444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Offshore oil and gas pipelines play a crucial role in the energy industry, serving as the primary means of transporting hydrocarbon resources from offshore drilling platforms to onshore processing facilities. These pipelines form an essential part of the global energy infrastructure, enabling the extraction and distribution of valuable resources from offshore reserves. The offshore oil and gas pipelines market has witnessed significant growth in recent years, driven by the increasing demand for energy and the exploration of new offshore reserves.

Meaning

Offshore oil and gas pipelines refer to the network of pipelines that are installed on the seabed to transport oil and gas from offshore wells to onshore processing facilities. These pipelines are constructed using various materials, such as steel or flexible composite pipes, and are designed to withstand the harsh marine environment and the high-pressure conditions associated with deepwater operations. Offshore pipelines are vital for the efficient and cost-effective transportation of oil and gas resources, ensuring a steady supply of energy to meet the global demand.

Executive Summary

The offshore oil and gas pipelines market has experienced substantial growth in recent years, driven by the rising demand for energy and the exploration of new offshore reserves. The market is characterized by the installation of pipelines in deepwater and ultra-deepwater areas, where the challenges of harsh environmental conditions and complex engineering solutions are prevalent. The market players are continuously investing in research and development to enhance pipeline integrity, improve installation techniques, and mitigate the environmental impact of offshore operations. The increasing focus on renewable energy sources and the transition towards a low-carbon economy pose both challenges and opportunities for the offshore oil and gas pipelines market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The offshore oil and gas pipelines market is influenced by several dynamic factors, including technological advancements, regulatory frameworks, market competition, and the evolving energy landscape. These dynamics shape the market trends, driving innovation, strategic alliances, and operational efficiency. Technological advancements in pipeline materials, such as the use of flexible composite pipes and corrosion-resistant alloys, enable the installation of pipelines in deeper waters and challenging environments. Enhanced installation techniques, including the use of autonomous underwater vehicles and remote-operated vehicles, facilitate cost-effective and efficient pipeline laying.

Regulatory frameworks play a critical role in ensuring the safety and environmental compliance of offshore pipeline projects. Stringent regulations govern pipeline design, construction, operation, and decommissioning, addressing concerns related to pipeline integrity, marine life protection, and pollution prevention. The offshore oil and gas pipelines market is highly competitive, with several key players vying for market share. Companies engage in strategic partnerships, mergers and acquisitions, and product innovations to gain a competitive edge. Continuous investments in research and development are undertaken to enhance pipeline performance, reduce maintenance costs, and mitigate environmental risks.

The evolving energy landscape, with a growing emphasis on renewable energy sources and the transition towards a low-carbon economy, poses both challenges and opportunities for the offshore oil and gas pipelines market. The integration of offshore wind farms, the repurposing of existing pipelines for different applications, and the adoption of carbon capture and storage technologies are among the trends shaping the future of the market.

Regional Analysis

The offshore oil and gas pipelines market exhibits regional variations in terms of market size, growth rate, and market dynamics. The key regions analyzed in the report include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America dominates the market, driven by extensive offshore exploration and production activities in the Gulf of Mexico and the Atlantic Ocean. The region benefits from well-established infrastructure, technological expertise, and a favorable regulatory environment. Europe also holds a significant market share, with offshore pipeline projects in the North Sea and the Baltic Sea contributing to market growth.

Asia Pacific is experiencing rapid growth in the offshore oil and gas pipelines market, fueled by increasing energy demand and the exploration of offshore reserves in countries such as China, Australia, and India. Latin America and the Middle East and Africa regions offer substantial opportunities for market expansion, driven by the development of offshore oil and gas fields and the need for infrastructure to support production activities.

Competitive Landscape

Leading Companies in the Offshore Oil and Gas Pipelines Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

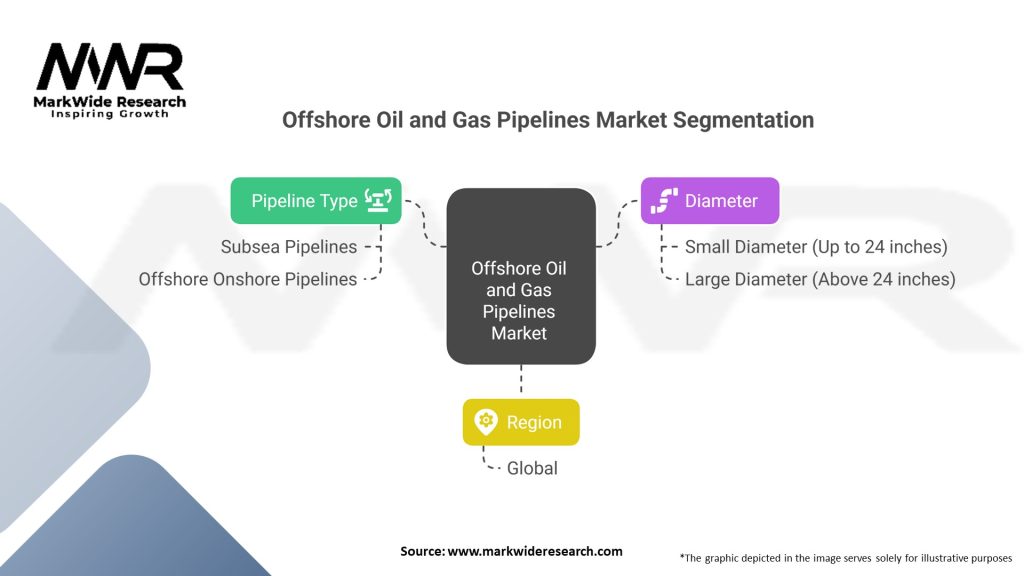

Segmentation

The offshore oil and gas pipelines market can be segmented based on various factors, including pipeline type, material, diameter, water depth, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The offshore oil and gas pipelines market offers several key benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of the offshore oil and gas pipelines market provides a comprehensive understanding of the market dynamics:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the offshore oil and gas pipelines market. The outbreak led to a sharp decline in oil and gas demand, as travel restrictions, lockdowns, and reduced economic activity resulted in decreased energy consumption. This downturn in demand led to a decline in oil and gas prices, affecting investment decisions and project viability in the offshore sector. The pandemic also disrupted supply chains, leading to delays in pipeline projects and a slowdown in construction activities. Travel restrictions and social distancing measures hindered offshore operations, including installation and maintenance activities. Additionally, the uncertainty surrounding the duration and severity of the pandemic created challenges for project planning and investment forecasting.

However, the offshore oil and gas pipelines market has shown resilience, adapting to the changing market conditions. Governments and industry players have implemented safety protocols to ensure the continuity of operations while safeguarding the health and well-being of the workforce. The gradual recovery of oil and gas demand, along with the growing focus on energy transition, is expected to drive the market’s resurgence in the post-pandemic period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the offshore oil and gas pipelines market is optimistic, driven by the increasing global energy demand, exploration of new offshore reserves, and the transition towards a low-carbon economy. Technological advancements will continue to play a crucial role, enabling the development of pipelines in deeper waters and harsh environmental conditions. The integration of offshore wind farms with existing pipeline infrastructure presents new growth opportunities. Repurposing pipelines for electricity transmission and the development of offshore renewable energy projects can contribute to sustainable energy solutions and infrastructure optimization.

However, market players need to address challenges related to capital investment, environmental concerns, and regulatory compliance. Continued focus on safety, sustainability, and social responsibility will be essential to navigate the evolving market dynamics and meet the expectations of industry stakeholders and society as a whole.

Conclusion

The offshore oil and gas pipelines market is a critical component of the global energy infrastructure, enabling the efficient transportation of hydrocarbon resources from offshore reserves to onshore processing facilities. Despite challenges such as high capital investment, environmental concerns, and market volatility, the market has witnessed significant growth driven by increasing energy demand and exploration of new offshore reserves. Technological advancements, strategic partnerships, and regulatory compliance are key factors shaping the market. The integration of offshore wind farms and the focus on environmental sustainability present new opportunities for market expansion. The industry’s future outlook is positive, driven by the growing global energy demand and the transition towards a low-carbon economy.

Market players should embrace technological advancements, enhance environmental sustainability, and explore diversification into renewable energy sources. Strengthening partnerships and collaborations and staying abreast of regulatory developments will be vital for future success. With proactive strategies and a focus on innovation, the offshore oil and gas pipelines market is poised for continued growth and adaptation in the dynamic energy landscape.

What is Offshore Oil and Gas Pipelines?

Offshore oil and gas pipelines are conduits used to transport hydrocarbons from offshore production facilities to onshore processing plants. These pipelines are crucial for the efficient and safe movement of oil and gas resources extracted from beneath the ocean floor.

What are the key players in the Offshore Oil and Gas Pipelines Market?

Key players in the Offshore Oil and Gas Pipelines Market include companies like Subsea 7, TechnipFMC, and Saipem, which specialize in engineering and construction services for offshore projects. These companies are involved in various aspects of pipeline installation and maintenance, among others.

What are the main drivers of the Offshore Oil and Gas Pipelines Market?

The Offshore Oil and Gas Pipelines Market is driven by increasing energy demand, advancements in extraction technologies, and the need for efficient transportation of hydrocarbons. Additionally, the exploration of new offshore reserves contributes to market growth.

What challenges does the Offshore Oil and Gas Pipelines Market face?

Challenges in the Offshore Oil and Gas Pipelines Market include environmental concerns, regulatory compliance, and the high costs associated with installation and maintenance. These factors can hinder project timelines and increase operational risks.

What opportunities exist in the Offshore Oil and Gas Pipelines Market?

Opportunities in the Offshore Oil and Gas Pipelines Market include the development of new technologies for pipeline monitoring and maintenance, as well as the expansion of offshore renewable energy projects. These advancements can enhance efficiency and sustainability in the sector.

What trends are shaping the Offshore Oil and Gas Pipelines Market?

Trends in the Offshore Oil and Gas Pipelines Market include the increasing adoption of digital technologies for pipeline management and the focus on reducing carbon emissions. Additionally, there is a growing emphasis on safety and risk management practices in offshore operations.

Offshore Oil and Gas Pipelines Market

| Segmentation Details | Details |

|---|---|

| Pipeline Type | Subsea Pipelines, Offshore Onshore Pipelines |

| Diameter | Small Diameter (Up to 24 inches), Large Diameter (Above 24 inches) |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Offshore Oil and Gas Pipelines Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at