444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The NPL (Non-Performing Loan) servicing market has gained significant attention in recent years due to the growing number of non-performing assets in the financial industry. NPL servicing refers to the process of managing and recovering loans that have become delinquent or are at risk of default. Financial institutions and specialized servicing companies play a crucial role in this market by employing various strategies to mitigate the risks associated with non-performing loans.

Meaning

Non-performing loans are loans that borrowers have failed to repay according to the agreed terms and conditions. These loans become a burden for financial institutions as they tie up valuable capital and hinder their ability to lend to new borrowers. NPL servicing involves the management and resolution of these distressed assets, with the aim of maximizing recovery and minimizing losses for the lenders.

Executive Summary

The NPL servicing market has witnessed significant growth in recent years, driven by the increase in non-performing loans globally. Financial institutions are seeking efficient and specialized servicing solutions to address the challenges associated with managing distressed assets. This market analysis provides key insights into the NPL servicing market, including market drivers, restraints, opportunities, and regional analysis. The impact of the COVID-19 pandemic on the market and future outlook are also discussed.

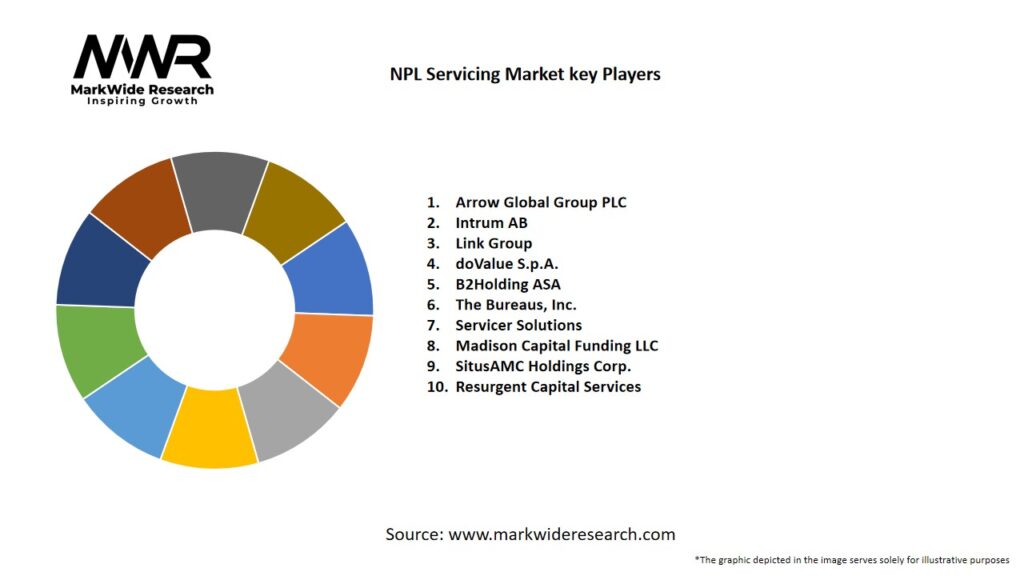

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The NPL servicing market is dynamic and influenced by various factors, including economic conditions, regulatory changes, and technological advancements. The market is highly competitive, with several established servicing companies vying for market share. Key market dynamics include:

Regional Analysis

The NPL servicing market exhibits regional variations based on economic conditions, regulatory frameworks, and market maturity. The key regions analyzed in this report include:

Competitive Landscape

Leading Companies in the NPL Servicing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

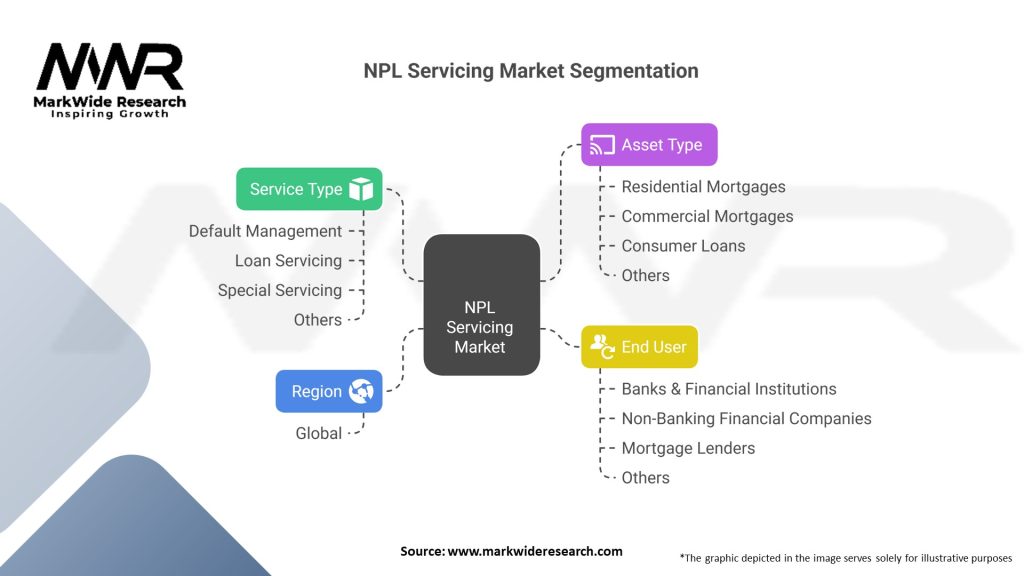

Segmentation

The NPL servicing market can be segmented based on various factors, including service type, end-user, and loan type. The key segments in the market include:

Segmentation allows servicing companies to tailor their services to specific client needs and effectively address the unique challenges associated with different loan types and end-users.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The NPL servicing market offers several advantages for industry participants and stakeholders. Firstly, it provides financial institutions with an effective solution to manage their non-performing assets. By outsourcing the servicing of NPLs to specialized providers, banks can streamline their operations, reduce costs, and focus on core competencies.

Secondly, NPL servicing companies offer expertise in managing distressed assets. These companies have developed sophisticated strategies and technologies to maximize recovery rates and minimize losses. By leveraging their industry knowledge and experience, they can effectively navigate the complexities of NPL portfolios and optimize returns for investors.

Additionally, the NPL servicing market creates opportunities for investors and asset management firms. Investors can gain access to a diversified pool of distressed assets, which have the potential to deliver attractive risk-adjusted returns. Asset management firms can expand their service offerings by entering the NPL servicing space, providing an additional revenue stream.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the NPL servicing market. One prominent trend is the utilization of advanced data analytics and artificial intelligence (AI) technologies to enhance the efficiency and effectiveness of NPL management. These technologies enable servicing providers to analyze large datasets, identify underlying trends, and make data-driven decisions to optimize recoveries.

Another significant trend is the focus on proactive and customer-centric approaches to NPL servicing. Servicers are increasingly adopting strategies that prioritize borrower engagement, such as loan modifications, debt restructuring, and alternative repayment plans. This approach aims to improve borrower outcomes while maximizing recovery rates for investors.

Moreover, environmental, social, and governance (ESG) considerations are gaining prominence in the NPL servicing market. Servicers are incorporating ESG factors into their decision-making processes, recognizing the potential impact of environmental and social risks on asset values and recoveries. This trend aligns with the broader sustainable finance movement and reflects the growing awareness of ESG issues in the financial industry.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the NPL servicing market. The economic disruptions caused by the pandemic have led to a surge in non-performing loans across various sectors, including retail, hospitality, and small businesses. This has created both challenges and opportunities for NPL servicing providers.

On one hand, the increased volume of distressed assets has expanded the market for NPL servicing. Financial institutions have sought the expertise of servicing providers to manage their growing NPL portfolios effectively. On the other hand, the uncertainties surrounding the pandemic and its aftermath have posed challenges in terms of asset valuation, recovery prospects, and regulatory considerations.

Key Industry Developments

The NPL servicing market has witnessed notable industry developments in recent years. One significant development is the increasing collaboration between financial institutions and servicing providers. Banks are partnering with specialized firms to leverage their expertise in NPL management, creating synergies and enhancing operational efficiency.

Another notable trend is the emergence of innovative digital platforms and technologies in the NPL servicing space. These platforms facilitate seamless communication and collaboration between all stakeholders involved in the NPL lifecycle, including banks, investors, servicers, and borrowers. Such technologies enable real-time monitoring of NPL portfolios, streamline workflows, and improve transparency and accountability.

Analyst Suggestions

Industry analysts suggest that NPL servicing providers should focus on several key areas to thrive in the market. Firstly, they should invest in advanced data analytics and AI technologies to gain deeper insights into NPL portfolios and improve decision-making. This includes leveraging predictive analytics models to identify early warning signs of potential defaults and enhance recovery rates.

Secondly, servicing providers should adopt a customer-centric approach by prioritizing borrower engagement and offering flexible solutions to distressed borrowers. Proactive communication, debt restructuring options, and financial literacy programs can contribute to better borrower outcomes and higher recovery rates.

Furthermore, analysts recommend that servicing providers closely monitor regulatory developments and adapt their strategies accordingly. Staying abreast of evolving regulations ensures compliance and mitigates legal risks associated with NPL management.

Future Outlook

The future outlook for the NPL servicing market appears promising. The growing volume of non-performing loans globally, coupled with the increasing recognition of the value that specialized servicing providers bring, is expected to drive market growth. The adoption of advanced technologies, customer-centric approaches, and ESG considerations will continue to shape the industry.

However, challenges such as economic uncertainties, regulatory changes, and potential competition necessitate a proactive and adaptable approach from NPL servicing providers. Those who can effectively navigate these challenges while delivering superior results for their clients are likely to succeed in the evolving market landscape.

Conclusion

In conclusion, the NPL servicing market provides numerous benefits for industry participants and stakeholders. The market is driven by increasing demand for specialized services, offers attractive investment opportunities, and promotes efficient NPL management. While the market faces certain challenges, the adoption of advanced technologies, customer-centric approaches, and ESG considerations are expected to fuel its growth. By staying proactive and adaptable, NPL servicing providers can capitalize on the market’s potential and deliver value to their clients in the years to come.

What is NPL Servicing?

NPL Servicing refers to the management and collection of non-performing loans, which are loans that are in default or close to being in default. This process involves various strategies to recover funds, including restructuring loans, negotiating settlements, and pursuing legal actions.

What are the key players in the NPL Servicing Market?

Key players in the NPL Servicing Market include companies like Cerberus Capital Management, Fortress Investment Group, and Apollo Global Management, which specialize in acquiring and managing distressed assets. These firms often employ various strategies to maximize recovery on non-performing loans, among others.

What are the main drivers of growth in the NPL Servicing Market?

The growth of the NPL Servicing Market is driven by increasing levels of defaulted loans, economic downturns, and the need for financial institutions to manage their risk exposure. Additionally, regulatory changes and the rise of alternative investment firms seeking distressed assets contribute to market expansion.

What challenges does the NPL Servicing Market face?

The NPL Servicing Market faces challenges such as regulatory scrutiny, the complexity of loan restructuring processes, and the potential for reputational damage associated with aggressive collection practices. These factors can hinder the effectiveness of servicing strategies and impact recovery rates.

What opportunities exist in the NPL Servicing Market?

Opportunities in the NPL Servicing Market include the potential for technological advancements in data analytics and artificial intelligence to improve collection strategies. Additionally, the growing trend of financial institutions outsourcing their NPL portfolios presents avenues for specialized servicing firms.

What trends are shaping the NPL Servicing Market?

Trends in the NPL Servicing Market include the increasing use of digital platforms for loan management and collection, as well as a shift towards more customer-centric approaches in debt recovery. Furthermore, there is a growing emphasis on compliance with consumer protection regulations, influencing servicing practices.

NPL Servicing Market

| Segmentation Details | Details |

|---|---|

| Service Type | Default Management, Loan Servicing, Special Servicing, Others |

| Asset Type | Residential Mortgages, Commercial Mortgages, Consumer Loans, Others |

| End User | Banks & Financial Institutions, Non-Banking Financial Companies, Mortgage Lenders, Others |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the NPL Servicing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at