444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The nutraceutical excipients market plays a vital role in the production and formulation of various nutraceutical products. Nutraceuticals are functional foods or dietary supplements that provide health benefits beyond basic nutrition. These products require specialized excipients to ensure stability, bioavailability, and controlled release of active ingredients. The nutraceutical excipients market is experiencing significant growth due to the rising demand for nutraceutical products worldwide.

Nutraceutical excipients are inactive substances or additives used in the manufacturing process of nutraceuticals. These excipients help in improving the physicochemical properties, stability, and functionality of the final product. They assist in maintaining the integrity of active ingredients, enhancing their absorption, and ensuring precise dosage delivery. Nutraceutical excipients can include binders, fillers, disintegrants, lubricants, coatings, and flavoring agents, among others.

Executive Summary

The nutraceutical excipients market is witnessing robust growth due to the increasing consumer awareness regarding health and wellness. The growing aging population and rising prevalence of chronic diseases have led to a surge in demand for nutraceutical products, thereby driving the demand for specialized excipients. Manufacturers are focusing on developing innovative excipients that offer improved functionality and enhanced product performance.

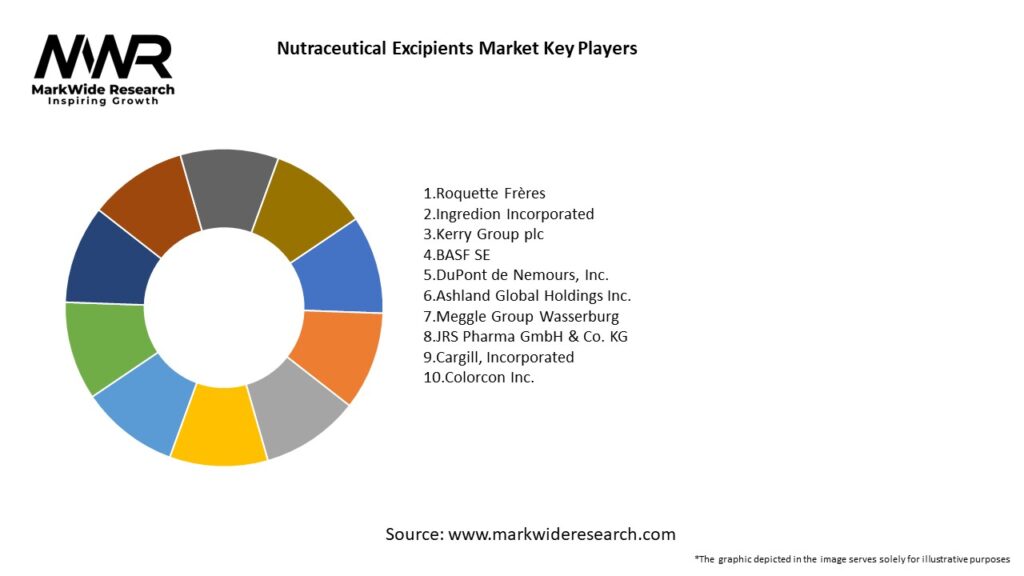

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The nutraceutical excipients market is driven by a combination of factors, including consumer preferences, regulatory environment, technological advancements, and market trends. The market is highly dynamic and continuously evolving, with manufacturers striving to meet the changing demands of consumers. Factors such as product quality, safety, efficacy, and cost-effectiveness play a crucial role in shaping the market dynamics.

Regional Analysis

Competitive Landscape

Leading Companies in the Nutraceutical Excipients Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

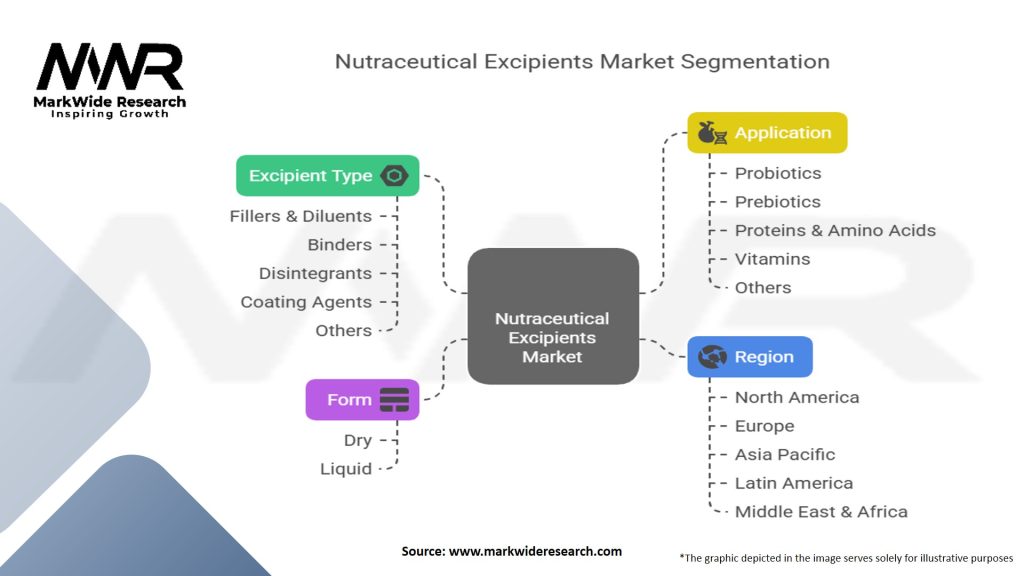

Segmentation

The nutraceutical excipients market can be segmented based on type, functionality, form, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The nutraceutical excipients market experienced a mixed impact during the COVID-19 pandemic. While the demand for nutraceutical products remained strong, disruptions in the supply chain and manufacturing operations affected the availability of certain excipients. Stringent lockdown measures and restrictions on international trade also posed challenges for market players. However, the pandemic highlighted the importance of preventive healthcare and boosted consumer interest in immune-boosting and wellness products, driving the demand for nutraceuticals and related excipients.

Key Industry Developments

Analyst Suggestions

Future Outlook

The nutraceutical excipients market is expected to continue its growth trajectory in the coming years. The rising consumer interest in health and wellness, along with the growing prevalence of chronic diseases, will drive the demand for nutraceutical products. Excipient manufacturers will focus on developing innovative excipients that offer improved functionality, enhanced bioavailability, and formulation flexibility. The market will witness advancements in natural and plant-based excipients, personalized nutrition solutions, and the integration of digital technologies to optimize formulation processes.

Conclusion

The nutraceutical excipients market plays a crucial role in the production and formulation of nutraceutical products. The market is witnessing significant growth driven by the increasing consumer awareness of health and wellness, the rising demand for preventive healthcare, and the popularity of dietary supplements and functional foods. Excipient manufacturers need to focus on developing innovative excipients that meet the specific formulation requirements of nutraceutical products. By staying abreast of market trends, regulatory changes, and consumer preferences, industry participants can position themselves for success in this dynamic and evolving market.

Nutraceutical Excipients Market

| Segmentation | Details |

|---|---|

| Excipient Type | Fillers & Diluents, Binders, Disintegrants, Coating Agents, Others |

| Form | Dry, Liquid |

| Application | Probiotics, Prebiotics, Proteins & Amino Acids, Vitamins, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Nutraceutical Excipients Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at