Market Overview:

The oil and gas industry operates in a high-risk environment, facing various challenges such as volatile commodity prices, geopolitical uncertainties, regulatory complexities, and operational hazards. Oil and gas insurance plays a critical role in managing these risks by providing coverage for property damage, liability claims, business interruptions, and other unforeseen events. The oil and gas insurance market encompasses a wide range of insurance products and services tailored to the needs of upstream, midstream, and downstream operations, including drilling contractors, exploration companies, refineries, pipelines, and petrochemical plants.

Meaning:

Oil and gas insurance refers to the insurance coverage designed to protect companies operating in the oil and gas industry from financial losses arising from property damage, liability claims, environmental risks, and business interruptions. It includes various types of insurance policies such as property insurance, liability insurance, business interruption insurance, environmental liability insurance, and specialized coverage for offshore operations, construction projects, and transportation of hazardous materials. Oil and gas insurance helps mitigate the financial impact of unforeseen events and ensures continuity of operations in an industry prone to risks and uncertainties.

Executive Summary:

The oil and gas insurance market is driven by the dynamic nature of the industry, characterized by high-value assets, complex operations, and inherent risks. Despite facing challenges such as fluctuating oil prices, regulatory changes, and environmental concerns, the market offers significant opportunities for insurers to provide innovative risk management solutions and support the growth and sustainability of the oil and gas sector. Understanding the key market insights, drivers, challenges, and emerging trends is crucial for insurers and industry stakeholders to navigate the evolving landscape and capitalize on opportunities in the oil and gas insurance market.

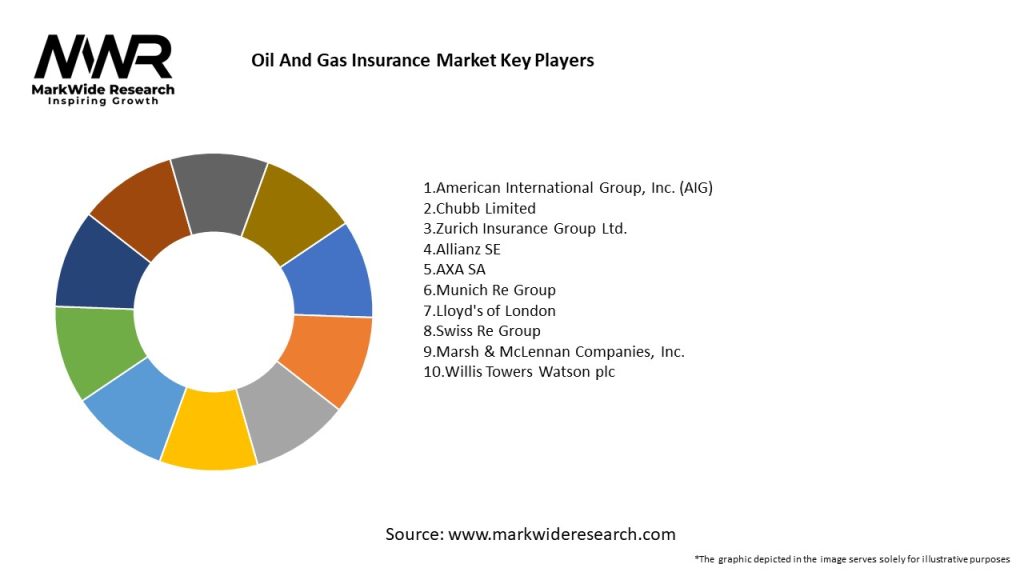

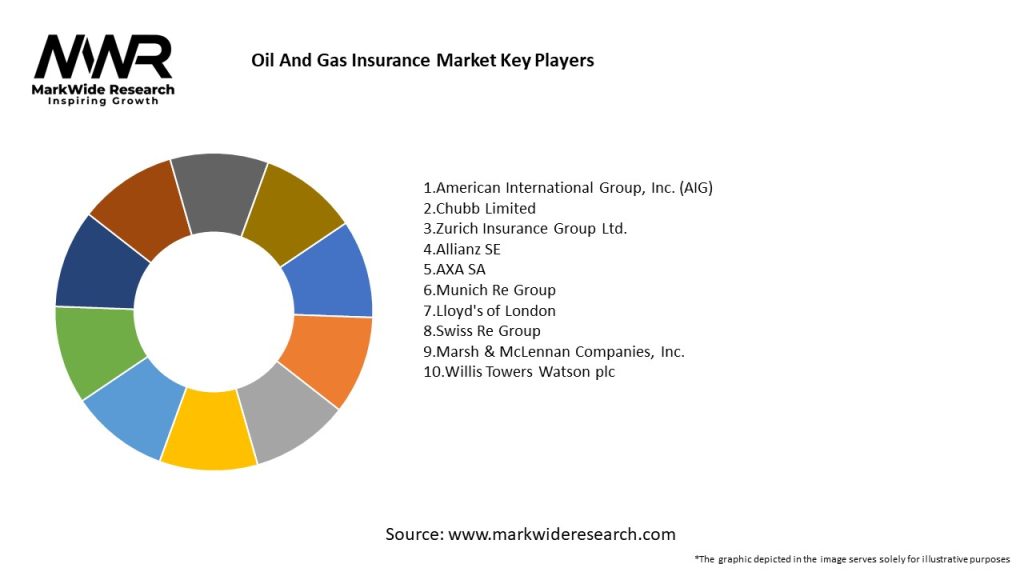

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

- Industry Volatility: The oil and gas industry is susceptible to fluctuations in commodity prices, supply and demand dynamics, geopolitical tensions, and regulatory changes, which impact insurance premiums, coverage terms, and risk exposure for insurers and policyholders.

- Asset Intensity: Oil and gas operations involve high-value assets such as drilling rigs, production facilities, pipelines, and storage tanks, requiring comprehensive insurance coverage to protect against property damage, equipment breakdowns, and natural disasters.

- Regulatory Compliance: The oil and gas industry is subject to stringent regulatory requirements governing safety standards, environmental protection, and operational practices, influencing insurance underwriting criteria, risk assessment, and claims management processes.

- Technological Advancements: Technological innovations such as automation, digitalization, and data analytics are transforming the oil and gas industry, driving demand for specialized insurance solutions to address emerging risks related to cyber threats, digital asset protection, and technology failures.

Market Drivers:

- Global Energy Demand: The growing global demand for energy, driven by population growth, urbanization, and economic development, fuels investments in oil and gas exploration, production, and infrastructure projects, driving demand for insurance coverage to mitigate associated risks.

- Infrastructure Investments: Investments in oil and gas infrastructure, including pipelines, refineries, LNG terminals, and offshore platforms, create opportunities for insurers to provide construction and operational insurance solutions to project developers, contractors, and operators.

- Emerging Markets: Emerging markets such as Asia-Pacific, Africa, and Latin America offer significant growth potential for the oil and gas industry, driven by rising energy consumption, expanding industrialization, and increasing investments in hydrocarbon resources, necessitating insurance protection for new ventures and assets.

- Risk Mitigation Strategies: Heightened awareness of environmental risks, climate change impacts, and social responsibilities prompt oil and gas companies to adopt risk mitigation strategies, including insurance, to manage operational, financial, and reputational risks effectively.

Market Restraints:

- Commodity Price Volatility: Fluctuations in oil and gas prices impact project economics, cash flows, and profitability, leading to cost-cutting measures, project delays, and cancellations, which may affect insurance demand and premium levels in the industry.

- Regulatory Uncertainties: Evolving regulatory frameworks, compliance requirements, and legal liabilities pose challenges for insurers and policyholders in assessing and managing risks associated with environmental regulations, social responsibilities, and corporate governance practices.

- Geopolitical Risks: Geopolitical tensions, trade disputes, and regional conflicts in key oil-producing regions such as the Middle East, North Africa, and Eurasia create uncertainties for oil and gas operations, affecting insurance underwriting, coverage availability, and pricing in the market.

- Transition to Renewable Energy: The global transition to renewable energy sources and decarbonization initiatives pose long-term challenges for the oil and gas industry, impacting investment decisions, asset valuations, and insurance requirements in a changing energy landscape.

Market Opportunities:

- Cyber Insurance: The increasing digitization of oil and gas operations and the growing threat of cyber attacks create opportunities for insurers to offer specialized cyber insurance products covering data breaches, network disruptions, and ransomware attacks.

- Renewable Energy Insurance: The transition to renewable energy sources such as wind, solar, and hydroelectric power presents opportunities for insurers to develop insurance solutions tailored to the specific risks and challenges associated with renewable energy projects and technologies.

- supply chain Risk Management: Supply chain disruptions, vendor failures, and logistics challenges in the oil and gas industry highlight the importance of supply chain risk management and insurance coverage to ensure continuity of operations and mitigate supply chain disruptions.

- Climate Change Adaptation: The impacts of climate change, including extreme weather events, sea-level rise, and natural disasters, emphasize the need for insurers to develop climate resilience solutions and innovative insurance products to help oil and gas companies adapt to changing environmental conditions.

Market Dynamics:

The oil and gas insurance market operates in a dynamic environment influenced by factors such as economic conditions, geopolitical risks, regulatory changes, technological advancements, and environmental considerations. These dynamics shape market trends, risk profiles, and insurance strategies for insurers and policyholders, requiring continuous monitoring, analysis, and adaptation to evolving market conditions.

Regional Analysis:

The oil and gas insurance market exhibits regional variations in terms of market size, growth prospects, risk profiles, and insurance market dynamics. Key regions driving demand for oil and gas insurance include:

- North America: The United States and Canada are major markets for oil and gas insurance, driven by extensive oil and gas production activities, pipeline infrastructure, and regulatory requirements governing environmental liabilities and risk management.

- Europe: European countries such as the United Kingdom, Norway, and the Netherlands have mature oil and gas insurance markets, characterized by offshore exploration and production activities, strict safety regulations, and environmental protection measures.

- Asia-Pacific: Asia-Pacific countries such as China, Australia, and India present growth opportunities for oil and gas insurance, driven by increasing energy demand, infrastructure investments, and expansion of oil and gas exploration and production activities in the region.

- Middle East and Africa: The Middle East and Africa are significant regions for oil and gas production, characterized by large reserves, mega projects, and geopolitical complexities, creating demand for insurance coverage for upstream, midstream, and downstream operations.

- Latin America: Latin American countries such as Brazil, Mexico, and Venezuela have diverse oil and gas insurance markets, influenced by political stability, regulatory frameworks, and investment climates, with opportunities for insurers to provide coverage for exploration, production, and transportation risks.

Competitive Landscape:

Leading Companies in the Oil And Gas Insurance Market:

- American International Group, Inc. (AIG)

- Chubb Limited

- Zurich Insurance Group Ltd.

- Allianz SE

- AXA SA

- Munich Re Group

- Lloyd’s of London

- Swiss Re Group

- Marsh & McLennan Companies, Inc.

- Willis Towers Watson plc

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The oil and gas insurance market can be segmented based on various factors such as:

- Insurance Product: Segmentation by insurance product includes property insurance, liability insurance, business interruption insurance, environmental liability insurance, and specialty insurance coverage tailored to specific industry risks.

- Industry Sector: Segmentation by industry sector includes upstream exploration and production, midstream transportation and storage, downstream refining and distribution, and oilfield services and equipment manufacturing.

- Geography: Segmentation by geography includes regional markets such as North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, each with unique market dynamics and risk profiles.

- Risk Type: Segmentation by risk type includes property damage, natural disasters, equipment breakdowns, pollution and environmental liabilities, political risks, and cyber risks, among others.

Segmentation provides insurers and policyholders with a deeper understanding of market trends, risk exposures, and insurance needs, enabling them to develop tailored insurance solutions and risk management strategies to address specific requirements and challenges in the oil and gas industry.

Category-wise Insights:

- Upstream Insurance: Upstream insurance covers risks associated with oil and gas exploration, drilling, and production activities, including property damage, well control incidents, blowouts, and environmental liabilities arising from spills and leaks.

- Midstream Insurance: Midstream insurance provides coverage for risks related to oil and gas transportation, storage, and distribution operations, including pipeline ruptures, storage tank leaks, transportation accidents, and third-party liability claims.

- Downstream Insurance: Downstream insurance protects against risks associated with oil and gas refining, processing, and distribution activities, including property damage, business interruption, product liability, and environmental pollution liabilities.

- Offshore Insurance: Offshore insurance covers risks specific to offshore oil and gas operations, including drilling platforms, production facilities, floating production storage and offloading (FPSO) vessels, and subsea equipment, addressing challenges such as hurricanes, tsunamis, and well blowouts.

Key Benefits for Industry Participants and Stakeholders:

The oil and gas insurance market offers several benefits for industry participants and stakeholders:

- Risk Transfer: Oil and gas insurance allows companies to transfer financial risks associated with property damage, liability claims, business interruptions, and environmental liabilities to insurers, protecting assets and preserving financial stability.

- Compliance: Oil and gas insurance helps companies comply with regulatory requirements, contractual obligations, and lender mandates by providing insurance coverage tailored to industry-specific risks and exposures.

- Business Continuity: Oil and gas insurance ensures continuity of operations by providing coverage for unforeseen events such as natural disasters, equipment failures, supply chain disruptions, and regulatory compliance issues, minimizing disruptions and losses.

- Risk Management: Oil and gas insurance facilitates risk management and loss prevention efforts by identifying, assessing, and mitigating potential risks and liabilities through risk engineering, loss control measures, and claims management strategies.

- Financial Protection: Oil and gas insurance provides financial protection against catastrophic losses and liabilities, enabling companies to recover quickly from adverse events and resume normal operations with minimal financial impact.

SWOT Analysis:

A SWOT analysis of the oil and gas insurance market provides insights into its strengths, weaknesses, opportunities, and threats:

- Strengths:

- Specialized expertise in energy risk assessment and underwriting.

- Strong financial stability and risk management capabilities.

- Diverse portfolio of insurance products and services tailored to industry needs.

- Global presence and network of industry partners and clients.

- Weaknesses:

- Exposure to catastrophic events and large-scale losses.

- Reliance on reinsurance capacity and retrocession arrangements.

- Sensitivity to economic cycles, commodity prices, and regulatory changes.

- Limited transparency and data availability for emerging risks and exposures.

- Opportunities:

- Growth opportunities in emerging markets and renewable energy sectors.

- Innovation in insurance products, technology solutions, and risk management services.

- Expansion of cyber insurance, climate resilience, and sustainability initiatives.

- Collaboration with industry stakeholders to develop tailored risk solutions.

- Threats:

- Increasing competition from global and regional insurers and reinsurers.

- Regulatory uncertainties, legal liabilities, and compliance challenges.

- Geopolitical risks, trade tensions, and regional conflicts affecting market stability.

- Emerging risks such as cyber threats, climate change, and energy transition impacts.

Understanding these factors through a SWOT analysis helps insurers and industry stakeholders assess market dynamics, identify strategic priorities, and navigate challenges and opportunities in the oil and gas insurance market.

Market Key Trends:

- Cyber Insurance: The increasing digitization of oil and gas operations and the growing threat of cyber attacks drive demand for cyber insurance coverage to protect against data breaches, network intrusions, and ransomware attacks targeting critical infrastructure and operational technology systems.

- Renewable Energy Insurance: The transition to renewable energy sources such as wind, solar, and hydroelectric power creates opportunities for insurers to develop insurance products and services tailored to the specific risks and challenges associated with renewable energy projects, including construction, operation, and performance risks.

- Climate Resilience Solutions: Rising concerns about climate change impacts, extreme weather events, and natural disasters underscore the importance of climate resilience solutions and insurance coverage to help oil and gas companies adapt to changing environmental conditions, mitigate risks, and ensure business continuity.

- Sustainability Initiatives: Environmental sustainability initiatives, such as carbon offset programs, renewable energy investments, and eco-friendly practices, are driving demand for insurance solutions that support corporate sustainability goals, enhance reputation, and address stakeholder expectations for responsible business practices.

Covid-19 Impact:

The COVID-19 pandemic has had a significant impact on the oil and gas insurance market, influencing market trends, customer behaviors, and risk management strategies. Some key impacts of COVID-19 on the market include:

- Demand Volatility: The pandemic-induced economic downturn, travel restrictions, and lockdown measures led to fluctuations in oil and gas demand, production levels, and price volatility, affecting insurance demand and risk exposure for industry participants.

- Supply Chain Disruptions: Supply chain disruptions, logistics challenges, and operational disruptions caused by the pandemic disrupted oil and gas operations, triggering insurance claims for business interruptions, supply chain liabilities, and contractual disputes.

- Regulatory Changes: Regulatory responses to the pandemic, including government stimulus packages, tax relief measures, and environmental policy adjustments, influenced insurance compliance requirements, coverage terms, and regulatory reporting obligations for oil and gas companies.

- Remote Operations: The shift to remote working, virtual collaboration, and digitalization of operations accelerated by the pandemic raised cybersecurity risks, data privacy concerns, and technology vulnerabilities, driving demand for cyber insurance and digital risk management solutions.

Key Industry Developments:

- Energy Transition Initiatives: Oil and gas companies are increasingly focusing on energy transition initiatives, including investments in renewable energy projects, carbon capture and storage technologies, and sustainability initiatives, which impact insurance needs and risk profiles in the industry.

- Resilience Planning: The pandemic highlighted the importance of resilience planning, crisis management, and business continuity strategies for oil and gas companies, prompting investments in risk mitigation measures, insurance coverage enhancements, and scenario planning exercises to prepare for future disruptions.

- Climate Risk Assessment: Climate risk assessment and scenario analysis are becoming integral parts of insurance underwriting and risk management practices, as insurers assess the potential impacts of climate change, extreme weather events, and energy transition risks on oil and gas operations and insurance portfolios.

- Digital Transformation: Digital transformation initiatives, such as blockchain technology, artificial intelligence, and Internet of Things (IoT) solutions, are reshaping insurance operations, claims processing, risk modeling, and customer engagement in the oil and gas industry, driving efficiency gains and innovation.

Analyst Suggestions:

- Risk Mitigation Strategies: Oil and gas companies should develop comprehensive risk mitigation strategies, including insurance coverage, risk engineering, and crisis response plans, to address evolving risks and uncertainties in the industry and enhance resilience to external shocks.

- Collaborative Partnerships: Insurers, reinsurers, brokers, and industry stakeholders should collaborate to develop innovative insurance solutions, risk management tools, and industry best practices that support sustainable growth, resilience, and competitiveness in the oil and gas sector.

- Sustainability Integration: Sustainability considerations, including environmental, social, and governance (ESG) factors, should be integrated into insurance underwriting criteria, risk assessment processes, and product offerings to align with industry trends, regulatory requirements, and stakeholder expectations.

- Technology Adoption: Oil and gas companies should embrace technology solutions, such as digital platforms, data analytics, and predictive modeling, to optimize risk management, improve operational efficiency, and enhance decision-making in insurance procurement and claims management.

Future Outlook:

The oil and gas insurance market is expected to witness continued evolution and transformation in response to changing industry dynamics, emerging risks, regulatory reforms, and technological advancements. While the industry faces challenges such as volatility, uncertainty, and regulatory scrutiny, it also presents opportunities for innovation, collaboration, and sustainable growth. The future outlook for the oil and gas insurance market is characterized by:

- Resilience Planning: Increasing emphasis on resilience planning, crisis management, and business continuity strategies to address systemic risks, including pandemics, climate change, cyber threats, and energy transition impacts.

- Digital Transformation: Accelerated adoption of digital technologies, data analytics, and automation solutions to enhance operational efficiency, risk modeling, claims processing, and customer engagement in the insurance value chain.

- Sustainability Integration: Growing focus on sustainability integration, ESG considerations, and climate risk assessment in insurance underwriting, risk management, and investment decision-making to support sustainable development goals and stakeholder expectations.

- Innovation and Collaboration: Collaborative partnerships, industry consortia, and innovation ecosystems driving the development of next-generation insurance products, risk management solutions, and industry standards that address emerging risks and deliver value to oil and gas stakeholders.

Conclusion:

The oil and gas insurance market plays a crucial role in supporting the resilience, growth, and sustainability of the global energy industry by providing risk management solutions, financial protection, and regulatory compliance support to industry participants. Despite facing challenges such as volatility, uncertainty, and regulatory complexities, the market offers significant opportunities for insurers, reinsurers, brokers, and industry stakeholders to innovate, collaborate, and adapt to evolving market dynamics and emerging risks. By embracing digital transformation, sustainability integration, and collaborative partnerships, the oil and gas insurance industry can navigate challenges, capitalize on opportunities, and contribute to the resilience and prosperity of the oil and gas sector in the future.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA