444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The offshore mooring systems market has been experiencing steady growth over the last few years, with an increasing number of offshore oil and gas exploration activities worldwide. An offshore mooring system is a device that is used to secure floating vessels or structures in place, primarily for oil and gas drilling operations. It includes a variety of components such as anchors, chains, ropes, and connectors, which work together to ensure the stability of the vessel.

The demand for offshore mooring systems is expected to grow steadily in the coming years, primarily due to the increase in offshore oil and gas exploration and production activities. Furthermore, the need for safe and secure mooring systems to prevent accidents and environmental damage has become increasingly important.

Offshore mooring systems are used to secure offshore structures, such as drilling rigs, floating production storage and offloading (FPSO) vessels, and other floating vessels. They help maintain the position of the structure in the sea and prevent it from drifting away. Mooring systems consist of several components such as anchors, chains, ropes, and connectors, which work together to ensure the stability of the structure.

The market for offshore mooring systems is driven by the increase in offshore oil and gas exploration and production activities worldwide. The need for safe and secure mooring systems to prevent accidents and environmental damage has become increasingly important.

Executive Summary

The global offshore mooring systems market is expected to grow at a steady rate during the forecast period (2021-2028). The market is driven by the increasing demand for offshore oil and gas exploration and production activities, as well as the need for safe and secure mooring systems to prevent accidents and environmental damage.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global offshore mooring systems market is primarily driven by the increase in offshore oil and gas exploration and production activities worldwide. The growing demand for energy worldwide has led to an increase in offshore exploration and production activities, which, in turn, has driven the demand for offshore mooring systems. The need for safe and secure mooring systems to prevent accidents and environmental damage has become increasingly important, and this has further propelled the market growth.

The market is highly competitive, with several major players competing for market share. The key players in the market are investing in research and development to develop innovative and cost-effective mooring technologies to maintain their market position.

Regional Analysis

The offshore mooring systems market is analyzed across various regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The Asia Pacific region is expected to dominate the market during the forecast period, primarily due to the growing demand for energy and the increasing investment in offshore exploration and production activities in the region.

China and India are expected to be the key markets in the Asia Pacific region, with significant investments being made in offshore exploration and production activities. North America is expected to be the second-largest market during the forecast period, primarily due to the increase in offshore drilling activities in the Gulf of Mexico. Europe is also expected to grow significantly during the forecast period, primarily due to the increasing investment in offshore wind farms.

Competitive Landscape

Leading companies in the Offshore Mooring Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

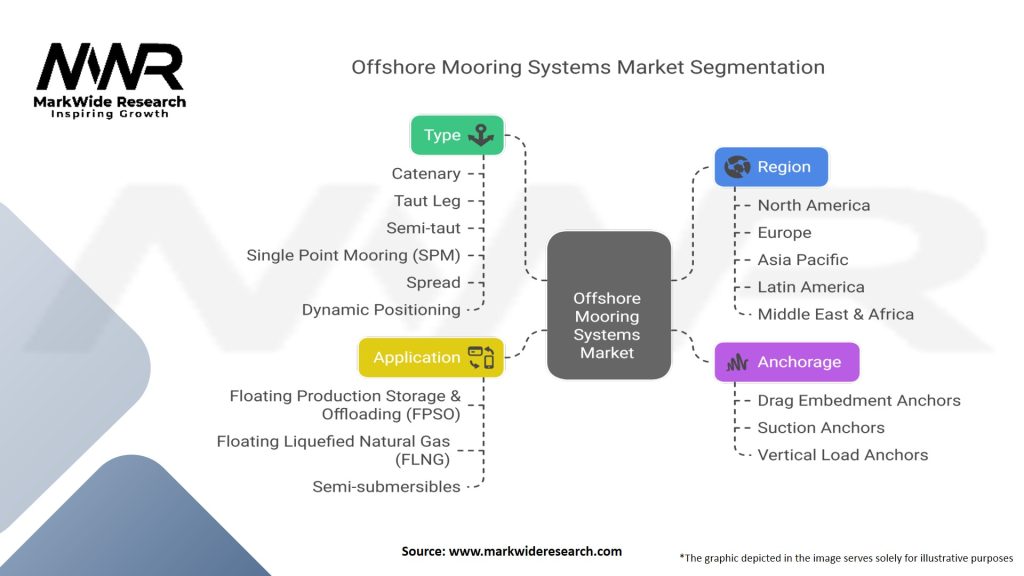

The offshore mooring systems market can be segmented based on the type of mooring system, application, and water depth.

Based on the type of mooring system, the market can be segmented into single point mooring, spread mooring, dynamic positioning, and turret mooring. Single point mooring is the most commonly used type of mooring system in the market, primarily due to its ease of use and cost-effectiveness.

Based on application, the market can be segmented into oil and gas, renewable energy, and others. The oil and gas segment is expected to dominate the market during the forecast period, primarily due to the increase in offshore oil and gas exploration and production activities worldwide.

Based on water depth, the market can be segmented into shallow water, deepwater, and ultra-deepwater. The deepwater segment is expected to dominate the market during the forecast period, primarily due to the increase in offshore exploration and production activities in deepwater locations.

Category-wise Insights

Anchors and chains are the most commonly used components in offshore mooring systems. Anchors are used to secure the mooring lines to the seabed, while chains provide the necessary tension to maintain the position of the vessel or structure.

Ropes and connectors are also essential components of mooring systems. Ropes are used to connect the anchors and chains, while connectors are used to connect the ropes to the vessel or structure.

Key Benefits for Industry Participants and Stakeholders

The offshore mooring systems market offers several benefits to industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Some of the key trends in the offshore mooring systems market include:

The outbreak of the Covid-19 pandemic has had a significant impact on the global offshore mooring systems market. The pandemic led to a decline in oil and gas prices, which resulted in a reduction in offshore exploration and production activities. Many companies have also delayed their investment plans due to the uncertainty caused by the pandemic.

However, the market is expected to recover gradually in the coming years, primarily due to the increasing demand for energy worldwide and the growing investment in renewable energy sources.

Key Industry Developments

Some of the key developments in the offshore mooring systems market include:

Analyst Suggestions

According to analysts, the offshore mooring systems market is expected to grow at a steady rate during the forecast period. The market is primarily driven by the increase in offshore oil and gas exploration and production activities worldwide, as well as the growing demand for safe and secure mooring systems to prevent accidents and environmental damage.

Analysts suggest that companies operating in the market should focus on developing innovative and cost-effective mooring technologies to maintain their market position. They should also invest in research and development to keep up with the changing market trends.

Future Outlook

The global offshore mooring systems market is expected to grow at a steady rate during the forecast period, primarily due to the increasing demand for energy worldwide and the growing investment in renewable energy sources. The market is expected to witness significant growth in the Asia Pacific region, primarily due to the growing demand for energy and the increasing investment in offshore exploration and production activities.

The market is highly competitive, with several major players competing for market share. Companies operating in the market should focus on developing innovative and cost-effective mooring technologies to maintain their market position.

Conclusion

The offshore mooring systems market is expected to grow steadily in the coming years, primarily due to the increase in offshore oil and gas exploration and production activities worldwide. The market is highly competitive, with several major players competing for market share. Companies operating in the market should focus on developing innovative and cost-effective mooring technologies to maintain their market position. Furthermore, the increasing demand for safe and secure mooring systems to prevent accidents and environmental damage has become increasingly important, which is expected to propel the market growth.

The market is segmented based on the type of mooring system, application, and water depth. Single point mooring is the most commonly used type of mooring system in the market, primarily due to its ease of use and cost-effectiveness. The oil and gas segment is expected to dominate the market during the forecast period, primarily due to the increase in offshore oil and gas exploration and production activities worldwide.

Anchors and chains are the most commonly used components in offshore mooring systems. Ropes and connectors are also essential components of mooring systems. The market offers several benefits to industry participants and stakeholders, including increased safety and security of offshore structures, improved efficiency of offshore operations, reduced risk of accidents and environmental damage, and increased profitability for oil and gas companies.

Offshore Mooring Systems Market

| Segmentation | Details |

|---|---|

| Type | Catenary, Taut Leg, Semi-taut, Single Point Mooring (SPM), Spread, Dynamic Positioning, Others |

| Anchorage | Drag Embedment Anchors, Suction Anchors, Vertical Load Anchors, Others |

| Application | Floating Production Storage & Offloading (FPSO), Floating Liquefied Natural Gas (FLNG), Semi-submersibles, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Offshore Mooring Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at