444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Norway rechargeable battery market represents a dynamic and rapidly evolving sector within the country’s clean energy ecosystem. As one of Europe’s most environmentally conscious nations, Norway has positioned itself at the forefront of sustainable energy solutions, with rechargeable batteries playing a crucial role in supporting the nation’s ambitious carbon neutrality goals. The market encompasses various battery technologies including lithium-ion, nickel-metal hydride, and emerging solid-state solutions across multiple applications ranging from electric vehicles to energy storage systems.

Market dynamics in Norway are significantly influenced by the country’s substantial hydroelectric power generation capacity, which provides an ideal foundation for battery charging infrastructure. The Norwegian government’s progressive policies supporting electric vehicle adoption have created a robust demand environment, with electric vehicle penetration rates reaching approximately 80% of new car sales in recent years. This exceptional adoption rate has positioned Norway as a global leader in electric mobility transition.

Industrial applications represent another significant growth driver, with Norway’s maritime industry increasingly adopting battery-powered solutions for ferries, offshore vessels, and coastal shipping. The country’s extensive coastline and commitment to reducing maritime emissions have created substantial opportunities for marine battery applications. Additionally, the integration of renewable energy sources with battery storage systems has become increasingly important for grid stability and energy security.

Technological advancement within the Norwegian market is characterized by strong collaboration between research institutions, technology companies, and government agencies. The market benefits from Norway’s sovereign wealth fund investments in clean technology and the country’s focus on developing sustainable industrial solutions. According to MarkWide Research analysis, the Norwegian rechargeable battery sector is experiencing robust growth driven by both domestic demand and export opportunities to neighboring Nordic countries.

The Norway rechargeable battery market refers to the comprehensive ecosystem of battery technologies, manufacturing capabilities, distribution networks, and application sectors within Norway’s borders that support energy storage and portable power solutions. This market encompasses the entire value chain from raw material processing and battery cell manufacturing to system integration and end-of-life recycling services.

Core components of this market include various battery chemistries such as lithium-ion, lithium iron phosphate, nickel-metal hydride, and emerging technologies like solid-state batteries. The market serves diverse applications including electric vehicles, marine vessels, grid-scale energy storage, industrial equipment, consumer electronics, and backup power systems for critical infrastructure.

Strategic importance of the Norwegian rechargeable battery market extends beyond domestic energy needs, as it represents a critical component of the country’s broader sustainability strategy and economic diversification efforts. The market supports Norway’s transition from petroleum-dependent industries toward renewable energy technologies while maintaining the country’s position as a leading energy exporter through clean technology solutions.

Norway’s rechargeable battery market demonstrates exceptional growth potential driven by the country’s leadership in electric vehicle adoption, maritime electrification initiatives, and renewable energy integration. The market benefits from strong government support, advanced research capabilities, and a population highly committed to environmental sustainability. Key growth drivers include the world’s highest electric vehicle adoption rates, expanding marine battery applications, and increasing demand for grid-scale energy storage solutions.

Market segmentation reveals diverse opportunities across automotive, marine, industrial, and residential applications. The automotive segment dominates current demand, supported by generous government incentives and comprehensive charging infrastructure. Marine applications represent a rapidly emerging segment, with Norway’s extensive shipping industry increasingly adopting battery-powered solutions for coastal and short-sea shipping operations.

Competitive landscape features a mix of international battery manufacturers, local system integrators, and specialized marine battery providers. Norwegian companies have developed particular expertise in harsh environment applications, cold-weather performance optimization, and marine-grade battery systems. The market benefits from strong collaboration between industry players, research institutions, and government agencies.

Future prospects indicate continued robust growth supported by expanding applications, technological advancement, and Norway’s commitment to achieving carbon neutrality. The market is expected to benefit from increasing battery recycling capabilities, development of domestic manufacturing capacity, and growing export opportunities to other Nordic and European markets.

Strategic insights reveal several critical factors shaping the Norwegian rechargeable battery market landscape:

Market maturity varies significantly across application segments, with automotive applications showing high penetration while marine and industrial segments offer substantial growth potential. The Norwegian market serves as a testing ground for advanced battery technologies due to demanding environmental conditions and sophisticated end-user requirements.

Government policy support represents the primary driver of Norway’s rechargeable battery market growth. The Norwegian government has implemented comprehensive incentive programs for electric vehicles, including exemptions from purchase taxes, tolls, and parking fees, while providing access to bus lanes and free charging at many public locations. These policies have created the world’s most favorable environment for electric vehicle adoption.

Environmental consciousness among Norwegian consumers and businesses drives demand for sustainable energy solutions. The country’s strong environmental awareness, combined with abundant renewable energy resources, creates natural demand for battery-powered alternatives to fossil fuel-dependent technologies. This cultural commitment to sustainability extends across all market segments from personal transportation to industrial applications.

Technological advancement in battery performance, particularly in cold-weather conditions, has made rechargeable batteries increasingly viable for Norwegian applications. Improvements in energy density, charging speed, and temperature tolerance have expanded the practical applications for battery technology in Norway’s challenging climate conditions.

Infrastructure development continues to support market growth through expanding charging networks, grid modernization projects, and specialized facilities for marine applications. Norway’s comprehensive charging infrastructure, with over 20,000 public charging points, provides the foundation for continued electric vehicle adoption and supports broader battery market development.

Industrial transformation across traditional Norwegian industries creates new opportunities for battery applications. The maritime sector’s electrification initiatives, offshore energy industry’s adoption of battery storage, and aquaculture industry’s move toward sustainable operations all contribute to expanding market demand.

High initial costs continue to present challenges for certain market segments, particularly in marine and industrial applications where large-scale battery systems require substantial capital investment. While costs have decreased significantly, the upfront investment required for comprehensive battery solutions can still present barriers for smaller operators and cost-sensitive applications.

Cold weather performance limitations affect battery efficiency and lifespan in Norway’s harsh winter conditions. Despite technological improvements, extreme cold temperatures can reduce battery capacity and require additional heating systems, increasing both complexity and operating costs. This challenge is particularly significant for outdoor applications and vehicles operating in northern regions.

Limited domestic manufacturing capacity creates supply chain dependencies on international suppliers, potentially affecting availability and pricing. While Norway has strong system integration capabilities, the country relies heavily on imported battery cells and components, creating potential vulnerabilities in supply chain disruptions.

Recycling infrastructure development lags behind market growth, creating potential environmental and economic challenges as early battery installations reach end-of-life. While Norway has strong environmental regulations, the specialized infrastructure required for large-scale battery recycling is still developing.

Grid integration challenges emerge as battery storage deployment increases, requiring sophisticated management systems and potential grid infrastructure upgrades. The integration of distributed battery storage with Norway’s hydroelectric-dominated grid presents technical challenges that require ongoing investment and development.

Marine electrification presents exceptional growth opportunities as Norway’s extensive maritime industry seeks to reduce emissions and comply with increasingly strict environmental regulations. The country’s leadership in ferry electrification provides a foundation for expanding into cargo vessels, offshore support vessels, and cruise ships operating in Norwegian waters.

Export potential to neighboring Nordic and European countries offers significant market expansion opportunities. Norway’s expertise in cold-weather battery applications, marine systems, and harsh environment solutions creates competitive advantages for serving similar markets in Sweden, Denmark, Finland, and other northern European countries.

Energy storage integration with renewable energy projects presents substantial opportunities as Europe seeks to enhance energy security and grid stability. Norway’s hydroelectric resources, combined with wind and solar developments, create demand for sophisticated battery storage solutions to optimize energy distribution and support grid services.

Industrial electrification across traditional Norwegian industries offers diverse application opportunities. The offshore energy sector’s adoption of battery-powered equipment, aquaculture industry’s move toward sustainable operations, and mining sector’s electrification initiatives all represent growing market segments.

Technology development and innovation opportunities exist in specialized applications such as arctic-grade batteries, marine-specific solutions, and grid-scale storage systems. Norway’s research capabilities and demanding application requirements create opportunities for developing next-generation battery technologies with global market potential.

Supply chain dynamics in the Norwegian rechargeable battery market reflect both global trends and local requirements. The market benefits from established relationships with leading international battery manufacturers while developing domestic capabilities in system integration, testing, and specialized applications. Norwegian companies have carved out niches in harsh environment applications and marine-grade systems.

Demand patterns show strong seasonality in certain segments, with electric vehicle sales typically higher during warmer months and marine applications concentrated during the shipping season. However, the overall market demonstrates consistent growth across all segments, supported by expanding applications and improving technology performance.

Price dynamics reflect global battery cost trends while incorporating premiums for specialized applications and harsh environment requirements. Norwegian market prices generally command premiums due to demanding performance requirements, comprehensive service needs, and the country’s high labor costs.

Innovation cycles in the Norwegian market are driven by collaboration between research institutions, industry partners, and government agencies. The market serves as a testing ground for advanced technologies due to demanding environmental conditions and sophisticated end-user requirements, accelerating innovation cycles and technology adoption.

Regulatory dynamics continue to evolve as the market matures, with increasing focus on safety standards, environmental regulations, and recycling requirements. The Norwegian government’s proactive approach to regulation provides market clarity while ensuring safety and environmental protection.

Primary research methodologies employed in analyzing the Norwegian rechargeable battery market include comprehensive interviews with industry executives, technology providers, government officials, and end-users across multiple application segments. Direct engagement with key market participants provides insights into current trends, challenges, and future opportunities within the Norwegian market context.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and company financial statements to establish market baselines and validate primary research findings. Norwegian government statistics, energy sector reports, and transportation data provide essential quantitative foundations for market analysis.

Market modeling approaches incorporate both bottom-up and top-down methodologies to ensure comprehensive market coverage and accurate projections. Bottom-up analysis examines individual application segments, while top-down analysis considers macroeconomic factors, policy impacts, and broader energy transition trends affecting the Norwegian market.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews, and applying statistical analysis techniques to ensure accuracy and reliability. The unique characteristics of the Norwegian market require specialized validation approaches that account for local conditions and market dynamics.

Trend analysis methodologies examine historical patterns, current developments, and emerging indicators to identify future market directions. The analysis considers both Norwegian-specific factors and global trends that may impact the domestic market, providing comprehensive perspective on market evolution.

Oslo and Eastern Norway represent the largest market concentration, accounting for approximately 45% of total market activity. This region benefits from the highest population density, extensive charging infrastructure, and concentration of government and corporate headquarters driving electric vehicle adoption. The region also hosts major research institutions and technology companies supporting market development.

Western Norway demonstrates strong market growth driven by the maritime industry and offshore energy sector. Bergen and surrounding areas show particular strength in marine battery applications, with numerous ferry electrification projects and offshore vessel conversions. The region accounts for approximately 25% of market activity, with significant growth potential in industrial applications.

Northern Norway presents unique opportunities and challenges, representing about 15% of current market activity but showing rapid growth in specialized applications. The region’s extreme weather conditions drive demand for cold-weather optimized battery solutions, while the mining industry and arctic shipping create niche application opportunities.

Central Norway shows steady market development supported by industrial applications and growing electric vehicle adoption. The region accounts for approximately 15% of market activity, with particular strength in energy storage applications supporting renewable energy integration and grid stability services.

Regional infrastructure development varies significantly, with southern regions benefiting from comprehensive charging networks while northern areas require specialized solutions for harsh operating conditions. This geographic diversity creates opportunities for different battery technologies and application approaches across Norway’s varied landscape.

International battery manufacturers maintain strong positions in the Norwegian market through established supply relationships and technology partnerships:

Norwegian system integrators and specialized providers have developed strong market positions:

Competitive strategies focus on technological differentiation, application specialization, and service capabilities. Norwegian companies leverage local expertise in harsh environment applications, while international players compete on scale, technology advancement, and cost efficiency. The market supports multiple competitive approaches due to diverse application requirements and customer needs.

By Technology:

By Application:

By End-User:

Automotive Category dominates the Norwegian rechargeable battery market with exceptional growth driven by the world’s highest electric vehicle adoption rates. The segment benefits from comprehensive government incentives, extensive charging infrastructure, and strong consumer acceptance. Battery electric vehicles represent the majority of new car sales, creating substantial demand for automotive battery systems. The category shows particular strength in premium vehicle segments and is expanding into commercial vehicle applications.

Marine Category represents the fastest-growing segment with significant potential for market expansion. Norway’s leadership in ferry electrification has demonstrated the viability of large-scale marine battery applications, with projects showing operational efficiency improvements of up to 30% compared to diesel alternatives. The category benefits from strict environmental regulations and the maritime industry’s commitment to reducing emissions.

Energy Storage Category shows steady growth driven by renewable energy integration requirements and grid modernization initiatives. The segment focuses on complementing Norway’s hydroelectric capacity with battery storage for grid stability and energy security. Applications range from utility-scale installations to distributed residential systems supporting energy independence.

Industrial Category demonstrates diverse applications across traditional Norwegian industries. The offshore energy sector’s adoption of battery-powered equipment, aquaculture industry’s electrification initiatives, and mining sector’s sustainable operations drive category growth. The segment requires specialized solutions for harsh operating environments and demanding performance requirements.

Consumer Electronics Category maintains steady demand while facing increasing competition from other segments. The category benefits from Norway’s high technology adoption rates and consumer preference for premium products. Growth focuses on high-performance applications and specialized devices for outdoor and professional use.

Battery Manufacturers benefit from access to a sophisticated market with demanding performance requirements that drive innovation and technology development. The Norwegian market provides opportunities to test and validate advanced battery technologies in challenging conditions, creating competitive advantages for global market expansion. Strong government support and environmental consciousness create stable demand conditions.

System Integrators gain advantages from developing specialized expertise in harsh environment applications, marine systems, and cold-weather performance optimization. Norwegian market experience provides valuable capabilities for serving similar markets globally while building strong relationships with leading technology providers and end-users.

End-Users benefit from access to advanced battery technologies, comprehensive support services, and government incentives that reduce total cost of ownership. The mature market provides multiple technology options, competitive pricing, and proven performance in demanding applications. Users gain operational advantages through improved efficiency, reduced emissions, and enhanced performance.

Government Stakeholders achieve policy objectives including emission reduction, energy security enhancement, and economic diversification through market development. The battery market supports Norway’s transition toward sustainable energy systems while creating opportunities for technology export and economic growth in clean technology sectors.

Research Institutions benefit from collaboration opportunities with industry partners, access to real-world testing environments, and government funding for battery technology development. The market provides platforms for translating research into commercial applications while supporting Norway’s innovation economy development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification Acceleration continues across all market segments, with expanding applications in maritime, industrial, and transportation sectors. The trend toward comprehensive electrification creates opportunities for integrated battery solutions and system-level optimization. Norwegian companies are developing expertise in complex electrification projects that require sophisticated battery management and integration capabilities.

Cold Weather Optimization represents a critical trend as battery manufacturers develop specialized solutions for arctic and sub-arctic conditions. Norwegian market demands have driven innovations in battery thermal management, heating systems, and cold-weather performance optimization. These developments create competitive advantages for serving similar markets globally.

Circular Economy Integration shows increasing importance as the market matures and early battery installations approach end-of-life. Norwegian companies are developing comprehensive recycling capabilities and sustainable lifecycle management approaches. The trend toward circular economy principles creates opportunities for new business models and service offerings.

Grid Integration Sophistication advances as battery storage systems become more intelligent and capable of providing multiple grid services. The integration of artificial intelligence, predictive analytics, and advanced control systems enables batteries to optimize performance across multiple applications simultaneously. MarkWide Research indicates this trend will accelerate as grid modernization continues.

Marine Technology Leadership continues to strengthen Norway’s position in maritime battery applications. The successful deployment of ferry electrification projects has created expertise and confidence for expanding into larger vessels and more complex applications. This trend positions Norwegian companies for global leadership in marine electrification.

Ferry Electrification Projects have achieved significant milestones with multiple successful deployments demonstrating the viability of large-scale marine battery applications. These projects have shown emission reductions of up to 95% compared to diesel alternatives while maintaining operational reliability and performance standards.

Domestic Manufacturing Initiatives are developing with several Norwegian companies announcing plans for battery cell production and system manufacturing. These developments aim to reduce supply chain dependence while creating domestic employment and technology capabilities in the growing battery sector.

Research Collaborations between Norwegian institutions and international partners continue to advance battery technology development. Recent breakthroughs in cold-weather performance, marine applications, and grid storage systems demonstrate the value of collaborative research approaches in addressing market-specific challenges.

Infrastructure Expansion continues with ongoing investments in charging networks, grid modernization, and specialized facilities for marine applications. The comprehensive approach to infrastructure development supports market growth across all application segments while ensuring reliable service delivery.

Regulatory Developments include updated safety standards, environmental regulations, and recycling requirements that shape market development. The proactive regulatory approach provides market clarity while ensuring safety and environmental protection as the market continues to expand.

Market participants should focus on developing specialized capabilities for harsh environment applications, as this represents a key differentiator in the Norwegian market and creates opportunities for global expansion. Companies that can demonstrate superior performance in extreme weather conditions will gain competitive advantages both domestically and internationally.

Investment priorities should emphasize marine applications, as this segment offers the highest growth potential and aligns with Norway’s maritime industry strengths. The successful ferry electrification projects provide a foundation for expanding into cargo vessels, offshore support vessels, and other maritime applications with significant market potential.

Technology development efforts should concentrate on cold-weather optimization, marine-grade systems, and grid integration capabilities. These focus areas address specific Norwegian market requirements while creating technologies with broader global applicability. According to MWR analysis, companies investing in these areas will achieve stronger market positions.

Partnership strategies should leverage Norway’s research excellence and government support to accelerate technology development and market penetration. Collaboration with Norwegian research institutions, technology companies, and government agencies can provide access to funding, expertise, and market opportunities.

Export development should build on Norwegian market success to serve similar markets in Nordic and European countries. The expertise gained in harsh environment applications, marine systems, and renewable energy integration creates competitive advantages for international expansion, particularly in northern European markets with similar requirements.

Long-term growth prospects for the Norwegian rechargeable battery market remain exceptionally positive, supported by continued government commitment to sustainability, expanding applications across multiple sectors, and Norway’s position as a technology leader in harsh environment applications. The market is expected to maintain robust growth rates as electrification expands beyond current applications into new sectors and use cases.

Technology evolution will continue to drive market development, with advances in energy density, charging speed, and cold-weather performance creating new application opportunities. The development of solid-state batteries, improved thermal management systems, and enhanced recycling capabilities will support market expansion while addressing current limitations.

Market expansion into new application areas appears likely, with potential growth in aviation, heavy industry, and specialized equipment applications. Norway’s expertise in demanding applications positions the market well for serving these emerging segments as battery technology continues to advance and costs decrease.

International opportunities will expand as Norwegian companies leverage domestic market success to serve global markets. The country’s leadership in marine applications, cold-weather performance, and renewable energy integration creates competitive advantages for international expansion, particularly in markets with similar environmental conditions and sustainability priorities.

Sustainability focus will intensify as the market matures, with increasing emphasis on circular economy principles, recycling capabilities, and lifecycle optimization. This trend will create opportunities for new business models and service offerings while supporting Norway’s broader environmental objectives and circular economy development.

The Norway rechargeable battery market represents a dynamic and rapidly evolving sector that has achieved global leadership in electric vehicle adoption while developing significant expertise in marine applications and harsh environment solutions. The market benefits from exceptional government support, strong environmental consciousness, and world-class research capabilities that drive innovation and technology development.

Market fundamentals remain exceptionally strong, with continued growth expected across automotive, marine, industrial, and energy storage applications. The successful deployment of large-scale battery projects, particularly in ferry electrification, demonstrates the market’s maturity and capability to handle complex, demanding applications. The combination of domestic demand strength and export potential creates a robust foundation for continued expansion.

Strategic positioning of Norwegian companies in specialized applications such as marine batteries, cold-weather solutions, and harsh environment systems provides competitive advantages that extend beyond the domestic market. The expertise developed in serving Norway’s demanding conditions creates opportunities for global market expansion and technology leadership in similar applications worldwide.

Future development will likely focus on expanding domestic manufacturing capabilities, enhancing recycling infrastructure, and developing next-generation technologies for emerging applications. The market’s evolution toward greater sustainability, circular economy principles, and comprehensive electrification across multiple sectors positions Norway as a continued leader in the global transition toward sustainable energy systems and clean technology solutions.

What is Rechargeable Battery?

Rechargeable batteries are energy storage devices that can be charged and discharged multiple times. They are commonly used in various applications, including consumer electronics, electric vehicles, and renewable energy systems.

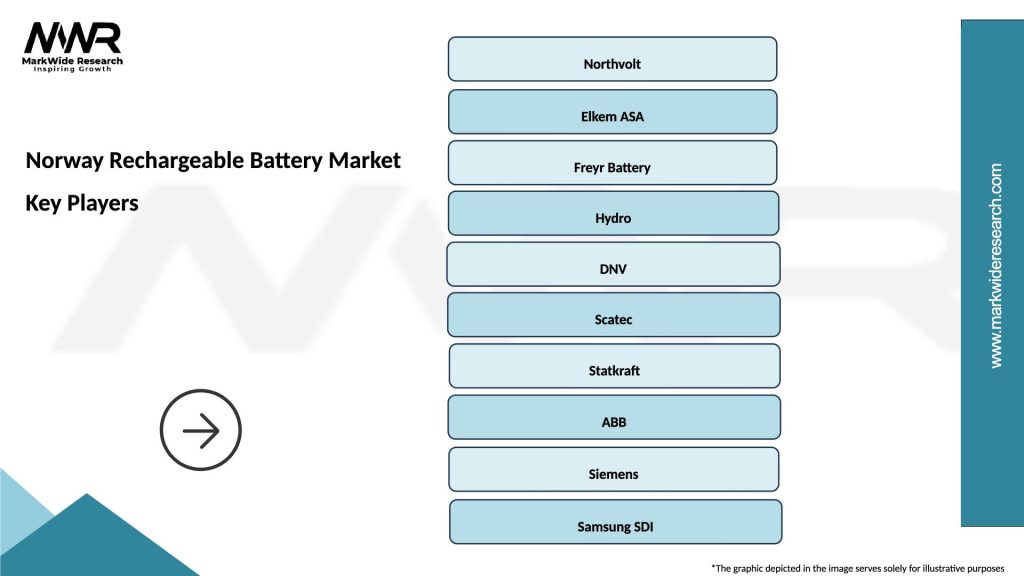

What are the key players in the Norway Rechargeable Battery Market?

Key players in the Norway Rechargeable Battery Market include companies like Northvolt, Aker Solutions, and Elkem, which are involved in the production and development of advanced battery technologies, among others.

What are the growth factors driving the Norway Rechargeable Battery Market?

The Norway Rechargeable Battery Market is driven by the increasing demand for electric vehicles, the growth of renewable energy storage solutions, and advancements in battery technology that enhance performance and efficiency.

What challenges does the Norway Rechargeable Battery Market face?

Challenges in the Norway Rechargeable Battery Market include the high cost of raw materials, recycling issues, and competition from alternative energy storage technologies that may limit market growth.

What future opportunities exist in the Norway Rechargeable Battery Market?

Future opportunities in the Norway Rechargeable Battery Market include the expansion of electric vehicle infrastructure, increased investment in battery recycling technologies, and the development of next-generation battery chemistries that offer improved energy density.

What trends are shaping the Norway Rechargeable Battery Market?

Trends in the Norway Rechargeable Battery Market include the rise of solid-state batteries, the integration of smart technologies for battery management, and a growing focus on sustainability and environmental impact in battery production.

Norway Rechargeable Battery Market

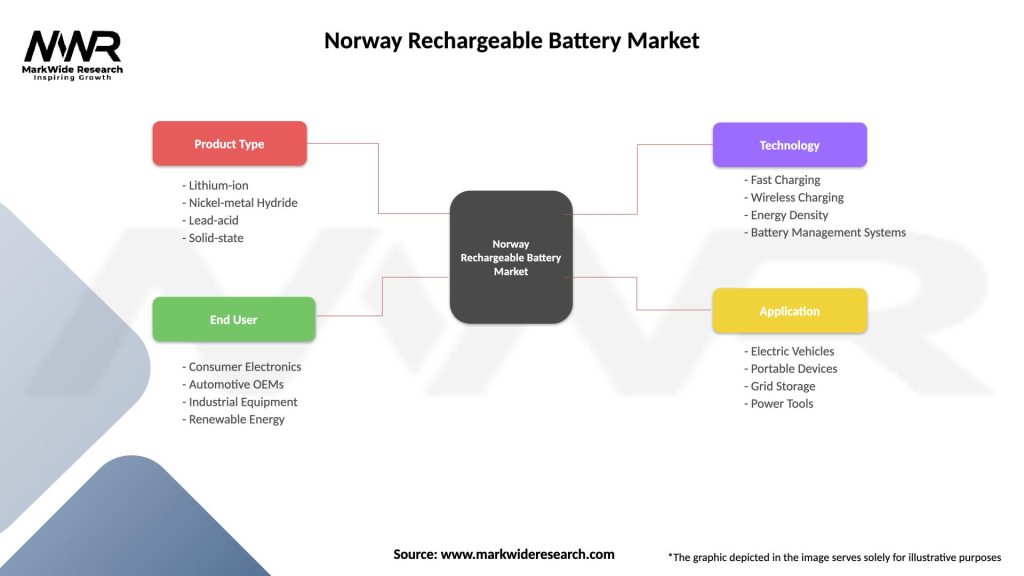

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Lead-acid, Solid-state |

| End User | Consumer Electronics, Automotive OEMs, Industrial Equipment, Renewable Energy |

| Technology | Fast Charging, Wireless Charging, Energy Density, Battery Management Systems |

| Application | Electric Vehicles, Portable Devices, Grid Storage, Power Tools |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Norway Rechargeable Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at