444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The offshore Autonomous Underwater Vehicle (AUV) and Remotely Operated Vehicle (ROV) market have witnessed significant growth in recent years. These advanced technologies play a crucial role in underwater exploration, inspection, and maintenance activities in offshore environments. AUVs and ROVs are widely used in various industries, including oil and gas, maritime, defense, and research, to perform tasks such as underwater surveying, pipeline inspection, and subsea maintenance.

Autonomous Underwater Vehicles (AUVs) are unmanned underwater vehicles that are capable of operating autonomously without human intervention. These vehicles are equipped with advanced sensors and navigation systems that enable them to navigate underwater and collect data efficiently. On the other hand, Remotely Operated Vehicles (ROVs) are remotely controlled robotic vehicles that are connected to a control station on the surface. ROVs are used for tasks that require more intricate control and manipulation, such as subsea construction and maintenance.

Executive Summary

The offshore AUV and ROV market have experienced substantial growth due to the increasing demand for efficient underwater operations and the exploration of deep-sea resources. The advancements in technology, such as improved sensors, enhanced maneuverability, and extended endurance, have further propelled the market growth. Additionally, the rise in offshore oil and gas exploration activities and the need for underwater infrastructure inspection and maintenance have significantly contributed to the market’s expansion.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Subsea Exploration Growth: Increasing offshore oil & gas and renewable energy projects drive demand for unmanned vehicles.

Technology Convergence: Hybrid systems integrating AUV autonomy with ROV power and tethered control enhance versatility.

Data Analytics Integration: Real-time 3D mapping and AI-based image recognition improve survey accuracy.

Operational Cost Reduction: Unmanned systems lower personnel risk and vessel time compared to manned submersibles.

Regulatory Mandates: Safety and environmental regulations require detailed seabed inspections and monitoring.

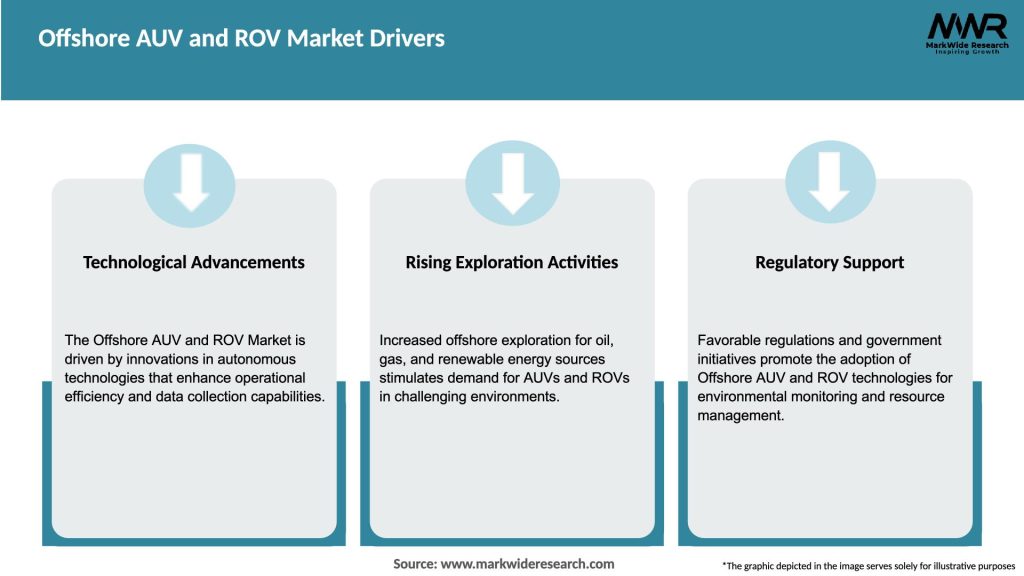

Market Drivers

Deepwater Drilling Expansion: Exploration in ultra-deepwater fields necessitates advanced unmanned inspection tools.

Offshore Wind Farms: Installation and maintenance of subsea cables and foundations increasingly use AUV/ROV surveys.

Marine Research & Conservation: Growing scientific initiatives for deep-sea biodiversity mapping stimulate equipment usage.

Pipeline Integrity Management: Regular automated inspections reduce spill risks and downtime in subsea pipelines.

Technological Advancements: Improvements in battery energy density and thruster efficiency extend mission durations.

Market Restraints

High Capital Investment: Purchase and operation of AUV/ROV fleets require significant upfront and maintenance costs.

Complex Deployment Logistics: Support vessels, launch/recovery systems, and skilled pilots add to project complexity.

Environmental Challenges: Strong currents, low visibility, and extreme depths limit operational windows.

Data Processing Bottlenecks: Large volumes of raw subsea data demand robust onshore analysis infrastructure.

Regulatory Hurdles: Permitting for certain oceanographic surveys can be time-consuming in sensitive marine areas.

Market Opportunities

Autonomous Survey Missions: Fully automated seabed mapping and inspection with minimal human intervention.

Hybrid Energy Systems: Fuel-cell and hybrid powerplants to further extend underwater endurance.

Global Energy Transition Projects: Decommissioning of aging oil platforms and installation of subsea carbon capture sites.

AI-driven Condition Monitoring: Predictive algorithms to forecast equipment wear and schedule proactive maintenance.

Cross-sector Applications: Expansion into offshore aquaculture, underwater archaeology, and disaster response.

Market Dynamics

The offshore AUV and ROV market are characterized by intense competition among key players. Technological advancements and product innovation remain the primary strategies adopted by market participants to gain a competitive edge. Collaboration with research institutions and universities is also a common practice to drive innovation and address industry challenges collectively. Moreover, the market is witnessing an increasing trend of partnerships and acquisitions among companies to expand their product portfolios and geographical presence.

Regional Analysis

The market for offshore AUV and ROV is segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market due to the presence of major offshore exploration and production activities in the Gulf of Mexico. Europe and Asia Pacific are also significant markets, driven by the increasing demand for energy resources and underwater infrastructure development in countries such as the United Kingdom, Norway, China, and Australia.

Competitive Landscape

Leading companies in the Offshore AUV and ROV Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The offshore AUV and ROV market can be segmented based on vehicle type, application, and end-user industry.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The outbreak of the COVID-19 pandemic had a significant impact on the offshore AUV and ROV market. The restrictions imposed on travel and offshore operations disrupted supply chains and delayed project timelines. The decline in oil prices and reduced investments in the oil and gas industry also affected the market growth. However, the market showed resilience, with the demand for AUVs and ROVs in sectors such as defense, security, and scientific research remaining relatively stable. The market is expected to recover as the global economy recovers and investments in offshore activities regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The offshore AUV and ROV market are expected to continue growing in the coming years. Technological advancements will play a crucial role in driving market expansion, with AI, machine learning, and advanced imaging technologies becoming increasingly integrated into AUVs and ROVs. The market will also witness increased collaboration between industry players and research institutions to address technological challenges and drive innovation. Growing investments in deep-sea mining activities, renewable energy projects, and underwater infrastructure development will provide significant growth opportunities for the market.

Conclusion

The offshore AUV and ROV market have experienced significant growth, driven by increasing demand for efficient underwater operations, exploration of deep-sea resources, and infrastructure inspection and maintenance. Technological advancements, expanding applications in various industries, and growing emphasis on environmental monitoring and research have contributed to the market’s expansion. While the market faces challenges such as high costs and regulatory complexities, strategic investments in R&D, cost optimization efforts, and collaborations will drive future market growth. Overall, the future outlook for the offshore AUV and ROV market remains promising, with a focus on technological advancements, market expansion, and sustainable practices.

What are Offshore AUV and ROV?

Offshore AUV (Autonomous Underwater Vehicle) and ROV (Remotely Operated Vehicle) are specialized underwater vehicles used for various applications such as underwater exploration, inspection, and maintenance in marine environments.

Who are the key players in the Offshore AUV and ROV Market?

Key players in the Offshore AUV and ROV Market include companies like Oceaneering International, Kongsberg Gruppen, and Teledyne Technologies, among others.

What are the growth factors driving the Offshore AUV and ROV Market?

The Offshore AUV and ROV Market is driven by factors such as the increasing demand for underwater inspections in oil and gas, advancements in robotics technology, and the growing need for marine research and environmental monitoring.

What challenges does the Offshore AUV and ROV Market face?

Challenges in the Offshore AUV and ROV Market include high operational costs, technical limitations in deep-sea environments, and regulatory hurdles that can impact deployment and operations.

What opportunities exist in the Offshore AUV and ROV Market?

Opportunities in the Offshore AUV and ROV Market include the expansion of renewable energy projects, such as offshore wind farms, and the increasing use of these technologies in marine conservation efforts.

What trends are shaping the Offshore AUV and ROV Market?

Trends in the Offshore AUV and ROV Market include the integration of artificial intelligence for enhanced navigation and data analysis, as well as the development of hybrid vehicles that combine AUV and ROV capabilities.

Offshore AUV and ROV Market:

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Autonomous Underwater Vehicle (AUV), Remotely Operated Vehicle (ROV) |

| Application | Oil and Gas Exploration, Scientific Research, Defense and Security, Environmental Monitoring, Others |

| Depth Range | Shallow Water (Up to 1,000 meters), Medium Water (1,000 – 3,000 meters), Deep Water (Above 3,000 meters) |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Offshore AUV and ROV Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at