444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The nucleic acid therapeutics contract development and manufacturing organization market represents a rapidly expanding segment within the biopharmaceutical industry, driven by the increasing demand for specialized manufacturing capabilities in RNA and DNA-based therapies. This market encompasses organizations that provide comprehensive services ranging from early-stage development to commercial-scale manufacturing of nucleic acid therapeutics, including mRNA vaccines, siRNA therapies, antisense oligonucleotides, and gene therapies.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.8% as pharmaceutical companies increasingly outsource complex nucleic acid manufacturing processes. The market has gained significant momentum following the success of mRNA-based COVID-19 vaccines, which demonstrated the commercial viability and therapeutic potential of nucleic acid technologies on a global scale.

Key market drivers include the growing pipeline of nucleic acid therapeutics in clinical development, increasing regulatory approvals for RNA-based therapies, and the need for specialized manufacturing expertise that many pharmaceutical companies lack in-house. The market serves diverse therapeutic areas including oncology, rare diseases, infectious diseases, and genetic disorders, with oncology applications representing approximately 35% of current development activities.

Geographic distribution shows North America leading the market with a 45% market share, followed by Europe at 28% and Asia-Pacific at 18%. The remaining regions account for 9% of market activity, with emerging markets showing increasing interest in nucleic acid therapeutic development and manufacturing capabilities.

The nucleic acid therapeutics contract development and manufacturing organization market refers to the specialized sector of companies that provide outsourced services for the development, optimization, and large-scale production of therapeutic products based on nucleic acids such as DNA, RNA, and their synthetic analogs.

These organizations offer comprehensive services spanning the entire product lifecycle, from initial research and development through regulatory approval and commercial manufacturing. Services typically include process development, analytical method development, quality control testing, regulatory support, and both clinical and commercial manufacturing under Good Manufacturing Practice (GMP) conditions.

Nucleic acid therapeutics encompass various modalities including messenger RNA (mRNA) therapies, small interfering RNA (siRNA), antisense oligonucleotides (ASOs), microRNA, aptamers, and plasmid DNA for gene therapy applications. Each modality requires specialized manufacturing processes, purification techniques, and quality control measures that differ significantly from traditional small molecule or protein-based therapeutics.

Contract development and manufacturing organizations (CDMOs) in this space must possess unique capabilities including specialized equipment for nucleic acid synthesis, advanced purification systems, cold chain storage and distribution networks, and expertise in handling the inherent instability challenges associated with nucleic acid molecules.

The nucleic acid therapeutics CDMO market has emerged as a critical enabler of the rapidly expanding RNA and DNA therapeutics sector, providing essential manufacturing infrastructure and expertise to pharmaceutical and biotechnology companies worldwide. The market has experienced unprecedented growth driven by the success of mRNA vaccines and the increasing recognition of nucleic acid therapeutics as viable treatment options across multiple therapeutic areas.

Market expansion is fueled by several key factors including the growing number of nucleic acid therapeutics in clinical development, increasing regulatory approvals, and the complex manufacturing requirements that necessitate specialized expertise. The sector benefits from strong investment flows, with venture capital and private equity funding increasing by 78% year-over-year in nucleic acid CDMO capabilities.

Technology advancement continues to drive market evolution, with innovations in lipid nanoparticle delivery systems, improved synthesis methods, and enhanced purification techniques enabling more efficient and cost-effective manufacturing processes. The market serves a diverse customer base ranging from large pharmaceutical companies to emerging biotechnology firms developing novel nucleic acid therapeutics.

Competitive landscape features both established pharmaceutical service providers expanding into nucleic acid manufacturing and specialized companies built specifically for this market segment. The industry is characterized by high barriers to entry due to the significant capital investment required for specialized equipment and facilities, as well as the need for deep technical expertise in nucleic acid chemistry and manufacturing processes.

Strategic market insights reveal several critical trends shaping the nucleic acid therapeutics CDMO landscape. The following key insights provide a comprehensive understanding of market dynamics and growth drivers:

Primary market drivers propelling growth in the nucleic acid therapeutics CDMO sector stem from both technological advances and evolving pharmaceutical industry dynamics. The increasing complexity of nucleic acid therapeutics manufacturing creates significant opportunities for specialized service providers.

Regulatory success of nucleic acid therapeutics has fundamentally changed industry perceptions and investment priorities. The approval and commercial success of mRNA vaccines demonstrated the viability of nucleic acid platforms, leading to increased research and development investments across the pharmaceutical industry. This regulatory validation has resulted in a 65% increase in nucleic acid therapeutic programs entering clinical development over the past three years.

Manufacturing complexity represents another significant driver, as nucleic acid therapeutics require specialized production capabilities that most pharmaceutical companies lack internally. The need for controlled environments, specialized equipment, and expert personnel creates natural demand for outsourced manufacturing services. Companies are increasingly recognizing that building internal capabilities requires substantial capital investment and time that can be better allocated to core research and development activities.

Pipeline expansion across multiple therapeutic areas continues to drive demand for CDMO services. Oncology applications lead development activity, but significant programs exist in rare diseases, infectious diseases, and genetic disorders. The diversity of applications ensures sustained demand growth and reduces market concentration risks for CDMO providers.

Cost efficiency considerations increasingly favor outsourcing models, particularly for smaller biotechnology companies that lack the resources to build comprehensive manufacturing capabilities. CDMOs offer access to state-of-the-art facilities and expertise without the significant capital investment required for internal development.

Market restraints in the nucleic acid therapeutics CDMO sector primarily relate to technical challenges, regulatory complexities, and capacity limitations that can constrain growth and market development. Understanding these constraints is essential for market participants and investors.

Technical complexity represents a fundamental challenge, as nucleic acid therapeutics are inherently unstable and require sophisticated manufacturing processes. The need for precise temperature control, specialized purification methods, and complex quality control testing creates operational challenges that can limit production efficiency and increase costs. Manufacturing yields for nucleic acid therapeutics typically remain lower than traditional pharmaceuticals, impacting overall economics.

Regulatory uncertainty continues to pose challenges, particularly for novel nucleic acid modalities that lack established regulatory pathways. While mRNA vaccines have established precedents, other nucleic acid therapeutics may face longer and more complex approval processes. Regulatory requirements vary significantly across different regions, creating additional complexity for global manufacturing strategies.

Capacity constraints limit market growth as demand for nucleic acid manufacturing services often exceeds available capacity. The specialized nature of required equipment and facilities means that capacity expansion requires significant lead times and capital investment. Current industry capacity utilization rates exceed 85% at leading CDMOs, creating bottlenecks for new customer acquisition.

Talent shortage represents a significant operational constraint, as the specialized knowledge required for nucleic acid manufacturing is scarce in the labor market. Competition for experienced personnel drives up labor costs and can limit expansion plans for CDMO providers.

Significant market opportunities exist within the nucleic acid therapeutics CDMO sector, driven by technological advances, expanding therapeutic applications, and evolving industry dynamics. These opportunities present attractive prospects for both established players and new market entrants.

Emerging therapeutic areas offer substantial growth potential beyond the current focus on oncology and infectious diseases. Applications in neurological disorders, cardiovascular diseases, and metabolic conditions are gaining traction in clinical development. The expansion into these new therapeutic areas could increase the addressable market by an estimated 40% over the next five years.

Technology advancement creates opportunities for CDMOs that invest in next-generation manufacturing platforms. Innovations in automated synthesis, continuous manufacturing processes, and advanced purification techniques can significantly improve efficiency and reduce costs. Companies that successfully implement these technologies can achieve competitive advantages and premium pricing.

Geographic expansion presents opportunities in emerging markets where regulatory frameworks for nucleic acid therapeutics are developing. Asia-Pacific markets, in particular, show strong growth potential as local pharmaceutical industries invest in advanced therapeutic modalities. Establishing manufacturing presence in these regions can provide cost advantages and market access benefits.

Partnership opportunities with pharmaceutical companies seeking to develop nucleic acid therapeutic capabilities offer potential for long-term revenue streams and joint investment in advanced manufacturing technologies. Strategic partnerships can provide stability and enable CDMOs to invest in specialized capabilities with greater confidence.

Vertical integration opportunities exist for CDMOs to expand their service offerings into related areas such as drug delivery system development, analytical services, and regulatory consulting. This expansion can increase customer stickiness and improve profit margins.

Market dynamics in the nucleic acid therapeutics CDMO sector reflect the complex interplay between technological innovation, regulatory evolution, and competitive forces. According to MarkWide Research analysis, these dynamics are reshaping the industry landscape and creating new opportunities for growth and differentiation.

Supply and demand imbalances characterize current market conditions, with demand for specialized manufacturing services significantly exceeding available capacity. This imbalance has resulted in extended lead times for new projects and premium pricing for available capacity. The situation is expected to persist as new therapeutic programs enter development faster than manufacturing capacity can be expanded.

Technology evolution continues to drive market transformation, with advances in manufacturing processes, quality control systems, and delivery technologies creating competitive advantages for early adopters. Companies that invest in cutting-edge technologies can achieve higher yields, improved quality, and reduced manufacturing costs, enabling them to capture market share and improve profitability.

Competitive intensity is increasing as both established pharmaceutical service providers and new specialized companies enter the market. This competition is driving innovation and service quality improvements while putting pressure on pricing for standard services. However, companies with unique capabilities or superior service quality continue to command premium pricing.

Customer concentration varies across the market, with some CDMOs serving primarily large pharmaceutical companies while others focus on biotechnology firms. The customer mix influences business models, with large pharma relationships typically involving longer-term contracts and higher volumes, while biotech relationships may offer higher margins but greater project risk.

Regulatory evolution continues to shape market dynamics as health authorities develop more specific guidance for nucleic acid therapeutics manufacturing. These regulatory developments can create opportunities for CDMOs with strong regulatory expertise while potentially disadvantaging companies with limited regulatory capabilities.

Comprehensive research methodology employed in analyzing the nucleic acid therapeutics CDMO market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. The methodology combines primary research, secondary analysis, and expert consultation to provide a complete market picture.

Primary research includes extensive interviews with industry executives, technical experts, and key stakeholders across the nucleic acid therapeutics value chain. Interview subjects include CDMO executives, pharmaceutical company procurement managers, regulatory affairs professionals, and technology providers. This primary research provides insights into market trends, competitive dynamics, and future growth prospects that are not available through secondary sources.

Secondary research encompasses analysis of company financial reports, regulatory filings, patent databases, and industry publications. This research provides quantitative data on market size, growth rates, and competitive positioning. Special attention is given to tracking clinical trial databases to understand pipeline development and future demand drivers.

Market modeling utilizes advanced analytical techniques to project market growth and identify key trends. The modeling incorporates multiple variables including pipeline development, regulatory approvals, manufacturing capacity, and competitive dynamics. Scenario analysis is employed to understand potential market outcomes under different conditions.

Expert validation ensures research findings are accurate and relevant through consultation with industry experts and technical specialists. This validation process helps identify potential biases and ensures that conclusions are supported by market evidence.

Data triangulation methods are employed to cross-verify findings from multiple sources and ensure consistency in market analysis. This approach helps identify discrepancies and ensures that market insights are based on reliable data.

Regional market analysis reveals significant variations in nucleic acid therapeutics CDMO market development, regulatory environments, and growth prospects across different geographic regions. Understanding these regional differences is crucial for market participants developing global strategies.

North America maintains market leadership with approximately 45% of global market share, driven by the presence of major pharmaceutical companies, advanced regulatory frameworks, and significant research and development investments. The United States leads regional development with established CDMOs and strong venture capital support for nucleic acid therapeutics development. Canada contributes to regional strength through government support for biotechnology innovation and favorable regulatory policies.

Europe represents the second-largest market with 28% market share, characterized by strong regulatory frameworks and increasing investment in nucleic acid therapeutics manufacturing capabilities. Germany leads European development through significant pharmaceutical industry presence and government support for biotechnology innovation. The United Kingdom, Switzerland, and Netherlands also contribute significantly to regional market development through specialized CDMO capabilities and pharmaceutical industry clusters.

Asia-Pacific shows the highest growth potential with current 18% market share but rapidly expanding capabilities. China leads regional development through significant government investment in biotechnology infrastructure and growing pharmaceutical industry capabilities. Japan contributes through advanced technology development and established pharmaceutical companies investing in nucleic acid therapeutics. Singapore and South Korea are emerging as important regional hubs for CDMO services.

Rest of World markets account for 9% of current market activity but show increasing interest in nucleic acid therapeutics development. Brazil and India are developing domestic capabilities while Israel contributes through innovative biotechnology companies and specialized service providers.

The competitive landscape in the nucleic acid therapeutics CDMO market features a diverse mix of established pharmaceutical service providers, specialized nucleic acid manufacturers, and emerging companies built specifically for this market segment. Competition is intensifying as market opportunities expand and new players enter the sector.

Competitive differentiation factors include manufacturing capacity, technology platforms, regulatory expertise, geographic presence, and service quality. Companies with proven track records in nucleic acid manufacturing and strong regulatory relationships maintain competitive advantages in customer acquisition and retention.

Market consolidation trends are emerging as larger CDMOs acquire specialized nucleic acid manufacturers to expand their capabilities and market presence. This consolidation is driven by the need for scale, specialized expertise, and comprehensive service offerings that can serve the full development lifecycle.

Market segmentation analysis reveals distinct categories within the nucleic acid therapeutics CDMO market, each with unique characteristics, growth drivers, and competitive dynamics. Understanding these segments is essential for market participants developing targeted strategies.

By Product Type:

By Service Type:

By Application:

Category-wise analysis provides detailed insights into specific segments within the nucleic acid therapeutics CDMO market, revealing unique growth drivers, challenges, and opportunities for each category.

mRNA Therapeutics Manufacturing represents the fastest-growing category, driven by the success of COVID-19 vaccines and expanding applications in cancer immunotherapy and protein replacement therapy. This category requires specialized lipid nanoparticle formulation capabilities and cold chain distribution networks. Manufacturing challenges include mRNA stability and the need for precise quality control throughout the production process.

siRNA Manufacturing benefits from established regulatory pathways and proven clinical efficacy in multiple therapeutic areas. This category requires specialized conjugation chemistry capabilities and advanced purification techniques. The manufacturing process is generally more stable than mRNA but requires expertise in chemical modifications and delivery system integration.

Antisense Oligonucleotide Production represents a mature category with multiple approved products and established manufacturing processes. This category benefits from relatively stable chemistry and well-understood manufacturing requirements. However, competition is intense, and differentiation often depends on cost efficiency and service quality rather than technical capabilities.

Gene Therapy Manufacturing using plasmid DNA requires specialized bacterial fermentation capabilities and advanced purification systems. This category faces unique challenges related to plasmid stability and the need for high-purity products suitable for human administration. Regulatory requirements are particularly stringent for gene therapy applications.

Process Development Services command premium pricing due to the specialized expertise required for nucleic acid therapeutic optimization. This category benefits from long-term customer relationships and the potential for follow-on manufacturing contracts. Success depends on technical expertise, analytical capabilities, and regulatory knowledge.

Industry participants and stakeholders in the nucleic acid therapeutics CDMO market realize significant benefits from the specialized services and capabilities provided by contract development and manufacturing organizations. These benefits extend across the entire value chain from pharmaceutical companies to patients.

Pharmaceutical Companies benefit from access to specialized manufacturing capabilities without the significant capital investment required to build internal facilities. CDMOs provide expertise in complex nucleic acid chemistry, regulatory compliance, and quality systems that would be difficult and expensive to develop internally. This allows pharmaceutical companies to focus resources on core research and development activities while ensuring access to world-class manufacturing capabilities.

Biotechnology Companies particularly benefit from CDMO partnerships as they typically lack the resources to build comprehensive manufacturing capabilities. CDMOs provide scalable manufacturing solutions that can grow with biotech companies from clinical development through commercial launch. The partnership model allows biotechnology companies to preserve capital for research and development while accessing proven manufacturing expertise.

Investors benefit from the attractive growth prospects and defensive characteristics of the nucleic acid therapeutics CDMO market. The specialized nature of services creates high barriers to entry and sustainable competitive advantages for established players. Long-term customer relationships and recurring revenue models provide stability and predictable cash flows.

Patients ultimately benefit from improved access to innovative nucleic acid therapeutics enabled by efficient and cost-effective manufacturing. CDMOs help reduce development timelines and manufacturing costs, making advanced therapies more accessible and affordable. The specialized expertise of CDMOs also helps ensure product quality and safety.

Healthcare Systems benefit from the development of more effective treatments for previously untreatable diseases. Nucleic acid therapeutics enabled by CDMO manufacturing capabilities offer new treatment options for cancer, rare diseases, and genetic disorders, potentially reducing long-term healthcare costs through improved patient outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the nucleic acid therapeutics CDMO landscape reflect technological advances, evolving customer needs, and changing competitive dynamics. MWR analysis identifies several critical trends that will influence market development over the coming years.

Automation and Digitalization are transforming manufacturing processes, with CDMOs investing heavily in automated synthesis platforms, robotic handling systems, and digital quality control technologies. These investments improve manufacturing efficiency, reduce human error, and enable better process control. Advanced data analytics and artificial intelligence are being integrated into manufacturing processes to optimize yields and predict potential quality issues.

Continuous Manufacturing is gaining traction as an alternative to traditional batch processing, offering potential advantages in cost efficiency, quality consistency, and manufacturing flexibility. Several leading CDMOs are investing in continuous manufacturing platforms for nucleic acid therapeutics, though adoption remains in early stages due to regulatory and technical challenges.

Integrated Service Offerings are becoming more common as CDMOs expand beyond manufacturing to provide comprehensive development and commercialization support. This trend includes services such as formulation development, analytical method development, regulatory consulting, and supply chain management. Integrated offerings increase customer stickiness and improve profit margins.

Sustainability Initiatives are gaining importance as pharmaceutical companies and CDMOs focus on reducing environmental impact. This includes investments in energy-efficient manufacturing processes, waste reduction programs, and sustainable packaging solutions. Sustainability considerations are increasingly influencing customer selection of CDMO partners.

Regional Diversification strategies are being implemented to reduce supply chain risks and serve global markets more effectively. CDMOs are establishing manufacturing presence in multiple regions to provide redundancy and reduce transportation costs and regulatory complexity.

Recent industry developments highlight the dynamic nature of the nucleic acid therapeutics CDMO market and the rapid pace of innovation and investment in this sector. These developments provide insights into market direction and competitive positioning.

Capacity Expansion Investments have accelerated significantly, with major CDMOs announcing substantial facility expansions and new site developments. These investments reflect strong demand growth and the need for specialized manufacturing capabilities. Several companies have announced investments exceeding hundreds of millions of dollars in nucleic acid manufacturing facilities.

Technology Partnerships between CDMOs and technology providers are becoming more common, enabling access to cutting-edge manufacturing platforms and delivery technologies. These partnerships allow CDMOs to offer differentiated services while sharing the costs and risks of technology development.

Regulatory Milestones continue to validate the nucleic acid therapeutics market, with multiple approvals for siRNA and antisense oligonucleotide therapies. These approvals demonstrate the commercial viability of nucleic acid therapeutics and support continued investment in manufacturing capabilities.

Acquisition Activity has increased as larger CDMOs seek to acquire specialized nucleic acid manufacturing capabilities and expand their market presence. These acquisitions reflect the strategic importance of nucleic acid manufacturing capabilities and the premium valuations commanded by specialized providers.

Quality System Enhancements are being implemented across the industry in response to increasing regulatory scrutiny and customer quality requirements. CDMOs are investing in advanced quality management systems, real-time monitoring technologies, and enhanced documentation systems to ensure compliance and product quality.

Strategic recommendations for market participants in the nucleic acid therapeutics CDMO sector focus on building sustainable competitive advantages while managing the risks associated with this rapidly evolving market. These suggestions are based on comprehensive market analysis and industry best practices.

Investment in Technology should be a top priority for CDMOs seeking to maintain competitive positioning. This includes investments in automated manufacturing platforms, advanced analytical capabilities, and digital quality systems. Companies that fail to keep pace with technological advancement risk losing market share to more innovative competitors.

Regulatory Expertise Development is critical for success in this highly regulated market. CDMOs should invest in regulatory affairs capabilities and maintain strong relationships with global health authorities. Companies with proven regulatory track records command premium pricing and preferred partner status with pharmaceutical customers.

Talent Acquisition and Retention strategies must be prioritized given the shortage of skilled personnel in nucleic acid manufacturing. This includes competitive compensation packages, professional development programs, and efforts to build internal expertise through training and knowledge transfer initiatives.

Customer Diversification can reduce business risks associated with customer concentration while providing opportunities for growth. CDMOs should seek to balance their customer portfolios across different therapeutic areas, company sizes, and geographic regions to reduce dependence on any single customer or market segment.

Strategic Partnerships with pharmaceutical companies, technology providers, and other industry participants can provide access to new capabilities, markets, and growth opportunities. These partnerships should be structured to provide mutual benefits while maintaining operational flexibility.

Quality System Excellence must be maintained as a fundamental requirement for market participation. CDMOs should invest in continuous improvement of quality systems and maintain focus on product quality and regulatory compliance as core competitive advantages.

Future market outlook for the nucleic acid therapeutics CDMO sector remains highly positive, driven by continued growth in nucleic acid therapeutic development, expanding therapeutic applications, and increasing outsourcing by pharmaceutical companies. The market is expected to maintain strong growth momentum over the next decade.

Growth projections indicate the market will continue expanding at a robust pace, with growth rates expected to remain in the double-digit range for the foreseeable future. This growth will be driven by increasing numbers of nucleic acid therapeutics entering clinical development, expanding therapeutic applications, and growing acceptance of outsourcing models by pharmaceutical companies.

Technology evolution will continue to shape market development, with advances in manufacturing processes, delivery systems, and quality control technologies creating new opportunities for differentiation and efficiency improvement. Companies that successfully adopt and integrate new technologies will be best positioned for future success.

Market maturation is expected to bring increased competition and pricing pressure for standard services, while specialized capabilities and superior service quality will continue to command premium pricing. Market consolidation may accelerate as companies seek scale advantages and comprehensive service capabilities.

Regulatory environment evolution will continue to influence market dynamics, with clearer guidance for nucleic acid therapeutics potentially reducing development risks and timelines. However, increasing regulatory scrutiny of manufacturing processes and quality systems will require continued investment in compliance capabilities.

Geographic expansion opportunities will continue to emerge as nucleic acid therapeutics gain acceptance in new markets and regulatory frameworks develop in emerging economies. CDMOs with global presence and capabilities will be best positioned to capitalize on these opportunities.

The nucleic acid therapeutics CDMO market represents one of the most dynamic and promising segments within the broader pharmaceutical services industry, driven by the revolutionary potential of RNA and DNA-based therapies across multiple therapeutic areas. The market has demonstrated remarkable resilience and growth potential, supported by strong fundamentals including increasing therapeutic approvals, expanding clinical pipelines, and growing recognition of the commercial viability of nucleic acid therapeutics.

Market dynamics favor continued growth and expansion, with demand for specialized manufacturing services significantly exceeding current capacity. The technical complexity and regulatory requirements associated with nucleic acid therapeutics create natural barriers to entry and sustainable competitive advantages for established CDMOs with proven capabilities and track records.

Strategic positioning in this market requires significant investment in specialized capabilities, regulatory expertise, and quality systems. Companies that successfully navigate these requirements while maintaining operational excellence and customer focus will be well-positioned to capitalize on the substantial growth opportunities ahead. The market rewards innovation, quality, and reliability while penalizing companies that fail to keep pace with technological and regulatory evolution.

Future success in the nucleic acid therapeutics CDMO market will depend on the ability to balance growth investments with operational excellence, maintain strong customer relationships while diversifying risk, and adapt to evolving technology and regulatory landscapes while preserving core competitive advantages. The companies that achieve this balance will play a critical role in enabling the next generation of breakthrough therapeutics that have the potential to transform treatment outcomes for patients worldwide.

What is Nucleic Acid Therapeutics Contract Development And Manufacturing Organization?

Nucleic Acid Therapeutics Contract Development And Manufacturing Organization refers to companies that specialize in the development and manufacturing of nucleic acid-based therapies, such as RNA and DNA therapeutics, for various medical applications.

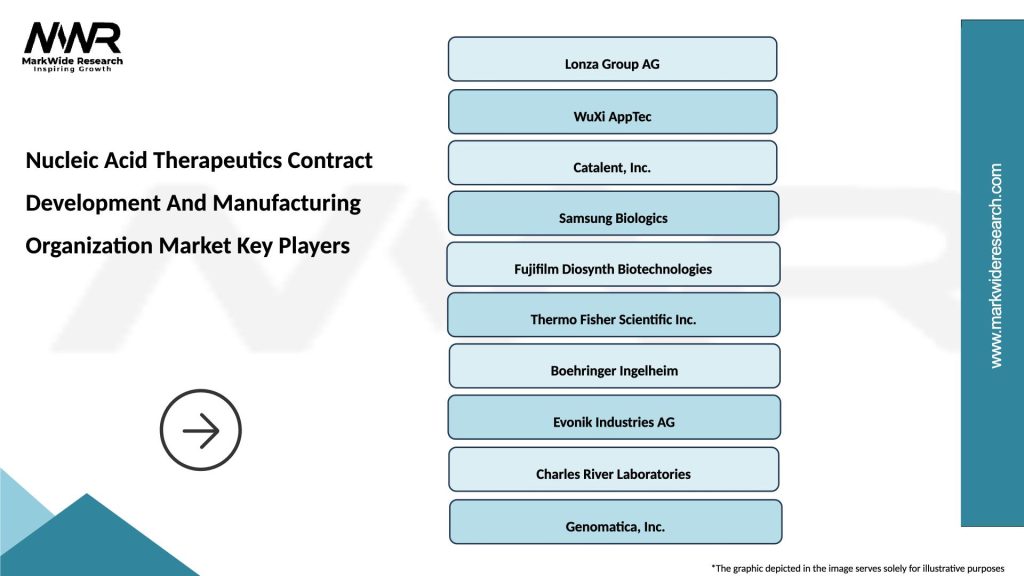

What are the key players in the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market?

Key players in the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market include Lonza, WuXi AppTec, and Catalent, among others. These companies provide essential services ranging from preclinical development to commercial manufacturing.

What are the growth factors driving the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market?

The growth of the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market is driven by the increasing prevalence of genetic disorders, advancements in gene editing technologies, and the rising demand for personalized medicine.

What challenges does the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market face?

Challenges in the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market include regulatory hurdles, high development costs, and the complexity of manufacturing processes for nucleic acid therapies.

What opportunities exist in the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market?

Opportunities in the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market include the growing interest in mRNA vaccines, the expansion of gene therapies, and collaborations between biotech firms and CDMOs to enhance innovation.

What trends are shaping the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market?

Trends in the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market include the increasing use of artificial intelligence in drug development, the rise of modular manufacturing solutions, and a focus on sustainable practices in production.

Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market

| Segmentation Details | Description |

|---|---|

| Product Type | Plasmid DNA, mRNA, Oligonucleotides, Gene Editing |

| Application | Oncology, Genetic Disorders, Infectious Diseases, Vaccines |

| End User | Pharmaceutical Companies, Biotech Firms, Research Institutions, Contract Research Organizations |

| Technology | CRISPR, RNA Interference, Viral Vectors, Nanoparticle Delivery |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nucleic Acid Therapeutics Contract Development And Manufacturing Organization Market

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at