444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The office real estate market plays a pivotal role in the commercial property sector, serving as a crucial hub for businesses to operate and thrive. It encompasses properties such as office buildings, business parks, and coworking spaces. This market overview will delve into the various aspects of the office real estate market, including its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, and more.

Meaning

The office real estate market refers to the buying, selling, and leasing of properties specifically designed for office use. These properties are equipped with amenities and infrastructure to support businesses, providing office spaces where employees can carry out their work activities. The market caters to a diverse range of industries, including finance, technology, healthcare, and more.

Executive Summary

The office real estate market has experienced steady growth over the years, driven by the expansion of businesses, urbanization, and the need for flexible and modern workspaces. However, it has also faced challenges, particularly in the wake of the COVID-19 pandemic. This executive summary aims to provide a concise overview of the market’s current state, highlighting its key trends, impact of COVID-19, and future outlook.

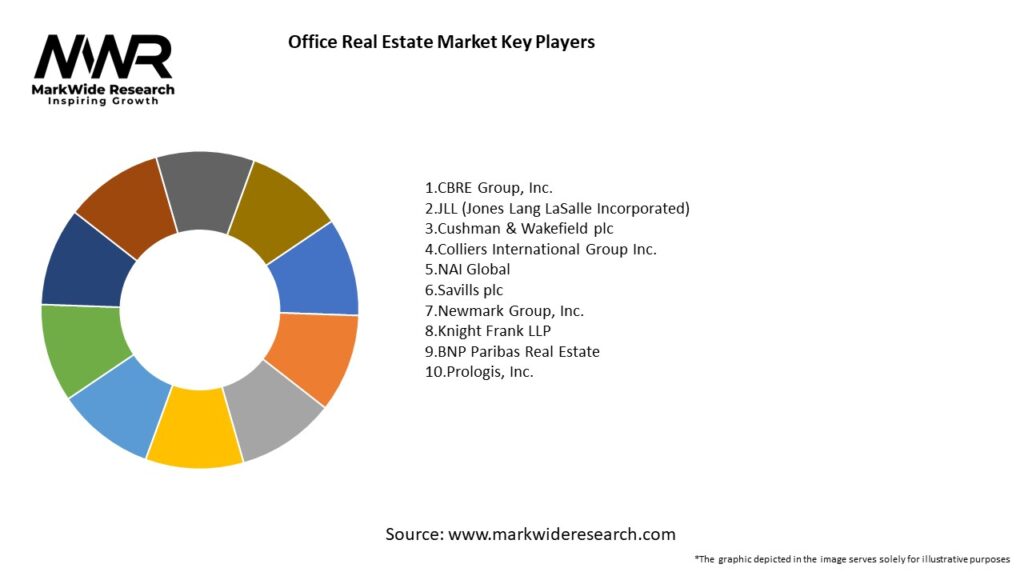

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The office real estate market operates in a dynamic environment influenced by various factors. Economic conditions, technological advancements, regulatory frameworks, and social trends contribute to the dynamics of the market. It is essential for industry participants and stakeholders to adapt to these dynamics and identify opportunities for growth and innovation.

Regional Analysis

The office real estate market varies significantly across regions, reflecting the unique characteristics of each market. Factors such as economic growth, urbanization rates, infrastructure development, and industry clusters impact regional dynamics. A comprehensive regional analysis will provide insights into the specific trends, opportunities, and challenges present in different markets.

Competitive Landscape

Leading Companies in the Office Real Estate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

Segmentation of the office real estate market allows for a deeper understanding of the various sub-markets and their specific characteristics. Segmentation can be based on factors such as location, property size, building class, amenities, and target industries. By analyzing these segments, industry participants can tailor their offerings to specific client requirements and preferences.

Category-wise Insights

Different categories within the office real estate market, such as traditional office spaces, coworking spaces, and serviced offices, each have their own unique dynamics. Analyzing these categories individually provides insights into their growth patterns, demand drivers, and competitive advantages, helping stakeholders make informed decisions.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Prime Location Assets: Core CBD and business-park properties offer long-term value.

Strong Tenant Demand for Quality Space: Corporates seek flexible, amenity-rich offices.

Stable Income Streams: Long-term leases provide predictable cash flows.

Weaknesses:

High Entry Costs: Purchasing or developing new office properties requires significant capital.

Vacancy Risks Post-Pandemic: Hybrid work models have reduced space requirements in some regions.

Maintenance & CapEx Burden: Aging buildings need ongoing investment to remain competitive.

Opportunities:

Repurposing & Mixed-Use Conversions: Turning underused offices into residential or co-living spaces.

Green Building Retrofits: Energy-efficiency upgrades can attract ESG-focused tenants.

Flexible Workspace Solutions: Demand for co-working and short-term leases is on the rise.

Threats:

Economic Downturns: Corporate cost-cutting can lead to lease non-renewals.

Regulatory Changes in Zoning & Taxation: New rules may affect development feasibility.

Climate-Related Risks: Flood or heat-stress exposures threaten asset values.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a profound impact on the office real estate market. Remote work became the norm for many businesses, leading to reduced occupancy rates and changing office space requirements. The pandemic highlighted the importance of flexibility, adaptability, and health and safety measures in office spaces.

Key Industry Developments

Analyst Suggestions

Future Outlook

The office real estate market is expected to evolve in response to changing work patterns, technological advancements, and sustainability considerations. The future outlook suggests a greater emphasis on flexible workspaces, health and wellness features, and the integration of advanced technologies. As businesses adapt to new work models and prioritize employee well-being, the demand for innovative office spaces will continue to evolve.

Conclusion

The office real estate market plays a crucial role in providing suitable work environments for businesses across industries. With its ever-changing dynamics, the market presents both challenges and opportunities for industry participants and stakeholders. By understanding market trends, embracing flexibility, and prioritizing sustainability and technology, stakeholders can navigate this dynamic landscape and capitalize on the evolving demands of businesses and employees.

What is Office Real Estate?

Office real estate refers to properties specifically designed for business use, including office buildings, coworking spaces, and business parks. These spaces are essential for housing corporate operations and facilitating employee collaboration.

What are the key players in the Office Real Estate Market?

Key players in the office real estate market include companies like CBRE Group, JLL, and Cushman & Wakefield, which provide services such as property management, leasing, and investment advisory. These firms play a significant role in shaping market trends and property valuations, among others.

What are the main drivers of growth in the Office Real Estate Market?

The main drivers of growth in the office real estate market include the increasing demand for flexible workspaces, the rise of remote work leading to hybrid office models, and urbanization trends that drive corporate relocations to metropolitan areas. Additionally, technological advancements are influencing office design and functionality.

What challenges does the Office Real Estate Market face?

The office real estate market faces challenges such as fluctuating demand due to remote work trends, economic uncertainties affecting corporate leasing decisions, and the need for properties to adapt to new health and safety standards. These factors can impact occupancy rates and rental income.

What opportunities exist in the Office Real Estate Market?

Opportunities in the office real estate market include the development of sustainable buildings that meet ESG criteria, the integration of smart technologies in office spaces, and the potential for repurposing underutilized properties into mixed-use developments. These trends can attract new tenants and enhance property value.

What are the current trends in the Office Real Estate Market?

Current trends in the office real estate market include the rise of coworking spaces, increased focus on employee wellness in office design, and the growing importance of location flexibility. Additionally, there is a shift towards hybrid work models that influence space utilization and design.

Office Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Class A, Class B, Class C, Co-Working |

| Lease Type | Gross Lease, Net Lease, Modified Gross, Short-Term Lease |

| End User | Corporations, Startups, Government, Non-Profits |

| Building Feature | Smart Building, Green Certification, High Ceilings, Parking Availability |

Leading Companies in the Office Real Estate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at