444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The oil and gas asset integrity management market represents a critical segment within the energy sector, focusing on maintaining the operational safety, reliability, and efficiency of infrastructure throughout its lifecycle. This comprehensive market encompasses advanced technologies, methodologies, and services designed to prevent asset failures, minimize operational risks, and ensure regulatory compliance across upstream, midstream, and downstream operations. Asset integrity management has become increasingly vital as aging infrastructure, stringent environmental regulations, and the need for operational excellence drive demand for sophisticated monitoring and maintenance solutions.

Market dynamics indicate robust growth driven by the industry’s shift toward predictive maintenance, digital transformation initiatives, and enhanced safety protocols. The integration of Internet of Things (IoT) technologies, artificial intelligence, and advanced analytics has revolutionized traditional asset management approaches, enabling real-time monitoring and data-driven decision-making. Industry analysis suggests the market is experiencing a compound annual growth rate of 8.2%, reflecting the critical importance of maintaining asset reliability in an increasingly complex operational environment.

Regional distribution shows significant activity across major oil and gas producing regions, with North America and the Middle East leading adoption rates at approximately 35% and 28% respectively. The market’s evolution reflects the industry’s recognition that proactive asset integrity management is essential for operational continuity, environmental protection, and long-term profitability in an era of heightened regulatory scrutiny and operational complexity.

The oil and gas asset integrity management market refers to the comprehensive ecosystem of technologies, services, and methodologies designed to ensure the safe, reliable, and efficient operation of energy infrastructure throughout its operational lifecycle. This market encompasses solutions that monitor, assess, maintain, and optimize the performance of critical assets including pipelines, refineries, offshore platforms, storage facilities, and processing equipment to prevent failures and ensure regulatory compliance.

Asset integrity management involves systematic approaches to managing physical assets to ensure they continue to perform their intended functions effectively while maintaining safety and environmental standards. The concept extends beyond traditional maintenance practices to include risk-based inspection strategies, condition monitoring systems, and predictive analytics that enable operators to make informed decisions about asset maintenance, replacement, and optimization.

Core components of this market include inspection and monitoring technologies, data analytics platforms, maintenance management systems, and consulting services that collectively provide comprehensive asset lifecycle management capabilities. These solutions enable energy companies to transition from reactive maintenance approaches to proactive, data-driven strategies that optimize asset performance while minimizing operational risks and costs.

Market transformation in the oil and gas asset integrity management sector reflects the industry’s evolution toward digitalization, predictive maintenance, and risk-based management strategies. The convergence of advanced technologies including artificial intelligence, machine learning, and IoT sensors has created unprecedented opportunities for real-time asset monitoring and predictive analytics, fundamentally changing how energy companies approach asset management challenges.

Key growth drivers include aging infrastructure requiring enhanced monitoring, stringent regulatory requirements demanding comprehensive compliance solutions, and the industry’s focus on operational excellence and cost optimization. The market benefits from increasing adoption of digital twin technologies, which enable virtual asset modeling and simulation capabilities that enhance decision-making processes and optimize maintenance strategies.

Technology integration trends show significant advancement in cloud-based platforms, mobile inspection applications, and integrated asset management systems that provide comprehensive visibility across entire asset portfolios. Industry data indicates that companies implementing advanced asset integrity management solutions achieve operational efficiency improvements of up to 25%, demonstrating the tangible value proposition driving market adoption.

Competitive landscape features established technology providers, specialized service companies, and emerging digital solution providers competing to deliver comprehensive asset integrity management capabilities. The market’s evolution toward integrated platforms and end-to-end solutions reflects customer demand for simplified vendor relationships and seamless data integration across multiple asset types and operational environments.

Technology adoption patterns reveal accelerating implementation of advanced monitoring and analytics solutions across the oil and gas sector. The following key insights highlight critical market developments:

Infrastructure aging represents a primary driver for asset integrity management solutions as energy companies grapple with maintaining aging facilities while ensuring operational safety and reliability. The global oil and gas infrastructure includes assets that are decades old, requiring sophisticated monitoring and maintenance strategies to extend operational lifecycles and prevent catastrophic failures that could result in environmental damage, safety incidents, and significant financial losses.

Regulatory compliance requirements continue to intensify across major oil and gas producing regions, driving demand for comprehensive asset integrity management solutions that ensure adherence to safety, environmental, and operational standards. Regulatory bodies worldwide are implementing stricter inspection requirements, documentation standards, and reporting obligations that necessitate advanced management systems capable of maintaining detailed asset histories and compliance records.

Operational excellence initiatives within energy companies emphasize the importance of maximizing asset utilization, minimizing unplanned downtime, and optimizing maintenance costs through data-driven decision-making processes. Companies implementing comprehensive asset integrity management programs report maintenance cost reductions of up to 20% while simultaneously improving asset reliability and operational performance.

Digital transformation trends across the energy sector create opportunities for advanced asset integrity management solutions that leverage emerging technologies including artificial intelligence, machine learning, and advanced analytics. The integration of these technologies enables predictive maintenance capabilities, automated anomaly detection, and optimization recommendations that significantly enhance traditional asset management approaches and deliver measurable operational improvements.

High implementation costs associated with comprehensive asset integrity management systems present significant barriers for many energy companies, particularly smaller operators with limited capital budgets. The initial investment required for advanced monitoring technologies, software platforms, and system integration can be substantial, requiring careful justification based on long-term operational benefits and risk mitigation value propositions.

Technical complexity of modern asset integrity management solutions creates challenges for organizations lacking specialized technical expertise or comprehensive change management capabilities. The integration of multiple technologies, data sources, and operational processes requires significant organizational commitment and technical resources that may exceed the capabilities of some energy companies, particularly those with limited digital transformation experience.

Data integration challenges emerge as companies attempt to consolidate information from multiple legacy systems, disparate data sources, and various operational environments into unified asset management platforms. The complexity of integrating historical maintenance records, inspection data, and real-time monitoring information often requires extensive data cleansing, standardization, and migration efforts that can delay implementation timelines and increase project costs.

Cybersecurity concerns related to connecting critical operational assets to digital networks and cloud-based platforms create hesitation among some energy companies regarding comprehensive digitalization initiatives. The potential for cyber threats targeting critical infrastructure requires robust security measures and ongoing monitoring capabilities that add complexity and cost to asset integrity management implementations while requiring specialized cybersecurity expertise.

Emerging market expansion presents significant opportunities for asset integrity management solution providers as developing regions increase oil and gas production capabilities and implement modern operational standards. Countries in Africa, Asia-Pacific, and Latin America are investing in new energy infrastructure while simultaneously upgrading existing facilities, creating demand for comprehensive asset management solutions that ensure operational reliability and regulatory compliance from project inception.

Renewable energy integration within traditional oil and gas operations creates new opportunities for asset integrity management solutions that can monitor and manage hybrid energy systems. As energy companies diversify their portfolios to include renewable energy assets, the need for integrated management platforms capable of handling multiple asset types and operational environments presents significant market expansion potential.

Advanced analytics capabilities offer opportunities for solution providers to differentiate their offerings through sophisticated predictive modeling, optimization algorithms, and artificial intelligence applications. Companies that can demonstrate measurable improvements in asset performance, maintenance cost reduction, and operational efficiency through advanced analytics capabilities are positioned to capture significant market share in an increasingly competitive landscape.

Service-based business models present opportunities for companies to offer asset integrity management as a comprehensive service rather than traditional product sales, enabling energy companies to access advanced capabilities without significant capital investments. MarkWide Research analysis indicates that service-based models are gaining traction, with adoption rates increasing by 15% annually as companies seek to optimize operational expenses while accessing cutting-edge asset management capabilities.

Technology convergence is reshaping the asset integrity management landscape as traditional inspection and maintenance approaches integrate with advanced digital technologies. The combination of IoT sensors, artificial intelligence, cloud computing, and mobile applications creates comprehensive ecosystems that provide unprecedented visibility into asset conditions and performance characteristics, enabling proactive management strategies that optimize operational outcomes.

Industry consolidation trends are influencing market dynamics as larger technology providers acquire specialized solution companies to create comprehensive asset integrity management platforms. This consolidation enables the development of integrated solutions that address multiple aspects of asset management while providing customers with simplified vendor relationships and seamless data integration capabilities across diverse operational environments.

Customer expectations continue to evolve toward comprehensive, user-friendly solutions that provide actionable insights and measurable operational improvements. Energy companies increasingly demand asset integrity management solutions that integrate seamlessly with existing operational systems, provide intuitive user interfaces, and deliver clear return on investment through improved asset performance and reduced maintenance costs.

Competitive pressures within the energy sector drive continuous innovation in asset integrity management solutions as companies seek competitive advantages through operational excellence, cost optimization, and risk mitigation. Market participants report that advanced asset management capabilities contribute to overall operational efficiency improvements of 18%, demonstrating the strategic importance of these solutions in maintaining competitive positioning within the global energy market.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the oil and gas asset integrity management market. Primary research activities included extensive interviews with industry executives, technology providers, and end-users across major oil and gas producing regions to gather firsthand insights into market trends, challenges, and opportunities driving sector evolution.

Secondary research encompassed detailed analysis of industry reports, regulatory filings, company financial statements, and technical publications to validate primary research findings and provide comprehensive market context. This approach ensured that market insights reflect both current operational realities and emerging trends that will influence future market development across diverse geographical and operational environments.

Data validation processes included cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and engaging industry experts to review preliminary conclusions. This rigorous validation approach ensures that market insights accurately represent industry conditions and provide reliable foundations for strategic decision-making by market participants and stakeholders.

Market modeling techniques utilized statistical analysis, trend extrapolation, and scenario planning to develop comprehensive market projections and identify key factors influencing market growth. The research methodology incorporated both quantitative analysis of market data and qualitative assessment of industry trends to provide balanced perspectives on market dynamics and future development opportunities.

North America maintains market leadership in oil and gas asset integrity management adoption, driven by mature energy infrastructure, stringent regulatory requirements, and advanced technology implementation capabilities. The region benefits from established technology providers, comprehensive service networks, and energy companies with significant experience in digital transformation initiatives. Market penetration rates in North America exceed 40% among major operators, reflecting the region’s leadership in adopting advanced asset management solutions.

Middle East represents a rapidly growing market segment as regional energy companies invest in modernizing operational capabilities and implementing international best practices for asset management. The region’s focus on operational excellence, combined with significant infrastructure investments and technology adoption initiatives, creates substantial opportunities for asset integrity management solution providers seeking to expand their global presence.

Europe demonstrates strong market growth driven by stringent environmental regulations, aging infrastructure requiring enhanced monitoring, and the region’s commitment to operational safety and environmental protection. European energy companies are increasingly implementing comprehensive asset integrity management solutions that ensure regulatory compliance while optimizing operational performance and minimizing environmental impact.

Asia-Pacific emerges as a high-growth market segment as developing economies expand energy production capabilities and implement modern operational standards. The region’s rapid industrialization, increasing energy demand, and infrastructure development initiatives create significant opportunities for asset integrity management solutions that support safe and reliable energy operations while ensuring environmental compliance and operational efficiency.

Market leadership in the oil and gas asset integrity management sector features a diverse ecosystem of established technology providers, specialized service companies, and emerging digital solution developers. The competitive landscape reflects the market’s evolution toward comprehensive, integrated platforms that address multiple aspects of asset management while providing seamless user experiences and measurable operational improvements.

Key market participants include:

Competitive strategies emphasize technology innovation, comprehensive service offerings, and strategic partnerships that enable solution providers to address diverse customer requirements while maintaining competitive positioning in an evolving market landscape.

By Technology:

By Application:

By Service Type:

Risk-Based Inspection represents the largest technology segment within the asset integrity management market, driven by its ability to optimize inspection resources while maintaining comprehensive asset monitoring capabilities. This category benefits from advanced analytics capabilities that enable operators to prioritize inspection activities based on risk assessment, operational criticality, and regulatory requirements, resulting in inspection cost reductions of up to 30% while maintaining or improving asset reliability.

Pipeline Integrity Management demonstrates strong growth as energy companies focus on ensuring the safety and reliability of extensive pipeline networks that transport oil and gas products across vast geographical areas. This segment benefits from advanced monitoring technologies including smart pigs, fiber optic sensing, and satellite monitoring systems that provide comprehensive pipeline condition assessment and enable proactive maintenance strategies.

Upstream Applications show significant adoption rates as exploration and production companies implement comprehensive asset management solutions for offshore platforms, drilling operations, and production facilities. The harsh operational environments and critical safety requirements associated with upstream operations drive demand for robust asset integrity management solutions that ensure operational continuity while maintaining safety standards.

Consulting Services experience growing demand as energy companies seek expert guidance for implementing comprehensive asset integrity management strategies that align with operational objectives, regulatory requirements, and industry best practices. MWR analysis indicates that companies utilizing professional consulting services achieve implementation success rates exceeding 85%, demonstrating the value of expert guidance in complex technology deployments.

Operational Excellence represents a primary benefit for energy companies implementing comprehensive asset integrity management solutions. These systems enable operators to optimize asset performance, reduce unplanned downtime, and improve overall operational efficiency through data-driven decision-making processes that identify potential issues before they result in costly failures or safety incidents.

Risk Mitigation capabilities provided by advanced asset integrity management solutions help energy companies minimize operational risks, ensure regulatory compliance, and protect against potential environmental incidents. The comprehensive monitoring and predictive analytics capabilities enable proactive identification and resolution of potential issues, significantly reducing the likelihood of catastrophic failures that could result in substantial financial, environmental, and reputational consequences.

Cost Optimization benefits include reduced maintenance costs, optimized inspection schedules, and improved asset utilization rates that contribute to enhanced profitability and operational efficiency. Companies implementing comprehensive asset integrity management solutions typically achieve total cost of ownership reductions of 15-25% through optimized maintenance strategies, extended asset lifecycles, and improved operational reliability.

Regulatory Compliance advantages include automated documentation, comprehensive audit trails, and streamlined reporting capabilities that simplify compliance with increasingly complex regulatory requirements. The systematic approach to asset management provided by these solutions ensures that companies maintain detailed records of asset conditions, maintenance activities, and compliance status, facilitating regulatory inspections and reducing compliance-related risks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Twin Technology emerges as a transformative trend enabling energy companies to create virtual representations of physical assets that facilitate advanced modeling, simulation, and optimization capabilities. This technology enables operators to test maintenance strategies, predict asset behavior, and optimize operational parameters without disrupting actual operations, resulting in improved decision-making and enhanced asset performance.

Artificial Intelligence Integration represents a significant trend as asset integrity management solutions incorporate machine learning algorithms and predictive analytics capabilities that enable automated anomaly detection, failure prediction, and optimization recommendations. These AI-powered capabilities enhance traditional asset management approaches by providing insights that would be difficult or impossible to identify through conventional analysis methods.

Cloud-Based Platforms demonstrate growing adoption as energy companies seek scalable, accessible, and cost-effective solutions that can be deployed across multiple operational environments. Cloud platforms enable centralized data management, real-time collaboration, and reduced infrastructure requirements while providing the flexibility to scale solutions based on operational needs and business growth.

Mobile Technology Integration facilitates field-based asset management activities through mobile applications that enable inspection personnel to access real-time asset information, update maintenance records, and communicate with central operations teams. This trend enhances operational efficiency by providing field personnel with immediate access to critical asset information while streamlining data collection and reporting processes.

Strategic Partnerships between technology providers and energy companies are accelerating innovation and market adoption of advanced asset integrity management solutions. These collaborations enable the development of industry-specific solutions that address unique operational challenges while providing technology providers with deep insights into customer requirements and operational environments.

Regulatory Evolution continues to shape market development as regulatory bodies worldwide implement enhanced requirements for asset integrity management, documentation, and reporting. Recent regulatory developments emphasize the importance of proactive asset management, comprehensive record-keeping, and advanced monitoring capabilities that ensure operational safety and environmental protection.

Technology Acquisitions within the asset integrity management sector reflect the industry’s consolidation toward comprehensive platform providers that can address multiple aspects of asset management through integrated solutions. These acquisitions enable companies to expand their technological capabilities while providing customers with simplified vendor relationships and seamless solution integration.

Innovation Investments in emerging technologies including artificial intelligence, machine learning, and advanced analytics demonstrate the industry’s commitment to continuous improvement and technological advancement. MarkWide Research data indicates that leading companies are investing 12-15% of annual revenues in research and development activities focused on next-generation asset integrity management capabilities.

Technology Integration Strategy should focus on developing comprehensive platforms that seamlessly integrate multiple asset management capabilities while providing intuitive user interfaces and measurable operational benefits. Companies should prioritize solutions that can demonstrate clear return on investment through improved asset performance, reduced maintenance costs, and enhanced operational reliability.

Market Expansion Approach should emphasize emerging markets where energy infrastructure development creates opportunities for implementing modern asset integrity management solutions from project inception. Companies should develop region-specific strategies that address local regulatory requirements, operational challenges, and market conditions while leveraging global technology capabilities and expertise.

Service Model Innovation presents opportunities for companies to differentiate their offerings through comprehensive service-based approaches that reduce customer investment requirements while providing access to advanced asset management capabilities. Developing flexible service models that can scale with customer needs and operational growth will be critical for maintaining competitive positioning.

Partnership Development should focus on strategic alliances that enhance technological capabilities, expand market reach, and provide comprehensive solutions that address diverse customer requirements. Successful partnerships will combine complementary strengths while maintaining focus on customer value creation and measurable operational improvements.

Market evolution toward comprehensive, integrated asset integrity management platforms will continue as energy companies seek simplified solutions that address multiple operational requirements through unified systems. The convergence of traditional asset management approaches with advanced digital technologies will create opportunities for solution providers that can demonstrate measurable operational improvements and clear return on investment.

Technology advancement will focus on artificial intelligence, machine learning, and predictive analytics capabilities that enable autonomous asset management functions and proactive decision-making processes. Future solutions will incorporate advanced algorithms that can automatically optimize maintenance schedules, predict equipment failures, and recommend operational adjustments that enhance asset performance while minimizing costs.

Geographic expansion will accelerate as developing regions implement modern energy infrastructure and adopt international best practices for asset management. Market growth projections indicate annual expansion rates of 10-12% in emerging markets as these regions invest in comprehensive asset integrity management capabilities that ensure operational reliability and regulatory compliance.

Industry transformation toward sustainable energy operations will create new requirements for asset integrity management solutions that can monitor and optimize diverse energy portfolios including traditional oil and gas assets alongside renewable energy infrastructure. This evolution will require flexible platforms capable of managing multiple asset types while providing comprehensive operational visibility and control capabilities.

The oil and gas asset integrity management market represents a critical and rapidly evolving sector that addresses fundamental operational requirements for safety, reliability, and efficiency in energy operations. The market’s growth reflects the industry’s recognition that proactive asset management is essential for operational continuity, regulatory compliance, and long-term profitability in an increasingly complex operational environment.

Technology innovation continues to drive market evolution as advanced digital solutions enable unprecedented visibility into asset conditions and performance characteristics. The integration of artificial intelligence, machine learning, and predictive analytics creates opportunities for autonomous asset management capabilities that optimize operational outcomes while minimizing costs and risks.

Market opportunities remain substantial as aging infrastructure, stringent regulatory requirements, and operational excellence initiatives drive continued demand for comprehensive asset integrity management solutions. The industry’s digital transformation trends, combined with emerging market expansion and technology convergence, create favorable conditions for sustained market growth and innovation.

Future success in the oil and gas asset integrity management market will depend on solution providers’ ability to deliver integrated platforms that demonstrate measurable operational improvements while addressing diverse customer requirements across multiple operational environments. Companies that can combine technological innovation with deep industry expertise and comprehensive service capabilities will be best positioned to capitalize on the significant opportunities within this essential and growing market segment.

What is Oil and Gas Asset Integrity Management?

Oil and Gas Asset Integrity Management refers to the systematic approach to ensuring that oil and gas assets operate safely, efficiently, and sustainably throughout their lifecycle. This includes monitoring, maintaining, and managing the physical condition of assets to prevent failures and ensure compliance with regulations.

What are the key players in the Oil and Gas Asset Integrity Management Market?

Key players in the Oil and Gas Asset Integrity Management Market include companies like SGS, DNV GL, and Bureau Veritas, which provide inspection, certification, and consulting services. These companies focus on enhancing safety and operational efficiency in the oil and gas sector, among others.

What are the main drivers of growth in the Oil and Gas Asset Integrity Management Market?

The main drivers of growth in the Oil and Gas Asset Integrity Management Market include the increasing need for safety and compliance, the rising costs associated with asset failures, and the growing emphasis on sustainable practices in the oil and gas industry. Additionally, technological advancements in monitoring and inspection are contributing to market expansion.

What challenges does the Oil and Gas Asset Integrity Management Market face?

Challenges in the Oil and Gas Asset Integrity Management Market include the high costs of implementing integrity management systems, the complexity of aging infrastructure, and the need for skilled personnel to manage these systems effectively. These factors can hinder the adoption of comprehensive asset integrity strategies.

What opportunities exist in the Oil and Gas Asset Integrity Management Market?

Opportunities in the Oil and Gas Asset Integrity Management Market include the integration of advanced technologies such as IoT and AI for real-time monitoring and predictive maintenance. Additionally, the increasing focus on environmental sustainability presents avenues for developing innovative integrity management solutions.

What trends are shaping the Oil and Gas Asset Integrity Management Market?

Trends shaping the Oil and Gas Asset Integrity Management Market include the adoption of digital twins for asset monitoring, the use of drones for inspections, and the implementation of risk-based inspection methodologies. These innovations are enhancing the efficiency and effectiveness of asset integrity management practices.

Oil and Gas Asset Integrity Management Market

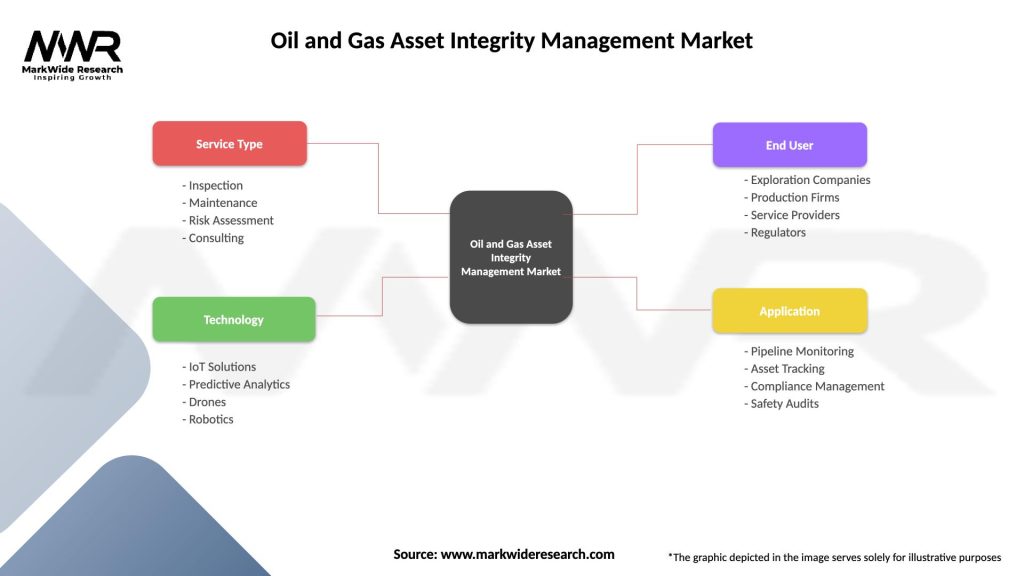

| Segmentation Details | Description |

|---|---|

| Service Type | Inspection, Maintenance, Risk Assessment, Consulting |

| Technology | IoT Solutions, Predictive Analytics, Drones, Robotics |

| End User | Exploration Companies, Production Firms, Service Providers, Regulators |

| Application | Pipeline Monitoring, Asset Tracking, Compliance Management, Safety Audits |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Oil and Gas Asset Integrity Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at