risk sharing between operators and service providers.

Technology advancement continues at an accelerated pace, with breakthrough developments in membrane technology, advanced oxidation processes, and biological treatment systems. Forward osmosis and other emerging membrane technologies are achieving higher recovery rates with lower energy consumption.

Regulatory developments include implementation of stricter discharge standards and expanded beneficial reuse approvals. Several states have updated their produced water regulations to encourage recycling and beneficial use applications. Federal initiatives are promoting research and development in water treatment technologies.

Market consolidation activity has intensified, with major service companies acquiring specialized technology providers and regional operators. These acquisitions are creating more comprehensive service offerings and expanding geographic coverage. Strategic partnerships between technology companies and service providers are accelerating innovation and market development.

Investment activity in water management technologies has increased significantly, with venture capital and private equity firms recognizing the sector’s growth potential. Public-private partnerships are emerging for large-scale water infrastructure projects and technology development initiatives.

International expansion by major service providers is accelerating as global oil and gas markets develop more stringent environmental standards. Technology transfer from mature markets to emerging regions is facilitating rapid adoption of advanced water management practices.

MarkWide Research analysis indicates that companies should prioritize technology innovation and service integration to maintain competitive advantage in the evolving market landscape. Investment in digital capabilities will be essential for service differentiation and operational efficiency improvements.

Geographic diversification strategies should focus on emerging markets with developing regulatory frameworks and expanding oil and gas activities. Companies should establish local partnerships and adapt service offerings to regional requirements and regulations. Technology localization may be necessary to address specific water chemistry and operational challenges.

Service portfolio expansion should emphasize comprehensive water lifecycle management rather than individual treatment services. Integrated solutions that combine treatment, transportation, disposal, and regulatory compliance services will command premium pricing and longer-term contracts.

Sustainability positioning will become increasingly important as operators prioritize environmental stewardship and corporate responsibility. Companies should develop circular economy solutions and demonstrate measurable environmental benefits through their service offerings.

Strategic partnerships with technology providers, equipment manufacturers, and regional operators can accelerate market development and capability expansion. Acquisition strategies should focus on complementary technologies and geographic expansion opportunities.

Market growth prospects remain robust driven by expanding unconventional resource development, strengthening environmental regulations, and increasing focus on water conservation. MWR projects continued market expansion with growth rates exceeding 8-10% annually in key regions over the next five years.

Technology evolution will continue driving service innovation and efficiency improvements. Advanced treatment technologies, digital integration, and automation will enable more cost-effective and environmentally sustainable water management solutions. Breakthrough technologies in areas such as membrane separation and biological treatment may disrupt existing service models.

Regulatory development will likely result in more stringent environmental standards and expanded beneficial reuse opportunities. Carbon pricing mechanisms may influence water management strategies by favoring recycling over disposal methods that generate greenhouse gas emissions.

Market consolidation is expected to continue as companies seek to achieve economies of scale and expand service capabilities. Vertical integration trends may result in operators developing internal water management capabilities for core operations while outsourcing specialized services.

Global expansion opportunities will emerge as developing countries implement more sophisticated environmental regulations and expand oil and gas exploration activities. Technology transfer from mature markets will accelerate adoption of advanced water management practices worldwide.

The oil and gas water management services market represents a critical and rapidly evolving sector within the global energy industry. Driven by expanding unconventional resource development, strengthening environmental regulations, and increasing focus on sustainability, the market continues to demonstrate robust growth potential and technological innovation.

Key success factors for market participants include technology leadership, service integration, regulatory expertise, and geographic diversification. Companies that can provide comprehensive water lifecycle management solutions while demonstrating measurable environmental benefits will be best positioned for long-term success.

Future market development will be characterized by continued consolidation, technology advancement, and geographic expansion. The integration of digital technologies, development of circular economy solutions, and expansion into emerging markets will create new opportunities for growth and differentiation. Sustainability considerations will increasingly influence service selection and technology adoption decisions, making environmental stewardship a competitive advantage rather than simply a compliance requirement.

What is Oil and Gas Water Management Services?

Oil and Gas Water Management Services refer to the processes and technologies used to manage water resources in the oil and gas industry. This includes water sourcing, treatment, recycling, and disposal, ensuring compliance with environmental regulations and optimizing resource use.

What are the key players in the Oil and Gas Water Management Services Market?

Key players in the Oil and Gas Water Management Services Market include companies like Veolia, Schlumberger, Halliburton, and Baker Hughes, which provide various water management solutions and technologies to the industry.

What are the main drivers of the Oil and Gas Water Management Services Market?

The main drivers of the Oil and Gas Water Management Services Market include the increasing demand for sustainable water management practices, regulatory pressures for environmental compliance, and the need for efficient water recycling and reuse in oil and gas operations.

What challenges does the Oil and Gas Water Management Services Market face?

Challenges in the Oil and Gas Water Management Services Market include the high costs associated with advanced water treatment technologies, regulatory complexities, and the variability of water availability in different regions, which can impact service delivery.

What opportunities exist in the Oil and Gas Water Management Services Market?

Opportunities in the Oil and Gas Water Management Services Market include the development of innovative water treatment technologies, partnerships for sustainable practices, and the expansion of services into emerging markets where oil and gas exploration is increasing.

What trends are shaping the Oil and Gas Water Management Services Market?

Trends shaping the Oil and Gas Water Management Services Market include the adoption of digital technologies for monitoring and managing water resources, increased focus on sustainability and ESG initiatives, and the integration of circular economy principles in water management strategies.

Oil and Gas Water Management Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Water Treatment, Water Recycling, Water Disposal, Water Supply |

| Technology | Reverse Osmosis, Filtration, Chemical Treatment, Bioremediation |

| End User | Exploration & Production, Refining, Petrochemical, Utilities |

| Application | Drilling Operations, Hydraulic Fracturing, Produced Water Management, Environmental Compliance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Oil and Gas Water Management Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at